Our final report: Canada’s leaders have committed to meeting our 2030 GHG reduction targets. New modelling shows which policies will actually get us there at lower cost. Carbon pricing tops the list. Thread below. #cdnpoli http://www.ecofiscal.ca/RealOptions

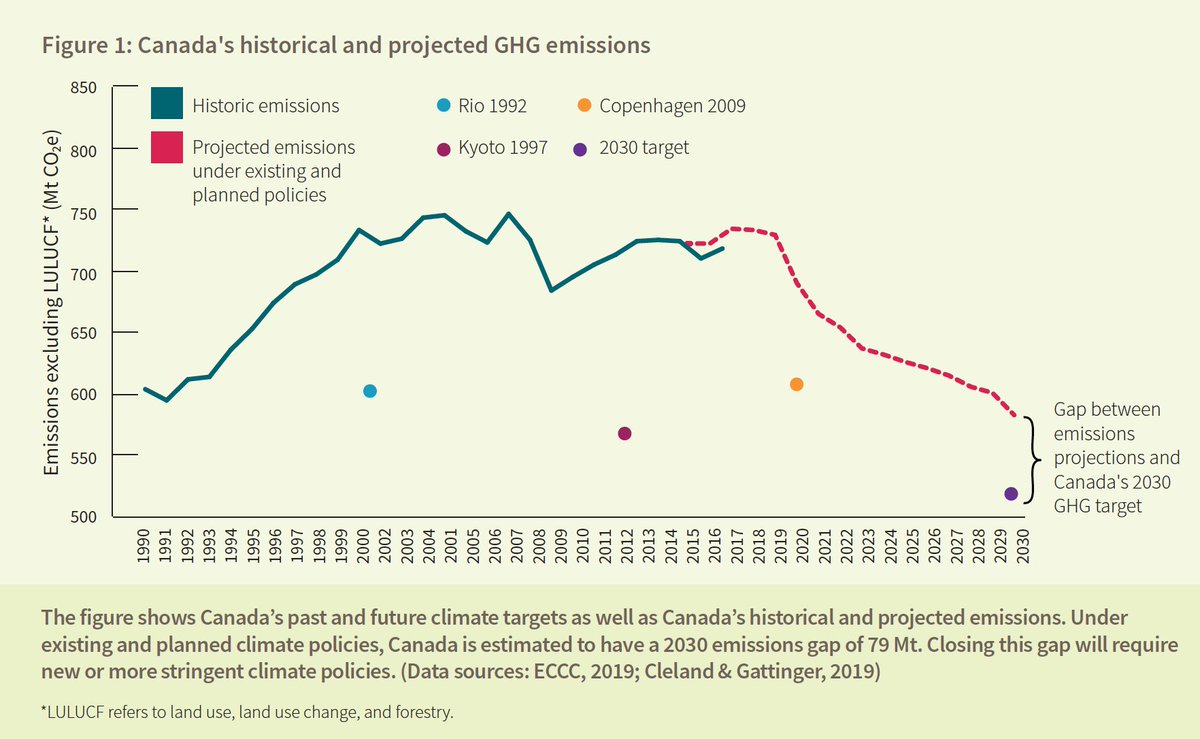

Meeting our 2030 Paris target will require more stringent policy. Technological innovation alone—without policy driving it—won’t be enough. We explore the policy menu that can bridge the gap to 2030.

