#PakistanEconomy #TrainCrashInSlowMotion

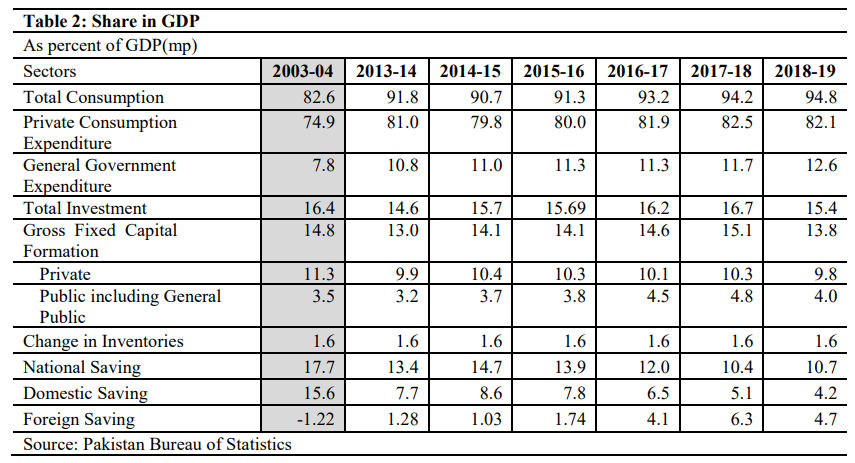

Despite low living std, pvt consumption in Pakistan is 82% of its GDP (same for last 3 years!). GFCF/GDP, which shows investor’s confidence in the future is DOWN from 14.8% in FY04 to 13.8% in FY19. Perspective, India’s is 28%.

+

Despite low living std, pvt consumption in Pakistan is 82% of its GDP (same for last 3 years!). GFCF/GDP, which shows investor’s confidence in the future is DOWN from 14.8% in FY04 to 13.8% in FY19. Perspective, India’s is 28%.

+

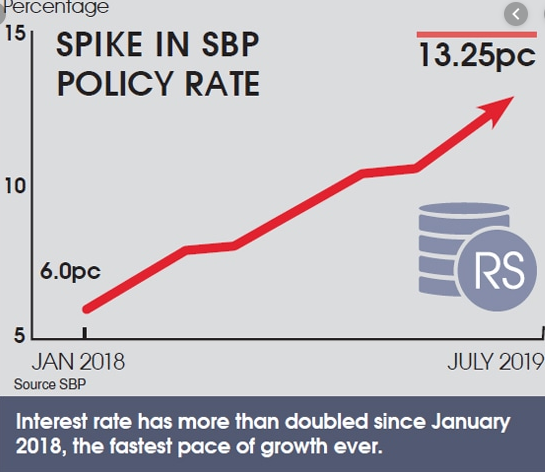

+Normally, the central bank should reduce interest rates to spur investments. But what has Pakistani State Bank (PSB) done? It has raised them by a lot! Note, the equivalent rate in India is 5.15%!+

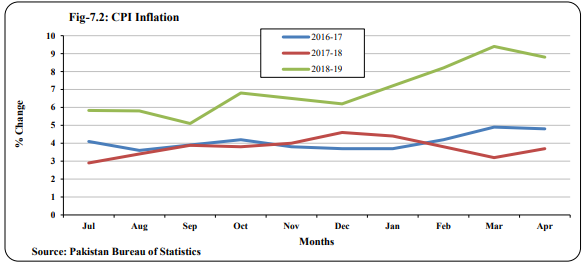

+ So money is that much more costlier in Pakistan, so capacities cannot be added easily and systemic problems continue. But why did PSB do this? Because of several macro imbalances. For example, the inflation rate in Pakistan is out of control (8-9%), with no easing in sight:+

+ In fact core inflation is higher than headline inflation. Perspective, India's inflation is about 4-5%, while core inflation is 3-3.5%. Another huge issue for Pak is that its currency is depreciating fast, over 50% fall in last 5 years.+

+ Normally an increasing in interest rate shores up a country's currency. But in the case of Pakistan its had absolutely no impact. In fact one wonders if Paki Rupees would have fallen below Rs200/ 1US$ had interest rates not been at multi decade highs there.+

+ This fall in currency hurts Pakistan in more ways that one.

