It’s easy to be your own worst enemy by behaving like a trader when your intent is to be an investor

[THREAD]

[THREAD]

1/x

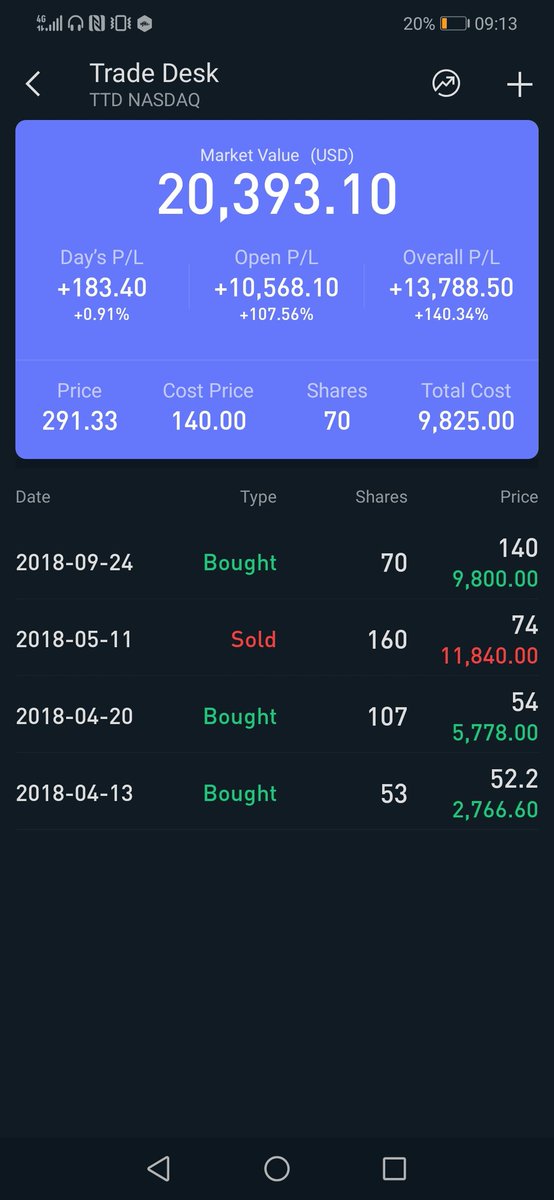

Despite showing the most impressive return in my portfolio (at over 100%)

my mismanagement of my position in The Trade Desk $TTD

has cost me USD 26,000

Despite showing the most impressive return in my portfolio (at over 100%)

