Plunge and bounce. All the market is doing now is debating whether we’ll be on the red line or the green line next year https://twitter.com/adam_tooze/status/1250506680367935488

Everyone has an opinion on red vs green. Objectively, there is no way to have any degree of certainty given the large number of unknowns

This extreme uncertainty is reflected in volatility, and years like this have an overwhelming tendency to remain volatile https://twitter.com/MacroCharts/status/1252915050190213120

You can throw 1Q (a different world) and 2Q (epically bad) in the toilet. 3Q (and 4Q more so) will offer the first clue about whether we’ll be on the red or green line next year https://twitter.com/LaMonicaBuzz/status/1253766281599295490

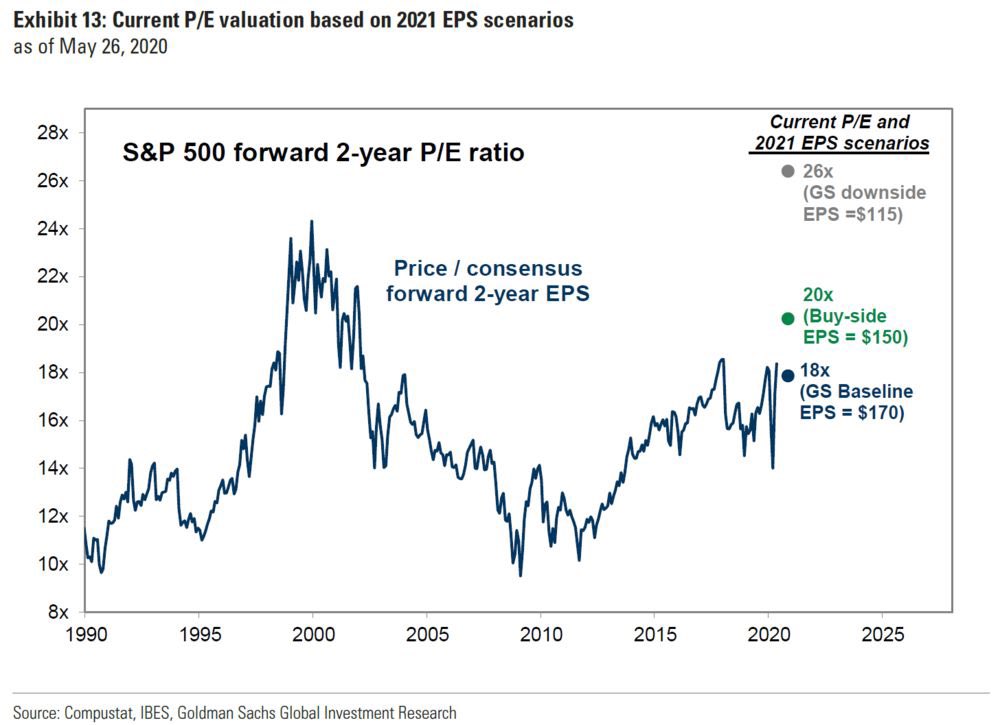

Also throw valuations based on next 12 months in the toilet: 2Q (and 3Q) will be horrible. Market is focused on FY21: will it be 5, 10 or 15% below trend EPS? Red or green line?

That uncertainly (and extended timeframe) obviously implies a much lower PE than the 19x at which $SPX was priced in February.

Fun with numbers: Ed Yardeni expects FY21 EPS of $150 (8% below FY20).

- At 15x (long term median PE), $SPX ‘fair value’ 2250.

- 14x = 2100.

- 13x = 1950.

Market doesn’t follow 1-yr forward PEs very closely (R2 < 10%) but a return to those levels would make some sense

- At 15x (long term median PE), $SPX ‘fair value’ 2250.

- 14x = 2100.

- 13x = 1950.

Market doesn’t follow 1-yr forward PEs very closely (R2 < 10%) but a return to those levels would make some sense

A ‘second wave’ in the autumn will drive those numbers lower; a breakthrough in technology will push them higher. A sideways range 2000-3000 (false breaks in both directions) will frustrate the most

There is no discernible correlation between rates and valuations at all http://fat-pitch.blogspot.com/2014/11/are-low-rates-responsible-for-high.html

FY20 EPS will be a disaster. Mr market is instead pricing off FY21 and trying to guess how much below FY19 it'll be. Current swag of $170 likely to fall to ~$150. Look higher in thread https://twitter.com/GS_CapSF/status/1255183932741447680

If you reopen, they still might not come https://twitter.com/adam_tooze/status/1255361166521643009

It’s early and it will take time https://twitter.com/JHWeissmann/status/1259903233994248193

What happened 2 months ago (1Q20) and even now (2Q20) is not indicative of what is likely in 2021 and beyond ($SPX’s focus) https://twitter.com/TheOneDave/status/1259906995886477312

