1/ A Weekend Thread on Currency, Debt Cycles, the World Monetary System, Gold, Silver, Central Banks & more.

In these times, a thread that is more relevant than ever.

Read on (39 tweets)

In these times, a thread that is more relevant than ever.

Read on (39 tweets)

2/ With so much Debt & Currency printing going on world wide, it's becoming hard to imagine that we won't have a complete reset of the 'Worlds Monetary System'

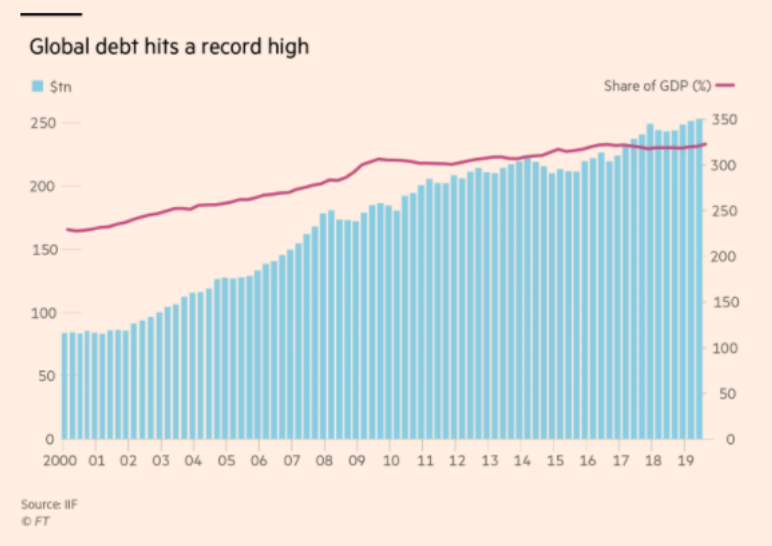

3/ Today we're at peak debt globally, far higher than the levels of 2008. The world now has >$250 Trillion of debt supporting a global economy of ~$90 Trillion / year

To put this in perspective, defaulting on 1.2% of that debt is $3T - that's the size of India's entire economy

To put this in perspective, defaulting on 1.2% of that debt is $3T - that's the size of India's entire economy

