Positives:

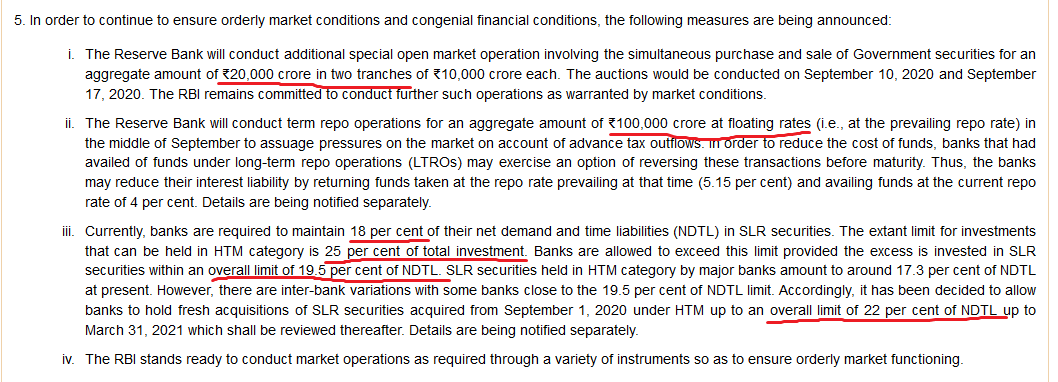

RBI cutting rates madly

Huge surplus liquidity

Neutral:

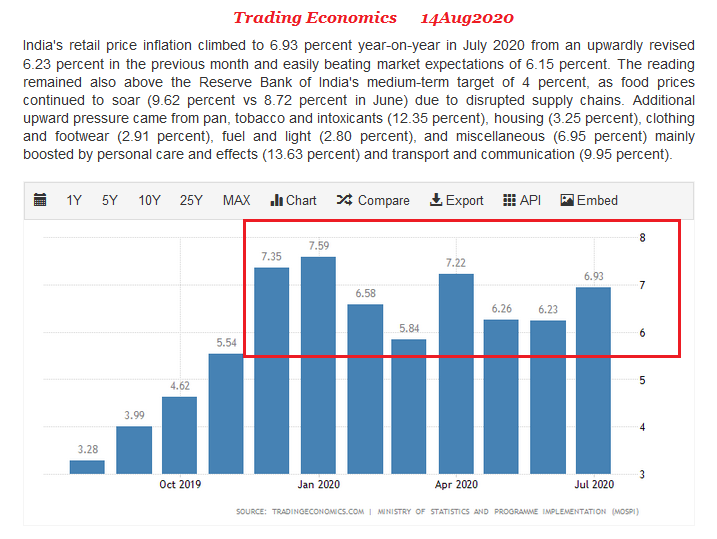

Hazy inflationary expectations

Volatile crude oil prices

Negatives:

Govt borrowing up 50%

Big fall in tax collections

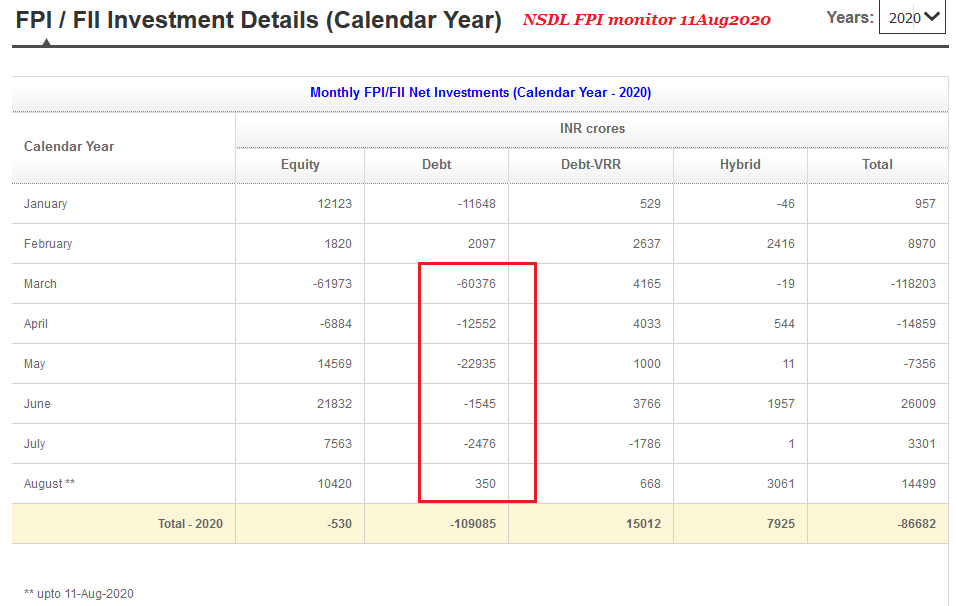

FPIs selling Indian G-Secs heavily

Slow growth in bank deposits

Zero disinvestment prospects

RBI cutting rates madly

Huge surplus liquidity

Neutral:

Hazy inflationary expectations

Volatile crude oil prices

Negatives:

Govt borrowing up 50%

Big fall in tax collections

FPIs selling Indian G-Secs heavily

Slow growth in bank deposits

Zero disinvestment prospects

More negatives:

Zero risk appetite by banks to lend.

