RELIANCE IND has a Board meeting on April 30th to discuss Q4FY20 Results, Dividend, and a Proposal of a rights issue

The last rights shares that RIL issued was in 1991 in ratio of 1:20

So here's a small thread on RIL, Dhirubhai Ambani, Mukesh Ambani, and a few amazing facts

The last rights shares that RIL issued was in 1991 in ratio of 1:20

So here's a small thread on RIL, Dhirubhai Ambani, Mukesh Ambani, and a few amazing facts

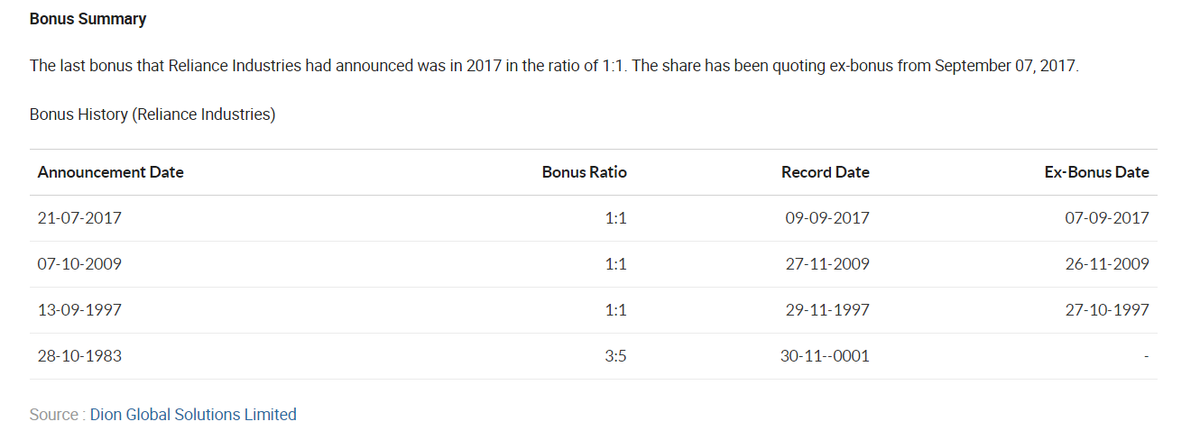

#1 This is the first public raise the company is doing after 1991 or after 29 years. (No Splits in its history)

The company does have a history of Bonus shares. (attached)

The company does have a history of Bonus shares. (attached)

Before jumping onto 2nd fact, we see that unlike other behemoths, Reliance Industries doesn't do concalls and management interviews. Now some ppl would argue that that's bad, but I think that's quite professional. They focus on business and not interviews!

#2 - Origins of RIL

The first office of the Reliance Commercial Corporation (RIL) was set up at the Narsinatha Street in Masjid Bunder. It was a 350 sq ft room with a telephone, one table and three chairs. Initially, they had two assistants to help them with their business!

The first office of the Reliance Commercial Corporation (RIL) was set up at the Narsinatha Street in Masjid Bunder. It was a 350 sq ft room with a telephone, one table and three chairs. Initially, they had two assistants to help them with their business!

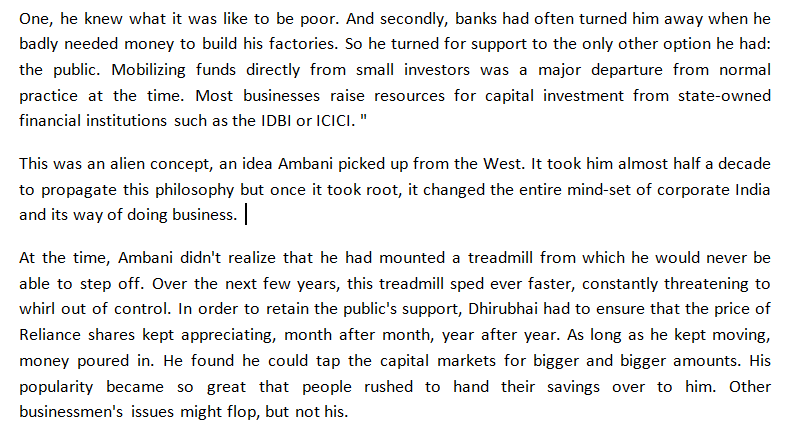

Dhirubhai Ambani Ji is known to have actually ignited the equity investing flame in India. Here's a snippet from a book that confirms the statement. https://twitter.com/adi2five/status/1143113111894777856