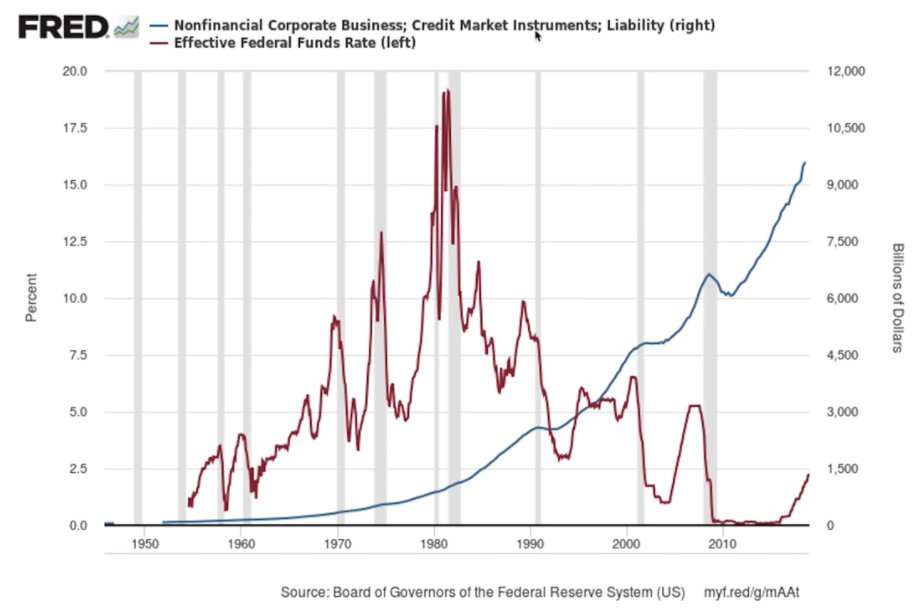

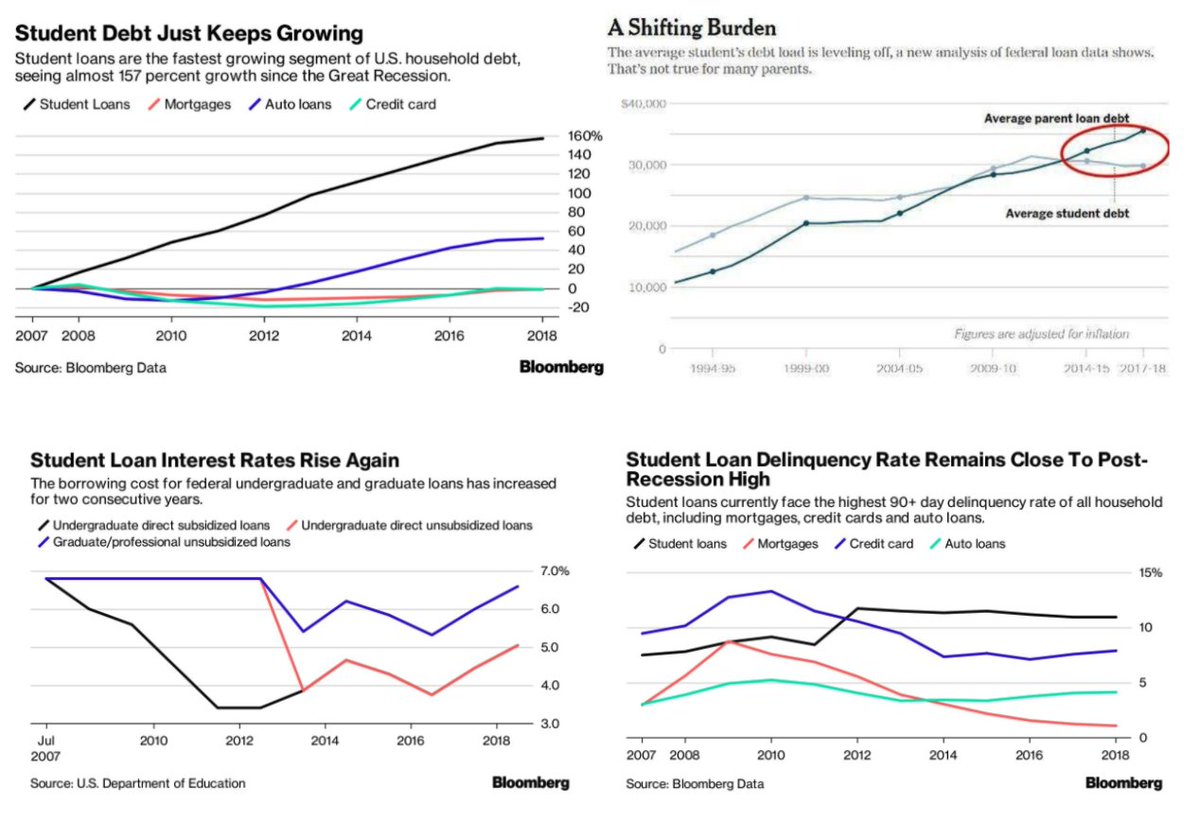

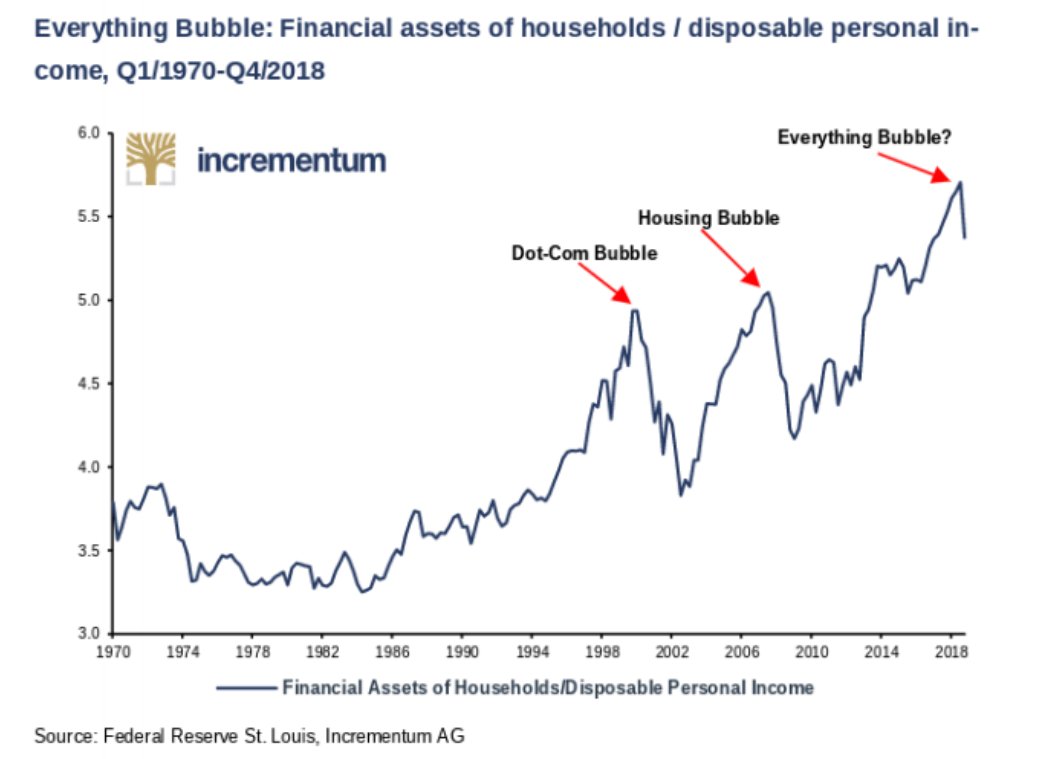

4/ With all that debt, asset prices have ballooned to never seen before levels (Inflation has many faces).

Usually it's just one asset class but this time it's much more → Stocks + Corporate + Housing + Student Loans + Financial.

Some are calling this → The Everything Bubble

Usually it's just one asset class but this time it's much more → Stocks + Corporate + Housing + Student Loans + Financial.

