1/N

My very first thread! ... I’d like to use it to explain some new work.

Let’s start with a thought experiment: Say all US household debt was refinanced to a 1% lower rate. Would it have an impact on the economy?

My very first thread! ... I’d like to use it to explain some new work.

Let’s start with a thought experiment: Say all US household debt was refinanced to a 1% lower rate. Would it have an impact on the economy?

2/N

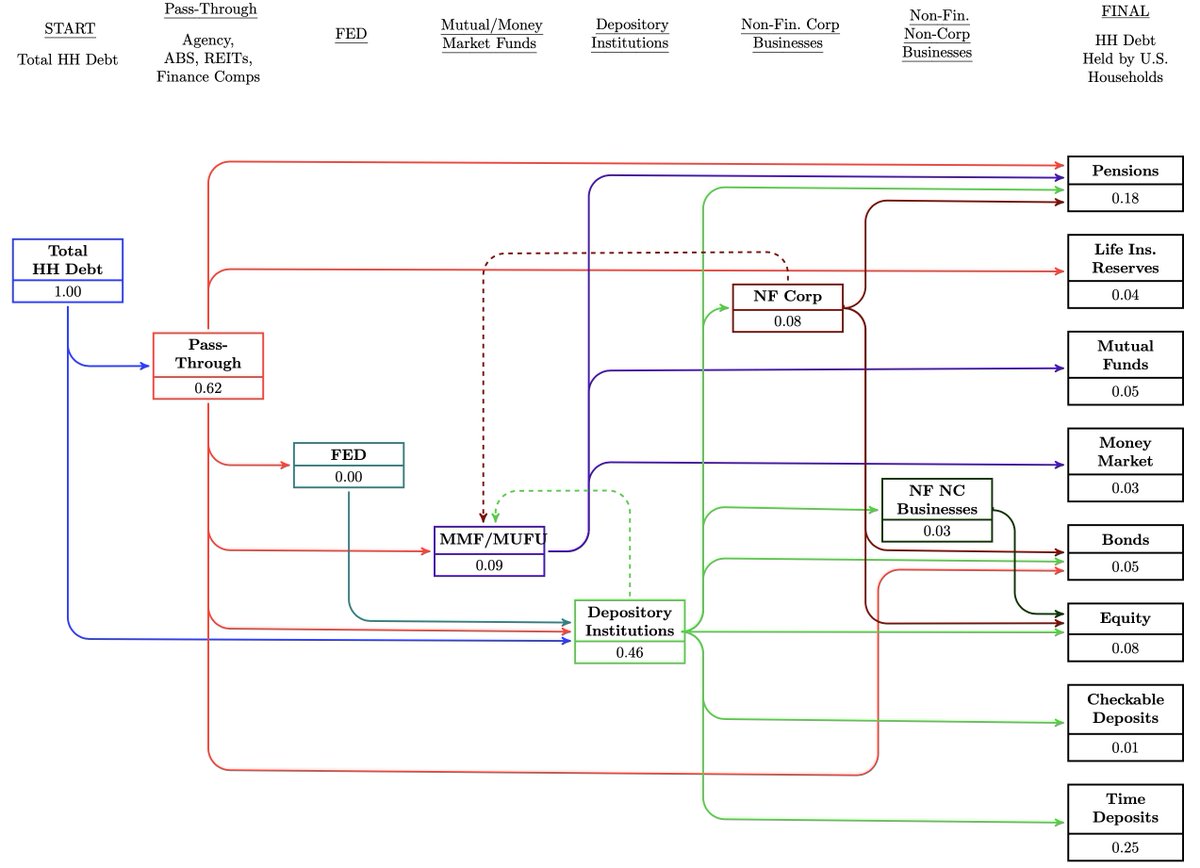

First, we look at who *holds* household debt in their portfolios. Recent work with @AtifRMian and @profsufi shows it’s mostly pension funds, time deposits of big corp's, foreign central banks & investment funds. These funds & their owners have a very high propensity to save!

First, we look at who *holds* household debt in their portfolios. Recent work with @AtifRMian and @profsufi shows it’s mostly pension funds, time deposits of big corp's, foreign central banks & investment funds. These funds & their owners have a very high propensity to save!

3/N

The borrowing households on the other hand have a high propensity to spend. The 1% decline in the interest rate would tend to *boost* aggregate demand!

