Some more data indicating that #Bitcoin  ’s attack-resistance will likely continue to deteriorate as its block subsidy declines. #halvening

’s attack-resistance will likely continue to deteriorate as its block subsidy declines. #halvening

Thread.

’s attack-resistance will likely continue to deteriorate as its block subsidy declines. #halvening

’s attack-resistance will likely continue to deteriorate as its block subsidy declines. #halveningThread.

Bitcoiners often state that hash power is increasing, and therefore the security of the network must be increasing, too.

However, hash power is an exceptionally poor metric for security, as described—for instance—by @OhGodAGirl: https://medium.com/@OhGodAGirl/the-problem-with-proof-of-work-da9f0512dad9

However, hash power is an exceptionally poor metric for security, as described—for instance—by @OhGodAGirl: https://medium.com/@OhGodAGirl/the-problem-with-proof-of-work-da9f0512dad9

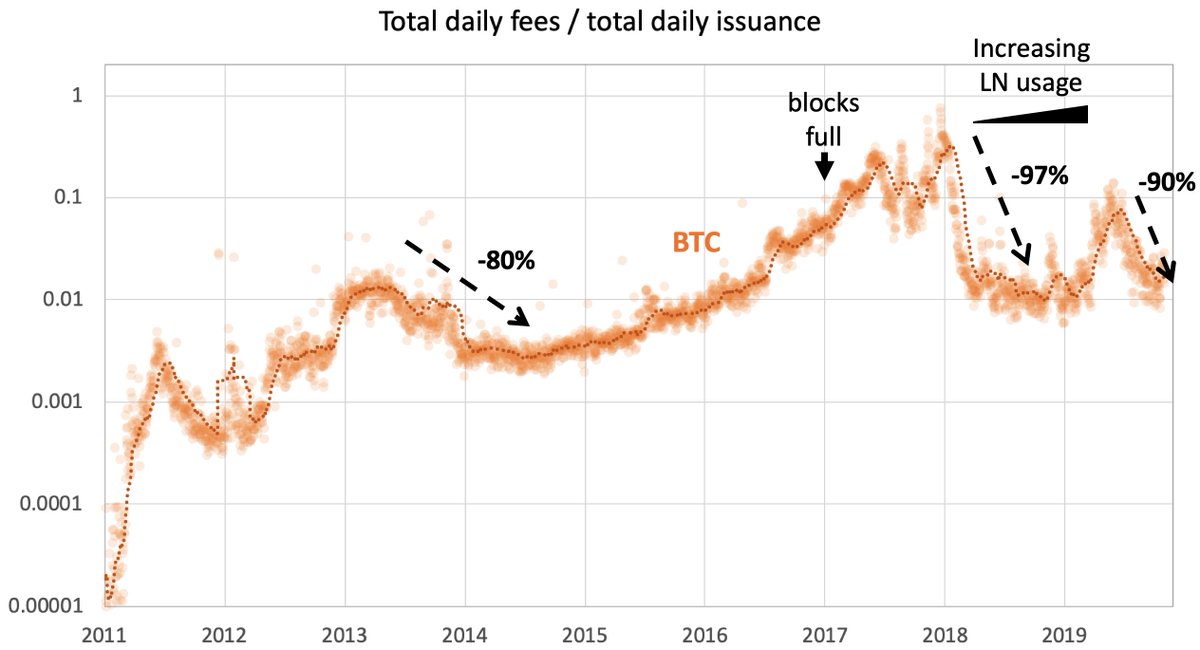

If transaction fees (F) were to replace issuance (I) (i.e., block subsidy) over time, the ratio F/I needs to grow indefinitely.

Let’s look at Bitcoin's F/I a bit more closely. (thanks to @coinmetrics for the raw data)

Let’s look at Bitcoin's F/I a bit more closely. (thanks to @coinmetrics for the raw data)

At first sight, this chart looks encouraging. Over the past decade, Bitcoin's F/I has indeed trended upward.

The bad news is that it has halted (in fact: decreased) since 2017, even though—or because?—blocks started filling up at the beginning of that year.