Some are calling this → The Everything Bubble

5/ Why is a bubble a problem? Because sooner or later they burst causing havoc on the economy.

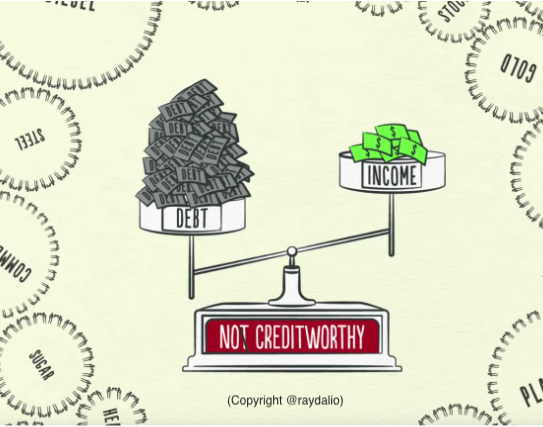

As debt grows so do debt repayments. Soon they both start growing much faster than income grows. When that happens we reach a tipping point where someone defaults

As debt grows so do debt repayments. Soon they both start growing much faster than income grows. When that happens we reach a tipping point where someone defaults

6/ One person defaulting is another persons income loss. And as income reduces so does spending.

This spirals into a vicious cycle leading to a bubble bursting and a massive deflationary event where the economy starts to de-grows (Think Recession or worse a Depression)

This spirals into a vicious cycle leading to a bubble bursting and a massive deflationary event where the economy starts to de-grows (Think Recession or worse a Depression)

7/ How does the world keep landing up here?

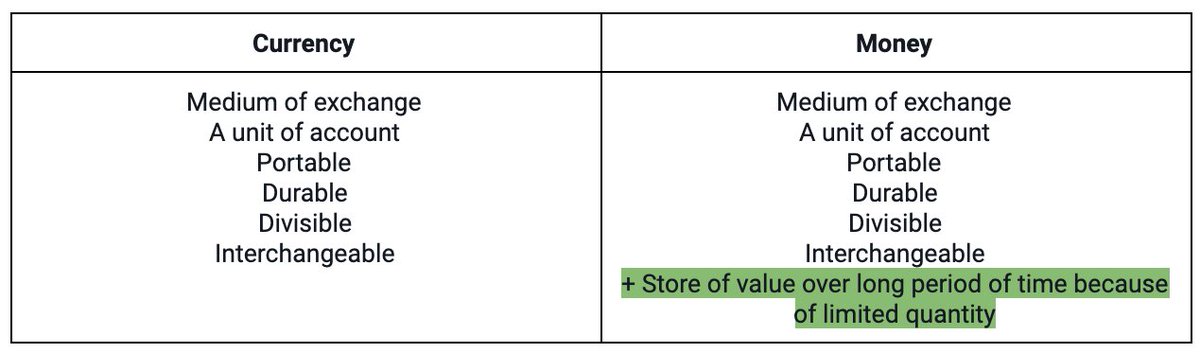

For that I first need to explain the difference between Currency & Money.

They're 2 very different things. 99% of the world's population is un-aware that we no longer use Money

For that I first need to explain the difference between Currency & Money.

They're 2 very different things. 99% of the world's population is un-aware that we no longer use Money

8/ The difference between Currency & Money below:

a. Money limited in quantity (Currency isn't, it's easily printed)

b. Money is a store of value over a long period of time (Currency isn't because of a)

a. Money limited in quantity (Currency isn't, it's easily printed)

b. Money is a store of value over a long period of time (Currency isn't because of a)

9/ This is how banks are able to lend multiples times of the deposits they hold. Fractional Reserve as it's called allows banks to do that.

If a bank's total deposits = $100 and if the Fractional Reserve Rate = 10%, they can lend $90 of that $100 to other customers.

If a bank's total deposits = $100 and if the Fractional Reserve Rate = 10%, they can lend $90 of that $100 to other customers.

10/ Banks are great at effectively creating Currency out of thin air.

In some countries FRR = 0% which means infinite Currency creation is possible

In some countries FRR = 0% which means infinite Currency creation is possible

11/ Because the world's monetary system runs on Currency & not Money, we’ve become accustomed to a culture of ‘borrowing & debt’ because Currency can be printed out of thin air.

Borrowing creates cycles because what you borrow today has to be paid back tomorrow

Borrowing creates cycles because what you borrow today has to be paid back tomorrow

