1/ $RSR is one of the only two coins on the @coinbase Ventures page that is currently listed on an exchange, the other one being $MATIC .

2/ Reserve investors: Sam Altman, Peter Thiel, Jack Selby, among many other big names. Coinbase is the only entity to make an equity investment, all other advisors and team members are compensated in $RSR tokens. They would only profit from a high price and recognition of $RSR .

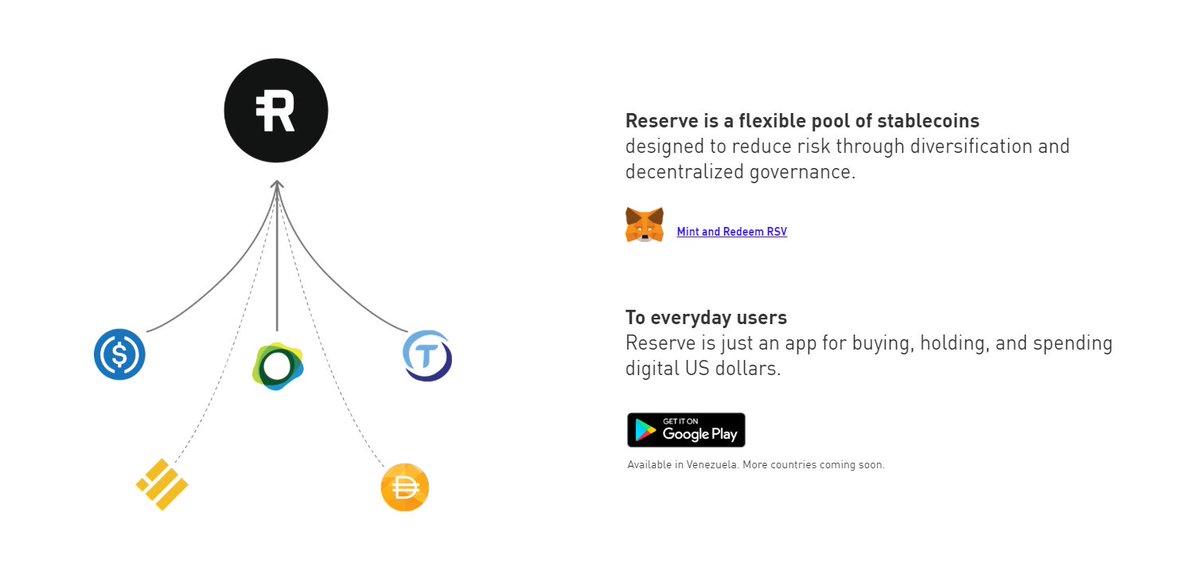

3/ Reserve aims to build a decentralized dollar-independent stablecoin, that primarily enables people and businesses in countries with high inflation to protect their wealth by seamlessly moving out of their fiat currencies into a stable digital currency.