my mismanagement of my position in The Trade Desk $TTD

has cost me USD 26,000

2/x

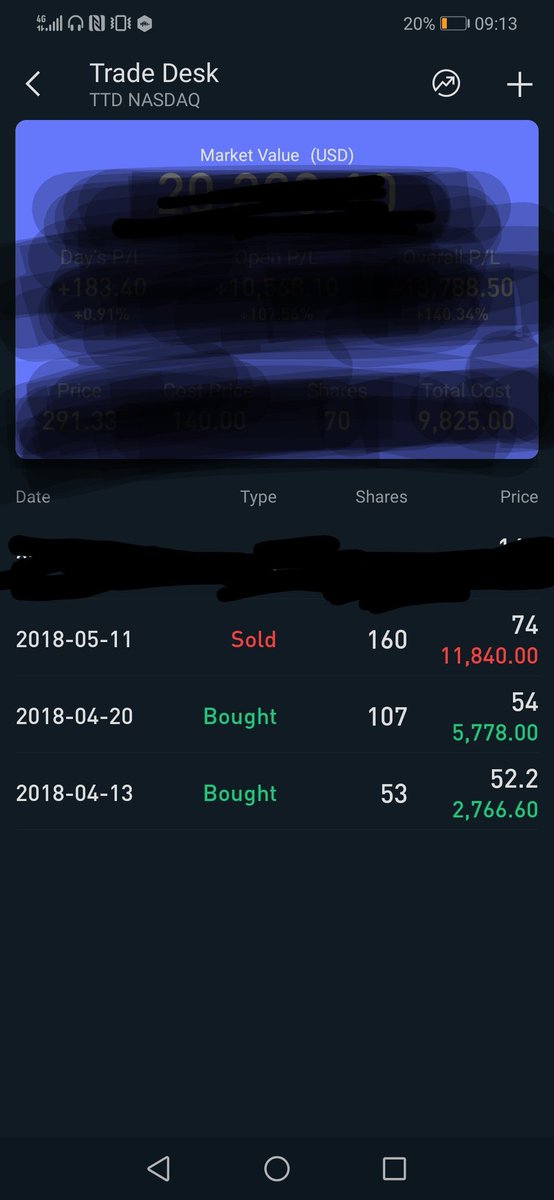

In April 2018, I bought 160 shares of The Trade Desk

for my LONG TERM portfolio at an average price of $53.39

$8,540 total

In April 2018, I bought 160 shares of The Trade Desk

for my LONG TERM portfolio at an average price of $53.39

$8,540 total

3/x

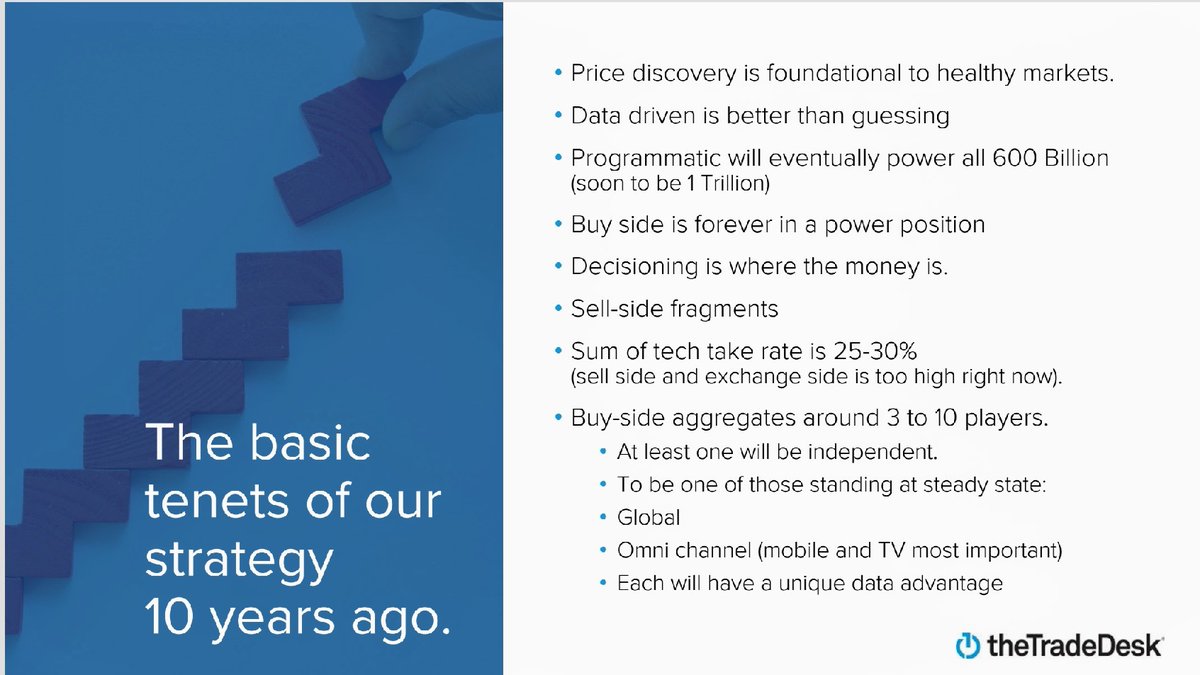

I had done my due diligence and loved:

The market opportunity in an important emerging market

The impressive growth metrics and history of beat/raises

It’s sustainable competitive advantage as the leading independent DSP

I had done my due diligence and loved:

The market opportunity in an important emerging market

The impressive growth metrics and history of beat/raises

It’s sustainable competitive advantage as the leading independent DSP

4/x

I also really liked

The quality of the management

(Seriously, Jeff Green and team are excellent)

The valuation of the company relative to its growth metrics

......

$TTD reported a blowout ER on May 11 2018, less than a month later

The stock jumped 40% in a day!

I also really liked

The quality of the management

(Seriously, Jeff Green and team are excellent)

The valuation of the company relative to its growth metrics

......

$TTD reported a blowout ER on May 11 2018, less than a month later

The stock jumped 40% in a day!

4/x

I thought that the ER was excellent

and was thrilled that I had returned 40% to my initial investment

within a month of my purchase

My trading instincts told me to “lock in my gains"

I sold all of my shares for $74 on 11 May 2018 through my phone app

Total $11,840

I thought that the ER was excellent

and was thrilled that I had returned 40% to my initial investment

within a month of my purchase

My trading instincts told me to “lock in my gains"

I sold all of my shares for $74 on 11 May 2018 through my phone app

Total $11,840

5/x

and then watched in dismay

as the stock continued a post earnings drift upwards in price

18 May $TTD price $85.63

18 June $TTD price $92.92

I thought that the next ER, the company might sell off

and I’d get my chance to get back in and correct my error

and then watched in dismay

as the stock continued a post earnings drift upwards in price

18 May $TTD price $85.63

18 June $TTD price $92.92

I thought that the next ER, the company might sell off

and I’d get my chance to get back in and correct my error

6/x

9 Aug 2018 $TTD had another blowout ER and

jumped another 35% IN A DAY

18 August $TTD price $125.61

A month later I decided I had to get back in

I swallowed my pride and bought 70 $TTD shares back

(less than half my original position)

at $140

for $9,800 on 24 Sep '18

9 Aug 2018 $TTD had another blowout ER and

jumped another 35% IN A DAY

18 August $TTD price $125.61

A month later I decided I had to get back in

I swallowed my pride and bought 70 $TTD shares back

(less than half my original position)