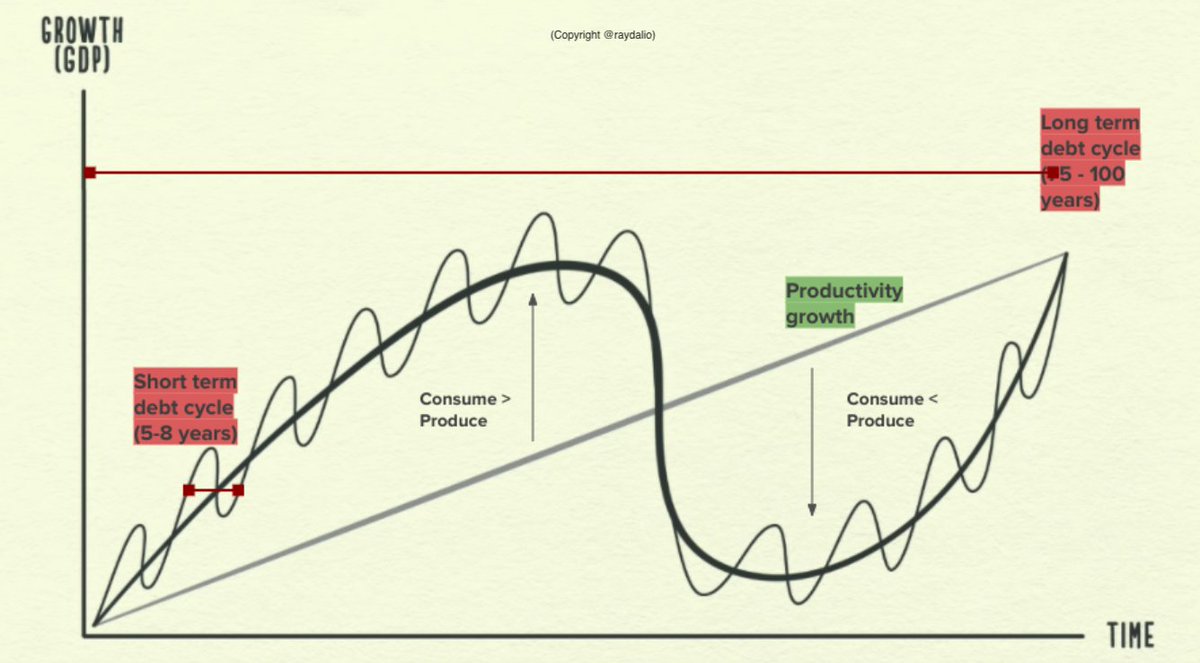

12/ @raydalio articulates this incredibly well. He talks about 2 debt cycles:

1. Short term (5-8 yrs) &

2. Long term debt cycles (75-100yrs)

Must Watch "How the Economic Machine Works" by Ray Dalio -

1. Short term (5-8 yrs) &

2. Long term debt cycles (75-100yrs)

Must Watch "How the Economic Machine Works" by Ray Dalio -

13/ The problem is as a civilisation we're good at borrowing but not very good at paying back this debt.

But sooner or later we have no choice because debt starts growing faster than incomes do and reach a tipping point where people begin to default on their debts

But sooner or later we have no choice because debt starts growing faster than incomes do and reach a tipping point where people begin to default on their debts

14/ We reach what @raydalio calls the 'Long Term Debt Cycle Peak' where it's unproductive to take on any more debt (see attached).

That means we have no choice but to start paying back debt given debt growth >> income growth.

But... we never do. Thus, a Bubble

That means we have no choice but to start paying back debt given debt growth >> income growth.

But... we never do. Thus, a Bubble

15/ Many are calling this the 'Everything Bubble'.

If true and it does burst, it's going to make 2008 and earlier crisis look pale in comparison

If true and it does burst, it's going to make 2008 and earlier crisis look pale in comparison

