1/50

ETH 2.0 is only a few months away, and could prove to be the largest economic shift in society for a few key reasons.

Here is my 7 economic cases for how ETH will preform with the ETH 2.0 rollout.

ETH 2.0 is only a few months away, and could prove to be the largest economic shift in society for a few key reasons.

Here is my 7 economic cases for how ETH will preform with the ETH 2.0 rollout.

2/50

Reason 1: Rent Seekers

Large investors eye stable returns around 3% - 5%, due to the scale of their principal. This is why traditional investments shift to below these rates (as big players stop pouring in funds sub-3%).

When ETH switches to staking, large investors will

Reason 1: Rent Seekers

Large investors eye stable returns around 3% - 5%, due to the scale of their principal. This is why traditional investments shift to below these rates (as big players stop pouring in funds sub-3%).

When ETH switches to staking, large investors will

3/50

likely pour money into the lock-up until we hit somewhere in that 3% - 5% range (we likely won't go below that as the network still has some tech risk not seen in traditional markets and so rent seekers will want a slightly higher gain to take the risk.)

likely pour money into the lock-up until we hit somewhere in that 3% - 5% range (we likely won't go below that as the network still has some tech risk not seen in traditional markets and so rent seekers will want a slightly higher gain to take the risk.)

4/50

in order to push down to that level, it means locking up somewhere between 10M - 30M+ Ethereum in ETH 2.0 validators.

During the early days of the chain there is no way to get that ETH back out. (So we may see lower investment and higher interest rates to start)

in order to push down to that level, it means locking up somewhere between 10M - 30M+ Ethereum in ETH 2.0 validators.

During the early days of the chain there is no way to get that ETH back out. (So we may see lower investment and higher interest rates to start)

5/50

But, this means that roughly 10% - 30% of all circulating Ethereum would need to be locked up before the network is below the return rate that is targeted by large rent seeking whales.

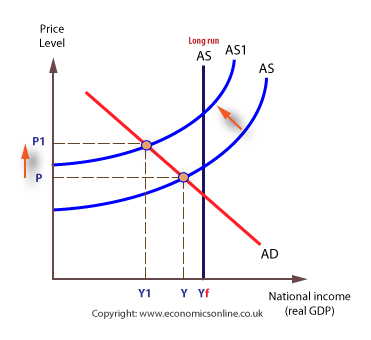

What happens when you remove 30% of the supply suddenly? You get a Supply Shock.

But, this means that roughly 10% - 30% of all circulating Ethereum would need to be locked up before the network is below the return rate that is targeted by large rent seeking whales.

What happens when you remove 30% of the supply suddenly? You get a Supply Shock.

6/50

Every major trader, investor and miner knows they can become a rent seeker, and so those who typically provided market liquidity are going to be hesitant to sell. This will likely hit the lending pools and DeFi liquidity first.

Every major trader, investor and miner knows they can become a rent seeker, and so those who typically provided market liquidity are going to be hesitant to sell. This will likely hit the lending pools and DeFi liquidity first.

7/50 ( https://en.wikipedia.org/wiki/Supply_shock)

Supply Shocks typically cause a drastic increase in the price of a good. Just like we've seen with disrupted covid supply chains.

So this lockup alone creates a scarcity causing a price spike.

Supply Shocks typically cause a drastic increase in the price of a good. Just like we've seen with disrupted covid supply chains.

So this lockup alone creates a scarcity causing a price spike.

8/50 Reason 2: Secondary Rounds

The price spike from Supply Shock means rent seekers are getting 3% - 5% RoI in Ether & actually getting much higher returns on their fiat principle on their books - possibly 2x - 4x+ and so they go in for a second round of buy & stake until their

The price spike from Supply Shock means rent seekers are getting 3% - 5% RoI in Ether & actually getting much higher returns on their fiat principle on their books - possibly 2x - 4x+ and so they go in for a second round of buy & stake until their

9/50

fiat on book RoI is back at the 3% - 5% RoI rate. This is a ripple effect with diminishing returns where each round gets smaller and smaller in terms of its price impact.

fiat on book RoI is back at the 3% - 5% RoI rate. This is a ripple effect with diminishing returns where each round gets smaller and smaller in terms of its price impact.

