What makes #Bitcoin  attractive?

attractive?

Let's take a look at some of the lesser known forces driving adoption.

Starting with B..B..Barbra Streisand

A ..

..

attractive?

attractive? Let's take a look at some of the lesser known forces driving adoption.

Starting with B..B..Barbra Streisand

A

..

..

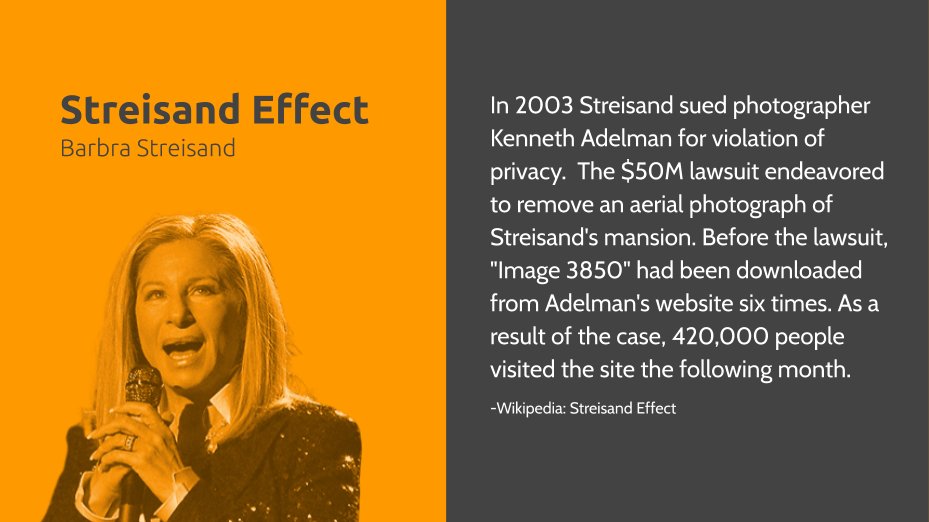

The STREISAND EFFECT:

A phenomenon whereby an attempt to hide, remove, or censor a piece of information has the unintended consequence of publicizing the information more widely, usually facilitated by the Internet.

A phenomenon whereby an attempt to hide, remove, or censor a piece of information has the unintended consequence of publicizing the information more widely, usually facilitated by the Internet.

Every time a an institution attempts to repress or dissuade Bitcoin usage, they are unknowingly driving traffic towards it.

I know you want to see the photo, so here it is.

Image of Barbra Streisand's Malibu house.

[Copyright (C) 2002 Kenneth & Gabrielle Adelman]

I know you want to see the photo, so here it is.

Image of Barbra Streisand's Malibu house.

[Copyright (C) 2002 Kenneth & Gabrielle Adelman]

The CANTILLON EFFECT:

In a fiat economy, the original recipients of new money enjoy higher standards of living at the expense of later recipients. As they create a disproportionate rise in prices, through their spending preferences, among different goods in an economy.

In a fiat economy, the original recipients of new money enjoy higher standards of living at the expense of later recipients. As they create a disproportionate rise in prices, through their spending preferences, among different goods in an economy.

VEBLEN GOOD:

'Types of luxury goods for which the quantity demanded increases as the price increases, an apparent contradiction of the law of demand.'

'Types of luxury goods for which the quantity demanded increases as the price increases, an apparent contradiction of the law of demand.'

“A higher price may make a product desirable as a status symbol. A product may be a Veblen good because it is a positional good, something few others can own.” - wikipedia

ANTIFRAGILITY:

“The classic example of something antifragile is Hydra, the Greek mythological creature that has numerous heads. When one is cut off, two grow back in its place.”

-Farnham Street

“The classic example of something antifragile is Hydra, the Greek mythological creature that has numerous heads. When one is cut off, two grow back in its place.”

-Farnham Street

GRESHAM'S LAW:

If two forms of commodity money circulate, which are accepted by law as having similar face value, the more valuable commodity will gradually disappear from circulation.

Gresham made his observations with respect to the poor quality of British coinage.

If two forms of commodity money circulate, which are accepted by law as having similar face value, the more valuable commodity will gradually disappear from circulation.

Gresham made his observations with respect to the poor quality of British coinage.

Henry VIII, had replaced 40% of the silver in the coin with base metals, to pay for wars without raising taxes.

Eventually the outer layer of silver had become so thin that it would wear off revealing the copper below.

Eventually the outer layer of silver had become so thin that it would wear off revealing the copper below.

SCHELLING POINT:

A solution that people tend to choose, by default, in the absence of communication.

Further Reading:

"Bitcoin becomes the Flag of Technology" by @balajis

https://bit.ly/3cqgyvt

"Shelling Out: The Origins of Money" by @NickSzabo4

https://bit.ly/2Tgs9FL

A solution that people tend to choose, by default, in the absence of communication.

