GM everyone

Received some queries over email on drawdown and return on investment (ROI)

So, am gonna try to hit two birds with one stone in this thread

1. Drawdowns and confusions around it

2. Small acct returns vs large acct returns

(1/n)

Received some queries over email on drawdown and return on investment (ROI)

So, am gonna try to hit two birds with one stone in this thread

1. Drawdowns and confusions around it

2. Small acct returns vs large acct returns

(1/n)

Many traders and trading enthusiasts always cast aspersions on the drawdown (DD) of a trend following system - it could be either lack of understanding or a mere overlooking from their part.

Let me try to clear some air here.just a try..so, pls bear with me

(2/n)

Let me try to clear some air here.just a try..so, pls bear with me

(2/n)

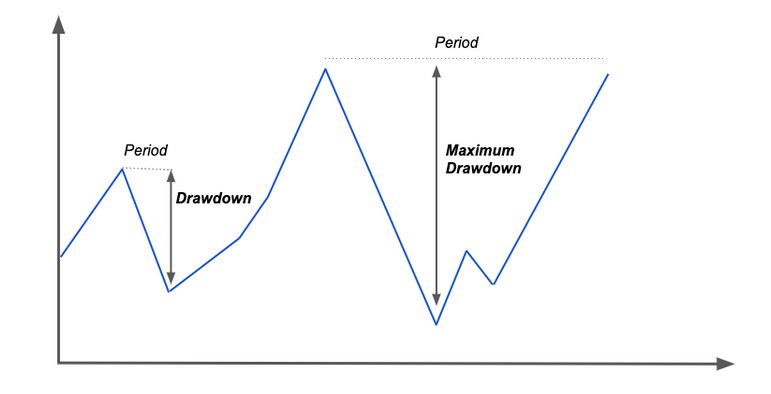

Drawdown is nothing but a peak-to-trough decline during a specific period of a trading account. A trading account can go through several DDs and infact,

equity curve high happens only 5% of the times and trading account will experience DD 95% of the times.

(3/n)

equity curve high happens only 5% of the times and trading account will experience DD 95% of the times.

(3/n)

We can hit eq curve high and then couple of losing trades

will lead us to DD again.

Drawdowns are simply a factor of how much risk a trader takes per trade. A trader who takes 1% risk/trade and gets a DD of 10% is same as a trader who risk 4% and getting a 40% DD

(4/n)

will lead us to DD again.

Drawdowns are simply a factor of how much risk a trader takes per trade. A trader who takes 1% risk/trade and gets a DD of 10% is same as a trader who risk 4% and getting a 40% DD

(4/n)

Let me elucidate with an example - In the live intraday options buying compounding experiment am doing ( https://marketswithmadan.com/intraday-options-model-account-performance-report-for-2019/ ) , I have had a drawdown of 34% and a overall return of 180% so far (without any compounding)

(5/n)

(5/n)

As it is aggressive compounding and the acct is so small (started with 3 lacs), i was taking around 4% risk per trade initially. So, with 4% risk, max DD was 34% so far with 180% returns.

Without compounding -

Risk = 4% per trade

max DD so far = 34%

Returns = 180%

(6/n)

Without compounding -

Risk = 4% per trade

max DD so far = 34%

Returns = 180%

(6/n)

If i had risked only 2% per trade (50% of 4% i took initially), the same 34% DD i faced would have been exactly at 17% and the returns would be 90%..everything would have been halved as we halved the risk

Hope you see the point now..let me go further.

(7/n)

Hope you see the point now..let me go further.

(7/n)

If the risk i took was 1% per trade, max DD so far would have been a meager 8.5% and a return of 45% (without compounding).

Without compounding --

Risk = 1% per trade

max DD so far = 8.5%

Returns = 45%

(8/n)

Without compounding --

Risk = 1% per trade

max DD so far = 8.5%

Returns = 45%

(8/n)

Now, let us include the compounding part.

