Thoughts on $PLOW: Leading NA manufacturer of snow plows (50-60% market share). Moving into adjacent custom truck solutions for commercial and municipal customers.

1. Company IPOed in June 2010. Was owned by Aurora and Area (PE). Performance post-IPO has been fantastic.

2. Company is broken down into Attachments and Solutions segment. Attachments makes snow plows and spreaders. Solutions provides custom truck upfitting for municipal and commercial clients.

3. Attachment products driven by Fisher and Western brands. These brands date back to the 1940's-1950's. Key competition is Boss brand (owned by Toro $TTC) and Meyers owned by Ash Group (based in Europe).

4. Toro acquired Boss brand in 2014 for $227m. At the time Boss was doing $125m of Revenue (1.8x). I estimate $PLOW generated ~$300m in Attachment Revenue that year. https://www.businesswire.com/news/home/20141027006359/en/Toro-Company-Acquire-BOSS%C2%AE-Professional-Snow-Ice

5. Attachment segment has very attractive financial characteristics and demand not driven by economic cycle. Instead purchase decision determined by amount of snowfall. View this as a positive for the segment. Nice to have an asset uncorrelated to economy.

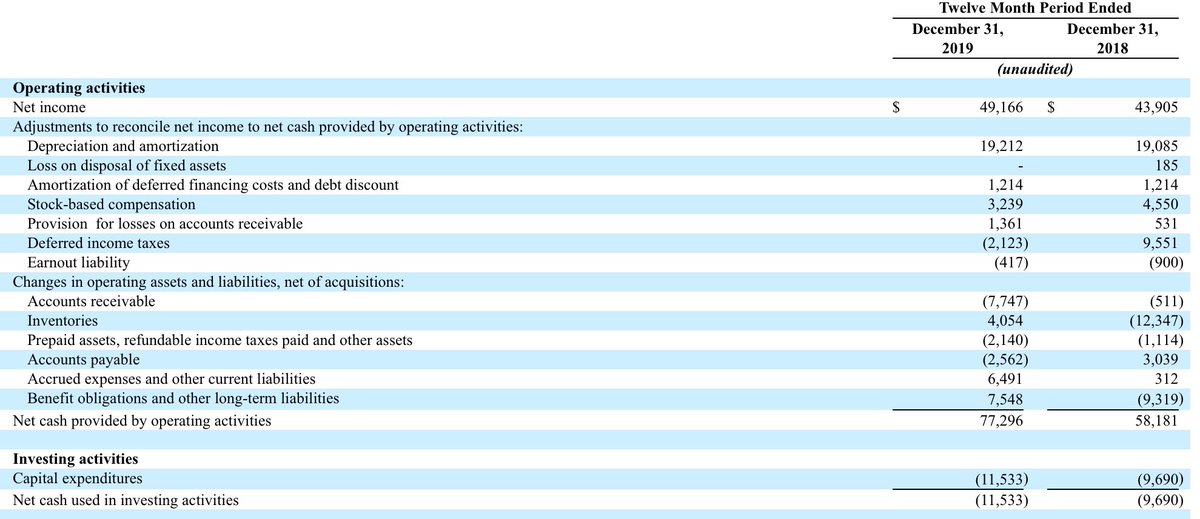

6. How good are the Attachment financials? Very good. Management just reorganized providing a clear picture for FY18. The segment generated $80m of EBITDA (29%) on $275m of Revenue. Only required $6.9m of CapEx. Generating >20% RoA.

7. They get 2-4% pricing per year based on new product roll-outs and brand/distributor value. However, market is mature meaning you are unlikely to see meaningful change unless there is a change in market share.

8. Solutions segment is a combination of Henderson and Dejana. Henederson was acquired in FY14. Dejana was acquired in FY15.

https://ir.douglasdynamics.com/news-releases/news-release-details/douglas-dynamics-completes-acquisition-henderson-products-inc https://ir.douglasdynamics.com/news-releases/news-release-details/douglas-dynamics-announces-agreement-acquire-dejana-truck-and

https://ir.douglasdynamics.com/news-releases/news-release-details/douglas-dynamics-completes-acquisition-henderson-products-inc https://ir.douglasdynamics.com/news-releases/news-release-details/douglas-dynamics-announces-agreement-acquire-dejana-truck-and

9. Henderson provides custom truck solutions for municipal snow equipment. Most of these projects are part of a tender process that can be found through Google searches. The segment has been negatively impacted over the last 12-24 months from demand for Class 6-8 trucks. ($CMI)

10. Commercial demand for these trucks has skyrocketed the last couple years. This has put municipal orders at the back of the line. As demand normalizes, Henderson should see an increase in Revenue and margins. Despite headwinds, I think it is still running in mid-teens.

11. Dejana is most recent acquisition and moved $PLOW into commercial truck solutions. This segment has underperformed expectations due to chassie delays and geographic expansion, which has hurt margins. https://dejana.com

12. If these prove to be transitory issues, then the company should be postioned to return to margins they had prior to acquisition.

https://www.bamsec.com/filing/110465916147659?cik=1287213

https://www.bamsec.com/filing/110465916147659?cik=1287213

13. Importantly for Dejana/Henderson they don't take ownership of vehicles. This allows them to keep relatively lean Balance Sheets. Prior to acquisition, both were turning Inventory 6.5x per year.

14. Mgmt. appears to be good stewards of capital. Focused on deals creating LT shareholder value. Each earnings call begins with an example of implementing DDMS (aka DBS). Payout >50% of FCF in dividends helping reduce chance of empire building.

Solid Earnings https://ir.douglasdynamics.com/news-releases/news-release-details/douglas-dynamics-reports-third-quarter-2019-results

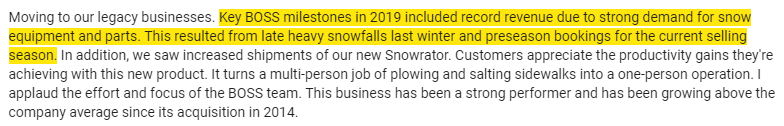

Competitor $TTC posting solid results on the back of strong demand for snow products.

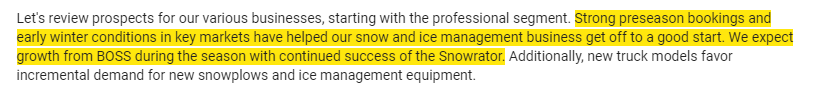

$PLOW built up inventory over tariff worries in 2018. Leads to impressive FCF generation in 2019. Positive to see management focused on meeting customer demand.

Strong margin expansion in Solutions segment.

Plow segment keeps on printing money.

Strong margin expansion in Solutions segment.

Plow segment keeps on printing money.

$TTC performance relative to $PLOW.

Not perfect comps, but large overlap in snowplow and exposure to heavy machinery/truck.

Not perfect comps, but large overlap in snowplow and exposure to heavy machinery/truck.

$PLOW re-financed and extended Credit Line.

Brought back 99% of EEs in May.

Went ex-dividend on 6/19. Payable 6/30.

Brought back 99% of EEs in May.

Went ex-dividend on 6/19. Payable 6/30.

Read on Twitter

Read on Twitter