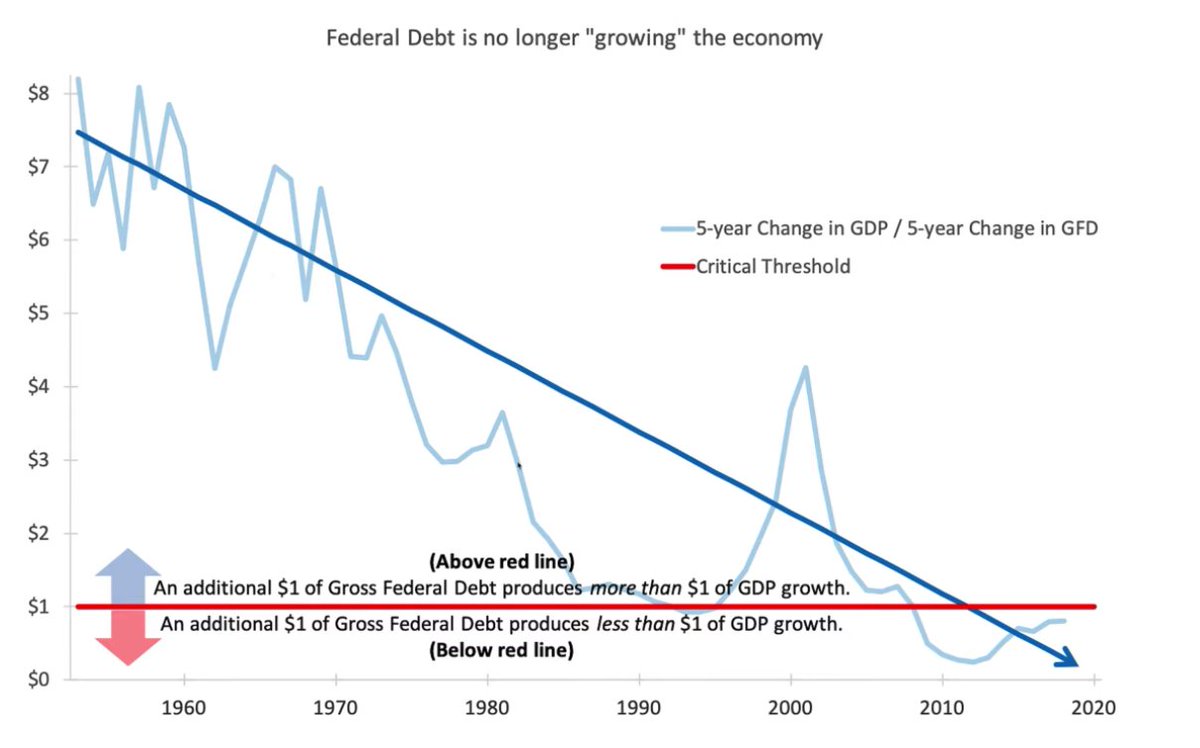

16/ Is the current system broken? Hard to think not. See attached.

This time the powers to be will likely have no choice and will be forced to ask some serious questions that will lead to a brand new 'World Monetary System'

This time the powers to be will likely have no choice and will be forced to ask some serious questions that will lead to a brand new 'World Monetary System'

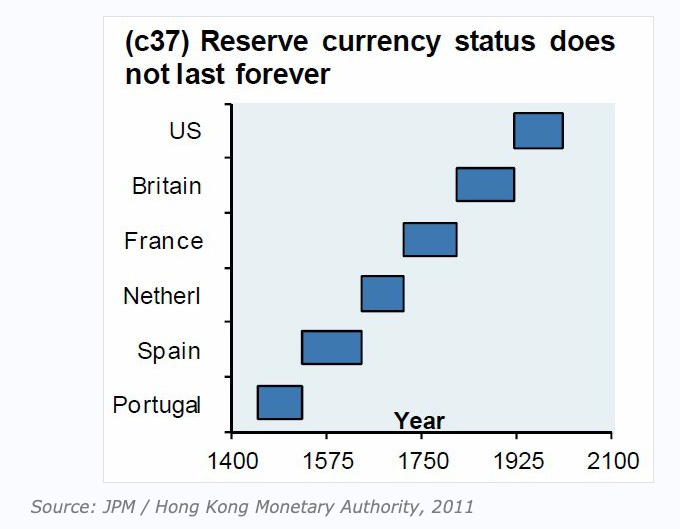

17/ Surprised? You shouldn’t be.

It turns out every 100 years the world's predominant reserve Currency changes.

And every 30-40 years there is a Currency Crisis and a new monetary system is put in place.

This was a big revelation.

It turns out every 100 years the world's predominant reserve Currency changes.

And every 30-40 years there is a Currency Crisis and a new monetary system is put in place.

This was a big revelation.

18/ Google the following events (approx years):

1. Genoa Pact (1913 to 1943) ~30 years

2. Bretton Woods (1944 - 1971) ~26 years

3. Smithsonian Agreement (1971 till today) ~49 years

We're clearly overdue a reset.

1. Genoa Pact (1913 to 1943) ~30 years

2. Bretton Woods (1944 - 1971) ~26 years

3. Smithsonian Agreement (1971 till today) ~49 years

We're clearly overdue a reset.

19/ What could a reset look like?

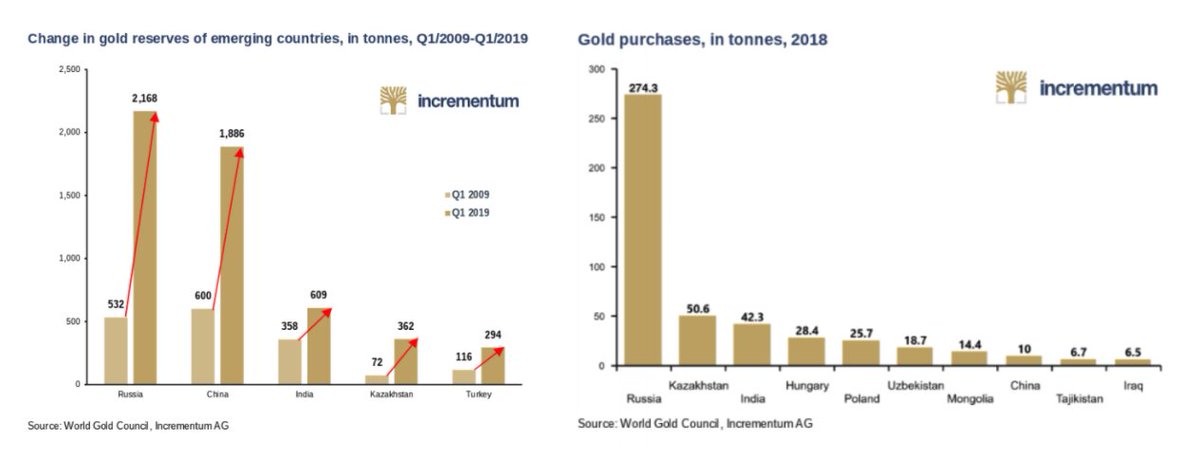

If you look close enough, you'll see that Central Banks have purchasing Gold for the last decade at record rates.