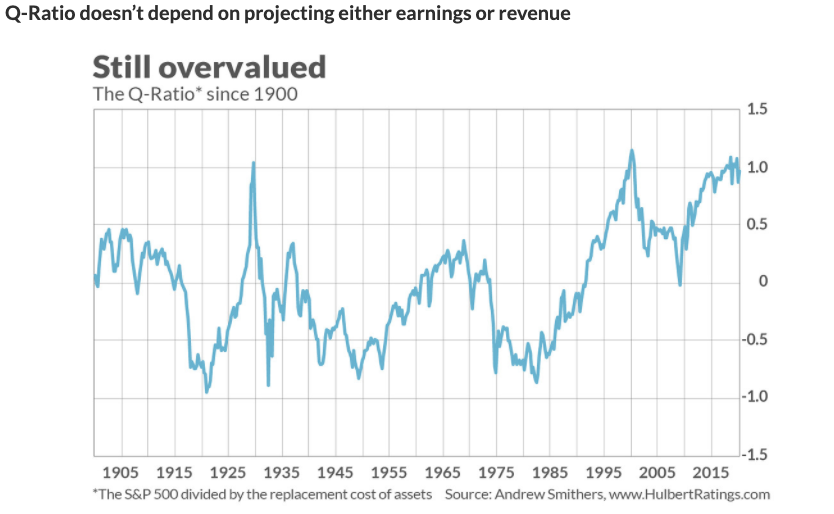

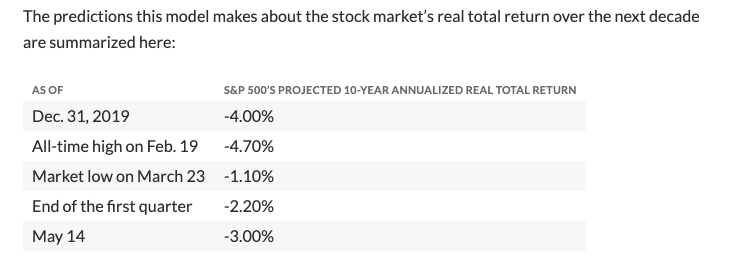

Q-Ratio has been able to explain 52% of the variations in the market’s 10-year returns, one of the highest r-squareds you will ever find in the stock-market

https://www.marketwatch.com/story/this-settles-the-stock-market-valuation-debate-between-david-tepper-and-nelson-peltz-2020-05-15

https://www.marketwatch.com/story/this-settles-the-stock-market-valuation-debate-between-david-tepper-and-nelson-peltz-2020-05-15