Further Reading:

"Bitcoin becomes the Flag of Technology" by @balajis

https://bit.ly/3cqgyvt

"Shelling Out: The Origins of Money" by @NickSzabo4

https://bit.ly/2Tgs9FL

To illustrate, let’s look at ‘The Bike Game’

Oncoming bikers need to coordinate to avoid a crash. They each can go straight, left or right.

If you drive on the right hand side of the road, it becomes natural that both bikers would swerve to their respective right side.

Oncoming bikers need to coordinate to avoid a crash. They each can go straight, left or right.

If you drive on the right hand side of the road, it becomes natural that both bikers would swerve to their respective right side.

LINDY EFFECT:

Adapted from Goldman’s 'Lindy Law', and later popularised by Taleb, Mandelbrot defined the 'Lindy Effect' in 'The Fractal Geometry of Nature' (1982).

"However long a person's past collected works, it will on the average continue for an equal additional amount.”

Adapted from Goldman’s 'Lindy Law', and later popularised by Taleb, Mandelbrot defined the 'Lindy Effect' in 'The Fractal Geometry of Nature' (1982).

"However long a person's past collected works, it will on the average continue for an equal additional amount.”

THE IMPOSSIBLE TRINITY:

Also known as the 'Mundell-Fleming Trilemma', this rule states that a country must choose between free capital movement, a fixed exchange-rate and an independent monetary policy. Only two-out-of-three can be achieved.

Also known as the 'Mundell-Fleming Trilemma', this rule states that a country must choose between free capital movement, a fixed exchange-rate and an independent monetary policy. Only two-out-of-three can be achieved.

Several major financial crises have occurred as a result of attempting to have all 3 policies:

The Mexican peso crisis (1994–1995)

https://bit.ly/39XixVP

The Asian financial crisis (1997–1998)

https://bit.ly/2Xzs6Ya

The Argentine Crisis (2001–2002)

https://bit.ly/2RstKHk

The Mexican peso crisis (1994–1995)

https://bit.ly/39XixVP

The Asian financial crisis (1997–1998)

https://bit.ly/2Xzs6Ya

The Argentine Crisis (2001–2002)

https://bit.ly/2RstKHk

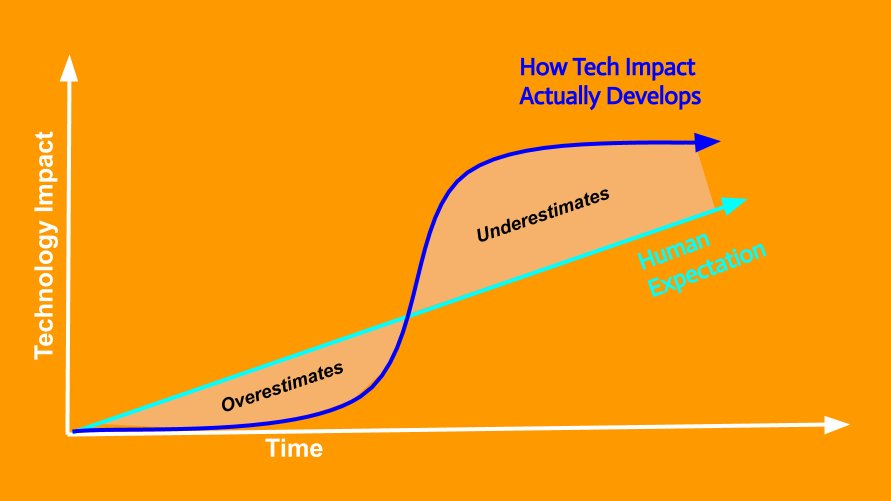

AMARA'S LAW:

Roy Amara captured how wildly excited we get about a new technology initially, but how our excitement eventually wanes due to disappointment. It's at this point the technology accelerates and becomes disruptive.

Roy Amara captured how wildly excited we get about a new technology initially, but how our excitement eventually wanes due to disappointment. It's at this point the technology accelerates and becomes disruptive.

THE KAPLAN DOCTRINE:

Coined by @DTAPCAP, the principle highlights the inherit risks of holding hard physical assets, specifically gold, in jurisdictions deemed risky or hazardous.

Coined by @DTAPCAP, the principle highlights the inherit risks of holding hard physical assets, specifically gold, in jurisdictions deemed risky or hazardous.

THE INEQUIVALENCE THEOREM:

Many economic assumptions about behaviour are rooted in

the 'tyranny of place'.

Countries that run ever-growing deficits w/ large unfunded liabilities will see rational & able people flee for jurisdictions with less indebtedness and more certainty.

Many economic assumptions about behaviour are rooted in

the 'tyranny of place'.

