Bajaj Finserv's Valuation Anomaly.

Bajaj Finserv holds 52.82% stake in Bajaj Finance worth 61,513 Cr. Market capitalisation of Bajaj Finserv is 67,661 Cr.

The balance 6,148 Crore will get you 74% each of Bajaj Allianz Life & General Insurance.

Let's analyse the subsidiaries:

Bajaj Finserv holds 52.82% stake in Bajaj Finance worth 61,513 Cr. Market capitalisation of Bajaj Finserv is 67,661 Cr.

The balance 6,148 Crore will get you 74% each of Bajaj Allianz Life & General Insurance.

Let's analyse the subsidiaries:

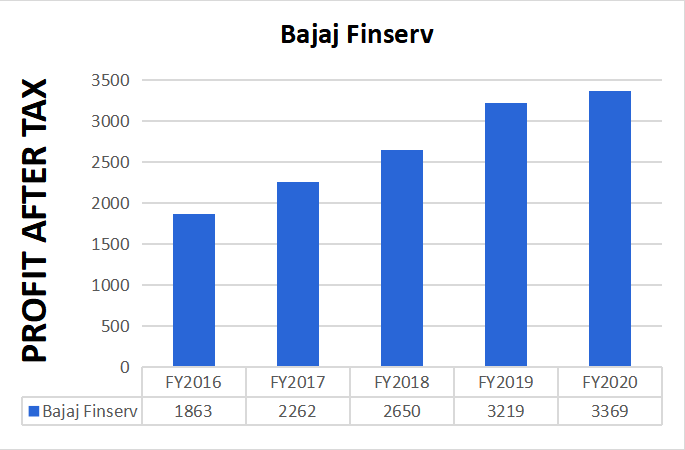

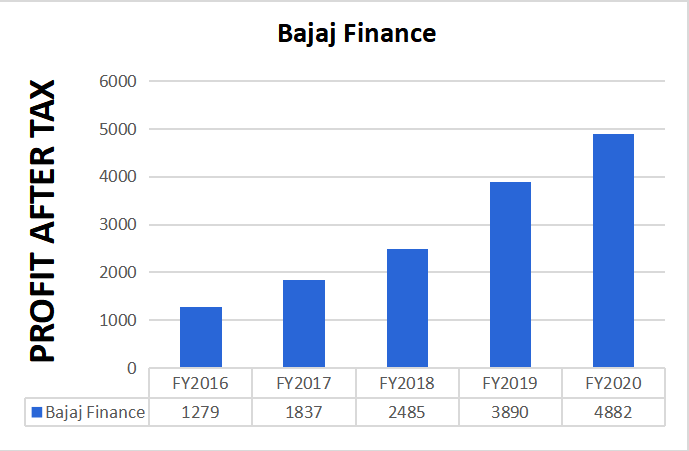

Bajaj Finance is the most diversified and profitable NBFC in the country with a wide portfolio of products spread across Consumer, SME & Commercial Lending as well as Wealth Management.

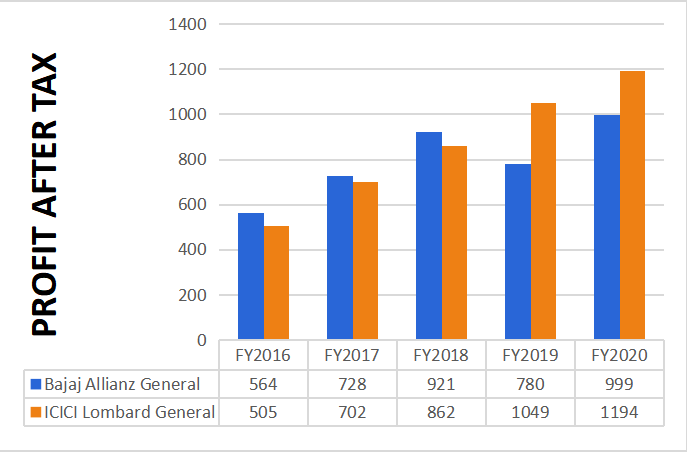

Profitability over the years:

Profitability over the years:

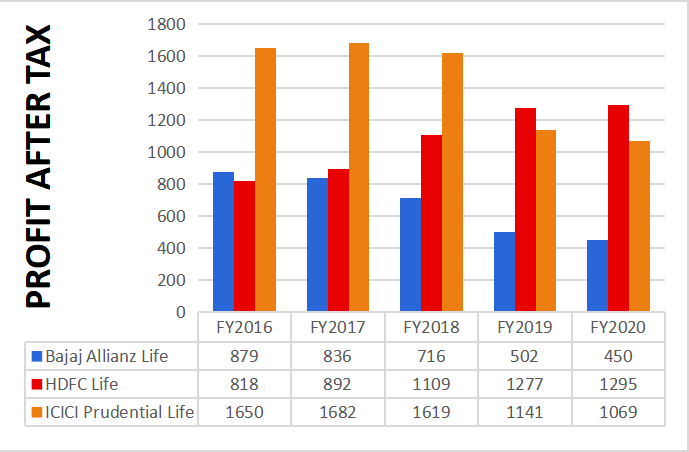

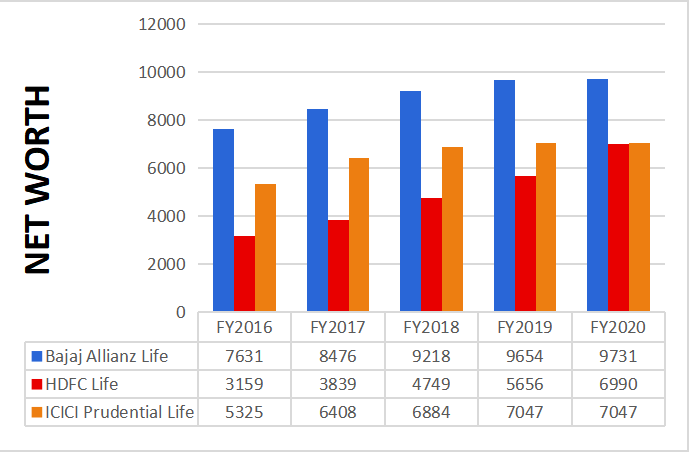

HDFC Life and ICICI Prudential Life Insurance has a market capitalisation of 1,01,715 Cr and 50,794 Cr respectively.

Bajaj Allianz Life Insurance is not listed. So, let's compare the three businesses:

Bajaj Allianz Life Insurance is not listed. So, let's compare the three businesses:

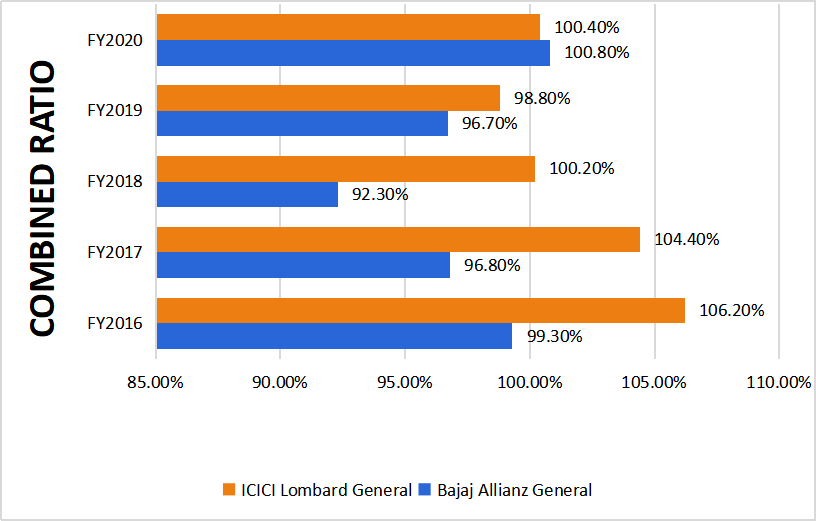

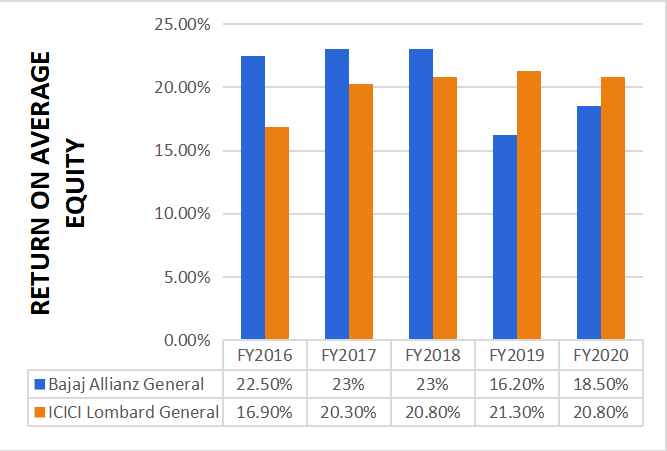

ICICI Lombard General Insurance has a market capitalisation of 55,964 Cr.

Bajaj Allianz General Insurance is not listed. So, let's compare the two businesses:

Bajaj Allianz General Insurance is not listed. So, let's compare the two businesses:

Bajaj Finserv clearly trades at a deep discount to the combined value of it's holdings. An investor can prosper although it may take years for the full value to be realized.

But even without a breakup, buying Bajaj Finserv puts more assets to work for the money you invest.

But even without a breakup, buying Bajaj Finserv puts more assets to work for the money you invest.

Read on Twitter

Read on Twitter