Dhirubhai Ambani from a very young age had an entrepreneurial zeal!

The more u read on Dhirubhai Ambani, the more u get inspired. https://twitter.com/adi2five/status/1144946713913724932

The more u read on Dhirubhai Ambani, the more u get inspired. https://twitter.com/adi2five/status/1144946713913724932

I came to know in 2019 that my Nana (Mothers' Father) started his investing journey with IPOs. He invested in Reliance Petroleum (now India's most valuable company) and through the profits, he married off his 3 sons, 2 daughters, traveled around India and built a few properties

This number is witness to the fact of the Equity Cult Dhirubhai Ambani Ji built in India - https://twitter.com/adi2five/status/1141991589822078976

Dhirubhai once said, "I consider myself a pathfinder.

I have been excavating the jungle and making the road for others to walk. I like to be the first in everything I do. Making money does not excite me, though I have to make it for my shareholders. "

I have been excavating the jungle and making the road for others to walk. I like to be the first in everything I do. Making money does not excite me, though I have to make it for my shareholders. "

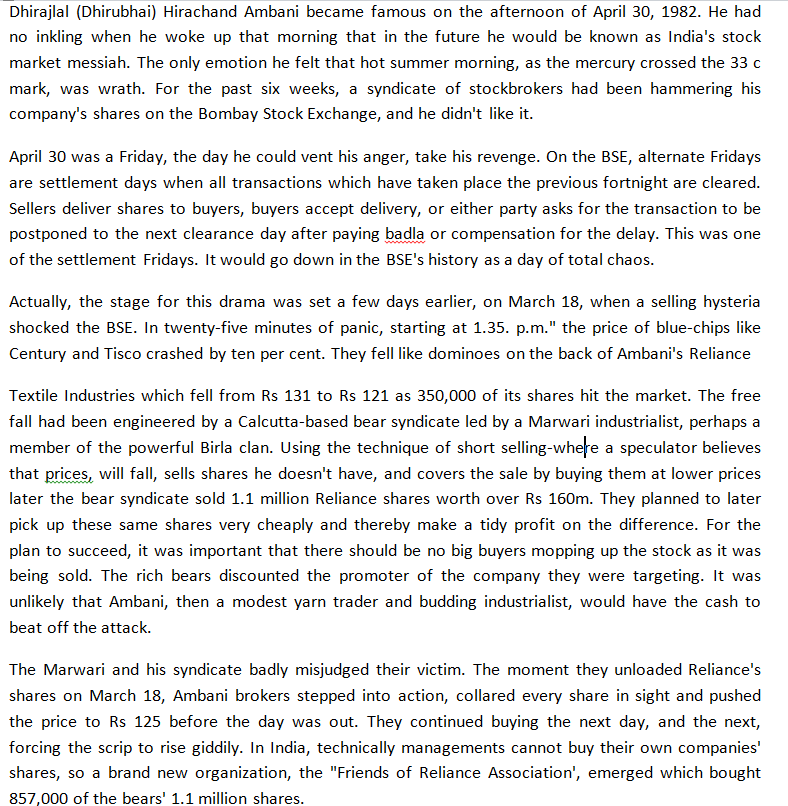

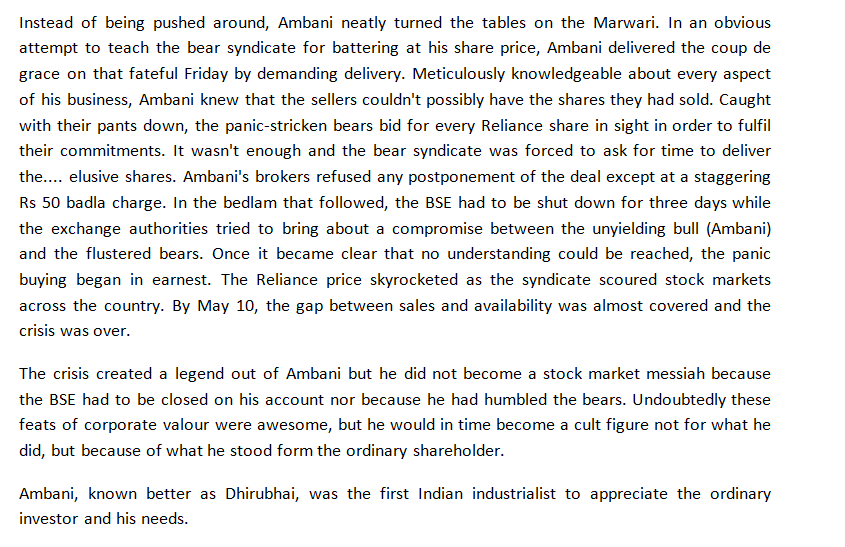

But just because Dhirubhai was good towards his shareholders, did not mean he was negligent towards negative forces!