GST compensation by centre to states Rs 410,000 crore (ICRA estimate) for FY 2020-21.

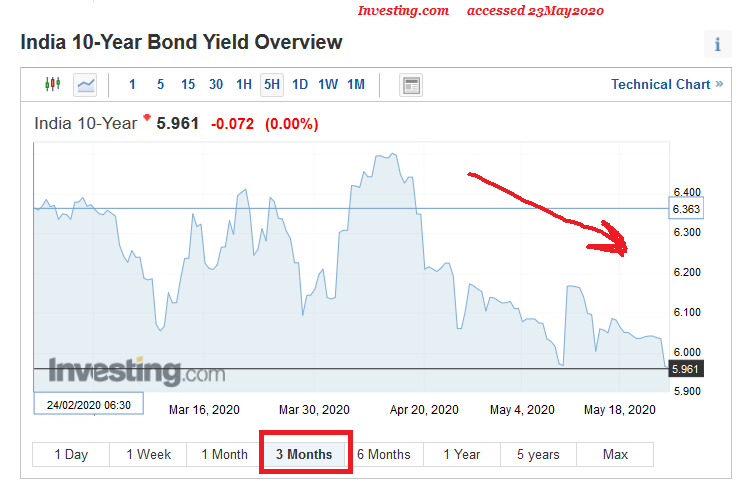

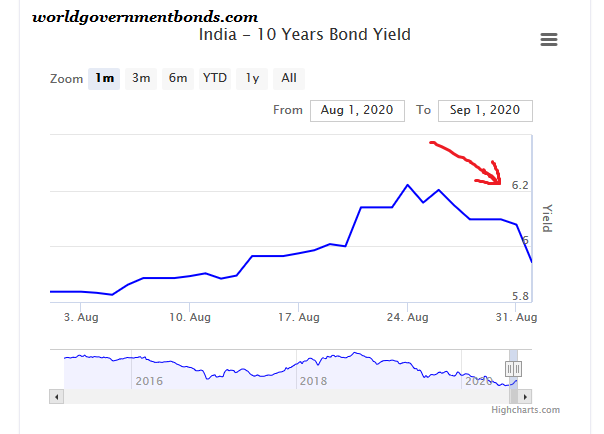

Even though RBI has been doing all it can to keep bond yields lower, is the recent fall in Indian G-Sec yields likely to sustain? I doubt.

Zero risk appetite by banks to lend.

GST compensation by centre to states Rs 410,000 crore (ICRA estimate) for FY 2020-21.

Even though RBI has been doing all it can to keep bond yields lower, is the recent fall in Indian G-Sec yields likely to sustain? I doubt.

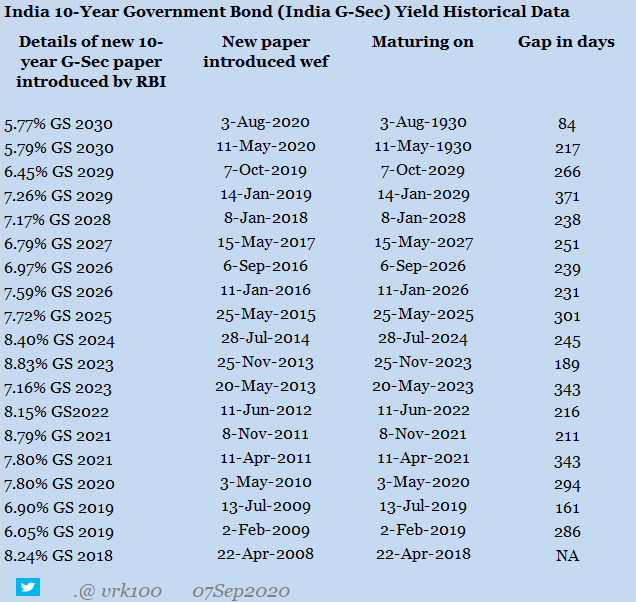

RBI has been trying every nerve to pull Indian bond market out of the morass, but to no avail. They even issued a new 10-year paper within 50 working days which is a record in the past 12 years!