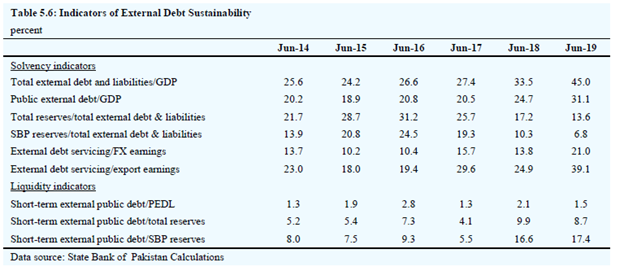

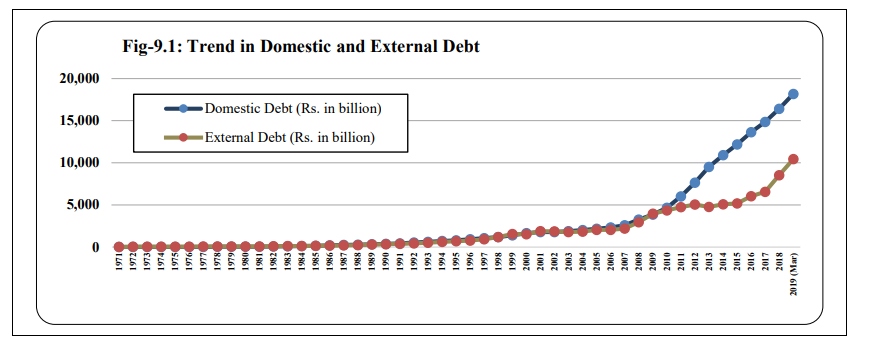

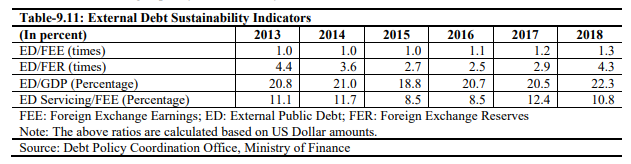

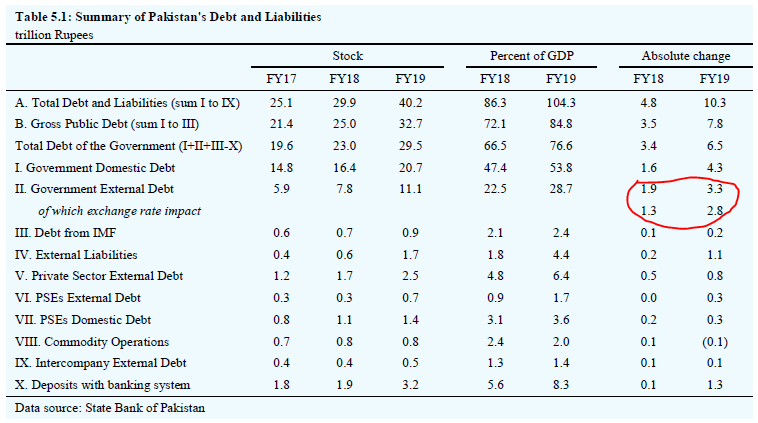

1) It has taken large loans from abroad. About 40% of Pakistan's total debt is in foreign currency. In fact external debt to GDP has risen from 19% of GDP in 2015 to 26% today!+

1) It has taken large loans from abroad. About 40% of Pakistan's total debt is in foreign currency. In fact external debt to GDP has risen from 19% of GDP in 2015 to 26% today!+

+ Paki external debt is >4 TIMES its forex reserves, and is 30% more than Pakistan's foreign exchange earnings. One can go so far as to say that falling Paki Rupee (PKR), coupled with slow economic growth will make the foreign debt unsustainable within the next 4-5 years!+