10/50

While it won't have the same full impact of the initial buying round, all the ripples combined may have the potential to impact up to 2/3rds the same volume depending on the price action.

While it won't have the same full impact of the initial buying round, all the ripples combined may have the potential to impact up to 2/3rds the same volume depending on the price action.

11/50

Reason 2: Retail FOMO

So now we have rent seekers creating supply shock, and we have secondary round ripple effects. This means the market really starts to move upwards.

That creates FOMO among the retail investors who typically react

Reason 2: Retail FOMO

So now we have rent seekers creating supply shock, and we have secondary round ripple effects. This means the market really starts to move upwards.

That creates FOMO among the retail investors who typically react

12/50

late to any investing stimulus (they buy part way up the up-swing, and sell part way down the down-swing). Retail investors, especially those in FOMO mode tend to be heavy-handed and over-extended. They'll hammer in market buys to make sure they don't miss out.

late to any investing stimulus (they buy part way up the up-swing, and sell part way down the down-swing). Retail investors, especially those in FOMO mode tend to be heavy-handed and over-extended. They'll hammer in market buys to make sure they don't miss out.

13/50

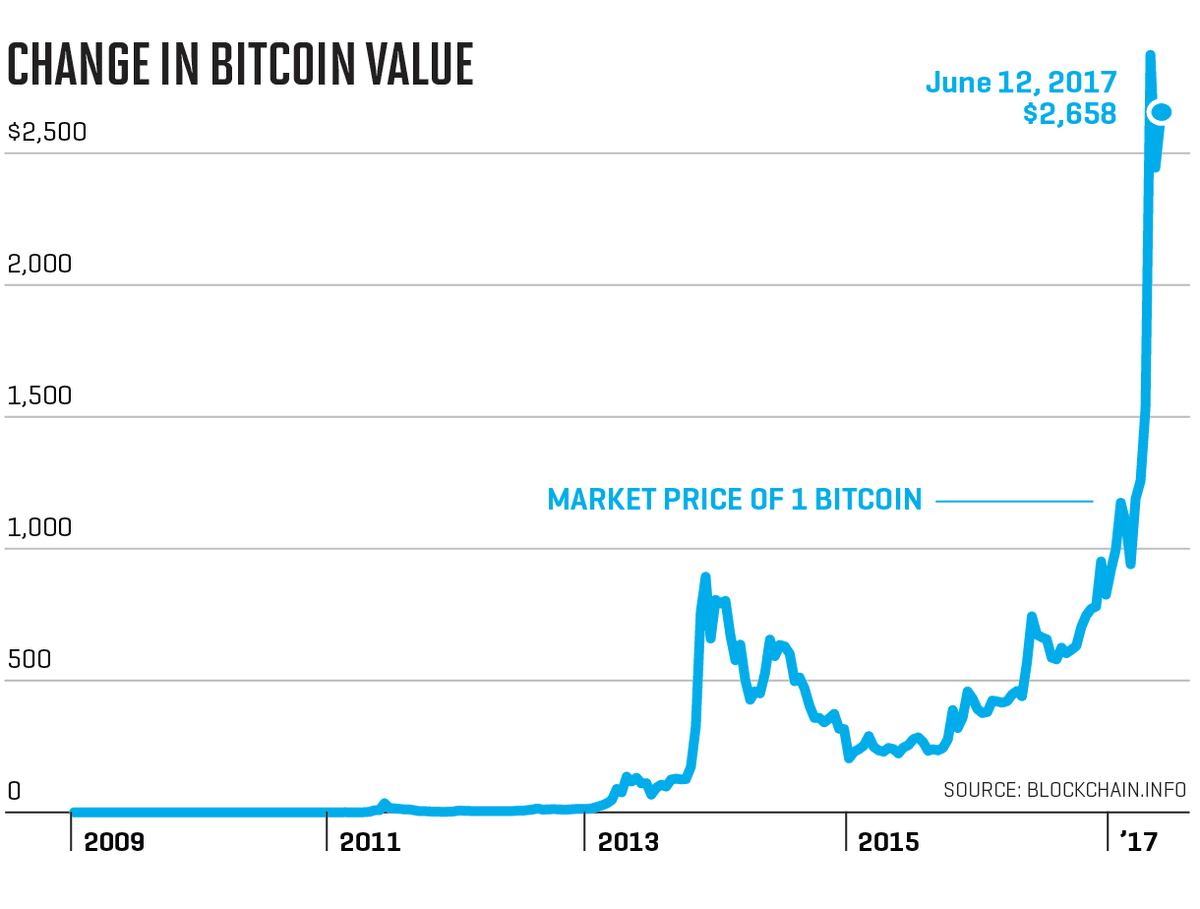

these retail investors don't care about P/E, or RSI, they aren't looking at market-depth. They just want in.