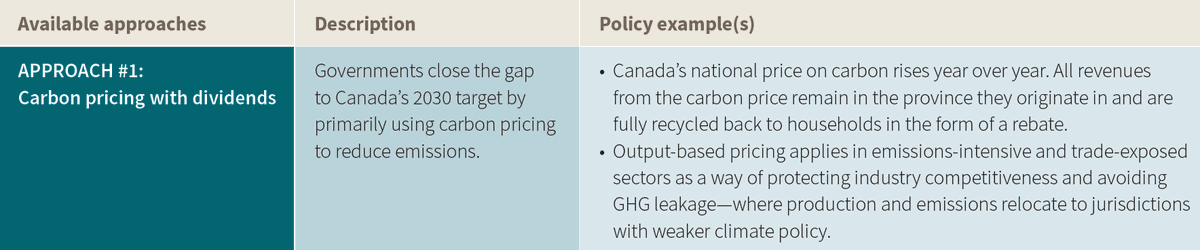

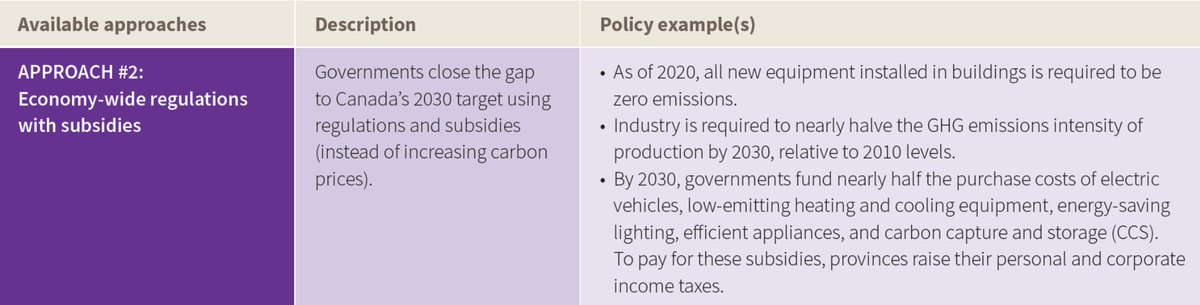

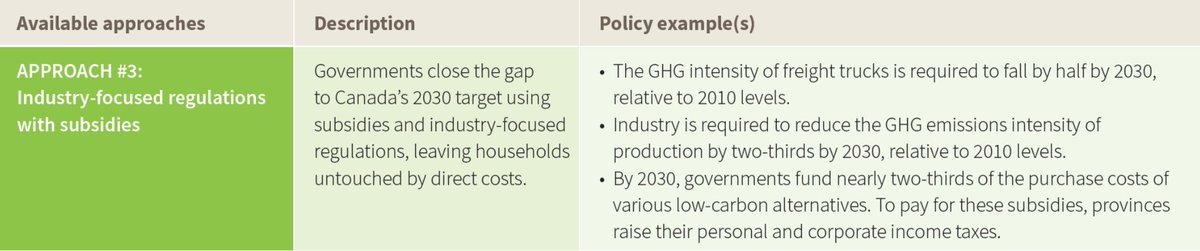

Our report takes alternatives to carbon pricing seriously. It asks: if not carbon pricing, then what? There are only a few options available in the policy toolkit: regulations, subsidies, and carbon pricing.

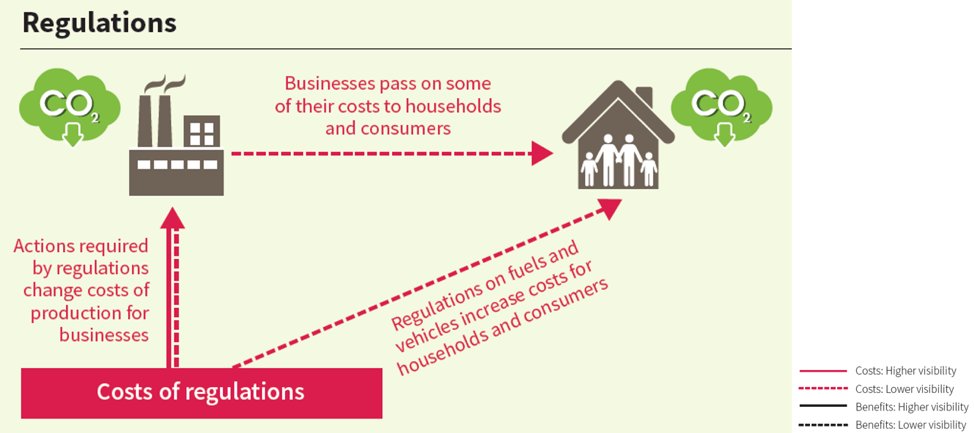

Regulations *require* certain actions or outcomes from emitters. These actions have costs. But households and businesses might not always be aware of the connection between policy and costs—the costs of regulations may not be “visible”.

