Much discussion on #solar PV expansion has taken place since the @IEA published their #WEO19 last week.

My thoughts on the topic and idea for a framework for discussing the future of solar PV.

(thread)

My thoughts on the topic and idea for a framework for discussing the future of solar PV.

(thread)

IEAs lead on power sector modelling @WannerBrent here provides an excellent explanation of what the @IEA has done. https://twitter.com/WannerBrent/status/1195996945560559616

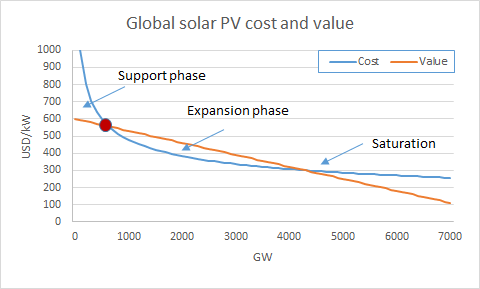

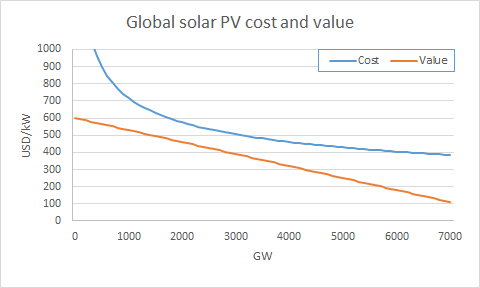

The @IEA both simulate learning and value of solar PV. That means as we build more and more solar PV the cost declines, but the value of production also drops. The relation between these two effects is pivotal in modelling.

Cost declines by about 20 % for each doubling of capacity while value declines roughly linearly with expansion. This yields three phases of solar PV buildout:

Support phase where costs > value

Expansion phase where costs < value

and saturation where value again drops below cost.

Support phase where costs > value

Expansion phase where costs < value

and saturation where value again drops below cost.

Much points to us being at beginning of the expansion phase. Projects are popping up everywhere without the need for financial support. We can therefore expect to see a snowball effect in the coming years where costs drop more than value as we increase capacity.

Historically the IEA has received much criticism that they underestimate the builout. But the NPS and STEPS are "frozen targets" scenarios and hence with low expansion targets would not have reached the expansion phase until in recent years. https://twitter.com/AukeHoekstra/status/1064529619951513600

However, the @IEA should capture this dynamic now. When it doesn't happen it is likely due to costs being overestimated. Using 1090 USD/kW as the 2018 starting point yields a cost curve that will never hit the value curve and hence the expansion phase never materialize.

Therefore, what is needed is good sources documenting that the cost of solar is less that what is currently fed into the World Energy Model. The Danish Energy Agency has an update to their technology data on solar in consultation stating 420 EUR/kW (DC) by 2020.

What is also needed are policies and technologies that raise the value curve. This could be carbon pricing shifting the curve up and cheap storage which will flatten out the value curve.

And lastly, we need policies that mitigates risk and lowers financing costs as @WannerBrent points out. https://twitter.com/WannerBrent/status/1195996967819776001

My thread on how we got to the expansion phase - and who paid for it - here: https://twitter.com/KarstenCapion/status/1178325129438388225?s=20

Read on Twitter

Read on Twitter