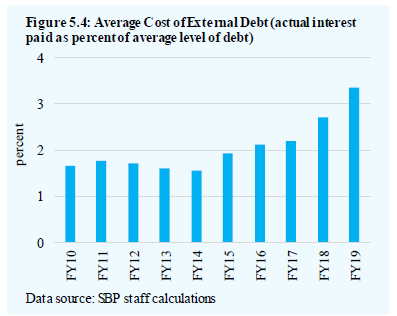

+ In fact, as per Pak SBP, Interest rates on external debt have doubled for Pak in the last 10 years. The actual yields that these external bonds trade at in the global market are 7-8%, showing investors lack of faith in Pakistan. +

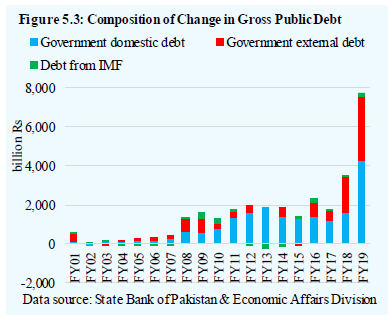

+ And at this time, there is the perfect storm that govt is unable to raise more domestic debt. SBP data shows that Pak is going to be more and more dependent on external debt going forward. Just look at this chart below!

+

+

+ Note that a falling currency causes the amount payable to a foreign lender to GO UP, as more PKR are needed to pay the same US$ value. For the last 2 years. 70-85% of increase in its external debt has come from just PKR falling. How long can this continue?!+

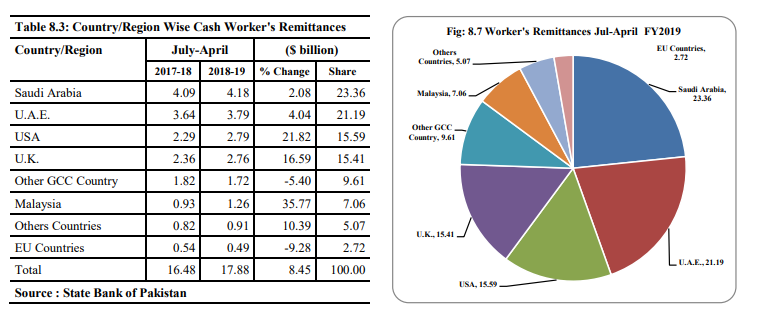

+ Current account deficit of Pakistan is sustained only due to remittances of its citizens who live and work abroad usually in some low paying job. Nearly half of its remittances are from just two countries, SaudiA and UAE. If for some reason these countries were to change+

+ how it employees foreign nationals, Pakistan would see the bottom fall off its external accounts overnight. For example if UAE were to replace its taxis with auto driven cars, many Pakistanis in UAE would have to come back. This is an extremely precarious situation.+

+ In fact one can say Pakistan is depending on its own economy NOT doing well keeping many of its citizens abroad in low paying jobs where they keep sending foreign exchange back home. +

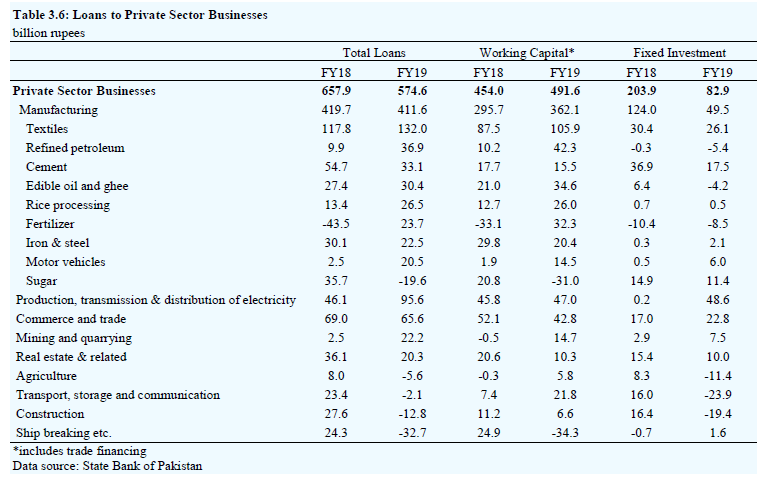

+ In fact look at the bank lending pattern in Pakistan. Of all the money lent to Pvt businesses in Pakistan, 86% was lent by way of working capita, and only 14% for fixed capital investing. In other words, businesses are borrowing just so that they can stay afloat, not grow!+

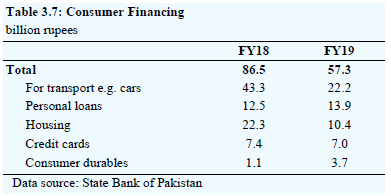

+ This lack of confidence is seen even in consumer financing. People are taking personal loans (to perhaps make ends meet) but not for creating assets like a house.