Thus: Aggregate demand is decreasing in debt service cost.

Why is this relevant in today’s world?

The borrowing households on the other hand have a high propensity to spend. The 1% decline in the interest rate would tend to *boost* aggregate demand!

Thus: Aggregate demand is decreasing in debt service cost.

Why is this relevant in today’s world?

4/N

(1) When borrowing rates fall, debt can be higher without harming demand. Great! This is often used as an argument why we shouldn’t worry about debt right now.

(1) When borrowing rates fall, debt can be higher without harming demand. Great! This is often used as an argument why we shouldn’t worry about debt right now.

5/N

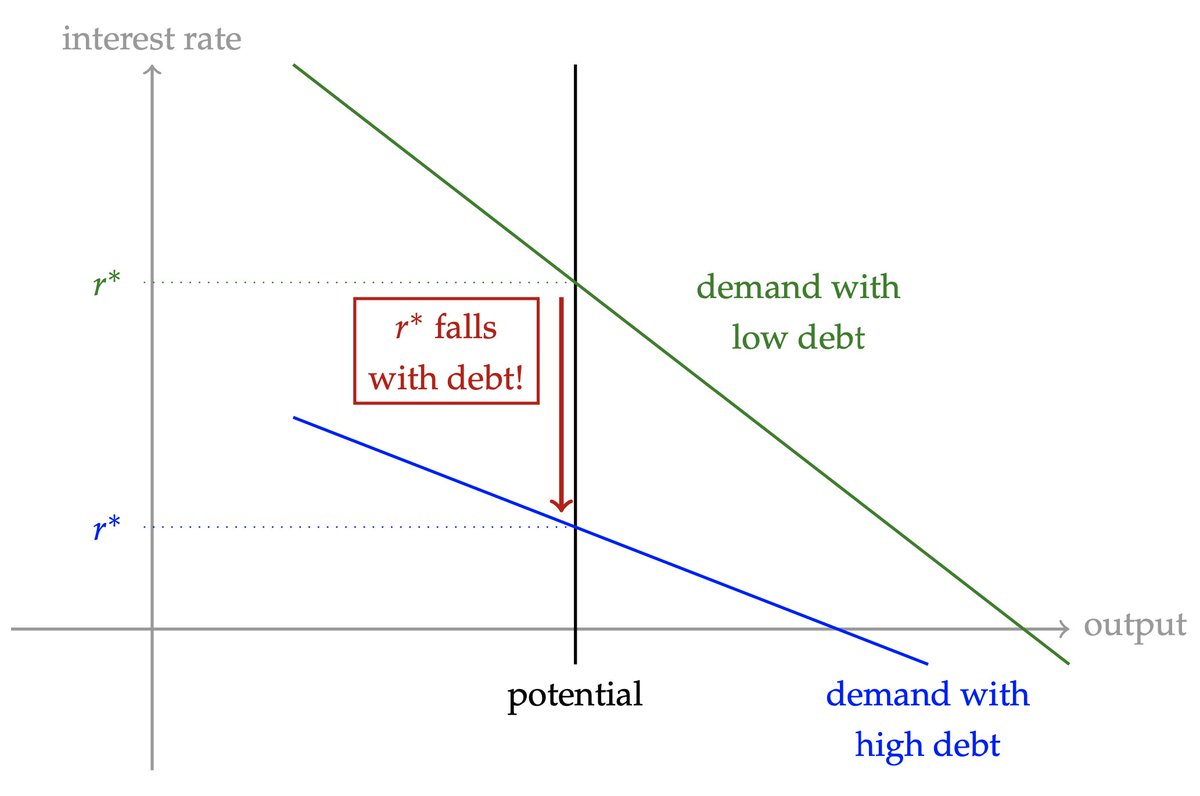

(2) That very argument however also implies that those greater debt levels *require* lower interest rates, or else they would harm demand! In other words, greater debt levels *force* central banks’ hands: They can no longer raise rates without sacrificing aggregate demand!

(2) That very argument however also implies that those greater debt levels *require* lower interest rates, or else they would harm demand! In other words, greater debt levels *force* central banks’ hands: They can no longer raise rates without sacrificing aggregate demand!

6/N

(3) Now imagine debt is so high that interest rates can no longer fall sufficiently, e.g. due to the ZLB (currency union similar). Then the economy enters a persistent state of too little demand. We call this a “debt trap”.