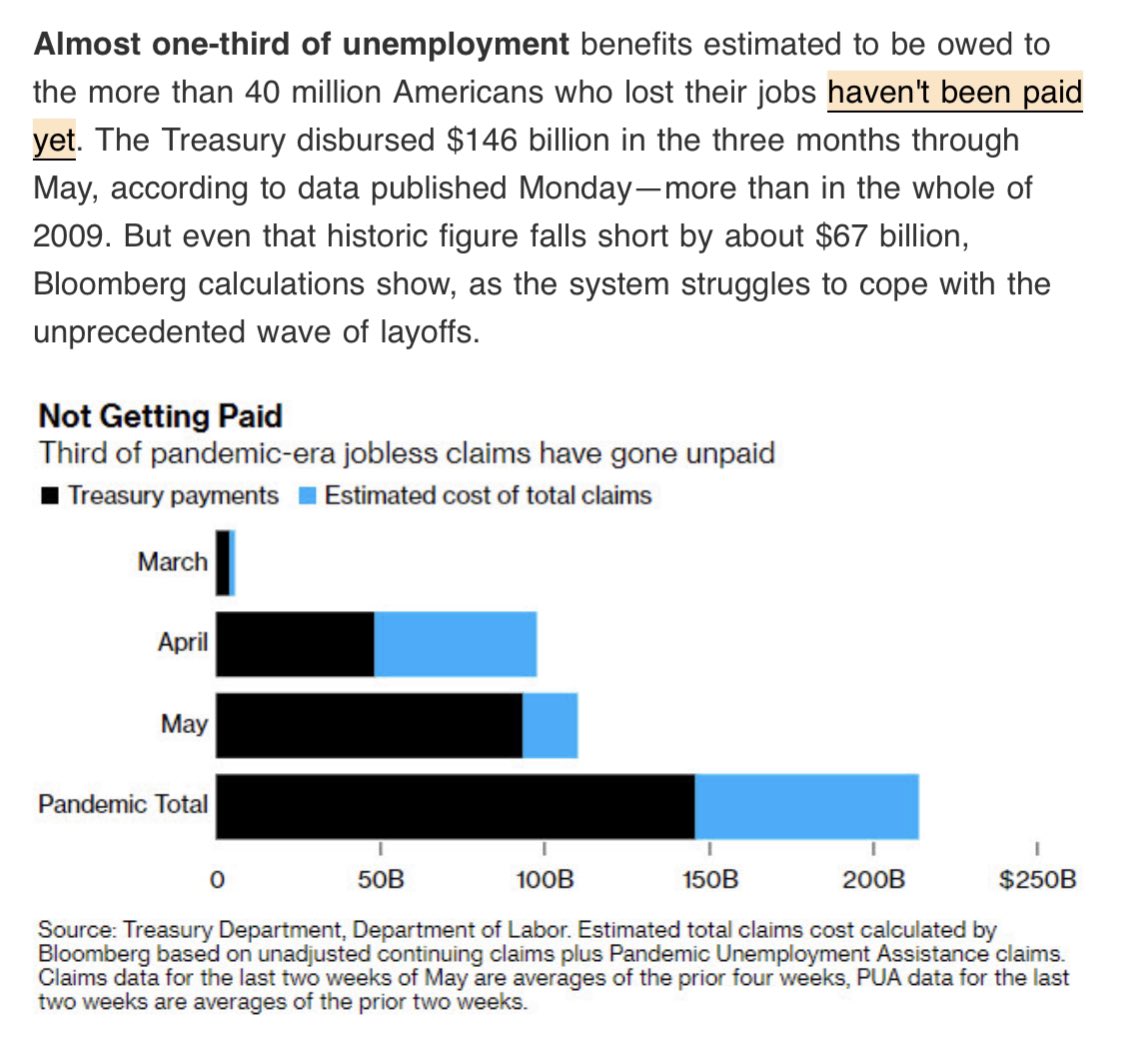

Public pension funds are already underfunded.

$SPX is overvalued (scroll up) but looking at next 12-m makes it absurd because it’s focused on what is probably an extreme outlier period

Valuation chart from GS but $150 happens to be the Yardeni estimate for FY21. No one knows, but we’re probably at the ‘priced for perfection’ stage. $spx

Current shape of the recovery curve https://twitter.com/adam_tooze/status/1267794341889740800

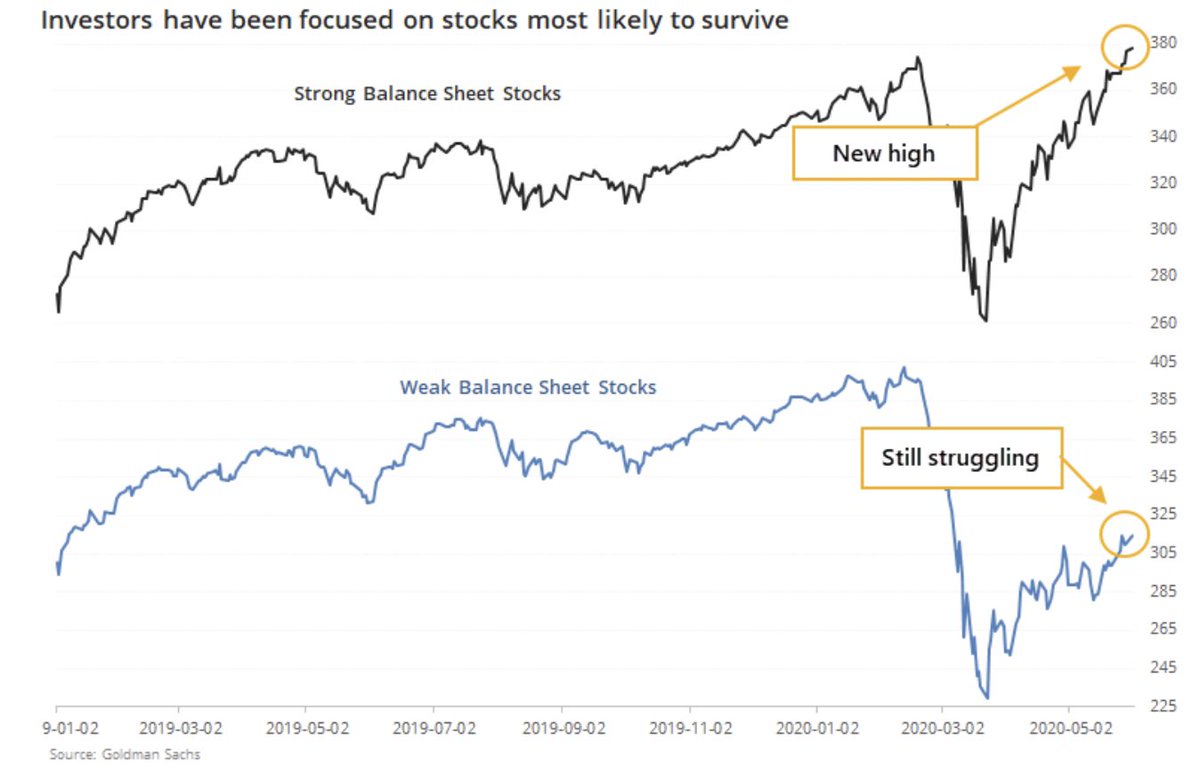

Not only have investors focused on the sectors with the best EPS growth (scroll up) but also those with the best balance sheets. The stock market isn’t all TA, despite what you read on FinTwit (chart from GS and @sentimentrader)