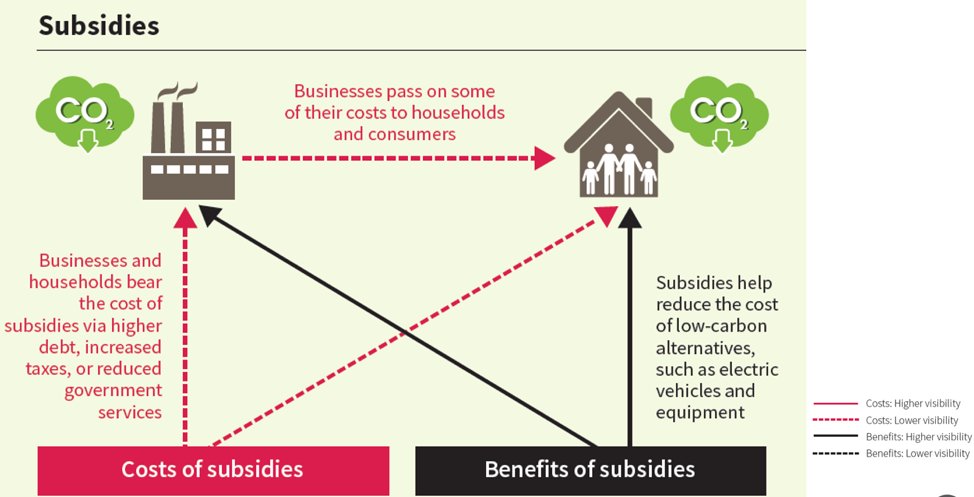

Subsidies reward GHG reductions. They have highly visible benefits. But they must be paid for with tax increases, public debt, or cuts to public services—costs which Canadians may not connect to the subsidies themselves.

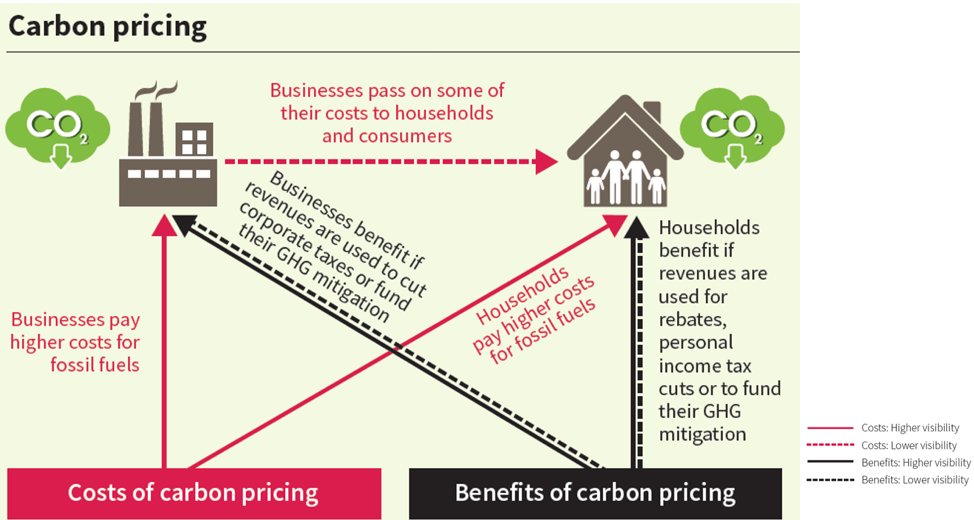

Carbon pricing transparently puts an explicit price on GHG emissions, creating an incentive to emit fewer GHGs. As a result, its costs are the most visible.

