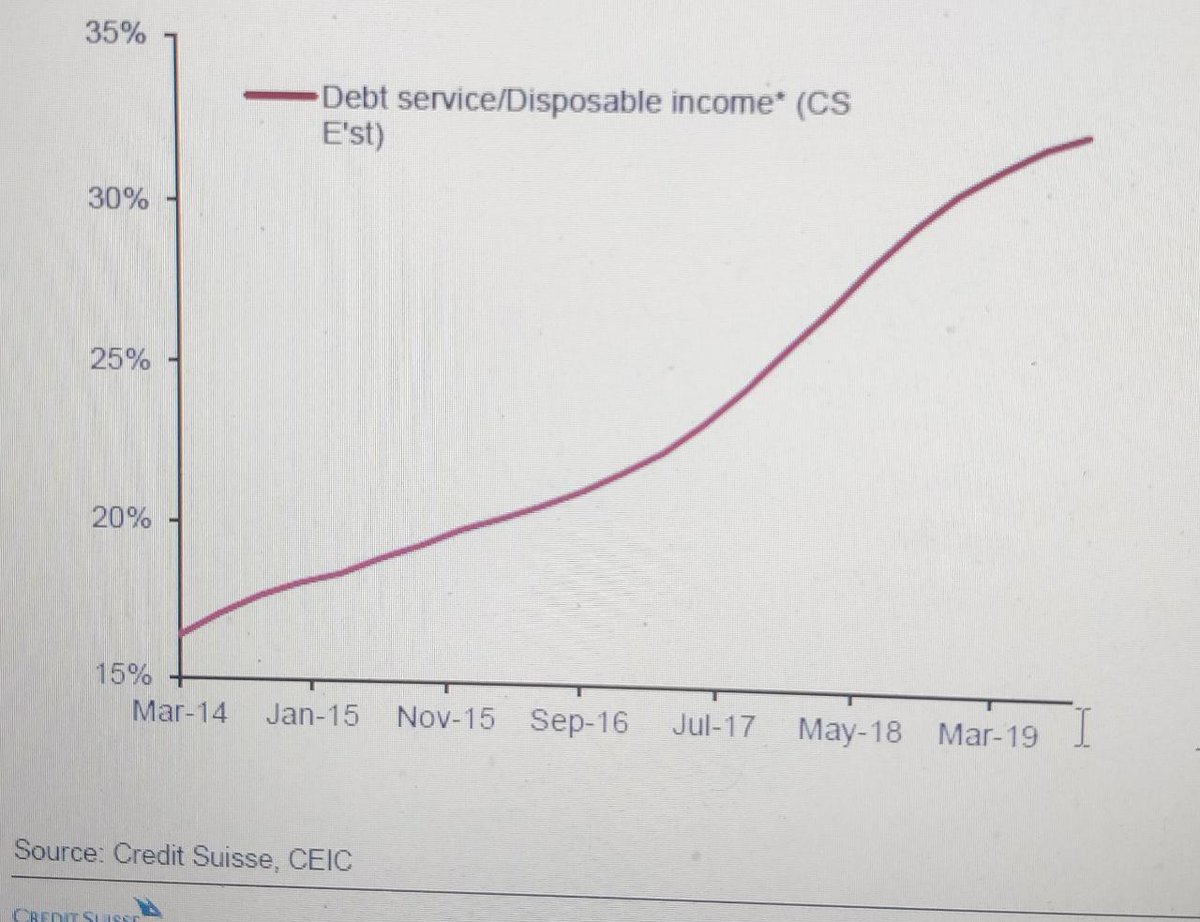

Small thread on household debt servicing capability-chart from CS where Chinese household debt service as % of disposable income has moved from 17% in Mar-14 to almost 35% now! A third of income to debt servicing in an environment of massive economic/health shocks is worrying..

"Overdue credit-card debt swelled last month by about 50% from a year earlier, according to executives at two banks who asked not to be named discussing internal figures."

https://finance.yahoo.com/news/global-consumer-default-wave-just-000000692.html

https://finance.yahoo.com/news/global-consumer-default-wave-just-000000692.html

In China, household debt has grown at 23% while household incomes have grown at 12%.Household debt has grown to 100% of income!Mortgages account for 50%+ of these loans.Nearly 66% of outstanding mortgage debt last year was owed by families who already own more than one property.