Very unusual → How bad could things have possibly gotten?

If you look close enough, you'll see that Central Banks have purchasing Gold for the last decade at record rates.

Very unusual → How bad could things have possibly gotten?

20/ A good conclusion would be that they're diversifying their reserves away from $.

Is the world anticipating a $ collapse? It seems so and given the world pegs to the $, something big might be coming.

A 21st Century Gold-Backed Monetary System.

Wouldn't that be something.

Is the world anticipating a $ collapse? It seems so and given the world pegs to the $, something big might be coming.

A 21st Century Gold-Backed Monetary System.

Wouldn't that be something.

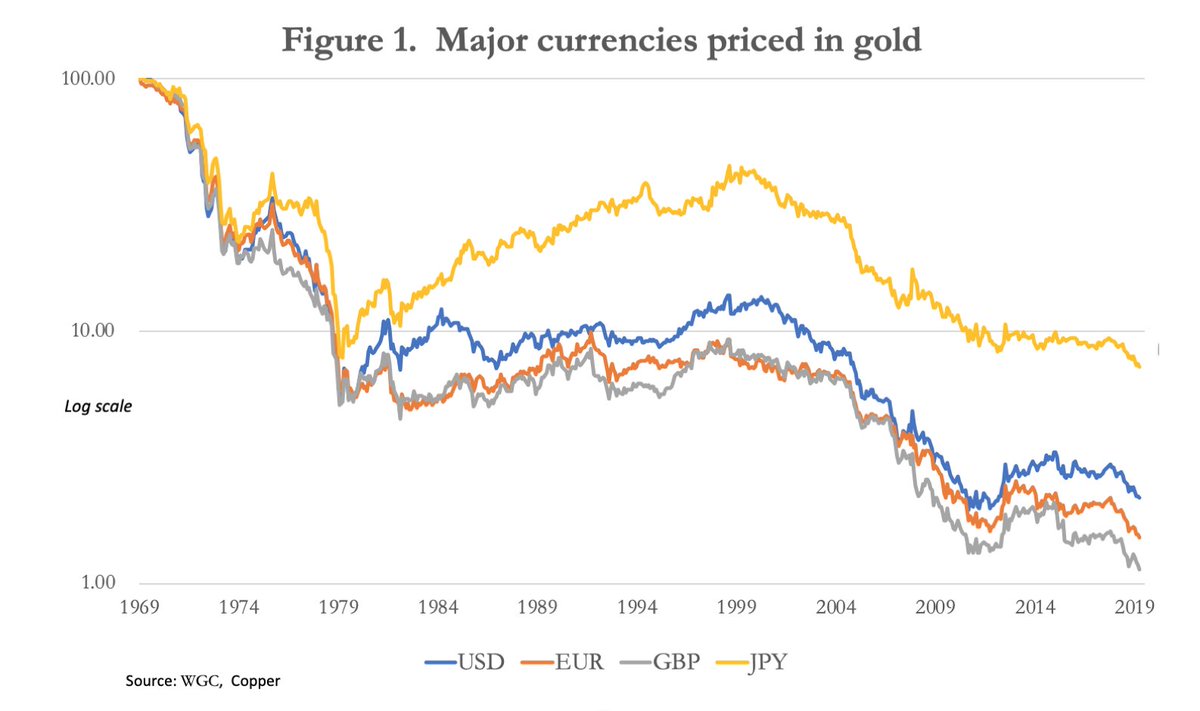

21/ Gold as Money?

Most people's first reaction would be

It would be no surprise given our last 2 generations have been rigorously conditioned by professors and policy makers to believe that Gold is a commodity and has no role in the world's monetary system

Most people's first reaction would be

It would be no surprise given our last 2 generations have been rigorously conditioned by professors and policy makers to believe that Gold is a commodity and has no role in the world's monetary system

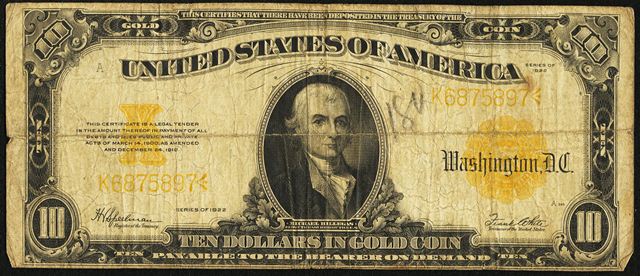

22/ On the contrary

Until the 1971, it turns out that the entire world ran on a Gold Standard in some form.

That was just 50 years ago. Incredible isn't it

Until the 1971, it turns out that the entire world ran on a Gold Standard in some form.

That was just 50 years ago. Incredible isn't it

23/ What would a Gold Standard System look like?