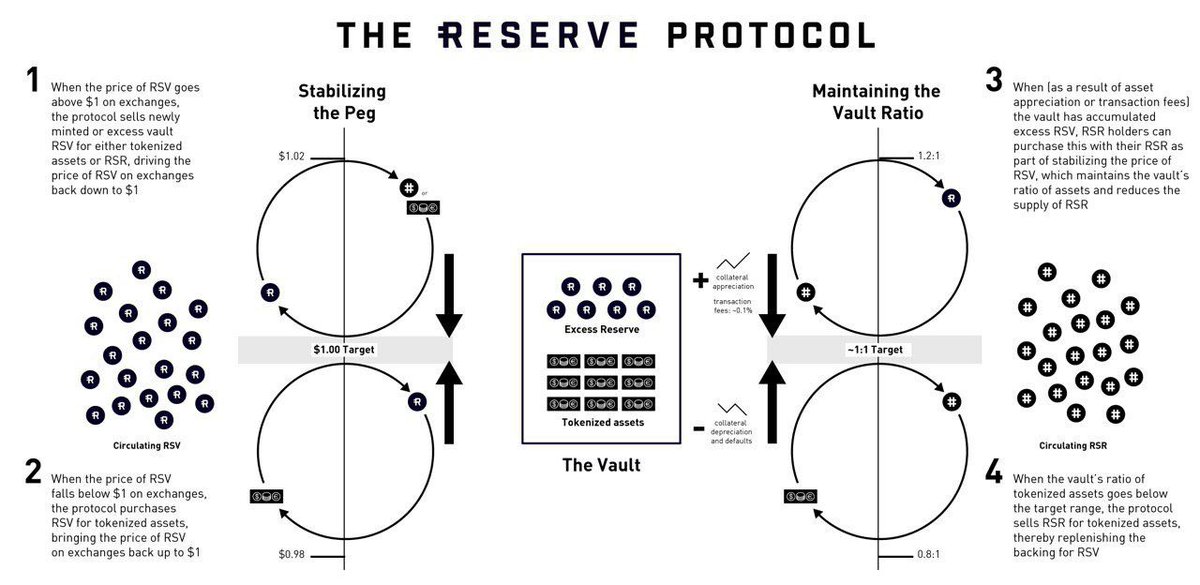

4/ $RSV is the Reserve token, a stable cryptocurrency initially pegged to the U.S. Dollar.

5/ $RSR is the Reserve Rights token, which gives holders the cryptographic right to buy excess $RSV tokens in order to facilitate the stability of $RSV.

6/ The Reserve Protocol uses three tokens: $RSV, $RSR, and collateral tokens. These tokens are other assets held by the Reserve smart contract in order to back the value of all $RSV tokens. The protocol is designed to hold collateral tokens worth at least 100% of all $RSV tokens.

7/ Whenever $RSV is spent, there’s a transaction fee. Both the transaction fees and the stochastic appreciation of collateral value will create an excess amount of Reserve tokens that are held by smart contract just sitting in a pool.

8/ As collateral appreciates. and the more $RSV is spent, the more $RSV in the pool. If the price of $RSV goes over $1.00, then the excess Reserve tokens will end up getting purchased by Reserve Rights tokens, which ultimately reduces the circulating supply of $RSR over time.

9/ Reserve intends for $RSV to function like "a more stable Bitcoin". The Bitcoin of all stablecoins, if you will.

11/ In the whitepaper, an example is used where the Reserve Rights token is $10. That's nearly a 4000x from the current price of $RSR, which is ~$0.0026.

12/ $RSR/ @reserveprotocol is literally the most technologically advanced stablecoin concept to date in a world where the current stablecoins have more problems than America does with @realDonaldTrump in office. In short, $RSV is the only stablecoin that is not a literal shitcoin.

13/ The Reserve team estimates that about 2-5% of the USD value of $RSV in circulation will be burned in $RSR per year. This comes from estimates about $RSV velocity (tx fees) and avg. collateral token appreciation rates (for things like tokenized treasury bills).

14/ $RSR and the Reserve Protocol complete the true vision of Satoshi, a decentralized P2P electronic cash payment system used for online commerce. Only a fully decentralized stablecoin can fulfill this vision. $RSV is Satoshi’s dream come true.

15/ As explained, arbitrage trading will be made possible through the simultaneous buying and selling of $RSV:

Buy or hold $1.00 worth of $RSR

Buy or hold $1.00 worth of $RSR

Trade $1.00 worth of $RSR for one $RSV token with the Reserve smart contract

Trade $1.00 worth of $RSR for one $RSV token with the Reserve smart contract

Sell one $RSV for $1.02 on an exchange

Sell one $RSV for $1.02 on an exchange

Profit

Profit

Buy or hold $1.00 worth of $RSR

Buy or hold $1.00 worth of $RSR Trade $1.00 worth of $RSR for one $RSV token with the Reserve smart contract

Trade $1.00 worth of $RSR for one $RSV token with the Reserve smart contract Sell one $RSV for $1.02 on an exchange

Sell one $RSV for $1.02 on an exchange Profit

Profit

16/ To simplify things; $RSR can be burned to buy $RSV for a dollar, even if $RSV is valued at higher than a dollar. This stabilizes $RSV and turns a profit for you. "Reserve Rights" (RSR) is your right to buy the stablecoin at a discount.