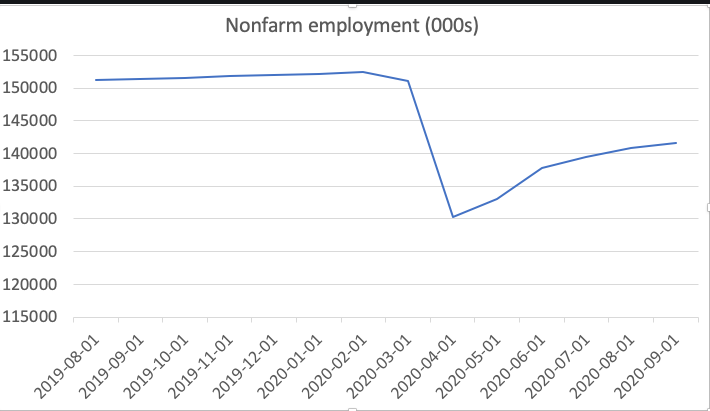

Today’s NFP data was less about "reopenings". 'That will be more of a June story. Instead it was likely due to companies rehiring because they let too many people go in April, and because some companies needed to rehire to qualify for PPP forgiveness.’ https://twitter.com/calculatedrisk/status/1268912802988621824

The micro focus on daily and weekly market swings (mostly psychology) disguise what drives the longer term market moves (mostly macro) https://twitter.com/BittelJulien/status/1273552760051507201

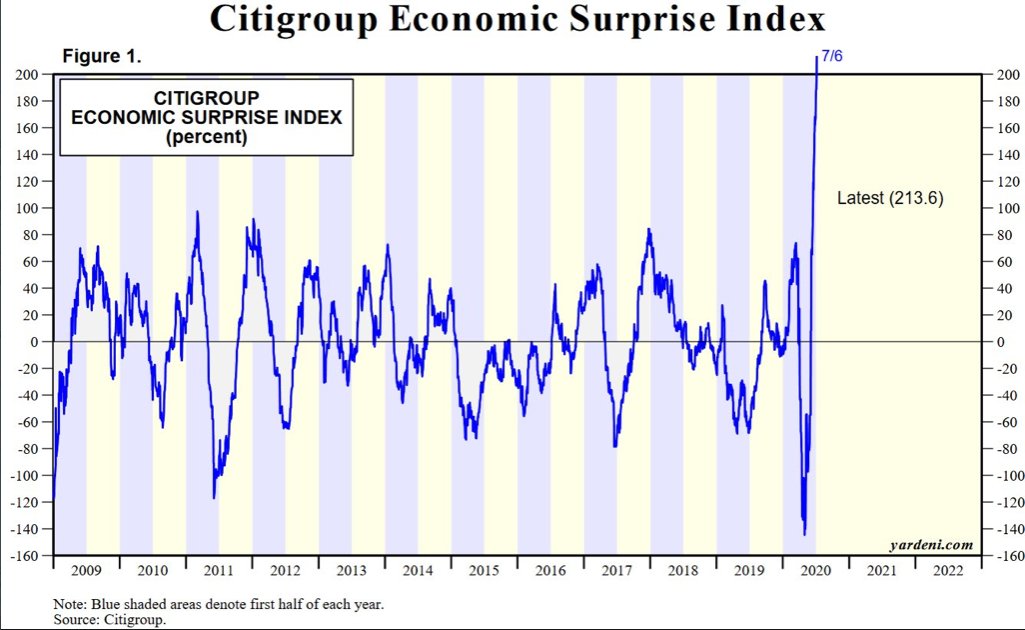

New post-GFC high https://twitter.com/LizAnnSonders/status/1273561343984111616

Recall first chart in this thread: all the market is doing now is debating the shape of the curve https://twitter.com/GregDaco/status/1273291977677770757

Shape of the curve https://twitter.com/SamRo/status/1275441329686769664

Economist ranked most accurate eight years in a row: US won't return to its fourth quarter 2019 real GDP level until at least 2022 https://markets.businessinsider.com/news/stocks/economic-outlook-forecaster-us-recovery-unlikely-stock-correction-christophe-barraud-2020-7-1029366890

Makes sense given selective rollback in reopening https://twitter.com/ernietedeschi/status/1280876252019204096

Thursday: June retail sales expect to explode +17.7%. How much that sticks now that Covid-19 cases are on the rise is a big question https://twitter.com/TimDuy/status/1282394615299993600

Schools not reopening is an economic reality slap

https://twitter.com/UreshP/status/1282754645648191488 https://twitter.com/nbcsandiego/status/1282748642839998467

https://twitter.com/UreshP/status/1282754645648191488 https://twitter.com/nbcsandiego/status/1282748642839998467