When they start ordering heavily, they tend to flood markets. In the major bull market in 2017, the big stop gap was users being able to on-board to exchanges

these retail investors don't care about P/E, or RSI, they aren't looking at market-depth. They just want in.

When they start ordering heavily, they tend to flood markets. In the major bull market in 2017, the big stop gap was users being able to on-board to exchanges

14/50

KYC/AML took time. At the time Coinbase had only ~5M users, and you couldn't buy crypto via fiat on exchanges like Binance.

Now cash onramps are everywhere (thanks to @sendwyre and @simplex) and Coinbase has 30M+ users, all verified and ready to go.

KYC/AML took time. At the time Coinbase had only ~5M users, and you couldn't buy crypto via fiat on exchanges like Binance.

Now cash onramps are everywhere (thanks to @sendwyre and @simplex) and Coinbase has 30M+ users, all verified and ready to go.

15/50

with no stop gap this time around, that means these users can all FOMO at the same time.

All it takes is one crazy MSNBC headline about Ethereum growth to remind them about their @coinbase account, and the retail investors create a flurry

with no stop gap this time around, that means these users can all FOMO at the same time.

All it takes is one crazy MSNBC headline about Ethereum growth to remind them about their @coinbase account, and the retail investors create a flurry

16/50

but, as we know, 10M-30M ETH just got locked for the launch of Eth2.0, so not only is the supply decreased and facing supply shock.

But now we are piling on a demand shock ( https://en.wikipedia.org/wiki/Demand_shock) - [everyone wants a piece of the asset]

but, as we know, 10M-30M ETH just got locked for the launch of Eth2.0, so not only is the supply decreased and facing supply shock.

But now we are piling on a demand shock ( https://en.wikipedia.org/wiki/Demand_shock) - [everyone wants a piece of the asset]

17/50

when we have both a supply shock and a demand shock taking place in a short time frame this really ignites the FOMO that is going to drive the short-term, all at once price spike.

when we have both a supply shock and a demand shock taking place in a short time frame this really ignites the FOMO that is going to drive the short-term, all at once price spike.

18/50

now that is just talking about the three reasons for a short-term price spike when we see the launch lockup for ETH2.0.

But, what does it look like long-term? There are a number of factors that will build a strong "Background Rate of Growth"

now that is just talking about the three reasons for a short-term price spike when we see the launch lockup for ETH2.0.

But, what does it look like long-term? There are a number of factors that will build a strong "Background Rate of Growth"

19/50

Reason #4: Actual demand

The best reason for this growth, and one that only ETH2.0 can really claim, is actual demand for the asset, as use for gas in a decentralized computer.

With the release of ETH2.0 (among other improvements) we're going to see

Reason #4: Actual demand

The best reason for this growth, and one that only ETH2.0 can really claim, is actual demand for the asset, as use for gas in a decentralized computer.

With the release of ETH2.0 (among other improvements) we're going to see

20/50

ETH drastically increase its tx/s and therefore its commercial and consumer viability. Gas clogs, high transaction costs, long wait times in dApps all goes away, even in a busy market.

ETH drastically increase its tx/s and therefore its commercial and consumer viability. Gas clogs, high transaction costs, long wait times in dApps all goes away, even in a busy market.