17/ The Reserve Protocol accumulates $RSV stablecoins through two means:

Transaction fees on $RSV transfers

Transaction fees on $RSV transfers

Appreciation of collateral tokens. These are the same revenue streams as @PayPal — transaction fees, and yield on the float — implemented in a decentralized way.

Appreciation of collateral tokens. These are the same revenue streams as @PayPal — transaction fees, and yield on the float — implemented in a decentralized way.

Transaction fees on $RSV transfers

Transaction fees on $RSV transfers Appreciation of collateral tokens. These are the same revenue streams as @PayPal — transaction fees, and yield on the float — implemented in a decentralized way.

Appreciation of collateral tokens. These are the same revenue streams as @PayPal — transaction fees, and yield on the float — implemented in a decentralized way.

18/ $RSV will be harder to shut off than Bitcoin. It will survive for centuries, completely independent of the founding team, through decentralized governance. This will be one of the greatest feats of political coordination of our lifetime.

19/ $RSR and the Reserve Protocol is the first ever invention of currency to fit the criteria of John Nash’s “Ideal Money”.

20/ CEO @nnevvinn of @reserveprotocol truly believes that $RSV will be the #1 cryptocurrency, alongside with $RSR.

21/ The current stablecoins will inevitably fail in the long term because they cannot scale. $RSV can scale. This is because the Reserve token will be backed by a basket of currencies and tokenized assets, and not just by USD, which we all know will not be sustainable overtime.

22/ The Reserve Protocol primarily manages two pools of value. The Reserve, a cryptocurrency kept stable at $1, and the Vault, a pool of other blockchain assets used to purchase Reserves whenever demand for it drops. The protocol aims to maintain at least 100% collateral backing.

23/ Today was the last day of private sale token unlock distributions for $RSR. The next token unlock will not happen until 2020.

“1.00% – 𝘗𝘳𝘪𝘷𝘢𝘵𝘦 𝘴𝘢𝘭𝘦 𝘵𝘰𝘬𝘦𝘯𝘴 (0.25% 𝘶𝘯𝘭𝘰𝘤𝘬𝘦𝘥 𝘯𝘰𝘸 [May 22] 0.75% 𝘷𝘦𝘴𝘵𝘪𝘯𝘨 𝘰𝘷𝘦𝘳 𝘵𝘩𝘳𝘦𝘦 𝘮𝘰𝘯𝘵𝘩𝘴).”

“1.00% – 𝘗𝘳𝘪𝘷𝘢𝘵𝘦 𝘴𝘢𝘭𝘦 𝘵𝘰𝘬𝘦𝘯𝘴 (0.25% 𝘶𝘯𝘭𝘰𝘤𝘬𝘦𝘥 𝘯𝘰𝘸 [May 22] 0.75% 𝘷𝘦𝘴𝘵𝘪𝘯𝘨 𝘰𝘷𝘦𝘳 𝘵𝘩𝘳𝘦𝘦 𝘮𝘰𝘯𝘵𝘩𝘴).”

24/ $RSV is the stable cryptocurrency that is economically and legally robust at any scale. Decentralized, 100% asset backed, and stabilized by $RSR, a fluctuating protocol token that confers the cryptographic right to purchase excess Reserve tokens as the network grows.

25/ The key benefit to holding $RSR is that it enables participants to profit through arbitrage opportunities (post mainnet), whenever the value of RSV is trading above $1.00 on exchanges; this opportunity alone is what sets it apart from every other stablecoin.

26/ Reserve is designed to be an independent cryptocurrency, so eventually to go off a peg; it will start off pegged to the U.S. Dollar, but in the long term becomes totally independent, backed essentially by a diversified basket of different assets.