+

+

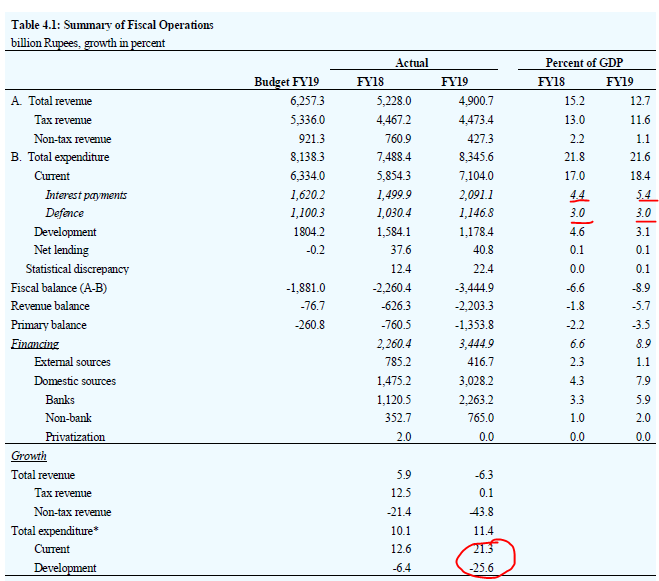

+ It is not surprising that Pakistan then pays more in interest (odd isnt is, for an Islamic country?) than it does for its defence! Also note its development expenditure is falling even as overall expenditure rises! Talk about hitting rock bottom and then beginning to dig!+