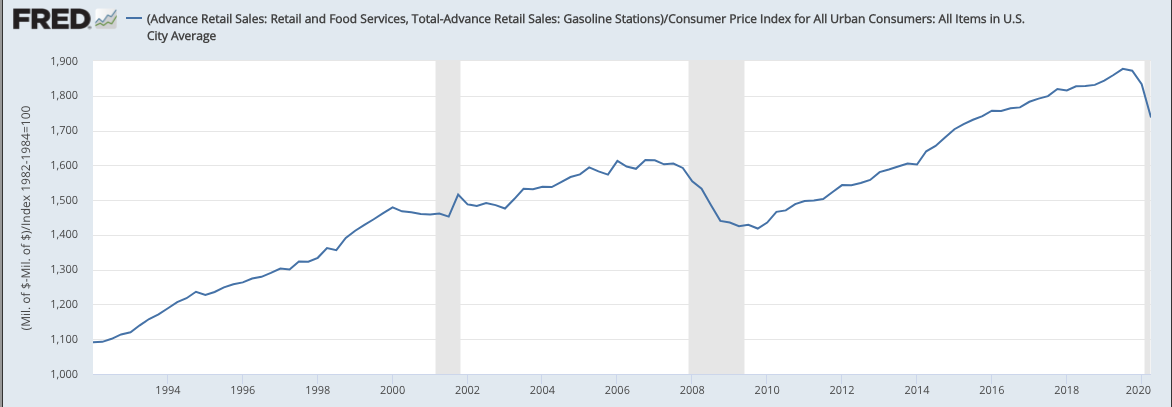

Real retails sales ex-gas at a new monthly ATH is impressive but for now this is just a reaction to the SIP. On Quarterly basis (chart) down -7% yoy. Semi-annual, down -4% yoy.

Starts down -4% yoy https://twitter.com/calculatedrisk/status/1284105525626454018