21/50

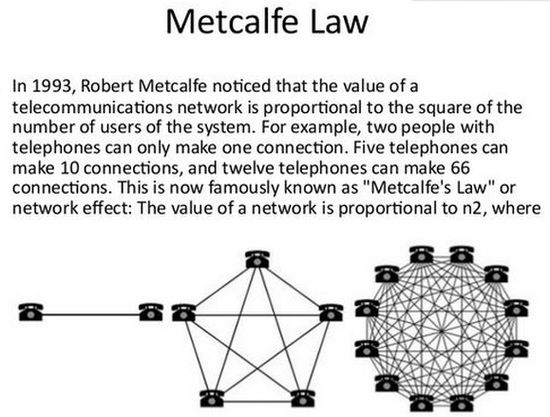

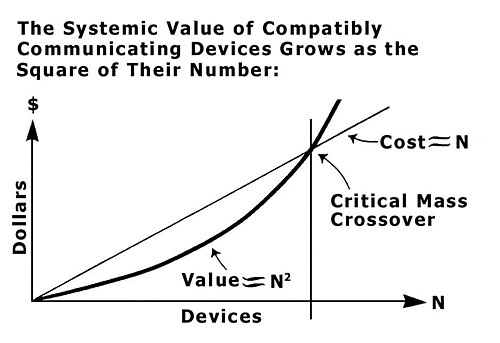

That means all those awesome people building on Eth (remember that list? https://twitter.com/AdamScochran/status/1217524744909660162) they can now deliver commercial and consumer scale products - and more companies can join them.

Usage drives value growth with Metcalfe's Law ( https://en.wikipedia.org/wiki/Metcalfe%27s_law)

That means all those awesome people building on Eth (remember that list? https://twitter.com/AdamScochran/status/1217524744909660162) they can now deliver commercial and consumer scale products - and more companies can join them.

Usage drives value growth with Metcalfe's Law ( https://en.wikipedia.org/wiki/Metcalfe%27s_law)

22/50

Simply put, the more actual demand there is to use the system then the more the price goes up, because there is a real underlying value being created for the user.

The best part in such an open system is this value is different for everyone and every transaction.

Simply put, the more actual demand there is to use the system then the more the price goes up, because there is a real underlying value being created for the user.

The best part in such an open system is this value is different for everyone and every transaction.

23/50

You might have valued one 200K gas transaction as being worth $0.10 but another as being worth $5. This means there is no static price agreed upon per person in the market, and that doesn't even take into account that we can ultimately decide to change what we pay for gas

You might have valued one 200K gas transaction as being worth $0.10 but another as being worth $5. This means there is no static price agreed upon per person in the market, and that doesn't even take into account that we can ultimately decide to change what we pay for gas

24/50

Reason 5: Whale Cycle Buying

As actual use drives up the price, what happens?

Those rent seeking whales are back.

The price has went up so much, that their RoI rate is up, and so they can put more money back into staking.

But, the more they put into staking,

Reason 5: Whale Cycle Buying

As actual use drives up the price, what happens?

Those rent seeking whales are back.

The price has went up so much, that their RoI rate is up, and so they can put more money back into staking.

But, the more they put into staking,

25/50

the more nodes there are. More nodes = proportionally lower payout.

This means each time a whale adds a node they are diluting the potential earnings of all the other rent seekers, who if they want to continue to earn the same rate also need to stake more.

the more nodes there are. More nodes = proportionally lower payout.

This means each time a whale adds a node they are diluting the potential earnings of all the other rent seekers, who if they want to continue to earn the same rate also need to stake more.

26/50

This creates a race condition. Where rent seekers have to buy more to maintain their earnings rate.

But, this in turn creates scarcity, increasing the price, which in turn results in more whales buying to stake.

This creates a race condition. Where rent seekers have to buy more to maintain their earnings rate.

But, this in turn creates scarcity, increasing the price, which in turn results in more whales buying to stake.

27/50

This whale cycle buying continues with whale's buying from their profits.

But, you can't stake fractional ETH, or even 1 ETH - you MUST stake ETH in allotments of 32 and that brings us to our next reason for the market growth:

Reason #6 Over Reaching (Rounding)

This whale cycle buying continues with whale's buying from their profits.

But, you can't stake fractional ETH, or even 1 ETH - you MUST stake ETH in allotments of 32 and that brings us to our next reason for the market growth:

Reason #6 Over Reaching (Rounding)

28/50

Were a whale to find themselves having made 20 ETH worth of profits from their nodes they can't simply stake that amount. They need to round it up to 32 ETH.

This means they have to go out and acquire 12 additional ETH with some other source of funds.

Were a whale to find themselves having made 20 ETH worth of profits from their nodes they can't simply stake that amount. They need to round it up to 32 ETH.

This means they have to go out and acquire 12 additional ETH with some other source of funds.