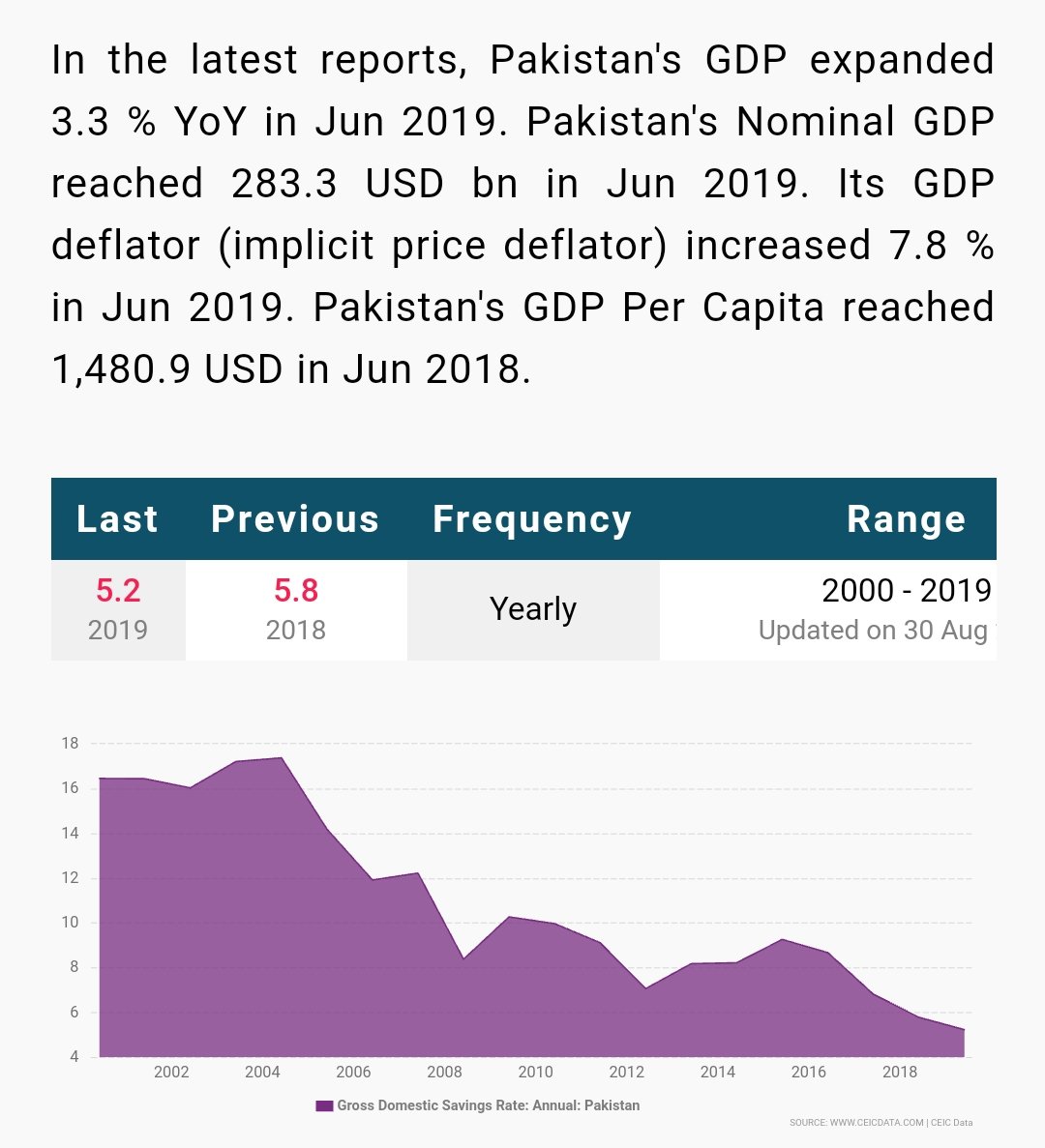

+ One would then think that if rates are so high then Pakistanis must be saving right? This will turn into investing later right? But look at the gross savings/gdp ratio. 5%, from 16% in 2004! (India's is 30%).+

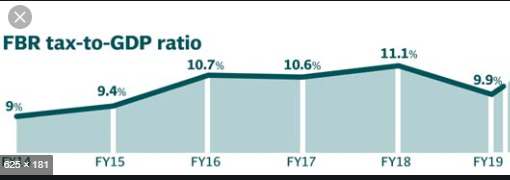

+ pakistans fiscal deficit is at staggering 9% of its GDP. Put this in perspective to gauge its staggering size. Paki tax/gdp ratio is 10%. So the HOLE in pakistans balance sheet is roughly to size of its entire tax collection. How do they come back from this?!+

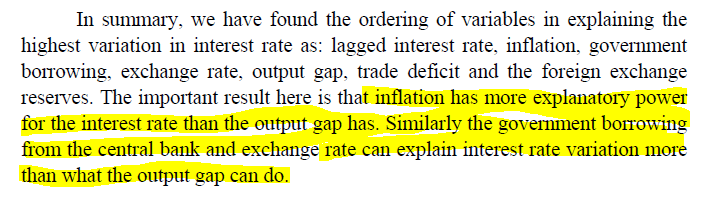

+ A paper by Wasim Malik of PIDE (excerpt attached) on SBP's rate policy corroborates a point I inferred earlier :

SBP is more concerned with trying to control inflation, make govt borrowing cheaper, and keep the bottom from falling off from its exchange rate, than growth!+

SBP is more concerned with trying to control inflation, make govt borrowing cheaper, and keep the bottom from falling off from its exchange rate, than growth!+