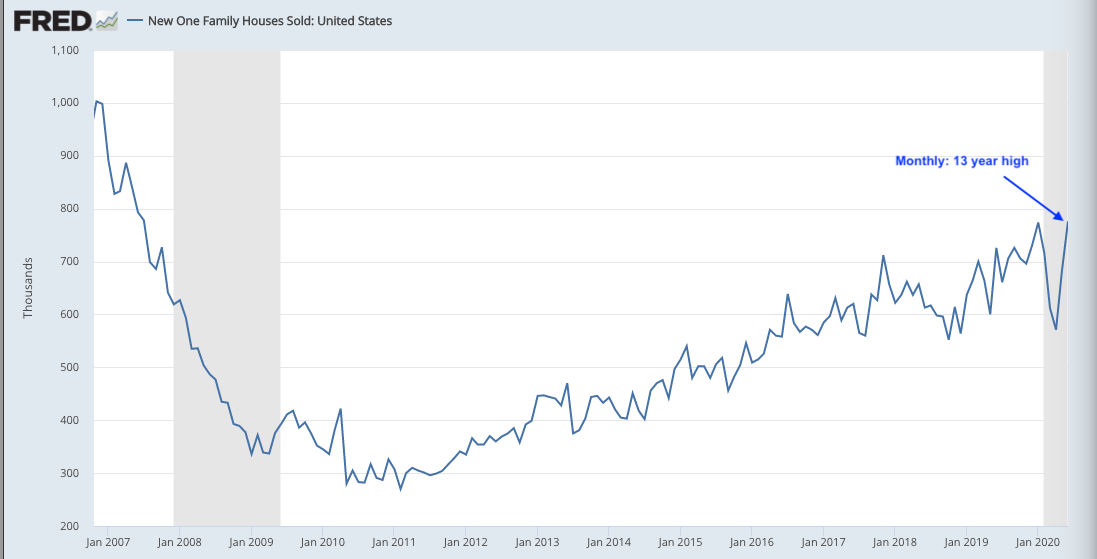

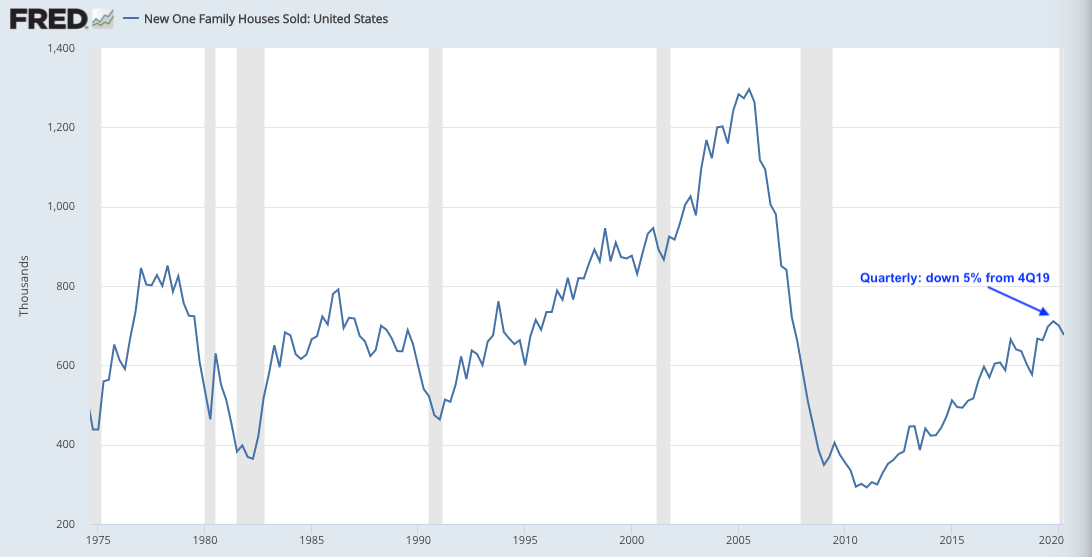

Like retail sales (scroll up), new home sales strength in June largely a reaction to SIP during prior months.

Monthly: new 13-yr high; quarterly, down 5% from 4Q19

Monthly: new 13-yr high; quarterly, down 5% from 4Q19

More stocks than ever have a yield greater than 10-yr notes (also, notes have never yielded less). From NDR

https://twitter.com/bencasselman/status/1291715927931793408?s=21 https://twitter.com/bencasselman/status/1291715927931793408

Shape of the curve https://twitter.com/LizAnnSonders/status/1291747060153298945

GS - optimisitcally, GDP at the end of next year will be 2% higher than it was at the start of this year https://twitter.com/ISABELNET_SA/status/1293164915482648577

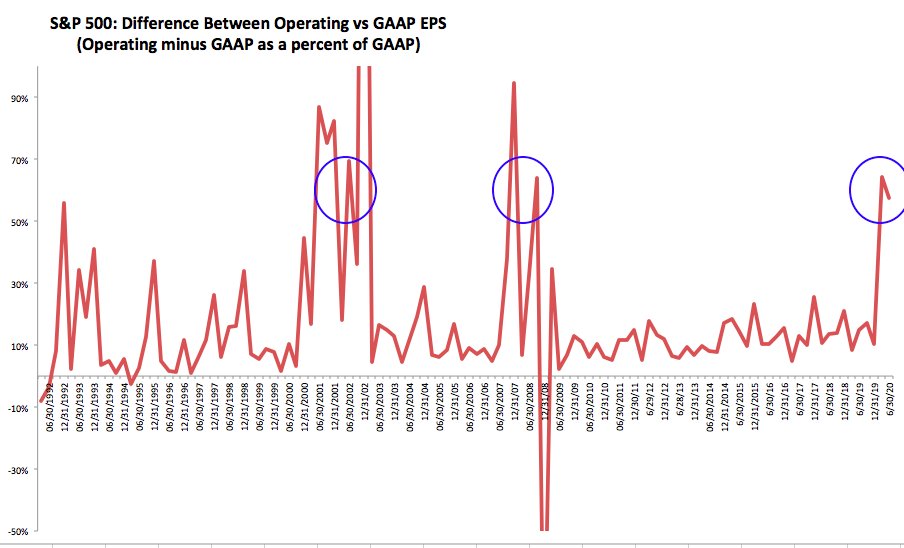

Surprisingly, there hasn't been much howling over the extent to which earnings are being overstated on an operating versus GAAP basis. For the first time in 12 years, this is true. It happens every recession