1. A new $ pegged to Gold & world remains pegged to $

2. Every country pegs to Gold directly

3. A crypto-based Gold solution

4. A global currency like the IMF SDR pegged to Gold

One can only speculate but my bet would be on #2

1. A new $ pegged to Gold & world remains pegged to $

2. Every country pegs to Gold directly

3. A crypto-based Gold solution

4. A global currency like the IMF SDR pegged to Gold

One can only speculate but my bet would be on #2

24/ Attached is a real $10 bill backed by $10 in Gold Coins. This was a very cool find :)

More ancient bills here - http://www.antiquemoney.com/value-of-1922-10-gold-certificate-bill/

More ancient bills here - http://www.antiquemoney.com/value-of-1922-10-gold-certificate-bill/

25/ The most common argument against a Gold Standard is - "There's not enough Gold!".

Well you just raise the value of Gold to match the global monetary supply. It's quite simple.

Well you just raise the value of Gold to match the global monetary supply. It's quite simple.

26/ There is historical precedence to this → Gold Reserve Act from President Roosevelt in the 1930s where the $ was de-valued from $20/ounce to $35/ounce over a short period - https://en.wikipedia.org/wiki/Gold_Reserve_Act

While history may not repeat itself but it can certainly inform the future.

While history may not repeat itself but it can certainly inform the future.

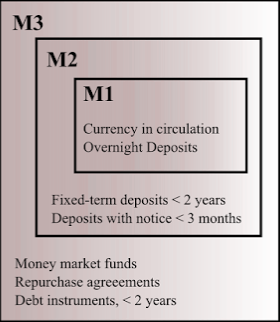

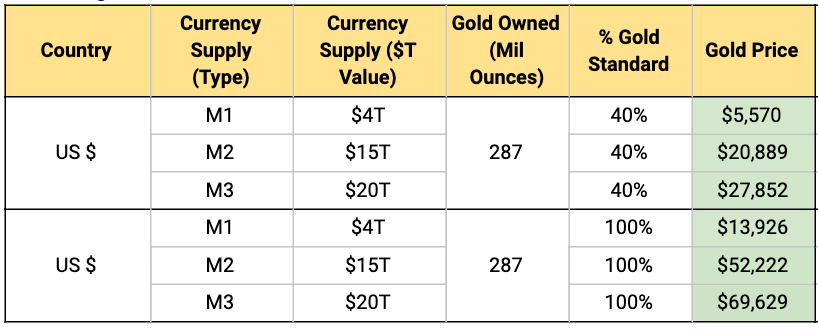

27/ If this happens, watch out for price of Gold

Given it's limited supply, each country would de-value their Currency vs Gold. This would be based on 2 things:

1. Type of Monetary Supply (M0,1,2,3)

2. What % is currency Gold-backed

Attached are some wild calculations

Given it's limited supply, each country would de-value their Currency vs Gold. This would be based on 2 things:

1. Type of Monetary Supply (M0,1,2,3)

2. What % is currency Gold-backed

Attached are some wild calculations

28/ More interesting data points:

1. 11 US States have already made Gold (& Silver) legal tenders - https://gsiexchange.com/states-gold-silver-become-legal-tender/

2. In 2012 & 2016, Republicans passed a House bill to investigate viability of Gold

So clearly a big interest.

1. 11 US States have already made Gold (& Silver) legal tenders - https://gsiexchange.com/states-gold-silver-become-legal-tender/

2. In 2012 & 2016, Republicans passed a House bill to investigate viability of Gold

So clearly a big interest.

29/ Another interesting data point is @realdonaldtrump most recent nominee to the Fed Board - Judy Shelton, a big backer of a Gold Standard.

Her authored paper "Gold & Government" - - https://www.cato.org/sites/cato.org/files/serials/files/cato-journal/2012/7/v32n2-9.pdf?mod=article_inline

Her authored paper "Gold & Government" - - https://www.cato.org/sites/cato.org/files/serials/files/cato-journal/2012/7/v32n2-9.pdf?mod=article_inline

30/ Is there another option? Just wipe off all consumer debt?

Looks like US and other countries are considering it but it would be kicking the can down the road and won't fix a broken system. https://www.fool.com/millionacres/real-estate-financing/articles/how-the-rent-and-mortgage-cancellation-act-of-2020-would-impact-real-estate-investors/

Looks like US and other countries are considering it but it would be kicking the can down the road and won't fix a broken system. https://www.fool.com/millionacres/real-estate-financing/articles/how-the-rent-and-mortgage-cancellation-act-of-2020-would-impact-real-estate-investors/

31/ If one does return to a Gold standard, it would be an interesting thought to ask what would happen to Central Banks?

It's increasingly likely that they won't exist in their current forms. Some say they may collapse - https://www.zerohedge.com/news/2019-08-26/will-central-banks-survive

It's increasingly likely that they won't exist in their current forms. Some say they may collapse - https://www.zerohedge.com/news/2019-08-26/will-central-banks-survive

32/ Maybe it's already begun.

Did anyone notice the US Treasury practically took over the Federal Reserve? https://www.washingtonpost.com/business/on-small-business/the-feds-cure-risks-being-worse-than-the-disease/2020/03/27/56357a52-7023-11ea-a156-0048b62cdb51_story.html

Did anyone notice the US Treasury practically took over the Federal Reserve? https://www.washingtonpost.com/business/on-small-business/the-feds-cure-risks-being-worse-than-the-disease/2020/03/27/56357a52-7023-11ea-a156-0048b62cdb51_story.html

33/ People tend to forget that Central Banks are a fairly new invention.

