I was fascinated by Paul Tudor Jones’s recent letter on bitcoin which I think it has a great impact on how traditional hedge funds think about bitcoin. He points out an important part of investing in bitcoin which I will share in this thread

1/ PTJ starts with Great Monetary Inflation (GMI) as a macro framework. He thinks monetary inflation is inevitable with central banks’ unprecedented monetary policy.

Now the trillion dollar question is which asset he thinks can serve like a store of value during GMI.

Now the trillion dollar question is which asset he thinks can serve like a store of value during GMI.

2/ PTJ’s model arrives at four characteristics of stores of value.

- Purchasing Power

- Trustworthiness

- Liquidity

- Portability

It reminds me of @edstromandrew’s Why Buy Bitcoin, where he measures SoV across assets in a similar logic (Recommend if you haven’t read it).

- Purchasing Power

- Trustworthiness

- Liquidity

- Portability

It reminds me of @edstromandrew’s Why Buy Bitcoin, where he measures SoV across assets in a similar logic (Recommend if you haven’t read it).

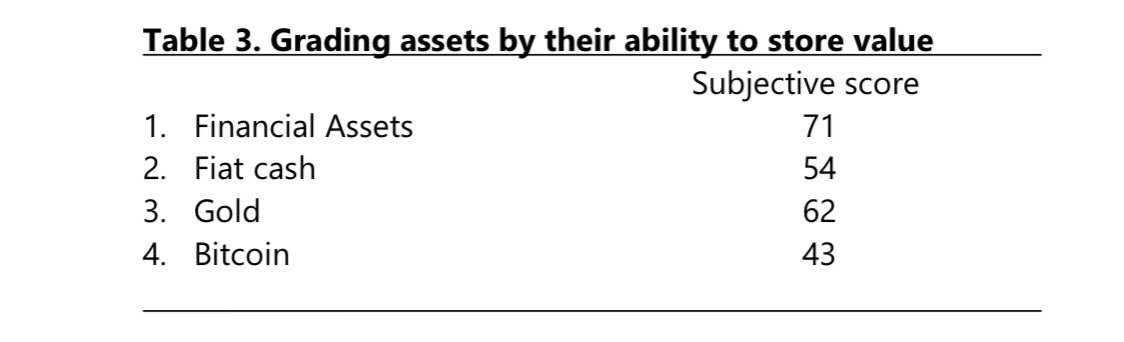

3/ According to PTJ’s model, grading assets by their ability to store value (Pic), Bitcoin came in last by scoring 43, below financial asset, fiat, and gold.

For PTJ, these are the final four horse men for store of value.

For PTJ, these are the final four horse men for store of value.

4/ In that logic of finding a good store of value, PTJ realized Bitcoin scores last. Like many other hedge fund managers, he should just put his money in gold and call it a day. However, he didn’t stop there (unlike Paul Singer, “Waiting for Good Dough”).

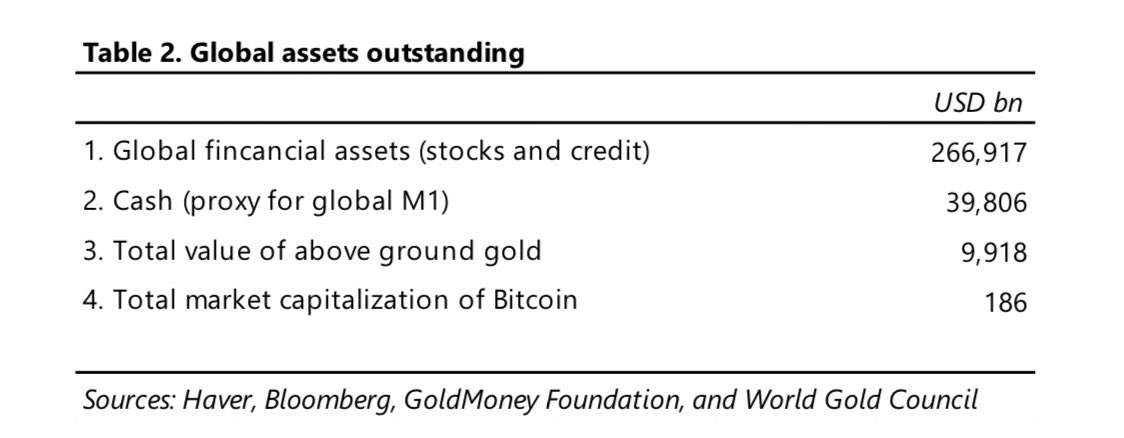

5/ He figures out that, “Bitcoin had an overall score nearly 60% (43/71) of that of financial assets but has a market cap that is 1/1200th of that. It scores 66% of gold as a store of value, but has a market cap that is 1/60th of gold’s outstanding value.”

6/ PTJ continues, ”Something appears wrong here and my guess is it is the price of Bitcoin.”

Very important to note that he is making a case: Bitcoin is undervalued cross other store of value assets based on outstanding value with SoV score.

Very important to note that he is making a case: Bitcoin is undervalued cross other store of value assets based on outstanding value with SoV score.

7/ He said Bitcoin remind him of gold in 1970s.

Comparing gold chart between 1975-1977 to Bitcoin’s between 2018-2020, they look similar before a parabolic run.

However, unlike gold, PTJ recognizes there is bitcoin’s “scarcity premium” with halving event.

Comparing gold chart between 1975-1977 to Bitcoin’s between 2018-2020, they look similar before a parabolic run.

However, unlike gold, PTJ recognizes there is bitcoin’s “scarcity premium” with halving event.

9/ The entire letter basically sets up a stage to discuss inflationary hedges. PTJ finally broke his silence to talk about bitcoin with sound investment logic in a modern portfolio. And comparison to gold is great marketing for bitcoin emerging as sound money.

8/ To finish, here is my favorite quote from PTJ on Bitcoin. He gets it.

On Bitcoin’s difficultly adjustment, PTJ comment, “This brilliant feature of Bitcoin was designed by the anonymous creator of Bitcoin to protect its integrity by making it increasingly near and dear, a concept alien to the current thinking of central banks and governments.”

Read on Twitter

Read on Twitter