Starts +23% yoy https://twitter.com/calculatedrisk/status/1295701497603227654

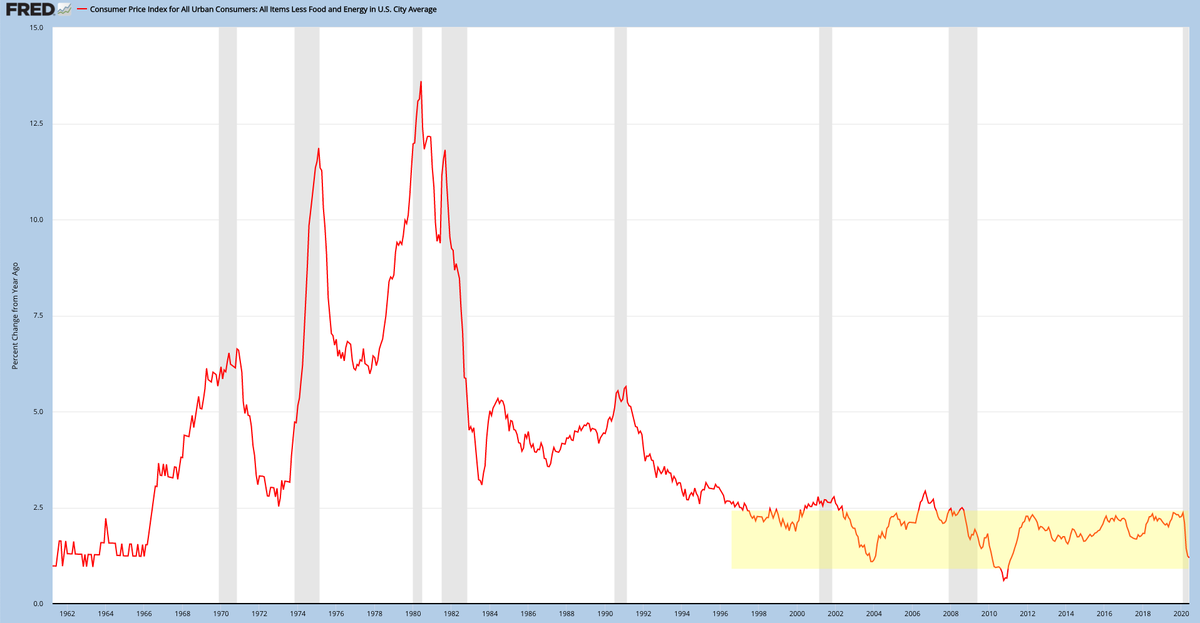

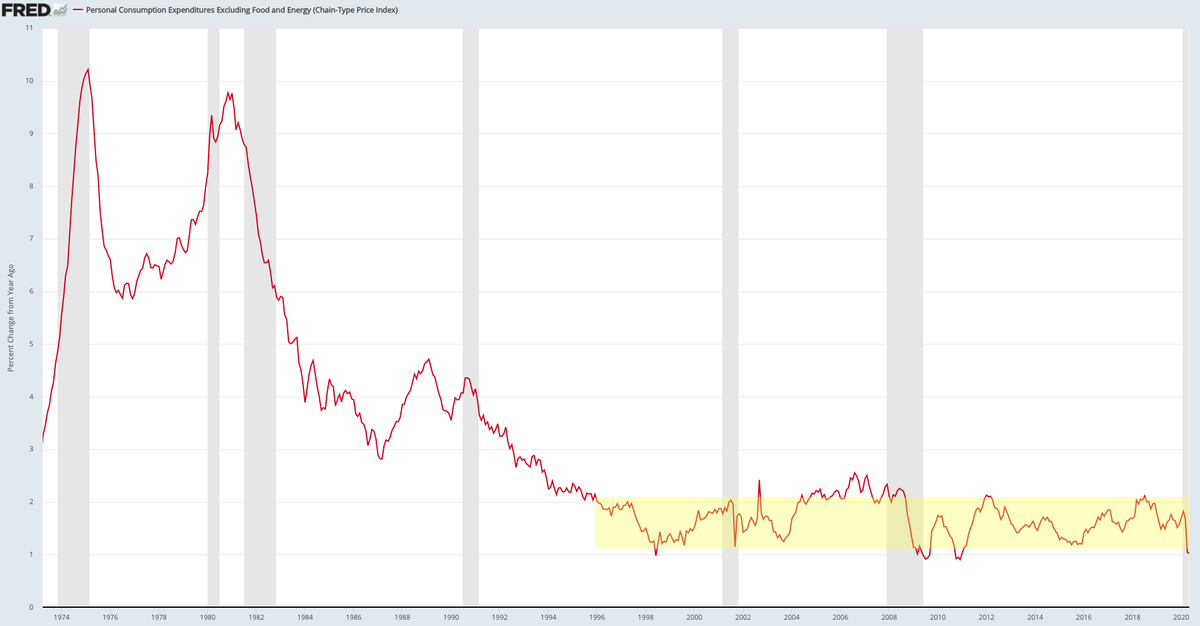

Reminder about inflation: https://twitter.com/ukarlewitz/status/1288221646155743232

Current shape of the curve https://twitter.com/ernietedeschi/status/1298967253107593216

Macro: overall consumer spending (black line) has flattened out at about ~5% below pre-Covid levels the past 2 months https://twitter.com/LizAnnSonders/status/1301110543013605376

Macro: small biz employment has also flattened out the past 2 months, but at ~20% below pre-Covid levels https://twitter.com/GregDaco/status/1301116843072122880

Macro: current shape of the curve. Emploiyment and consumer spending (scroll up) consistent https://twitter.com/ernietedeschi/status/1301512855976632320

Macro: Shape of the curve including August NFP. Even if the positive trend continues, this is going to take some time to fully recover https://twitter.com/LoganMohtashami/status/1301867639027892225

Macro: unemployment claims remains high and recovery has been flattening https://twitter.com/ernietedeschi/status/1304043011823874048

Macro: consumer spending ~6.5% below pre-Covid

1. https://twitter.com/TheStalwart/status/1303773720306225158

2. https://twitter.com/carlquintanilla/status/1303686570583748614

1. https://twitter.com/TheStalwart/status/1303773720306225158

2. https://twitter.com/carlquintanilla/status/1303686570583748614

Macro: Shape of the employment curve update. You have to be following Ernie if macro is of any interest https://twitter.com/ernietedeschi/status/1309173256646254595

Real retail sales: up+5.4% yoy in Sept, down -2.1% yoy for the first 3Q. The dip in the spring matters

Goods up, services not. Services $ > goods $ https://twitter.com/jc_econ/status/1317094602084651008

