Countries are best summarized by their corporate income tax schedule description in the OECD tax database, a thread.

Canada: the description is three lines long, it's clean, everyone agrees. It's a weighted average so everyone is happy.

France: all the names are in French. There are twenty different surtaxes, surcharges, one-off, temporary, additional contributions that end up being permanent. Threshold effects abound and your status matters. A lot.

Germany: there is a clear formula, and the rules apply to everyone. Unfortunately, they involve precise numbers with 15 decimals; it's obvious to every German person and to no one else.

Greece: There are twenty different tax codes, no one knows which version actually applies, but they all amend and replace each other in a Kafkaian circular way. Also there are no rules, only exemptions.

Israel: The rules of the corporate income tax are in a table instead of a paragraph of text like everyone else. Also, they are clearly *not* the rules of the corporate income tax.

Turkey: The rules would be one line long, except that the President can change them for whomever he likes.

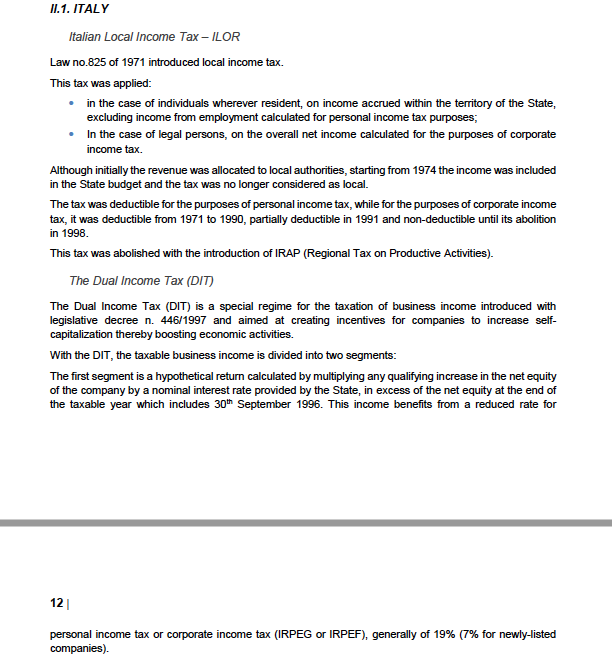

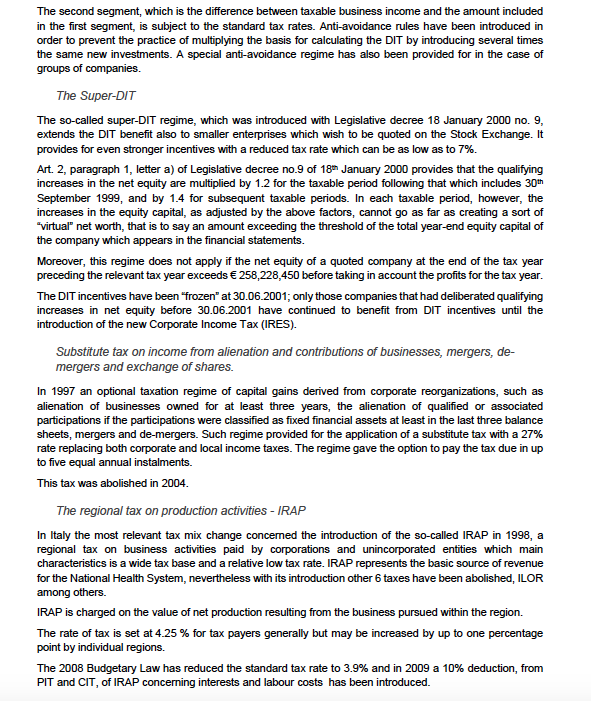

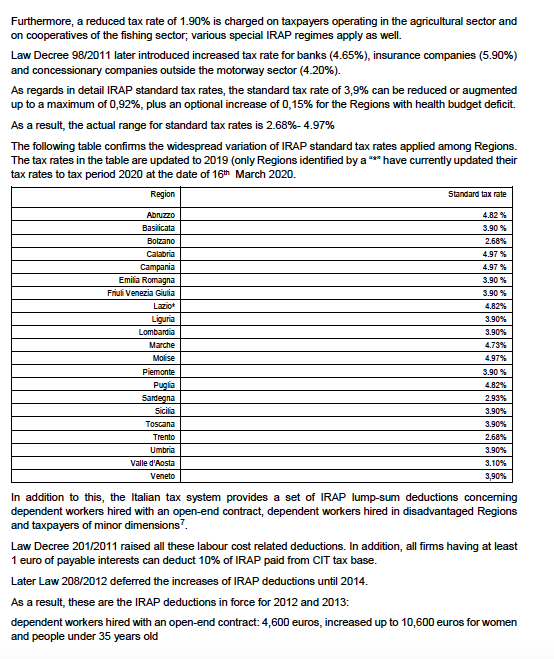

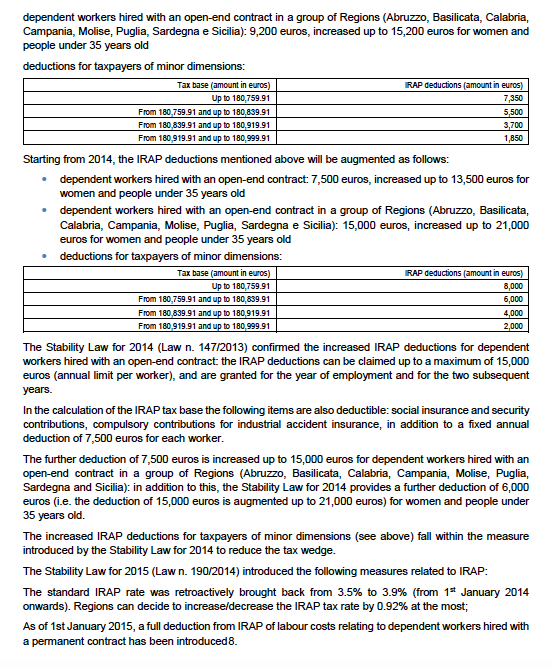

Italy: The rules are 8 pages long, more than everyone else combined. There are special rules, rates and deductions for each region, size, sector, age; thresholds abound and rates range from 2.68 to 58.14%. Also there's a rule preventing companies from shifting them to prices.

Read on Twitter

Read on Twitter