1/x Thread discussing European serial acquirers as pulled from a fantastic recent investor letter by Scott Management. Highly recommend reading it in whole via below link...I was tempted to tweet the whole thing http://www.scottlp.com/letters.html#Acquirers

http://www.scottlp.com/letters.html#Acquirers

http://www.scottlp.com/letters.html#Acquirers

http://www.scottlp.com/letters.html#Acquirers

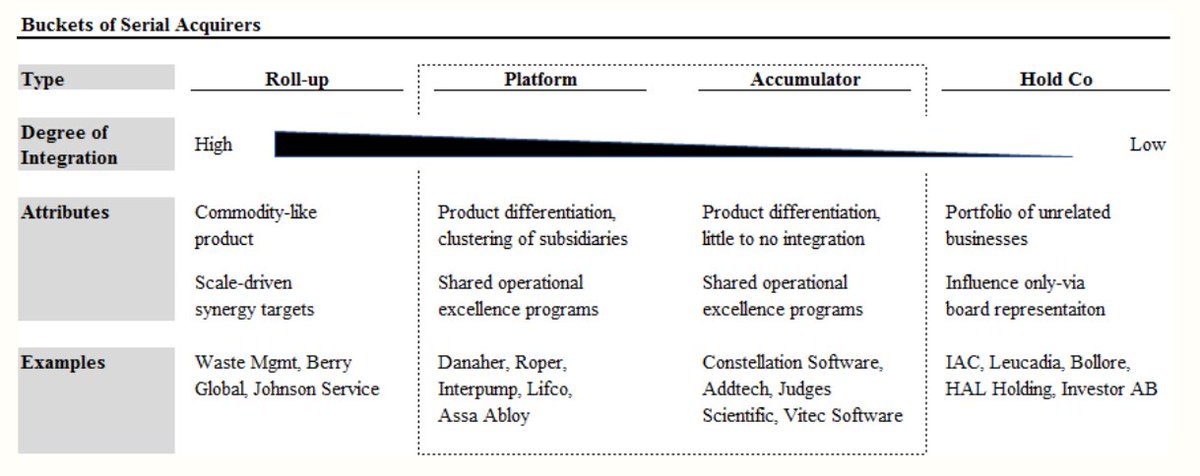

2/x Focuses on Platforms + Accumulators. So, industries where:

Small bizes can be good bizes on a stand-alone basis (excludes consolidation-driven roll-ups)

A direct line of sight between minority shareholders, mgmt & the point of customer interaction (excludes HoldCos).

Small bizes can be good bizes on a stand-alone basis (excludes consolidation-driven roll-ups)

A direct line of sight between minority shareholders, mgmt & the point of customer interaction (excludes HoldCos).

3/x The below are some of the best serial acquirers in Europe.

They are interesting investment candidates as they combine two attributes: they can potentially invest large amounts of capital at attractive rates of return, and they are sometimes overlooked or underestimated

They are interesting investment candidates as they combine two attributes: they can potentially invest large amounts of capital at attractive rates of return, and they are sometimes overlooked or underestimated

4/x "The specialized nature of products in these industries implies that it can be challenging for companies to success fully expand into adjacent markets. In this way, their organic growth rates can be limited by their intrinsic exposure to inflation-plus end markets."

5/x "Targeting smaller-sized companies. Many attractive prospects are too small to be considered by financial or strategic buyers. In Addtech’s case, acquisitions have, on average, had less than $10 million in sales and roughly 20 employees"

6/x "Well run serial acquirers are patient & have identified targets long in advance of them being available for purchase. Tending to deals in informal ways (i.e., lunches with the owners) provides an opportunity for more in-DD than that which is often available in a process"

7/x "Senior mgmt is often a key constraint of the privately-owned bizes we typically buy. Halma has the expertise and an infrastructure which helps companies grow internationally. Being part of a larger group mitigates the risk of significant investment by individual bizes"

8/x "As with money management, however, investing in a portfolio of businesses reduces risk. Many of SP Group’s deals, for example, have involved companies where a single customer accounted for more than 50% of sales."

9/x "Taking legacy considerations into account. Sellers sometimes ascribe greater value to seeing their business carry on as an independent subsidiary than hitting the highest bid, which affords a more amiable buyer such as Addtech an advantage over competitors"

Very true in

Very true in

10/x "...what makes them worth considering is the relative paucity of interest from other investors. In my view, this stems from three factors: their acquisition-oriented nature,their complexity, and Wall Street’s convention to exclude future acquisitions from forecasts"

Read on Twitter

Read on Twitter