They began setting interest rates only in the 1920s, and became the guardians of inflation in the 1980s.

They began setting interest rates only in the 1920s, and became the guardians of inflation in the 1980s.

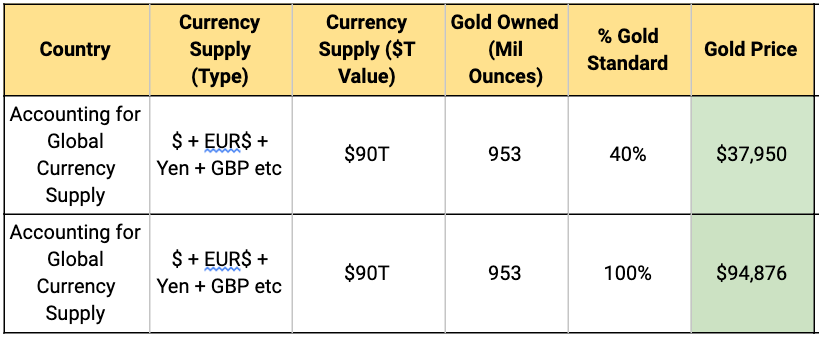

34/ We live in wild times right now. One thing should be clear to everyone whose made it this far → Cash (Currency) is no longer King.

As a matter of fact when was it? Most Currencies have lost nearly 99% of their value since inception.

As a matter of fact when was it? Most Currencies have lost nearly 99% of their value since inception.

35/ To finish off, here are some things that I think are fun and useful. Think of this as Appendix Tweets.

Thanks for tuning in!

Thanks for tuning in!

37/ Don't forget Silver

There is only one chart to watch for Silver which is the Gold:Silver ratio.

There is only one chart to watch for Silver which is the Gold:Silver ratio.

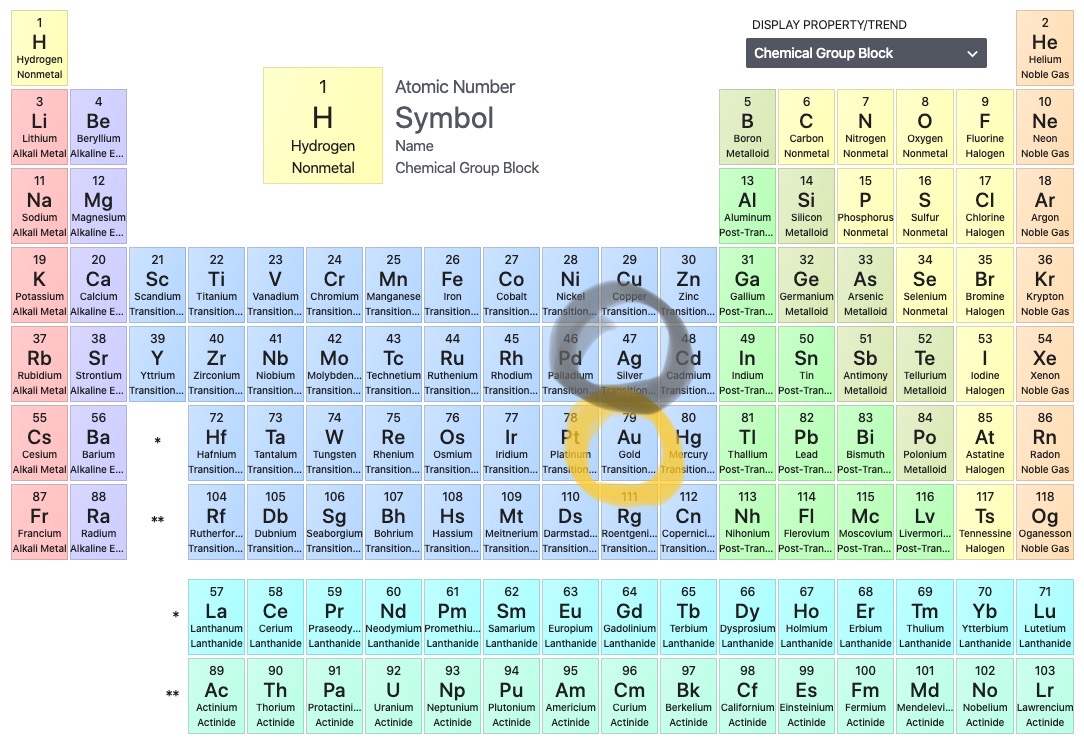

38/ Why Gold & Silver = Money and not other elements on the periodic table.

Au, Ag have relatively low melting points, aren't Gas or Liquid at room temperature, don't explode on contact with H20, aren't radioactive, don't rust (no debasing) and are not too rare.

Au, Ag have relatively low melting points, aren't Gas or Liquid at room temperature, don't explode on contact with H20, aren't radioactive, don't rust (no debasing) and are not too rare.

39/ A great in-depth read for the curious minded on Gold and it's history in our monetary system - https://www.cato.org/blog/classical-gold-standard-can-inform-monetary-policy

Read on Twitter

Read on Twitter