The new 10-year benchmark (5.79%) yield is stubbornly hovering around 5.75%-5.90%.

The new 10-year benchmark (5.79%) yield is stubbornly hovering around 5.75%-5.90%.

The newest 10-year (5.77% GS 2030) yield is at 5.86%, which is just 4 basis points below the new 10-year (5.79%) yield. India's fiscal situation is precarious. Crude oil prices are inching up. Corporate results continue to be bad, pressuring GST and corporate tax collections.

FPIs went on selling Indian bonds feverishly in March to May 2020--which is on expected lines given the reaction to the pandemic. The heavy selling has stopped since June, but FPIs don't show any interest in Indian bonds despite higher yield differential b/w US and Indian yields.

Inflationary expectations are back making the RBI MPC's task tougher. Indian stock markets can no longer afford to ignore bond market signals--considering Modi govt's lacklustre fiscal response to the growing COVID-19 crisis.

Interestingly, BSE market cap of listed firms is Rs 152.22 lakh crore, just 5% below its peak level in Feb2020. It would be tempting for Govt of India to offload its stakes--especially those in pvt sector if not in public ones.

Can the market absorb a new wave of disinvestment?

Can the market absorb a new wave of disinvestment?

It's not a good idea to look at any single market in isolation. The bond, equity and forex markets are inter-linked; not to speak of global linkages. The bulging forex reserves, now at USD 535 billion (one-year accretion is USD 106 billion) are a new headache for RBI and MPC.

Indian govt's debt manager @RBI can only do so much manipulation-something's gotta to give ultimately.

The newest 10-year (5.77% GS 2030) yield closed @ 5.95%, which is just 2 basis points (historical gap is 15 - 20 bp) below the new 10-year (5.79%) yield https://twitter.com/vrk100/status/1293217576588152832

The newest 10-year (5.77% GS 2030) yield closed @ 5.95%, which is just 2 basis points (historical gap is 15 - 20 bp) below the new 10-year (5.79%) yield https://twitter.com/vrk100/status/1293217576588152832

Inflationary expectations are back with a vengeance, with CPI inflation running above 6% continuously for the past eight months.

So, sanctity of much-trumpeted monetary policy framework (MPF) too has gone away?

https://twitter.com/vrk100/status/1283218172884037633

So, sanctity of much-trumpeted monetary policy framework (MPF) too has gone away?

https://twitter.com/vrk100/status/1283218172884037633

The newest 10-year (5.77% GS 2030) yield closed at 5.94%,

while the new 10-year (5.79% GS 2030) closed at 5.91%.

This round goes to RBI with yields falling today due to their stunts >

while the new 10-year (5.79% GS 2030) closed at 5.91%.

This round goes to RBI with yields falling today due to their stunts >

The newest 10-year (5.77% GS 2030) yield closed at 5.99%,

while the new 10-year (5.79% GS 2030) closed at 5.96%.

while the new 10-year (5.79% GS 2030) closed at 5.96%.

Issuing a new 10-year G-Sec paper has not helped stabilise bond yields. Instead, it created a distortion.

History of new G-Secs introduced by RBI in the past 12 years >

https://twitter.com/vrk100/status/1293216819835109376

History of new G-Secs introduced by RBI in the past 12 years >

https://twitter.com/vrk100/status/1293216819835109376

Kudos to RBI @RBI for its 'management' (I'm refraining from using my favourite word here) of 10-year G-Sec yield, which has remained more or less below 6 per cent for the three / four months despite inching above 6% briefly in Sep2020! #Bonds

What the 'stable' 10-year G-Sec yield tells you is that the package announced in mid-May is just bogus--though Indian bond market is distorted due to structural issues.

RBI yield 'management' may have lulled bond markets for some time, but this I think can't continue for long. The reality of higher fiscal deficit (lower tax collections, high GST compensation cess, fiscal 'stimulus,' elevated inflationary expectations, etc.) has to be priced in.

Indian bond market can't escape this reality. Interestingly, the spread between India 10-year and US 10-year has been falling in recent months (of course, bond markets in different nations are driven by different / local factors, as opposed to stocks which are more correlated).

In the past six months, the US 10-year Treasury yield rose from 0.72% to 0.93%; whereas India 10-year G-Sec yield fell from 6.18% to 5.88%--narrowing the spread (yield differential). India's inflation has been stubbornly high though the authorities want you to believe otherwise.

One caution: All are sailing in the same boat. I mean, globally, both the monetary and fiscal authorities have been following unconventional policies--with the result asset prices are not reflecting their true fundamentals. https://twitter.com/vrk100/status/1317631274685661185

Read on Twitter

Read on Twitter