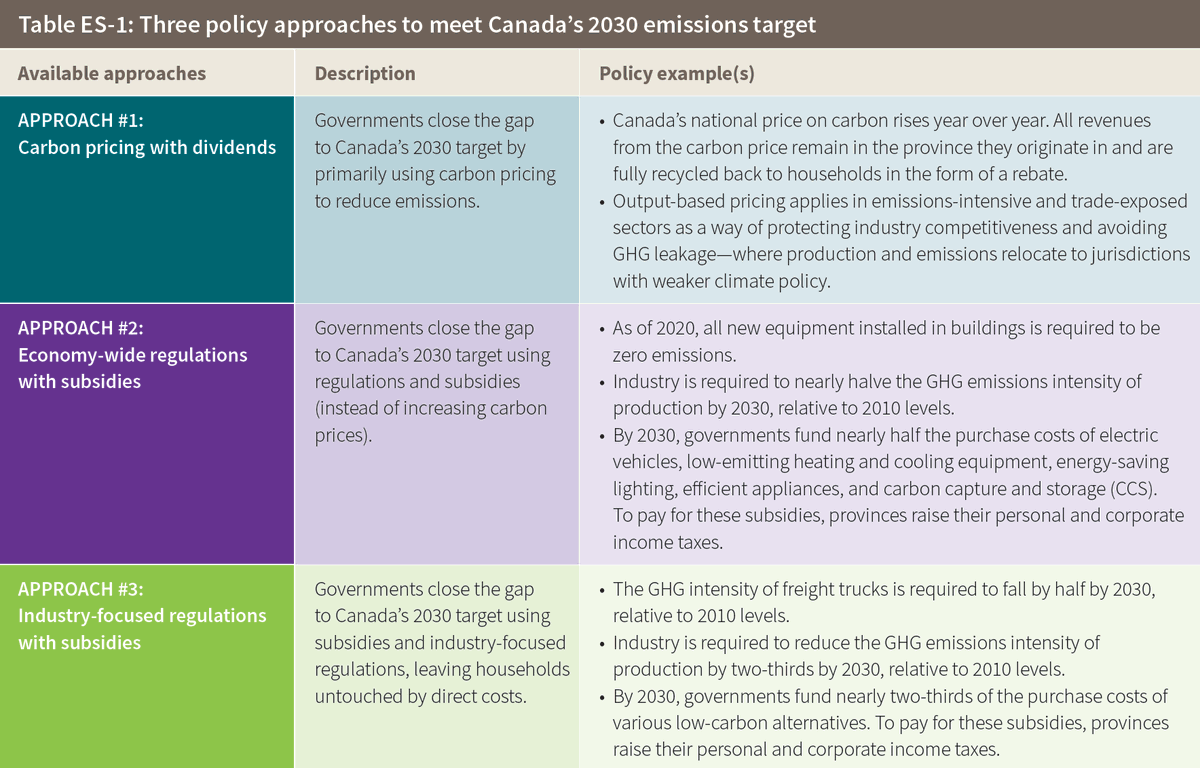

We consider three approaches that combine these tools in different ways. First, we could rely on a rising carbon price to hit Canada’s 2030 target. This approach would protect industrial competitiveness through output-based pricing and return revenues to Canadians.

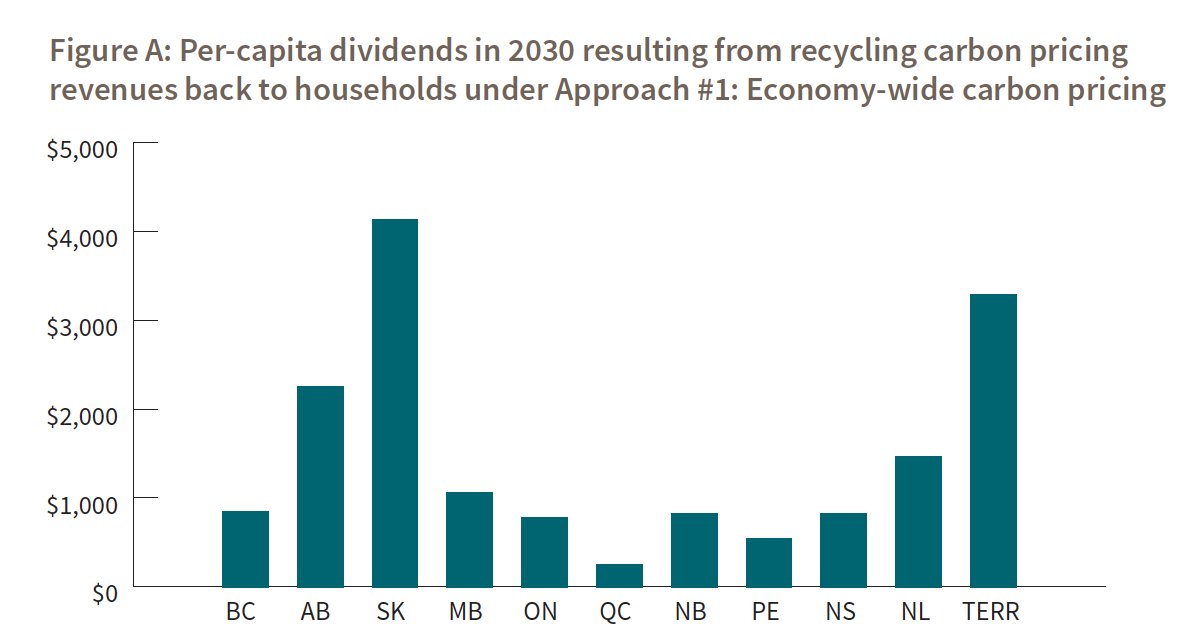

For Canada to meet its target with this kind of approach, the carbon price would have to continue to rise, increasing $20/year after the $50/tonne planned for 2022. This approach would also produce sizeable dividends for Canadian households.

But what if more stringent carbon pricing was off the table? Governments would instead have to rely on a combination of subsidies and regulations. But the stringency of these policies would have to go well beyond anything Canada has seen to date.

Finally, if governments want to avoid carbon pricing and avoid imposing *any* kind of direct cost on households (and voters), they could use regulations to target industry only, and use subsidies for personal transportation, home heating, and electricity.

