Shri @RahulGandhi MP (LS) and Shri @rssurjewala spokesperson of @INCIndia have attempted to mislead people in a brazen manner. Typical to @INCIndia, they resort to sensationalising facts by taking them out of context. In the following tweets wish to respond to the issues raised.

Today’s attempt of @INCIndia leaders is to mislead on wilful defaulters, bad loans & write-offs. Between 2009-10 & 2013-14, Scheduled Commercial Banks had written off Rs.145226.00 crores. Wished Shri. @RahulGandhi consulted Dr. Manmohan Singh on what this writing-off was about.

Provisions are made for NPAs as per the four-year provisioning cycle laid down by the @RBI. Upon full provisioning being done banks write-off the fully provided NPA but continue to pursue recovery against the borrower. No loan is waived off.

Those defaulters who do not repay despite having capacity to pay, divert or siphon-off funds, or dispose of secured assets without bank’s permission are categorised as wilful defaulters. They are those well connected promoters who benefitted from UPA’s ‘Phone banking’.

Useful to recall the words of Shri.Raghuram Rajan: “A large number of bad loans originated in the period 2006-2008...Too many loans were made to well-connected promoters who have a history of defaulting on their loans...Public sector bankers continued financing promoters even...

...while private sector banks were getting out. RBI could have raised more flags about the quality of lending...” RR Rajan.(Source: @IndiaToday Sept 11,2018 and many other print& electronic media). From 2015, PSBs were asked by GoI to check all NPAs >50 crore for wilful default.

Nirav Modi Case : Immovable and movable properties worth more than Rs 2387 Crore attached/seized.( Attachment Rs 1898 Crore and Seizure Rs 489.75 Crore) . This includes foreign attachments of Rs 961.47 Crore. Auction of luxury items for Rs 53.45 Crore. He is in prison in the UK.

Mehul Choksi Case : Attachments of Rs 1936.95 Crore including foreign attachment of Rs 67.9 Crore. Seizure of Rs 597.75 Crore. Red Notice issued. Extradition Request sent to Antigua. Hearing for declaration of Mehul Choksi as Fugitive Offender is in progress.

Vijay Mallya Case : Total value at the time of attachment was Rs 8040 Crore and of seizure was Rs 1693 Crore. Value of shares at the time of seizure was Rs 1693 Crore. Declared fugitive offender. On extradition request by GoI,UK High Court, has also ruled for extradition.

It is @PMO @narendramodi government which is pursuing these wilful defaulters.9967 recovery suits, 3515 FIRs, invoking Fugitive Amendment Act in cases are on now. Total value of attachment & seizures in the cases of Nirav Modi, Mehul Choksi and Vijay Mallya : Rs 18332.7 Crore.

Bank-wise details of aggregate funded amount outstanding & amount technically/prudentially written off, pertaining to top fifty wilful defaulters was provided as an annex to the answer to Lok Sabha starred question *305 of Shri. @RahulGandhi on 16.3.2020.

Earlier, on 18.11.2019, in the Lok Sabha for an unstarred Question no:52, a list of “Borrowers flagged as wilful defaulter by Public Sector Banks under CRILIC reporting as on 30.09.2019 (For borrowers with exposure of Rs. 5 crore and above, Global operations) was provided.

@INCIndia and Shri. @RahulGandhi should introspect why they fail to play a constructive role in cleaning up the system. Neither while in power, nor while in the opposition has the @INCIndia shown any commitment or inclination to stop corruption & cronyism.

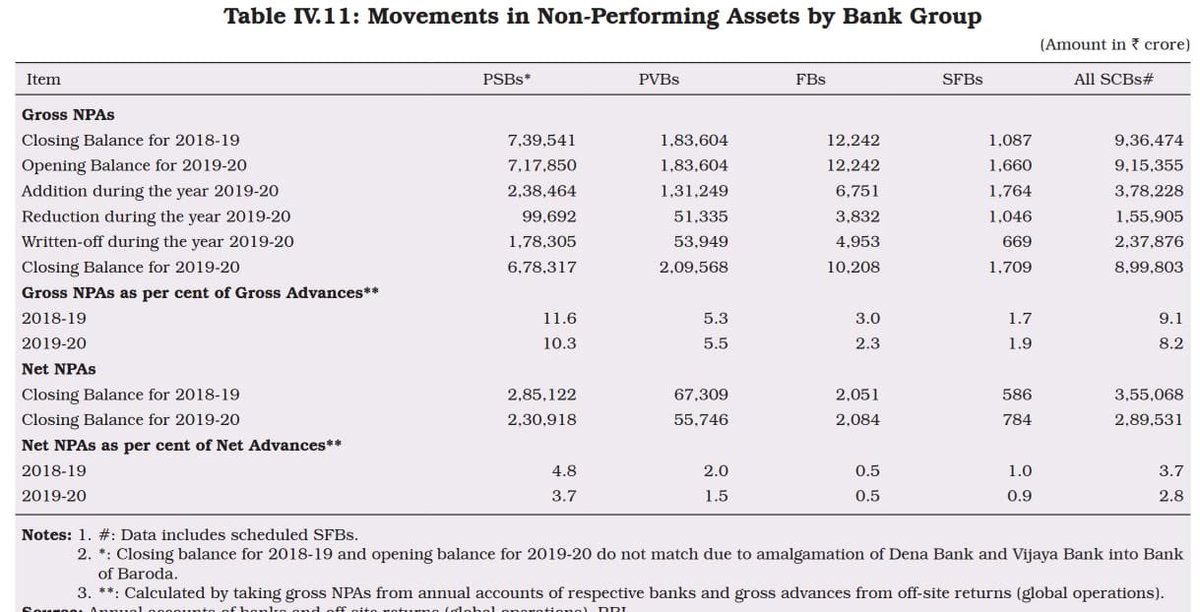

Link to thread explaining loan “write off.” Further, here is the link to the @RBI document and the screenshot of the table (page 62) from where @RahulGandhi picks and places out of context a number- for all Scheduled Comm Banks, private banks included.

https://rbidocs.rbi.org.in/rdocs/Publications/PDFs/6OPERATIONSPERFORMANCE47A74BB420C14199A7063F4C30842517.PDF

https://rbidocs.rbi.org.in/rdocs/Publications/PDFs/6OPERATIONSPERFORMANCE47A74BB420C14199A7063F4C30842517.PDF

Read on Twitter

Read on Twitter