If we include the compounding equation,

With compounding --

Risk = 4%

Max DD so far = 34%

Returns = 360%

Risk = 1%

Max DD so far = 8.5%

Returns = 70-75% (not an exact number)

(9/n)

If we include the compounding equation,

With compounding --

Risk = 4%

Max DD so far = 34%

Returns = 360%

Risk = 1%

Max DD so far = 8.5%

Returns = 70-75% (not an exact number)

(9/n)

So, pls dont get carried away with lesser drawdown pitches or high returns...It is always a factor of the risk we take per trade. Once we understand this basic stuff, it is easier to compare systems with varied results.

Many things will start making sense now, hopefully

(10/n)

Many things will start making sense now, hopefully

(10/n)

Essentially, 1% risk & max DD as 10% and returns as 40% is same as 2.5% risk with max DD as 25% and returns as 100%. Getting the drift?

In my intraday trading example, had i risked 1%, a 8.5% DD so far with 70-75% returns is definitely not an avg one by any standard.

(11/n)

In my intraday trading example, had i risked 1%, a 8.5% DD so far with 70-75% returns is definitely not an avg one by any standard.

(11/n)

Having said that, it is not great stuff either. It is just what it is

The folks who show lesser DD in their record will try to exaggerate the DD part of trend following systems..they dont tell the above points or do not know that this relationship exist.

(12/n)

The folks who show lesser DD in their record will try to exaggerate the DD part of trend following systems..they dont tell the above points or do not know that this relationship exist.

(12/n)

And the folks who show exorbitant returns in their record will never talk about risk taken/trade. So, as an informed person now, you know what to ask now when you hear these stuff

Part 2

-------

Now, the important Q - can i do this on a bigger account size? probably not

(13/n)

Part 2

-------

Now, the important Q - can i do this on a bigger account size? probably not

(13/n)

I have a lower single digit Cr acct for my positional trading and i risk around 0.75% per trade, return around 30-40% on an average year with max DD capped around 15%

Again see how DD is very less as my risk per trade is low.

(14/n)

Again see how DD is very less as my risk per trade is low.

(14/n)

My average DD in positional trading is around 6-8%. i have not seen a DD above 0.6x (absolute 10%) of the max DD i have calculated for this system.

As we move up in size, our returns will diminish for 3 reasons -

(15/n)

As we move up in size, our returns will diminish for 3 reasons -

(15/n)

1. lack of opportunities to deploy the fund,

2. it is humanely impossible to trade multiple instruments by an individual (this is where algo trading can be a great boon),

3. a predilection for mitigating the risk to bare minimum.

(16/n)

2. it is humanely impossible to trade multiple instruments by an individual (this is where algo trading can be a great boon),

3. a predilection for mitigating the risk to bare minimum.

(16/n)

Now, you all know why am moving towards automating my trading. This is to open myself up for trading more instruments/systems and in-turn, deploy more $$

This is why taking an acct from 10L->50L is much easier compared to 50cr->250cr - %age wise, its the same though.

(17/n)

This is why taking an acct from 10L->50L is much easier compared to 50cr->250cr - %age wise, its the same though.

(17/n)

Hence, it is bordering foolishness to compare a small acct returns(majestic) with a large acct returns.

I understand it still takes skill and psychological resilience to even be profitable in trading in long term but big-ticket account is a different ball game altogether

(18/n)

I understand it still takes skill and psychological resilience to even be profitable in trading in long term but big-ticket account is a different ball game altogether

(18/n)

Long story short - drawdowns are a factor of the risk we take per trade and small acct returns should never be compared with large acct returns (even a kid in mkts know it and will never do that).

It is unfortunate that many do it blindly and sermonize about it

(19/n)

It is unfortunate that many do it blindly and sermonize about it

(19/n)

All the great investors (you name anyone) was a trader in their early days and had exotic returns on their small (relative term) capital. Be it Warren Buffet or RJ or the Damanis of the world. So, let us approach mkts with proper understanding

Happy trading all !!

(20/20)

Happy trading all !!

(20/20)

Read on Twitter

Read on Twitter