at $140

for $9,800 on 24 Sep '18

7/x

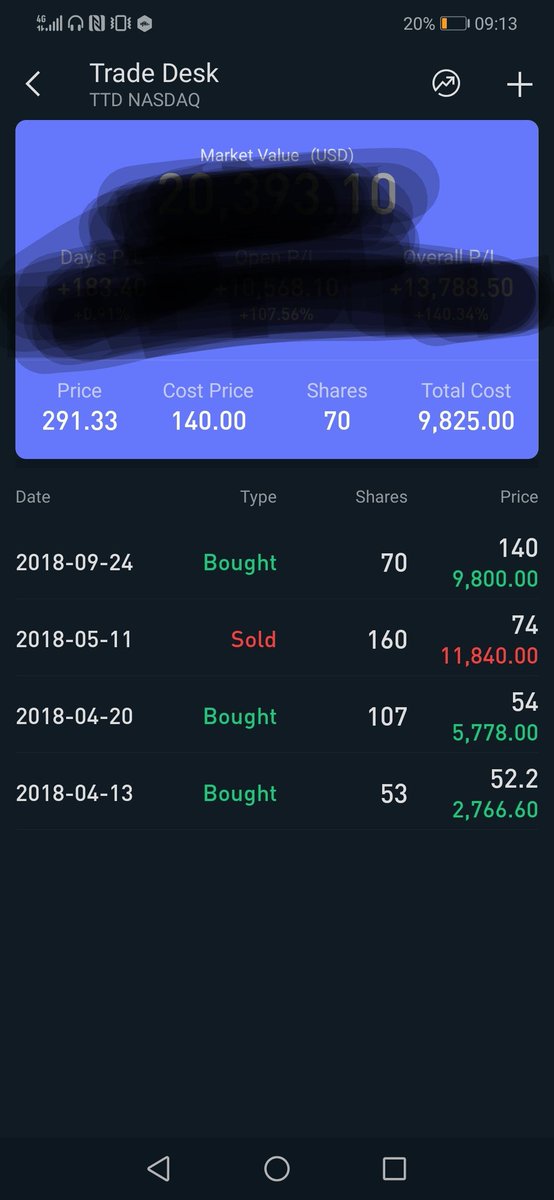

$TTD fell to $108 on Dec 24 2018

I held on, reminding myself it was all about the LT view

but it hurt, as I was now anchored to my new purchase price of $140

and the stock had declined almost 25% from there

(I wd have been still up 100% from my original price of <$54)

$TTD fell to $108 on Dec 24 2018

I held on, reminding myself it was all about the LT view

but it hurt, as I was now anchored to my new purchase price of $140

and the stock had declined almost 25% from there

(I wd have been still up 100% from my original price of <$54)

8/x

The stock price eventually recovered

And is now at > 100% over my re-entry price.

If I had just held to my original position in $TTD and behaved like an INVESTOR not a TRADER

my shares would be worth over $46,500, rather than $20,000

Money I left on the table

The stock price eventually recovered

And is now at > 100% over my re-entry price.

If I had just held to my original position in $TTD and behaved like an INVESTOR not a TRADER

my shares would be worth over $46,500, rather than $20,000

Money I left on the table

9/x

This is why the adage

"Time in the market > timing the market" exists.

In my opinion...

The most reliable way for ME to achieve life changing gains in the stock market

is through adopting the long term view on

market beating stocks like $TTD

This is why the adage

"Time in the market > timing the market" exists.

In my opinion...

The most reliable way for ME to achieve life changing gains in the stock market

is through adopting the long term view on

market beating stocks like $TTD

10/x

it is reasonable to have a core position

which is bought at an attractive price and is HELD unless it hits clearly defined SELL CRITERIA

as well as a shorter term “trading position”

Selling your entire position in a company you continue to believe in is a DUMB move

/fin

it is reasonable to have a core position

which is bought at an attractive price and is HELD unless it hits clearly defined SELL CRITERIA

as well as a shorter term “trading position”

Selling your entire position in a company you continue to believe in is a DUMB move

/fin

P.S

* Buy quality business when the risk/reward is attractive

* Review your investing thesis regularly

* Hold long term if the business performs and your thesis is intact

* Ignore short term noise

* Be willing to accept huge gains!

INVEST

https://raymondjames.uk.com/jeff-sauts-weekly-investment-strategy-do-you-have-the-mental-fortitude-to-accept-huge-gains/

* Buy quality business when the risk/reward is attractive

* Review your investing thesis regularly

* Hold long term if the business performs and your thesis is intact

* Ignore short term noise

* Be willing to accept huge gains!

INVEST

https://raymondjames.uk.com/jeff-sauts-weekly-investment-strategy-do-you-have-the-mental-fortitude-to-accept-huge-gains/

PART 2 - IT GETS WORSE

It’s easy to be your own worst enemy by behaving like a trader

when your intent is to be an investor

https://twitter.com/adventuresinfi/status/1226857103463153664?s=20

https://twitter.com/adventuresinfi/status/1226857103463153664?s=20

It’s easy to be your own worst enemy by behaving like a trader

when your intent is to be an investor

https://twitter.com/adventuresinfi/status/1226857103463153664?s=20

https://twitter.com/adventuresinfi/status/1226857103463153664?s=20

Read on Twitter

Read on Twitter