Thread on historical intraday move in expiry days in BN.

Objective - Backtesting for price move on 15 min interval to identify periods of lowest volatility for option writing position sizing.

RT for wider reach if useful.

@Mitesh_Engr @Abhishekkar_ @bhatiamanu

(1/n)

Objective - Backtesting for price move on 15 min interval to identify periods of lowest volatility for option writing position sizing.

RT for wider reach if useful.

@Mitesh_Engr @Abhishekkar_ @bhatiamanu

(1/n)

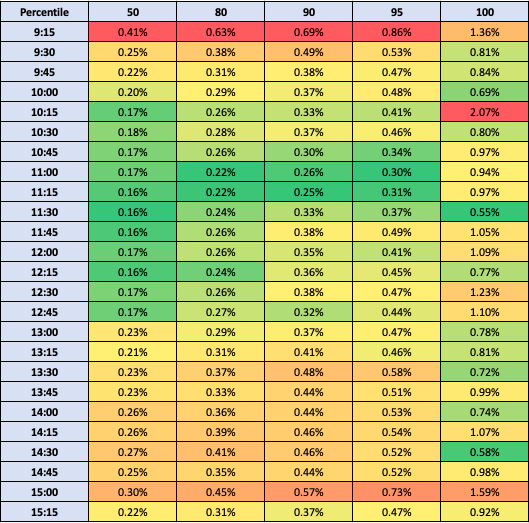

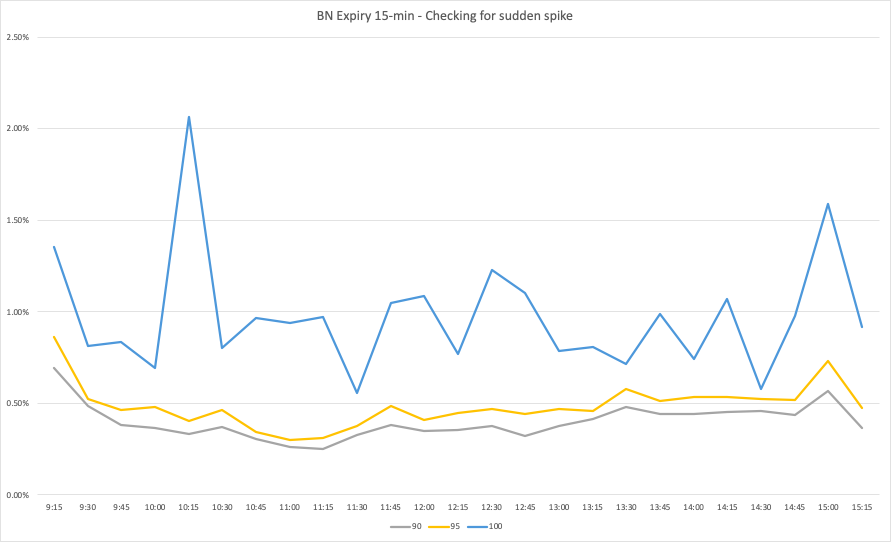

Breaking the % move in BankNifty for a 15 min period and plotting the percentile of move. So between 11:00-11:30 am, BN has moved <0.3% for 95% of times. See the table below.

Data considered - Jan '18 to Dec '19 on spot.

(2/n)

Data considered - Jan '18 to Dec '19 on spot.

(2/n)

Observations from the above data -

1. 10:15 am to 1:00 pm is the lowest movement timezone, i.e. best for options writing.

2. The claim that around 1:30-1:45 pm when Europe opens we see heavy moves is not justified by data.

3. As expected at 3:00-3:15 pm, a wild move comes.

(3/n)

1. 10:15 am to 1:00 pm is the lowest movement timezone, i.e. best for options writing.

2. The claim that around 1:30-1:45 pm when Europe opens we see heavy moves is not justified by data.

3. As expected at 3:00-3:15 pm, a wild move comes.

(3/n)

4. Outlier move between 95-100%ile, i.e. only 1-2 times during 2 year period is plotted with time below.

So what are the takeaways? Below.

(4/n)

So what are the takeaways? Below.

(4/n)

Takeaways

1. Look for trend till 10:15 am & write directional calls with 10-20% position size (stops could be triggered)

2. From 10:15-1:00pm manage strangle and deploy 100% slowly with delta weighted towards the trend

3. After 1 pm start exiting and before 3 pm exit fully.

(n/n)

1. Look for trend till 10:15 am & write directional calls with 10-20% position size (stops could be triggered)

2. From 10:15-1:00pm manage strangle and deploy 100% slowly with delta weighted towards the trend

3. After 1 pm start exiting and before 3 pm exit fully.

(n/n)

Read on Twitter

Read on Twitter