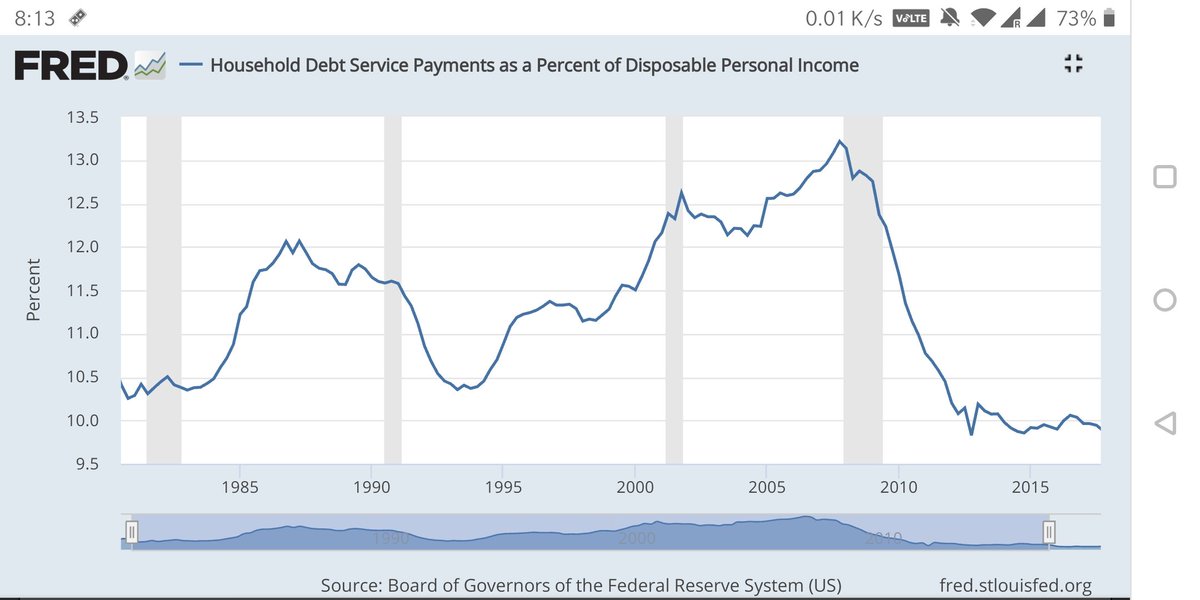

For US, this metric is at less than 10%. At peak of GFC crisis, this went up to 13%. Possibly given the magnitude of Covid19 crisis, this metric will worsen now, maybe more significantly than even GFC

For India, we don't have ready-reckoner data on this metric, so have attempted to do so from data culled from retail loans disclosed by scheduled commercial banks + NBFC + HFC. RBI gives data on household gross income.

As of Mar18, gross household income is at 132 lakh crore, while total retail loans given by system as on Mar 18 is some 32 lakh crores. Post taxes, net household income should be in vicinity of around 100 lakh crores.

Assuming a 5 year average loan repayment cycle (most mortgages in India pay up in about 8 years), and 12% average interest rates, total debt servicing is lower than 11 lakh crores, which broadly works out to debt service ratio of net disposable income of 11-12%

Household debt in 5 years has doubled, but over same time period as per RBI, aggregate gross income has grown by 88%, indicating a small increase in overall household debt to income in India, unlike China.

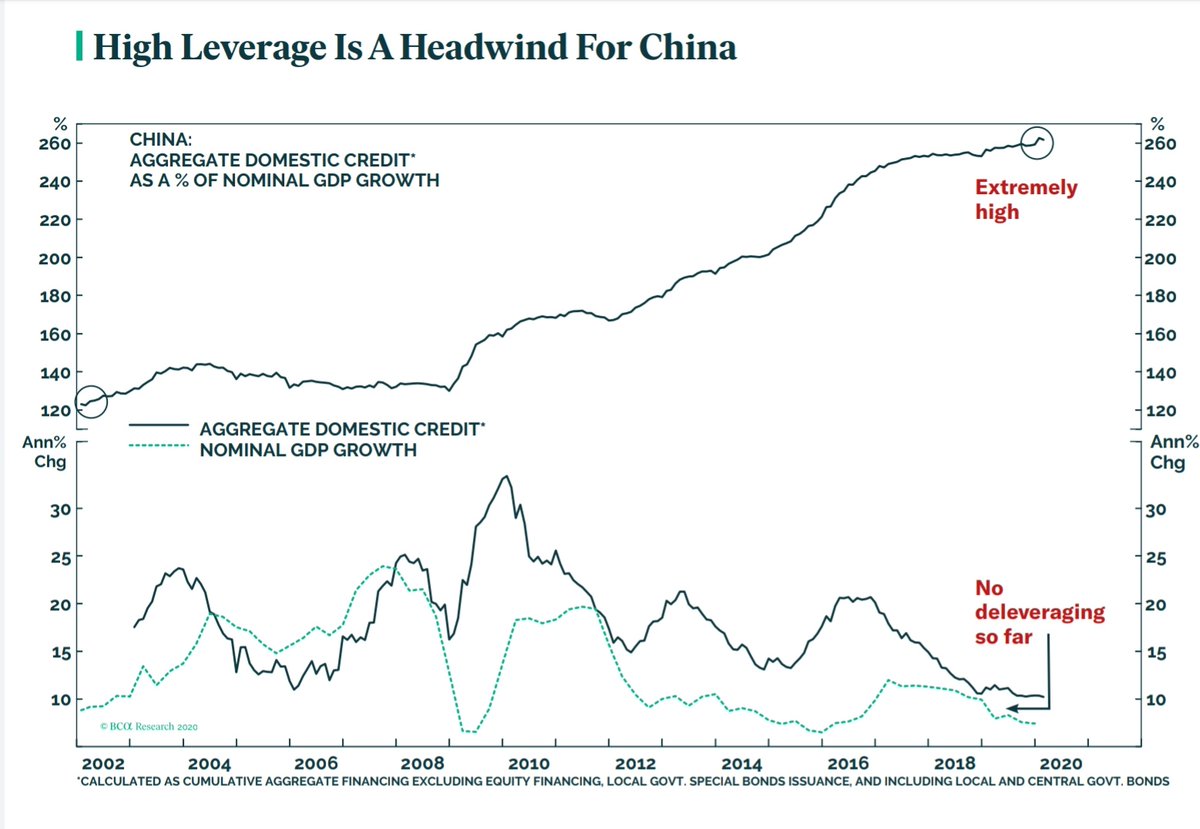

Needless to say, all this is on basis of aggregate data, lowest few deciles of income may have higher indebtedness in India/other countries etc.Basis this,will be interesting how chinese consumer can further stimulate growth in an already weak global economy amidst weak exports?

End of thread!

Read on Twitter

Read on Twitter