The bad news is that it has halted (in fact: decreased) since 2017, even though—or because?—blocks started filling up at the beginning of that year.

Satoshi had hoped that sustainably high fees can be achieved, once block space becomes scarce. The data suggests the opposite effect: When block space becomes scarce, demand stagnates, and so does F/I.

But there’s something more alarming: F/I is highly unstable. The value fell by -80% in 2013/14, -90% this Summer, and a staggering -97% in early 2018.

Note that F/I already adjusts for fluctuating market cap. The drop in total fees in early 2018 was even more dramatic: -99.3%.

Note that F/I already adjusts for fluctuating market cap. The drop in total fees in early 2018 was even more dramatic: -99.3%.

The sudden drops in fee revenue would have catastrophic consequences in the low-inflation scenario that BTC is heading towards.

So what about the Lightning network? Is it going to rescue Bitcoin?

Unfortunately, the increasing number of Lightning channels and growing network capacity in 2018 and the Lightning torch hype in early 2019 did nothing to improve the situation.

Unfortunately, the increasing number of Lightning channels and growing network capacity in 2018 and the Lightning torch hype in early 2019 did nothing to improve the situation.

As Lightning Network usage appears to have stalled since Spring 2019, we cannot know whether a further increase in LN transactions would have resulted in any different outcome.

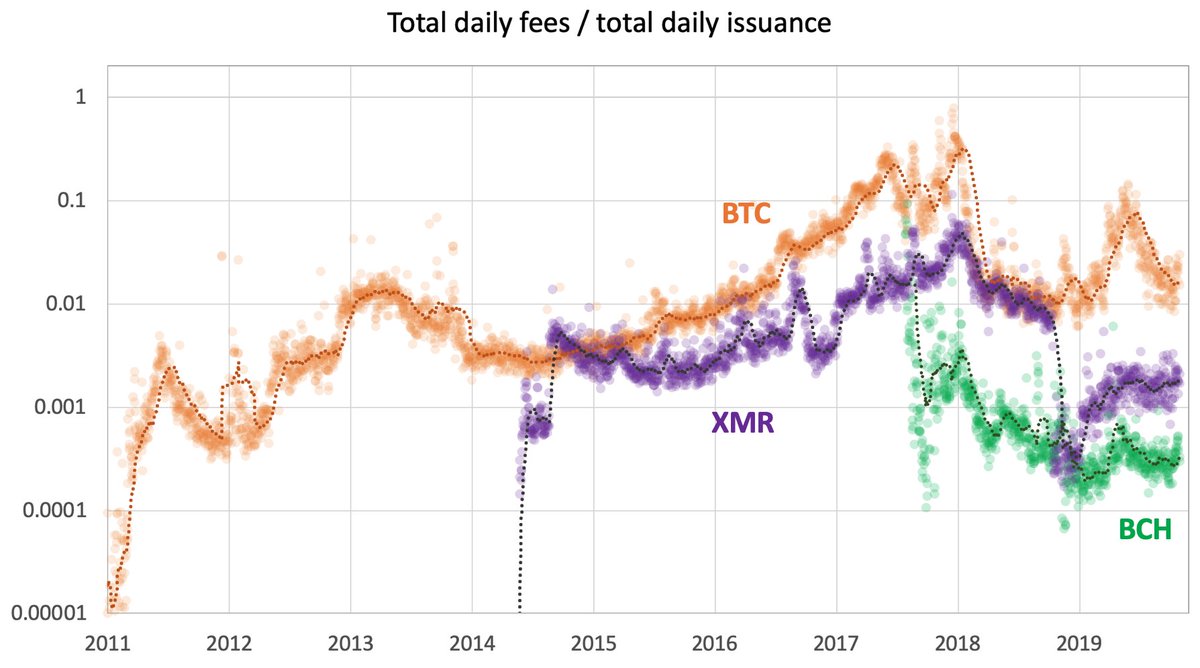

So let’s look at some other cryptocurrencies:

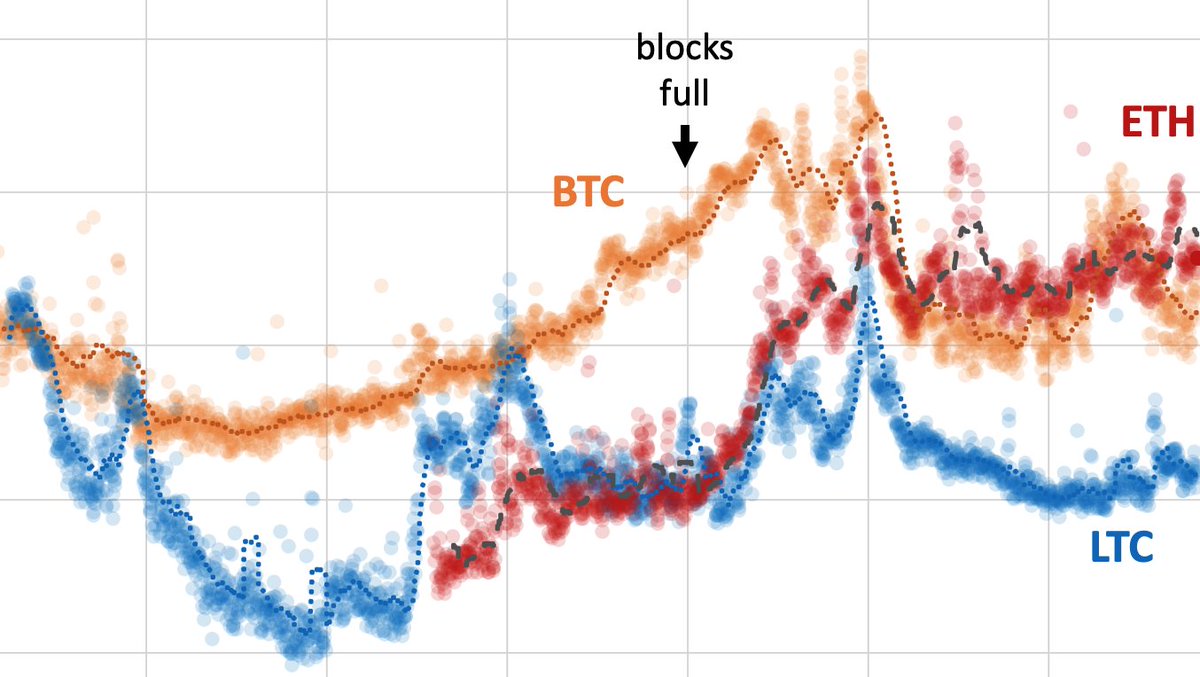

Interestingly, #Ethereum’s F/I crossed #Bitcoin in January 2018 and continued creeping up.

in January 2018 and continued creeping up.

Interestingly, #Ethereum’s F/I crossed #Bitcoin

in January 2018 and continued creeping up.

in January 2018 and continued creeping up.

This is likely due to two reasons:

1. Ethereum's greater throughput allows for higher total fees.

2. A rise in demand for block space on Ethereum, owing to its diverse use cases (coin transfers, ICOs, #DEFI, games, etc.).

1. Ethereum's greater throughput allows for higher total fees.

2. A rise in demand for block space on Ethereum, owing to its diverse use cases (coin transfers, ICOs, #DEFI, games, etc.).

Critics of smart contract platforms often highlight their increased attack surface. However, the added utility also potentially strengthens network security.

(See also @RyanSAdams tweet about the many positive developments in the Ethereum ecosystem): https://twitter.com/RyanSAdams/status/1194280646912413698

(See also @RyanSAdams tweet about the many positive developments in the Ethereum ecosystem): https://twitter.com/RyanSAdams/status/1194280646912413698

For #Litecoin $LTC the situation looks bleak, despite a recent #halvening.

The case of LTC appears to be representative of low-cap PoW coins in general. e.g., neither #Monero $XMR nor Bitcoin Cash $BCH show any encouraging development in this metric.

The case of LTC appears to be representative of low-cap PoW coins in general. e.g., neither #Monero $XMR nor Bitcoin Cash $BCH show any encouraging development in this metric.

Read on Twitter

Read on Twitter