29/50

by having this minimum staking amount, and requiring it not just as a minimum amount but the only amount that can be staked per node, people can't just cycle their profits.

Even whales who earn from the market MUST introduce new funds into the market to essentially

by having this minimum staking amount, and requiring it not just as a minimum amount but the only amount that can be staked per node, people can't just cycle their profits.

Even whales who earn from the market MUST introduce new funds into the market to essentially

30/50

'pro-rata' their staked amount as networks grow.

This is one of the most effective components of ETH's new layout, as whales will pour new money into the market to continue to round-up their stakable amounts of ETH.

Why?

Because of the opportunity cost.

'pro-rata' their staked amount as networks grow.

This is one of the most effective components of ETH's new layout, as whales will pour new money into the market to continue to round-up their stakable amounts of ETH.

Why?

Because of the opportunity cost.

31/50

Idle money loses 2%/year.

Idle ETH in these conditions might gain X% per year, but staked ETH gains (X% + Y%) where Y is the staking return.

The value of Y barely matters here. Because X+Y will ALWAYS be more than just X.

As long as it is around +2% then

Idle money loses 2%/year.

Idle ETH in these conditions might gain X% per year, but staked ETH gains (X% + Y%) where Y is the staking return.

The value of Y barely matters here. Because X+Y will ALWAYS be more than just X.

As long as it is around +2% then

32/50

At +2%, then putting the money in to round up your ETH is 200% more efficient then losing -2% per year due to inflation.

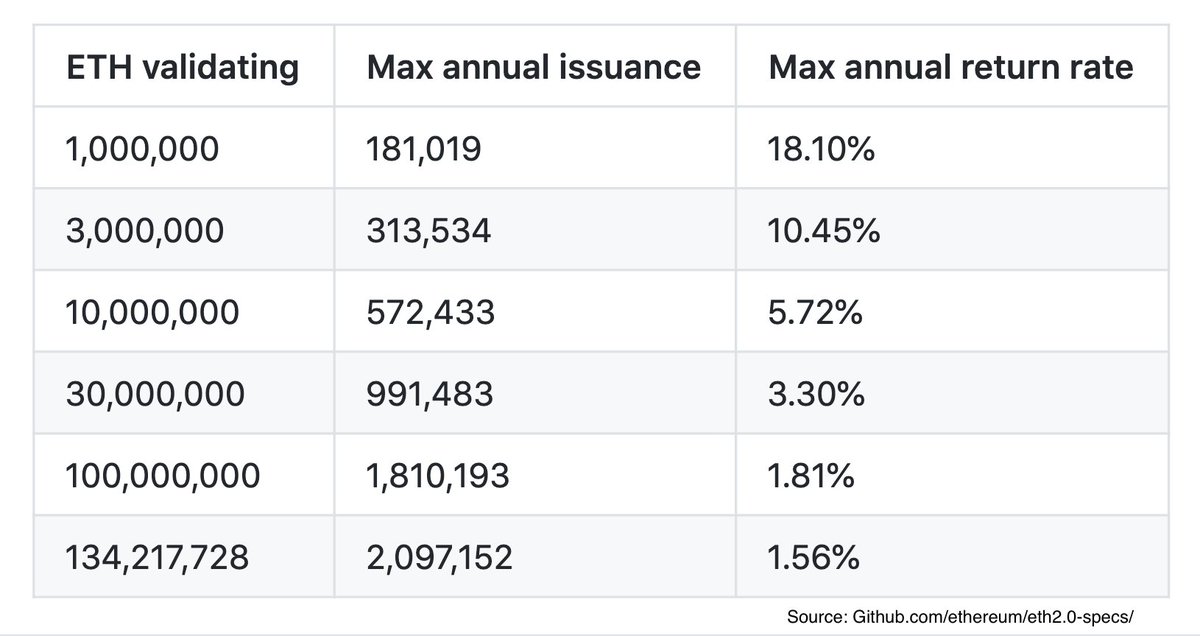

ETHs issuance rate under ETH2.0 means that we cap out at 1.81% return if 100M+ ETH was locked up. But, that would be

At +2%, then putting the money in to round up your ETH is 200% more efficient then losing -2% per year due to inflation.

ETHs issuance rate under ETH2.0 means that we cap out at 1.81% return if 100M+ ETH was locked up. But, that would be

33/50

insane in terms of demand/supply shock and send the price skyrocketing.