One of the craziest stories of the BSE when the exchange had to be closed!

What a legend!

One of the craziest stories of the BSE when the exchange had to be closed!

What a legend!

Needless to say, he was a perfectionist!

Here is a story that shows this! https://twitter.com/adi2five/status/1215525151522975744

Here is a story that shows this! https://twitter.com/adi2five/status/1215525151522975744

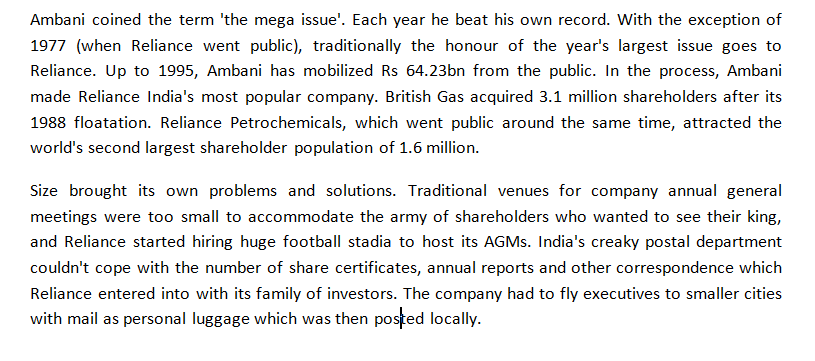

remember the Scene from the movie Guru ?(If you haven't watched this movie, please do) Where Gurubhai (Portrayed by Abhishek Bachchan) stands in a stadium full of shareholders?

Well, let me tell you that's true again!

RIL Stories keep getting crazy and crazy!

Well, let me tell you that's true again!

RIL Stories keep getting crazy and crazy!

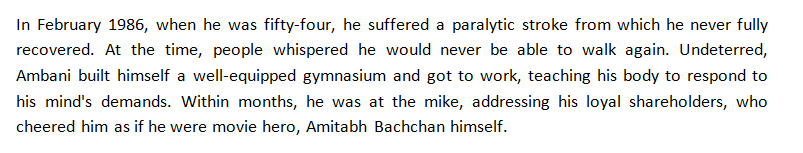

But all was not rosy! Dhirubhai Ambani suffered a paralytic stroke and many said, he won't be able to walk again!

But then this was Dhirubhai Ambani and u know what they say "When there is a will, there is a way"

The biggest takeaway from this legend for me is to Never give up!

But then this was Dhirubhai Ambani and u know what they say "When there is a will, there is a way"

The biggest takeaway from this legend for me is to Never give up!