Countries that run ever-growing deficits w/ large unfunded liabilities will see rational & able people flee for jurisdictions with less indebtedness and more certainty.

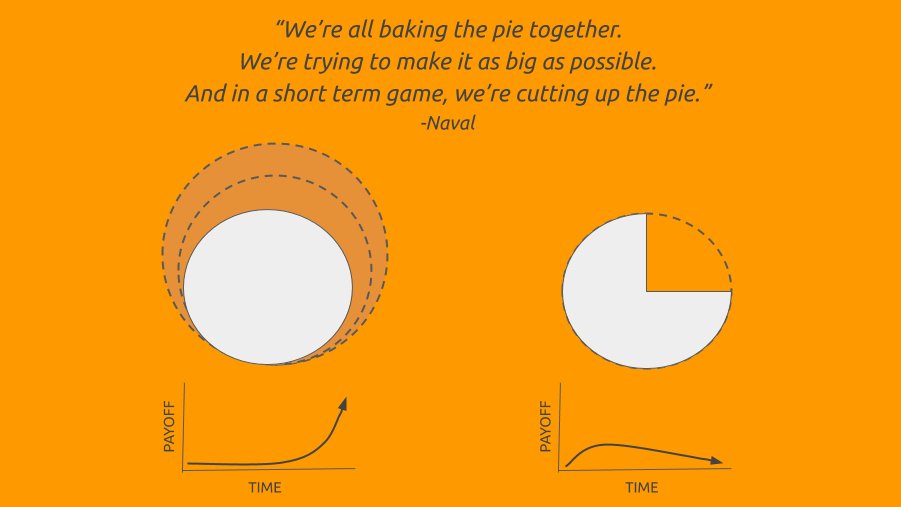

'An individual’s values, a company’s mission, and a nation’s constitution, all attract long term players playing long term games.'

‘All returns in life, whether in wealth, relationships, or knowledge come from compound interest.”

- @naval

https://nav.al/long-term

‘All returns in life, whether in wealth, relationships, or knowledge come from compound interest.”

- @naval

https://nav.al/long-term

The INTRANSIGENT MINORITY:

'The minority rule will show us how it all it takes is a small number of intolerant virtuous people with skin in the game, in the form of courage, for society to function properly.'

-Skin in the Game by @nntaleb

'The minority rule will show us how it all it takes is a small number of intolerant virtuous people with skin in the game, in the form of courage, for society to function properly.'

-Skin in the Game by @nntaleb

The LAW OF ACCELERATING RETURNS

An analysis of the history of technology shows that technological change is exponential... So we won’t experience 100 years of progress in the 21st century — it will be more like 20,000 years of progress (at today’s rate).

- Ray Kurzweil (2001)

An analysis of the history of technology shows that technological change is exponential... So we won’t experience 100 years of progress in the 21st century — it will be more like 20,000 years of progress (at today’s rate).

- Ray Kurzweil (2001)

"When it comes to history, we think in straight lines... In order to think about the future correctly, you need to imagine things moving at a much faster rate than they’re moving now."

- @waitbutwhy (2015)

Original Essay: https://bit.ly/2W0zASG

- @waitbutwhy (2015)

Original Essay: https://bit.ly/2W0zASG

JEVONS PARADOX

"As oil and gas companies continue to wake up and realize they can use all of the FREE gas they are currently wasting on their fields to mine bitcoin, this will severely reduce the price at which your average miner can mine profitably."

- @MartyBent

"As oil and gas companies continue to wake up and realize they can use all of the FREE gas they are currently wasting on their fields to mine bitcoin, this will severely reduce the price at which your average miner can mine profitably."

- @MartyBent

METCALFE’S LAW:

Conceived by George Gilder but attributed to Robert Metcalfe (co-inventor of Ethernet), this concept relates to the value of a communications network being proportional to the square of the number of connected users.

NV≈n^2

Conceived by George Gilder but attributed to Robert Metcalfe (co-inventor of Ethernet), this concept relates to the value of a communications network being proportional to the square of the number of connected users.

NV≈n^2

Read on Twitter

Read on Twitter

![Every time a an institution attempts to repress or dissuade Bitcoin usage, they are unknowingly driving traffic towards it. I know you want to see the photo, so here it is.Image of Barbra Streisand's Malibu house.[Copyright (C) 2002 Kenneth & Gabrielle Adelman] Every time a an institution attempts to repress or dissuade Bitcoin usage, they are unknowingly driving traffic towards it. I know you want to see the photo, so here it is.Image of Barbra Streisand's Malibu house.[Copyright (C) 2002 Kenneth & Gabrielle Adelman]](https://pbs.twimg.com/media/ESJQhtZUEAALEIs.jpg)