It's far more likely, that we'll cap out at a place where the return (Y) is somewhere between 3% - 7%. Which will cause people to round-up purchases to allotments of 32.

insane in terms of demand/supply shock and send the price skyrocketing.

It's far more likely, that we'll cap out at a place where the return (Y) is somewhere between 3% - 7%. Which will cause people to round-up purchases to allotments of 32.

34/50

Finally we have our last, and perhaps most important reason for ETH2.0 driving critical growth:

Reason #7: Burning for Flat Supply with EIP-1559:

EIP-1559 ( https://github.com/ethereum/EIPs/blob/master/EIPS/eip-1559.md) is a way to change the fees on the Ethereum blockchain take place.

Finally we have our last, and perhaps most important reason for ETH2.0 driving critical growth:

Reason #7: Burning for Flat Supply with EIP-1559:

EIP-1559 ( https://github.com/ethereum/EIPs/blob/master/EIPS/eip-1559.md) is a way to change the fees on the Ethereum blockchain take place.

35/50

First, it means more efficient payments and no miner cabals voting on fees.

But, most importantly for us it means that we can expect there to be a burning of BASEFEE with early estimates starting off as low as ~10k ETH/year and growing with use.

First, it means more efficient payments and no miner cabals voting on fees.

But, most importantly for us it means that we can expect there to be a burning of BASEFEE with early estimates starting off as low as ~10k ETH/year and growing with use.

36/50

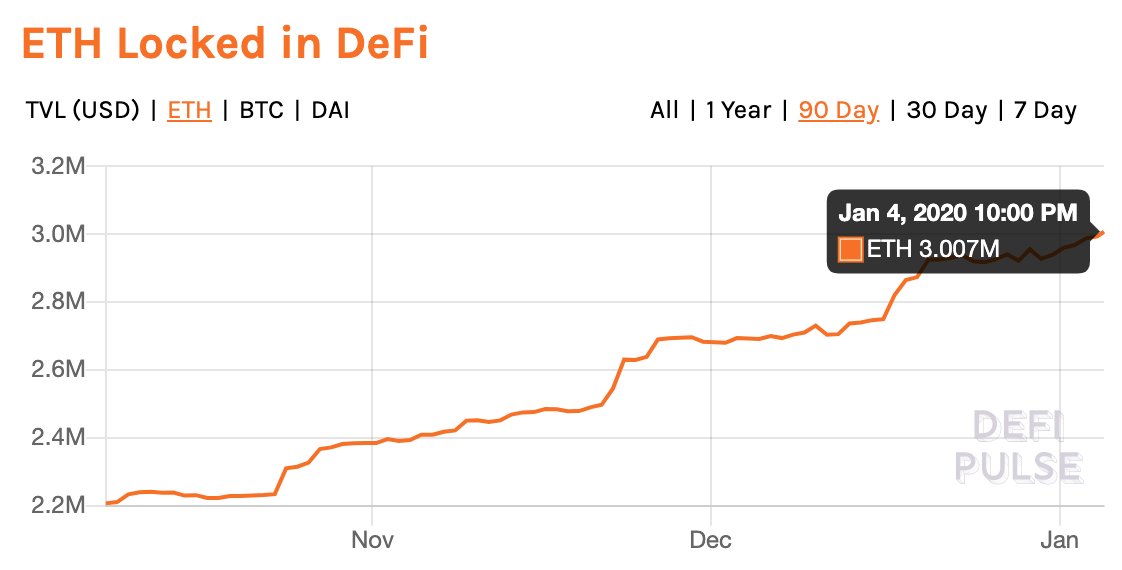

Now, that's only 0.01% of total supply per year, but this scales with actual usage and could become a significant driver. The goal here would be that it ultimately offsets the new annual issuance in the supply short-term.

But, long-term, if Ethereum is

Now, that's only 0.01% of total supply per year, but this scales with actual usage and could become a significant driver. The goal here would be that it ultimately offsets the new annual issuance in the supply short-term.

But, long-term, if Ethereum is

37/50

Then we can expect the number burnt each year to EXCEED the new issuance and start to lower the overall supply of ETH.

Right now, we estimate there is somewhere around 1.2M *ACTIVE* Ethereum users right now - many of which only use 1-2 services.