With that, we will stop talking about the legendary Dhirubhai Ambani Ji and come to RIL.

Let's look at a few historical images of the company https://twitter.com/adi2five/status/1129580902340677635

Let's look at a few historical images of the company https://twitter.com/adi2five/status/1129580902340677635

Some say Ambani is an acronym for ambition and money. It’s probably true. In the '80s, Reliance grew at an astonishing 1,100%

In 1975 a World Bank team visited 24 leading textile mills and said 'judged in relation to developed country standards, only 1 mill, Reliance, could be described as excellent'. The rest they described as slums.

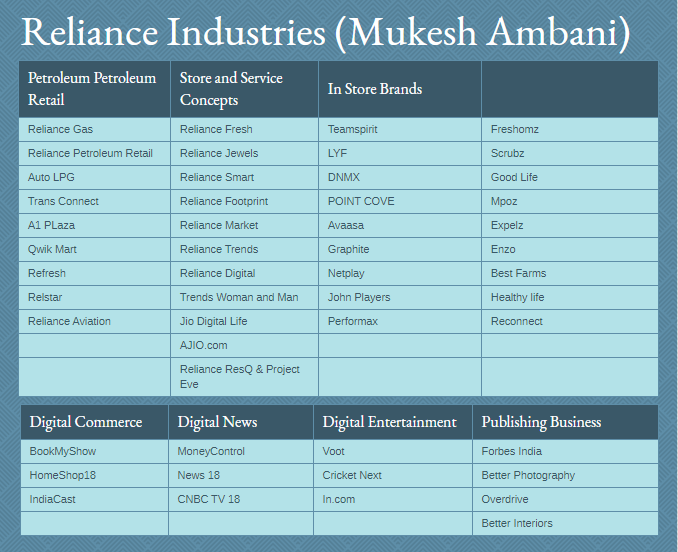

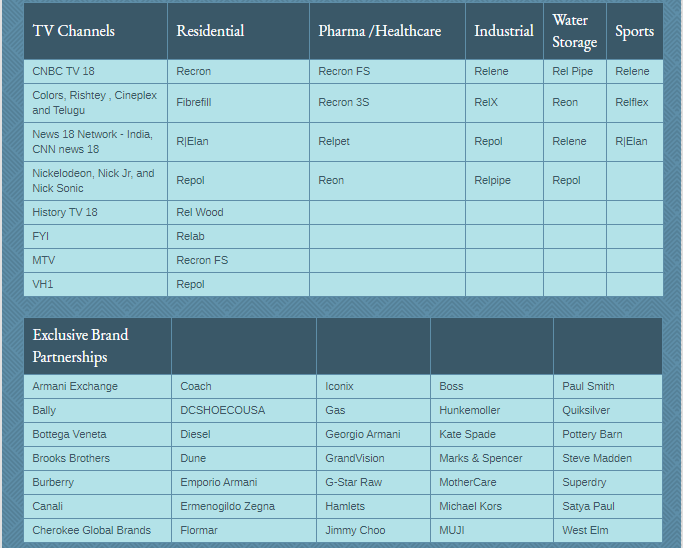

Fast forward to now, and we clearly see that Mukesh Ambani took forward his father’s legacy by introducing Jio and making it India’s top Telco Company.

Here is the Reliance Industries Empire right now -

Here is the Reliance Industries Empire right now -

One Amazing Fact of Reliance! https://twitter.com/adi2five/status/1149165912093675520

But RIL has had its problems as well in recent times, but just like before, they were strong and they went all in to solve the problems!

This is one crazy story! https://twitter.com/adi2five/status/1145274137566314497

This is one crazy story! https://twitter.com/adi2five/status/1145274137566314497

So now lets come to Reliance now.

We have seen the management talk about Data being the new oil. Now I like and respect managements who walk the talk?

Now has RIL walked the talk towards Data? They have!