(3) Now imagine debt is so high that interest rates can no longer fall sufficiently, e.g. due to the ZLB (currency union similar). Then the economy enters a persistent state of too little demand. We call this a “debt trap”.

7/N

This is, in my view, where many advanced economies are right now. Debt levels are at all time highs, interest rates at (close to) all time lows. With Covid, these trends will only accelerate, all but guaranteeing a long life close to, or at, the ZLB.

This is, in my view, where many advanced economies are right now. Debt levels are at all time highs, interest rates at (close to) all time lows. With Covid, these trends will only accelerate, all but guaranteeing a long life close to, or at, the ZLB.

8/N

What can be done?

(1) Redistribution: progressive income or wealth tax.

(2) Address structural problems leading to high inequality, e.g. inequality of opportunity.

(3) Re Covid, fix the health crisis first! But pay for gov’t debt by taxing the have’s, not the have-not’s.

What can be done?

(1) Redistribution: progressive income or wealth tax.

(2) Address structural problems leading to high inequality, e.g. inequality of opportunity.

(3) Re Covid, fix the health crisis first! But pay for gov’t debt by taxing the have’s, not the have-not’s.

9/N

For more details on all of this, see our recent paper on ‘indebted demand’

Paper: https://scholar.harvard.edu/files/straub/files/mss_indebteddemand.pdf

Slides: https://scholar.harvard.edu/files/straub/files/slides_vmacs.pdf

Youtube talk: @virtualmacrosem (incl. Covid discussion after 45 mins)

For more details on all of this, see our recent paper on ‘indebted demand’

Paper: https://scholar.harvard.edu/files/straub/files/mss_indebteddemand.pdf

Slides: https://scholar.harvard.edu/files/straub/files/slides_vmacs.pdf

Youtube talk: @virtualmacrosem (incl. Covid discussion after 45 mins)

10/N

Among the many more things in the paper: Why borrowing to *invest* (e.g. gov’t investment) is exempt from the above problem if the investment doesn’t raise inequality (i.e. unlike some of AI or robotics?).

Among the many more things in the paper: Why borrowing to *invest* (e.g. gov’t investment) is exempt from the above problem if the investment doesn’t raise inequality (i.e. unlike some of AI or robotics?).

11/N

Link to our empirical work, referenced above on link between rising income inequality and US household debt: https://scholar.harvard.edu/files/straub/files/mss_richsavingglut.pdf

Link to WSJ story mentioned above: https://www.wsj.com/articles/high-debt-levels-are-weighing-on-economies-11567935004

Link to our empirical work, referenced above on link between rising income inequality and US household debt: https://scholar.harvard.edu/files/straub/files/mss_richsavingglut.pdf

Link to WSJ story mentioned above: https://www.wsj.com/articles/high-debt-levels-are-weighing-on-economies-11567935004

12/N

All this is related to great work by many scholars in #econtwitter! Tiny sample:

Debt: @ProfGreenwald @VeronicaGuerri7 @guido_lorenzoni @EmilVerner @MSchularick @kuhnmo @alpsimsek_econ @monacelt @GautiEggertsson @paulkrugman @BIS_org @michaelxpettis @AdairTurnerUK @JoeVavra

All this is related to great work by many scholars in #econtwitter! Tiny sample:

Debt: @ProfGreenwald @VeronicaGuerri7 @guido_lorenzoni @EmilVerner @MSchularick @kuhnmo @alpsimsek_econ @monacelt @GautiEggertsson @paulkrugman @BIS_org @michaelxpettis @AdairTurnerUK @JoeVavra

13/13

Saving of rich: @M_De_Nardi @ben_moll @GNatvik @KarenDynan

Secular stagnation: @LHSummers @GautiEggertsson @LukaszRachel @sanjayrajsingh @annastansbury @Realprofneil

And lots on inequality, too! Probably forgetting many, feel free to add below!

Thanks for reading my thread!

Saving of rich: @M_De_Nardi @ben_moll @GNatvik @KarenDynan

Secular stagnation: @LHSummers @GautiEggertsson @LukaszRachel @sanjayrajsingh @annastansbury @Realprofneil

And lots on inequality, too! Probably forgetting many, feel free to add below!

Thanks for reading my thread!

Read on Twitter

Read on Twitter