Then we can expect the number burnt each year to EXCEED the new issuance and start to lower the overall supply of ETH.

Right now, we estimate there is somewhere around 1.2M *ACTIVE* Ethereum users right now - many of which only use 1-2 services.

38/50

But as big services, begin to adopt and deploy on the Ethereum blockchain that will change.

Consider the rumors that Reddit is set to launch their own tokens on the Ethereum blockchain and seem to be pushing Ethereum wallets within their apps: https://old.reddit.com/r/CryptoCurrency/comments/fyda25/update_reddits_blockchainbased_points_system/

But as big services, begin to adopt and deploy on the Ethereum blockchain that will change.

Consider the rumors that Reddit is set to launch their own tokens on the Ethereum blockchain and seem to be pushing Ethereum wallets within their apps: https://old.reddit.com/r/CryptoCurrency/comments/fyda25/update_reddits_blockchainbased_points_system/

39/50

This means instantly that their 330M Monthly Active users will all now have Ethereum wallets and reasons to interact with ETH on a weekly basis to claim their tokens.

If even 10% of those users become monthly active ETH users, then that 10k/year ETH burn becomes

This means instantly that their 330M Monthly Active users will all now have Ethereum wallets and reasons to interact with ETH on a weekly basis to claim their tokens.

If even 10% of those users become monthly active ETH users, then that 10k/year ETH burn becomes

40/50

250,000 ETH/year very quickly and thats with only 10% of users, from one major service only using that one major services blockchain integration.

Ultimately, the supply of ETH is going to go down long term.

250,000 ETH/year very quickly and thats with only 10% of users, from one major service only using that one major services blockchain integration.

Ultimately, the supply of ETH is going to go down long term.

41/50

And that's great news for everyone.

In ETH we just need to count the zeros. Someone using ETH as gas for a computer doesn't care if they spend 0.001 ETH or 0.00000001 ETH, as long as in both those cases the transaction works out to $0.001 USD.

And that's great news for everyone.

In ETH we just need to count the zeros. Someone using ETH as gas for a computer doesn't care if they spend 0.001 ETH or 0.00000001 ETH, as long as in both those cases the transaction works out to $0.001 USD.

42/50

Since gas is abstracted away from having to count zeros (unlike trying to painfully read payments denoted in BTC) it really doesn't matter where that price point is, as long as the price rises slowly enough that there is no difference between the time you bought

Since gas is abstracted away from having to count zeros (unlike trying to painfully read payments denoted in BTC) it really doesn't matter where that price point is, as long as the price rises slowly enough that there is no difference between the time you bought

43/50

ETH and the time when you spent it. (Which is also a gap we're getting better at closing.)

But, that's good news for investors, as we continue to get smaller supply and ETH increases in value their holdings rise. So they slowly release their staked holdings back into

ETH and the time when you spent it. (Which is also a gap we're getting better at closing.)

But, that's good news for investors, as we continue to get smaller supply and ETH increases in value their holdings rise. So they slowly release their staked holdings back into

44/50

the open market, creating a smooth background rate of growth.

Many of you probably knew that the economic design between ETH2.0 was pretty smart; but, you likely hadn't considered just how smart it was.

the open market, creating a smooth background rate of growth.

Many of you probably knew that the economic design between ETH2.0 was pretty smart; but, you likely hadn't considered just how smart it was.

45/50

It is the perfect combination of instant spikes, repetitive buying loops, competitive race conditions to drive up a short-term price, and just the right amount of background growth rate to catch that price before it falls, and offer a steady growing network thereafter.

It is the perfect combination of instant spikes, repetitive buying loops, competitive race conditions to drive up a short-term price, and just the right amount of background growth rate to catch that price before it falls, and offer a steady growing network thereafter.

46/50

In Vitalik's own words, the economic policy of ETH is the minimum necessary issuance to secure the network.

Ethereum will hit that equilibrium eventually and the supply and demand will push the price to have a nice steady growth rate so that it is always

In Vitalik's own words, the economic policy of ETH is the minimum necessary issuance to secure the network.