27/ A widely-used stablecoin like $RSV would remove the barriers of transacting globally and allow anyone to transact with anyone else, anytime, anywhere. It would also allow businesses to scale internationally w/o having to build new infrastructure to interface with local banks.

28/ If $RSV is large enough and circulating fast enough, then the project can participate in $RSR-powered arbitrage pro rata (proportionally) and maintain the same fraction of ownership of $RSR over time, without selling any $RSR on the open market.

29/ There's a particular reason why Reserve intended to restrict the launch $RSV to Venezuela only first, and the answer lies in network effects. More on this later.

30/ $RSR is still trading at 2x above its IEO price, which is unusual for recent projects.

31/ If the price of Reserve ( $RSV ) on the open market is $1.02, arbitrageurs will be incentivized to purchase newly minted Reserve tokens for $1.00 worth of either collateral or Reserve Rights ( $RSR ) tokens, and immediately sell them on the open market.

32/ Smart contracts hold the collateral tokens that back $RSV. When $RSV is sold on the open market, the assets used by market participants to buy them are placed into these smart contracts to be held as collateral. This process keeps the Reserve collateralized at a 1:1 ratio.

33/ The protocol is designed so that once the tokenized assets held in smart contracts is stable, $RSV can transition to representing a fractional ownership of the collateral tokens. This is so that if the U.S. Dollar starts to depreciate, $RSV can maintain a more stable value.

34/ By diversifying the Reserve Vault across asset classes, it mitigates systemic risk associated with particular assets. When some assets drop sharply, a well diversified portfolio only drops a little bit, and could even stay stable if it contains anti-correlated assets.

35/ Cryptocurrency in general and @reserveprotocol are so important, as it is them who are taking this heavy burden of creating a solution (where long term fiat money is concerned) that can potentially better the way of life for many across the globe.

36/ Multiple internationally dispersed issuers can drastically reduce the default risk due to off-chain collateral backing.

37/ The Reserve Protocol uses 4 other components:

• The Reserve Manager: keeps $RSV stable at $1

• The Vault Manager: manages assets in the Vault

• The Market Feed: tracks market data on $RSV, $RSR, and the Vault assets

• The Auctioneer: runs the protocol’s market operations

• The Reserve Manager: keeps $RSV stable at $1

• The Vault Manager: manages assets in the Vault

• The Market Feed: tracks market data on $RSV, $RSR, and the Vault assets

• The Auctioneer: runs the protocol’s market operations

38a/ It’s theoretically possible for the Reserve to remain less than 1:1 collateralized if the collateral tokens depreciate and no market participants wish to purchase $RSR tokens for more than the minimum auction price set by the protocol.

38b/ In this case, the protocol widens the price band it defends for $RSV. For example, instead of a very tight band around $1.00, the protocol would adjust the band to range from $0.95 to $1.05 if the collateral tokens had depreciated 5% and there were no demand for Rights.

38c/ This means that $RSV tokens would temporarily be redeemable for $0.95, and would cost $1.05 to purchase. This expanding band approach eliminates the possibility of a bank run, since even if everyone were to redeem, the last redeemer would receive the same rate as the first.

39/ When there is an excess pool of $RSV, then the Reserve Manager will sell $RSV tokens from that pool for $1 worth of Reserve Rights tokens each, allowing $RSR holders to perform an arbitrage loop that brings the price back down to $1.

40/ In summary, to keep the price of $RSV stable, the protocol adjusts the supply relative to changes in demand. The protocol ensures it always has enough backing to repurchase the supply of $RSV through a fully collateralized vault consisting of carefully chosen on-chain assets.

41/ $RSR has been sitting over 2x from the bottom since the last week

42/ Earlier this year, @reserveprotocol made the first change to their homepage at http://reserve.org

43/ $RSV has a supply cap built into it, initially at $100K currently $3M, which will further increase based on how secure and robust their systems are in order to be able to pay users back in full should anyone actually pull off a successful attack on their network.

Read on Twitter

Read on Twitter