(For context, scroll up) https://twitter.com/TheCompoundNews/status/1317982085097938946

Many planning and building departments were closed for two months and came back to a massive backlog. Avg for the first 9-mo is 8% below 4Q19 https://twitter.com/stlouisfed/status/1318723693141516289

Goods up, services not. Services-based economy https://twitter.com/adam_tooze/status/1319237061178605574

Macro: this is the uphill battle now being fought by every small town https://twitter.com/LizAnnSonders/status/1319233243523223555

The first tweets in this thread acknowledged that all the market would be doing in 2020 is debating next year’s economy ('the shape of the curve’) https://twitter.com/SoberLook/status/1319192899779702784

Macro: Goods up, services not https://twitter.com/jc_econ/status/1321796155827773440

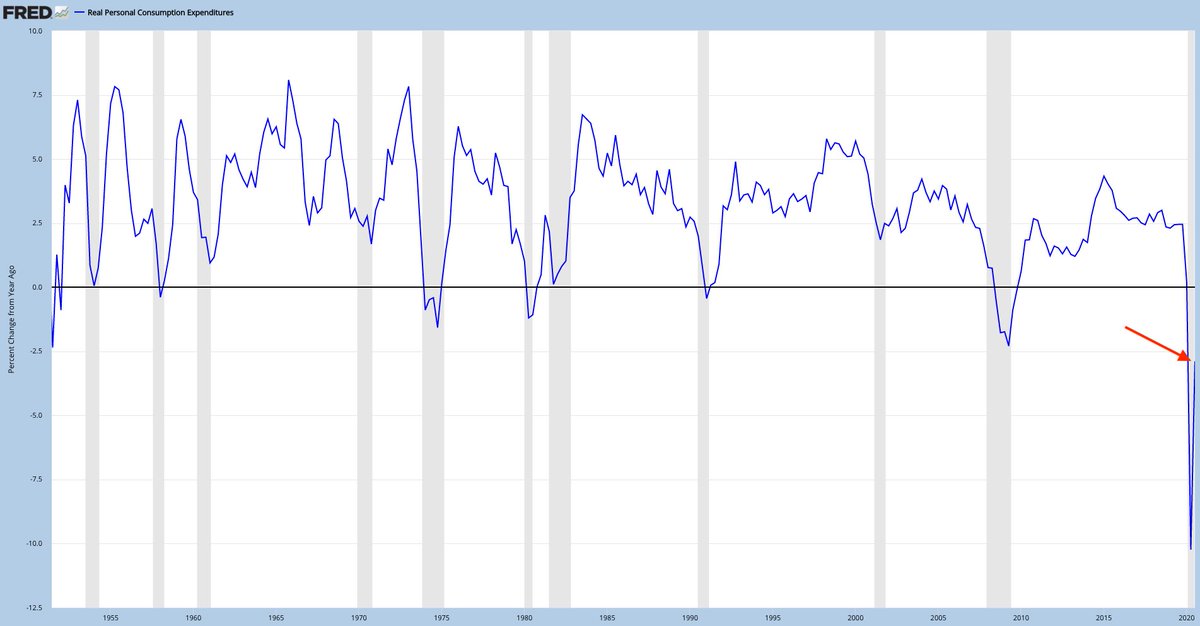

Likewise, personal consumption falls 2.9% yoy in 3Q20. May not seem like a lot but that’s worse than any other time in the past 70 years (aside from 2Q20)

Obvious, but for the record: https://twitter.com/JStein_WaPo/status/1324378243500285952

It will likely take until late next year to get back to where employment was last year https://twitter.com/ernietedeschi/status/1324708752377946112

Starting the pivot https://twitter.com/ericawerner/status/1324740256189583362

If they haven’t already, many counties and states will be rolling back their reopening https://twitter.com/COVID19Tracking/status/1326321342933831680

Retail sales up +2.7% yoy in 3Q but down -2.1% yoy YTD. The dip in 2Q matters https://twitter.com/ernietedeschi/status/1328695194137620480

US GDP won't likely get back to 4Q19 levels until another year from now https://twitter.com/GregDaco/status/1331608758116642817

20% of full year retail sales take place during the year-end holidays. The time to make hay on Main St is right now https://twitter.com/carlquintanilla/status/1333852145259585536

No surprise as it is getting cold and the pandemic is getting worse. Keeping Main St alive is really hard right now https://twitter.com/SoberLook/status/1334080114536157184

Your local downtown provides employment and essential revenues for city services you rely upon. A vibrant downtown is an essential component to a city’s character and beauty. Hard to overstate how vital it is that you support it week in and week out https://twitter.com/HarryWanger/status/1334174847425859584

Good thread. Long story short: there’ll be vaccines in 2021 and normally that would be great for the economy except we declined a no-risk pre-order so now we might not have anywhere near enough https://twitter.com/lucymcaldwell/status/1337147790095507456

Read on Twitter

Read on Twitter