Ethereum will hit that equilibrium eventually and the supply and demand will push the price to have a nice steady growth rate so that it is always

47/50

be economically viable to secure the Ethereum network. However, that equilibrium will likely happen at a much higher price point than we are at right now (because of the reasons we mentioned) and so it will highly reward early adopters/investors.

be economically viable to secure the Ethereum network. However, that equilibrium will likely happen at a much higher price point than we are at right now (because of the reasons we mentioned) and so it will highly reward early adopters/investors.

48/50

In turn, it will create one of the largest, if not the largest, economic growth events in our modern society - and right now it's still affordable to be a part of, and doesn't require you to be an accredited investor or a big money bank.

To summarize:

In turn, it will create one of the largest, if not the largest, economic growth events in our modern society - and right now it's still affordable to be a part of, and doesn't require you to be an accredited investor or a big money bank.

To summarize:

49/50

Recap:

All at once creating a spike:

#1 Rent Seekers & Supply Shock

#2 Secondary Rounds/Ripple Effect

#3 Retail FOMO

Background Rate of Growth:

#4 Actual Demand

#5 Cycle Buying Whales

#6 Over Reaching (Rounding)

#7 Burning for Flat Supply

Result:

-Blue Diamond Go Up.

Recap:

All at once creating a spike:

#1 Rent Seekers & Supply Shock

#2 Secondary Rounds/Ripple Effect

#3 Retail FOMO

Background Rate of Growth:

#4 Actual Demand

#5 Cycle Buying Whales

#6 Over Reaching (Rounding)

#7 Burning for Flat Supply

Result:

-Blue Diamond Go Up.

50/50

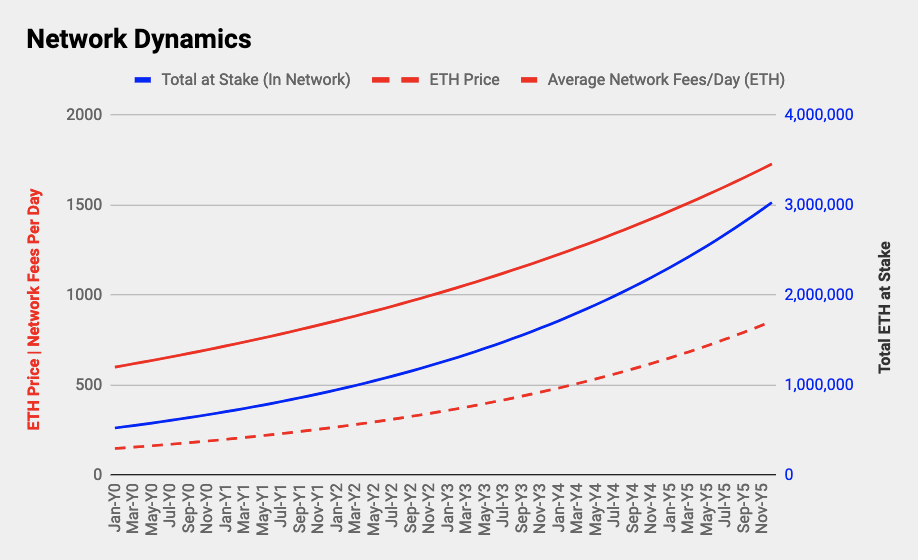

[This was previously to be a conference lecture. Can't attend as its cancelled from COVID so turned it into a tweet storm! - Special thanks to DeFi Prime for the chart I stole from them!]

[This was previously to be a conference lecture. Can't attend as its cancelled from COVID so turned it into a tweet storm! - Special thanks to DeFi Prime for the chart I stole from them!]

Made a Medium version for all the crazy folks on Twitter, who apparently don't like Twitter: https://medium.com/@adamscochran/7-reasons-eth2-0-will-create-the-next-economic-shift-f689d2f1ec24

Read on Twitter

Read on Twitter

![16/50 but, as we know, 10M-30M ETH just got locked for the launch of Eth2.0, so not only is the supply decreased and facing supply shock.But now we are piling on a demand shock ( https://en.wikipedia.org/wiki/Demand_shock) - [everyone wants a piece of the asset] 16/50 but, as we know, 10M-30M ETH just got locked for the launch of Eth2.0, so not only is the supply decreased and facing supply shock.But now we are piling on a demand shock ( https://en.wikipedia.org/wiki/Demand_shock) - [everyone wants a piece of the asset]](https://pbs.twimg.com/media/EVw5LS-XYAE9VbN.jpg)