Here's the proof! https://twitter.com/adi2five/status/1218405285426937858

We have seen the management talk about Data being the new oil. Now I like and respect managements who walk the talk?

Now has RIL walked the talk towards Data? They have!

Here's the proof! https://twitter.com/adi2five/status/1218405285426937858

Let me squeeze in one unknown company Reliance owns - https://twitter.com/adi2five/status/1245632168715419648

Now what are Reliance's ambitions? They had said Data is the new oil and they have been making many media and tech bets!

Now ~2 years back, I said RIL going to make a super app like WeChat.

And it seems, this forecast of mine turned out to be true! https://twitter.com/adi2five/status/1250796244806455296

Now ~2 years back, I said RIL going to make a super app like WeChat.

And it seems, this forecast of mine turned out to be true! https://twitter.com/adi2five/status/1250796244806455296

Now we all know Facebook invested in Jio. And we know RIL is in talks to sell a part of the Oil business to Aramco. So this brings the question, why does RIL need money?

Here's why

To retire debt

To get strategic partners in each of their big businesses (Oil, Retail and Jio)

Here's why

To retire debt

To get strategic partners in each of their big businesses (Oil, Retail and Jio)

Now point 2 of the reason, why a strategic partner in 3 business?

I make one more wild forecast here - The other 2 businesses will be de-merged to bring 3 RIL entities in total. 1 out of each of these 3 companies will be given to each one of their children (Akash, Anant, Isha)

I make one more wild forecast here - The other 2 businesses will be de-merged to bring 3 RIL entities in total. 1 out of each of these 3 companies will be given to each one of their children (Akash, Anant, Isha)

What advantages does FB deal bring to Jio and then FB themselves?

Quora answer on the same - https://qr.ae/pNrVP6

Quora answer on the same - https://qr.ae/pNrVP6

Now I think just like his legendary father Dhirubhai Ambani Mr. Mukesh Ambani Turns to the public after 29 long years to raise cash and to take RIL in the next era of growth and new-age businesses. I think this is a very befitting tribute to his father.

I feel the right's issue is going to be one crazy market event as it comes in this market backdrop of COVID.

What needs to be seen is whether the rights issue sucks up all or majority of the liquidity of the market (Rights issue approval and the ratio still needs to be seen)

What needs to be seen is whether the rights issue sucks up all or majority of the liquidity of the market (Rights issue approval and the ratio still needs to be seen)

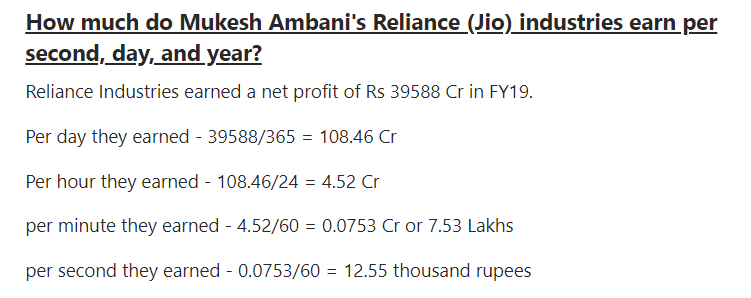

How much Reliance earns in a year, a month, a day, a minute, and a second?

Here are some numbers I crunched -

Here are some numbers I crunched -

Now one more interesting fact!

According to Sebi data, the total number of demat accounts rose to 34.8 million in 2018 from 30.8 million in 2017.

We will remove duplicate accounts (so 17 mil), removing closed and inactive accounts lets assume there are 1.2 cr unique accounts

According to Sebi data, the total number of demat accounts rose to 34.8 million in 2018 from 30.8 million in 2017.

We will remove duplicate accounts (so 17 mil), removing closed and inactive accounts lets assume there are 1.2 cr unique accounts

As of December 2019 shareholding pattern, there were 22.29 lakh retail investors in RIL. That means that every 1 in 5 retail investors holds RIL shares!

That's truly remarkable!

That's truly remarkable!

Read on Twitter

Read on Twitter