Some confusion on twitter about supply shocks vs. demand shocks.

I think *likely* much more supply shock than demand shock. No the CPI does not settle the issue (see below).

But I'm all for demand policies since that is what we can solve with economic tools.

THREAD:

I think *likely* much more supply shock than demand shock. No the CPI does not settle the issue (see below).

But I'm all for demand policies since that is what we can solve with economic tools.

THREAD:

Let's define terms:

Demand shock: A reduction in consumption or investment caused by declining incomes, declining income expectations, and animal spirits more generally.

Supply shock: An increase in the cost of production due to higher input costs or worsening technology.

Demand shock: A reduction in consumption or investment caused by declining incomes, declining income expectations, and animal spirits more generally.

Supply shock: An increase in the cost of production due to higher input costs or worsening technology.

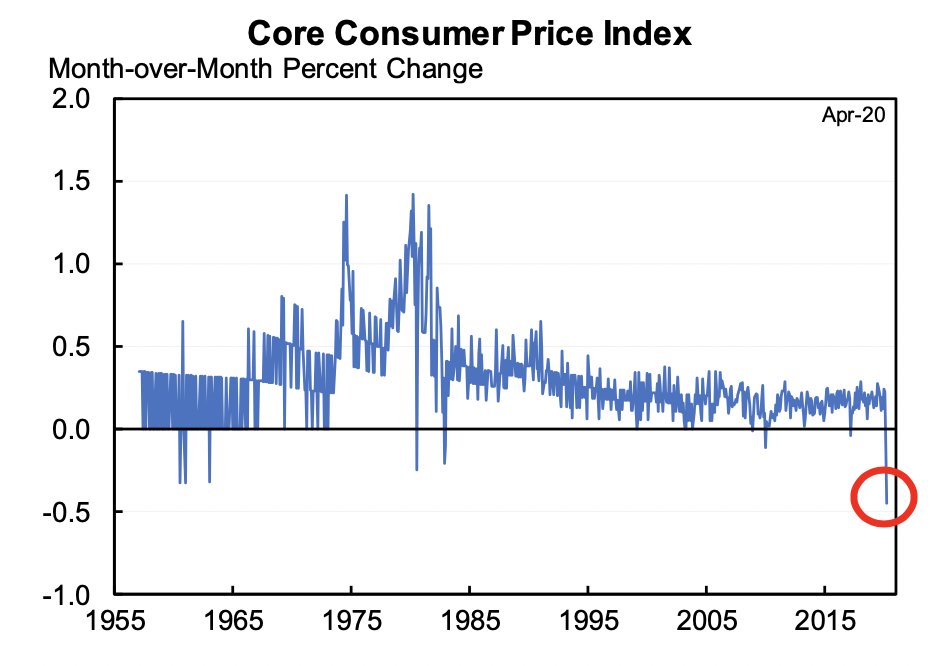

Normally price changes would be the way to assess the relative magnitude of supply and demand. And the fact that the core CPI was -0.4% in April, the lowest in the history of the series, appears to favor the demand shock interpretation.

The problem is that currently the CPI is massively biased downward because it does not adjust for quality deteriorations & disappearing goods (the opposite of the CPI bias in normal times).

Restaurant meals cost infinity. A plane ticket ticket comes with COVID risk, etc.

Restaurant meals cost infinity. A plane ticket ticket comes with COVID risk, etc.

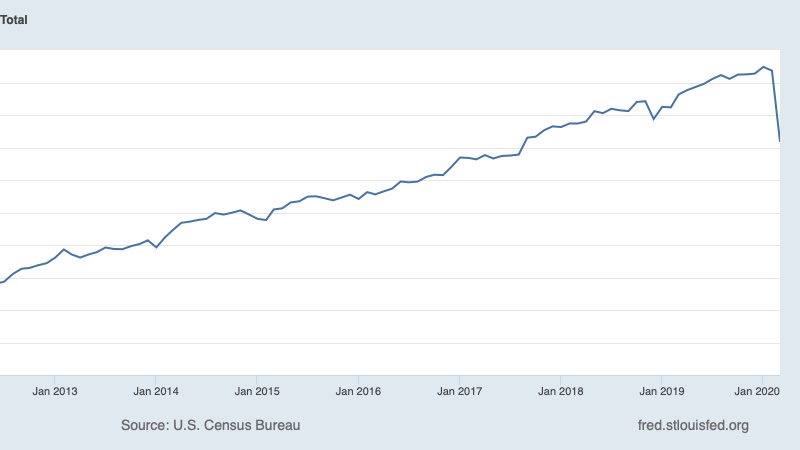

Nominal spending has fallen sharply. Should we think of this as demand or supply?

Partly it is demand: some have seen their incomes fall, many more have seen their expected incomes and/or wealth fall, precautionary savings is up, all of this causes a reduction in spending.

Partly it is demand: some have seen their incomes fall, many more have seen their expected incomes and/or wealth fall, precautionary savings is up, all of this causes a reduction in spending.

But demand is likely a relatively smaller part of the story:

Fiscal policy has been a massive positive demand shock, offsetting much of the negative COVID demand shock. Totals ~30% of GDP over the current and next quarter.

Fiscal policy has been a massive positive demand shock, offsetting much of the negative COVID demand shock. Totals ~30% of GDP over the current and next quarter.

UI replaces >100% of income for the majority of unemployed (and is not subject to tax withholding). Families have gotten checks. Taxes payments delayed. Etc.

Not enough, too many poor falling through cracks and large/unnecessary demand reduction coming from states/localities.

Not enough, too many poor falling through cracks and large/unnecessary demand reduction coming from states/localities.

Disposable personal income in April & May may be higher than in February.

To be clear, income has declined for some. And even if your income is replaced by UI, you likely have lower expectations for future income. Wealth effect negative. So definitely some demand reduction.

To be clear, income has declined for some. And even if your income is replaced by UI, you likely have lower expectations for future income. Wealth effect negative. So definitely some demand reduction.

But the bigger issue seems to be supply. It costs much more (in some cases infinitely more) to produce the goods and especially services that were being produced in January. At those prices people are buying a lot less food/travel/live entertainment/small business shopping etc.

Aggregating from personal experience is dangerous, but ask yourself: Are you spending less than you did before? Is this because your income is lower or you expect it to be lower? Or is this because it is impossible or unsafe to buy what you were buying before?

Again, don't misunderstand, for some there is a demand shock and that is playing a role. Moreover to the degree that there is not a much larger demand shock that is not an argument against demand policy--in fact that represents a success of the demand policies we have pursued.

I have an open mind. Macro data will help a little (e.g., disposable personal income for April and May). Micro data would help more, including surveys etc. Until then, I'm relying a lot on introspection to tentatively conclude that net of policy it's mostly a supply shock.

And, of course, the only way to address the supply shock (plus the demand shock and just about every shock) is to get the health response right: how partial reopening are handled, test/trace/isolate, vaccine/treatment, etc. etc.

Read on Twitter

Read on Twitter