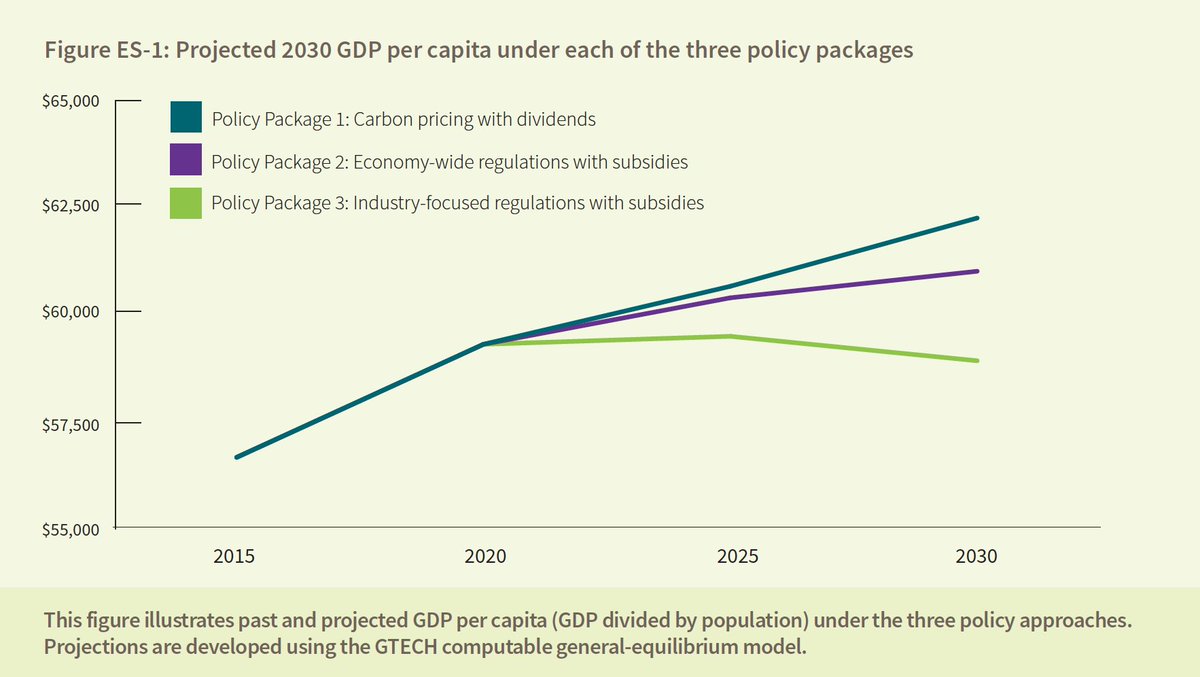

Looking across these approaches, our modelling shows that incomes would grow the most under carbon pricing, while a narrow, industry-focused approach would undermine economic growth.

Our comparison of options isn’t quite done. The report also considers how design choices might affect cost-effectiveness. For each approach, we can improve performance through better design—sometimes dramatically.

We could improve carbon pricing by 1) using revenue to cut taxes rather than provide dividends to all citizens; and 2) more carefully calibrating output-based support to industry. These design changes would make Canadians $1,500 richer on average in 2030.

We could improve non-carbon pricing options by 1) avoiding high-cost subsidies; and 2) using flexible, market-based regulations. A flexible regulation version of Approach 2 can come close to the cost-effectiveness of carbon pricing—if implemented right.

Despite our best efforts, we couldn’t design a more efficient version of Approach 3 that successfully achieved the target. With households exempted from climate policy entirely, industry couldn’t deliver the emissions reductions required.

Efficient policy is easier said than done. But flexible regulations may be particularly challenging. There are more policies to manage, with more variables to administer and calibrate. Stakeholder influence and pressure may pose practical challenges, too.

So how does it all stack up? Ironically, policies with the most visible costs tend to be the *least* costly. Exemptions and subsidies sound appealing, but trying to shelter consumers from costs ultimately costs them the most.

High-visibility, low-cost policies such as carbon pricing may be more difficult to implement at the outset. But in the end, they may be the only way to get stringent, effective climate policy in place.

Regulations and subsidies might fly under the radar at low stringency. But if we're serious about meeting our targets, their higher costs will become more apparent as stringency rises. This risks causing a backlash that can undermine the long-term durability of climate policy.

Canada has few #RealOptions for achieving its targets. If governments want to minimize costs, they should rely on carbon pricing. Flexible regulations are next best. Other approaches will cost too much or deliver too little. Check out the details below. http://ecofiscal.ca/RealOptions

Read on Twitter

Read on Twitter