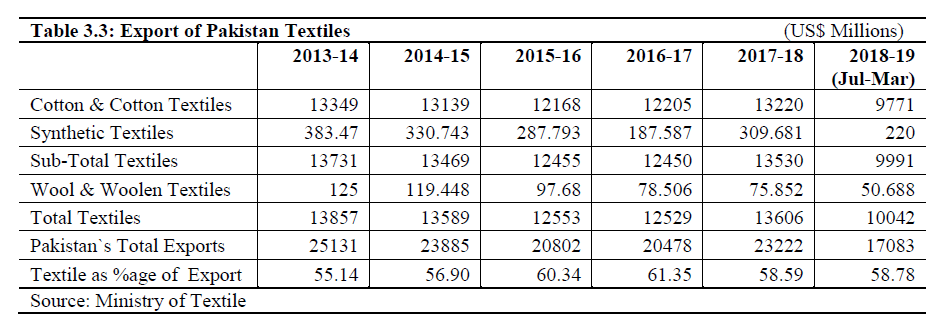

+ Look at Pakistan's precarious situation. Its biggest export textiles is stagnant or declining at a time it needs more forex to pay for its foreign debt. Forget guns, if @narendramodi simply weaponizes India's textile sector, Pak economy will be dismantled in a few years+

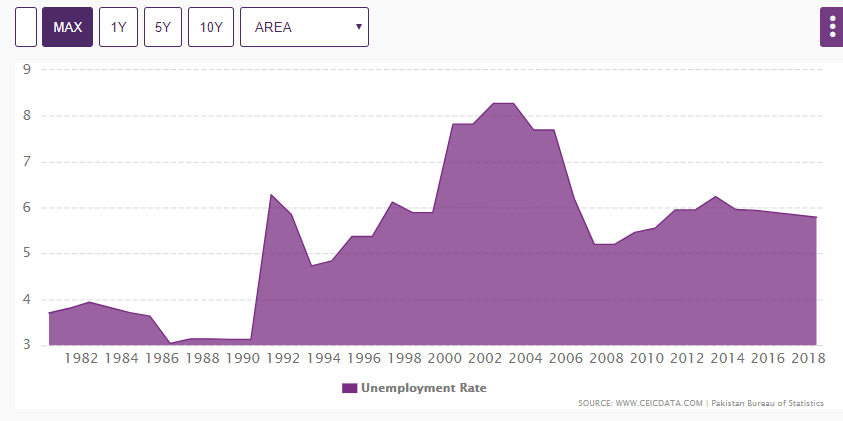

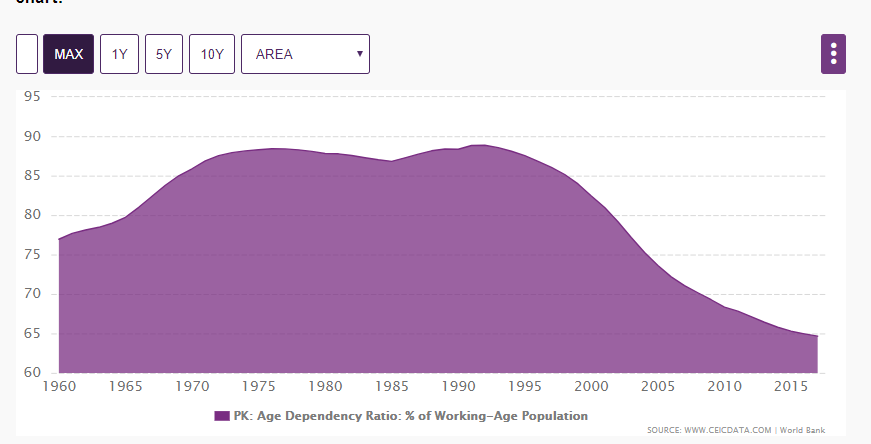

+ See falling GFCF along with high levels of unemployment which means very less chances of unemployment falling in the future. In fact if you see the high % of young population in Pakistan (dependency ratio at all time low), it means unemployment will explode going up. Unrest.

+

+

+ Can you guess what is Pakistan's trade deficit with China? In FY07 it used to be US$3bn, in 11 years it has risen to US$14bn. This is 5.4% of Pakistan's entire GDP. I cant think of a family friendly analogy for this relationship.

+

+

+ and guess how this is being financed? By taking loans, grants etc from China itself,who financed about US$4.7bn, and further help for its ever widening BoP hole came from just three more countries: Saudi, UAE, and Qatar. In fact Pakistan's own overseas citizens who arent+

+ in low paying jobs in middle eastern countries have no faith left in Pakistan. Pakistan tried to raise "Pakistan Banao Certificates (PBC)", but managed to get only US$30mn in the entire of 2019.+

Read on Twitter

Read on Twitter