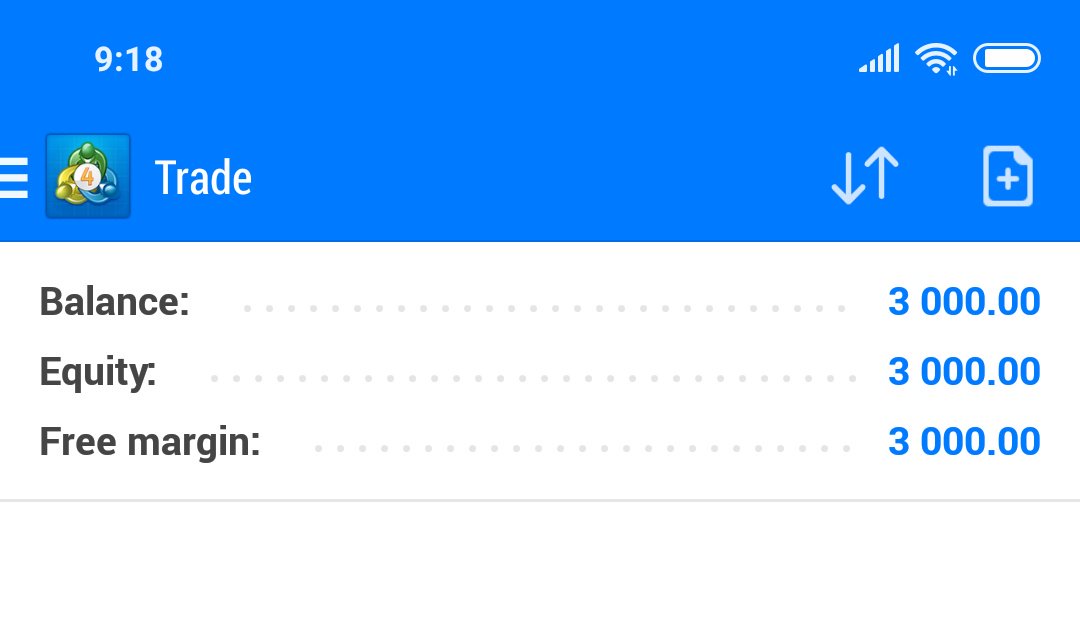

I'm going to live tweet making $100k trading FX in the next hour.

I will start with just $3k & post time stamped screenshots.

Aim is to illustrate a couple of things:

1. Why trading FX is extremely risky

2. Why FX scams aren't worth it

3. How leverage & risk mgt works

I will start with just $3k & post time stamped screenshots.

Aim is to illustrate a couple of things:

1. Why trading FX is extremely risky

2. Why FX scams aren't worth it

3. How leverage & risk mgt works

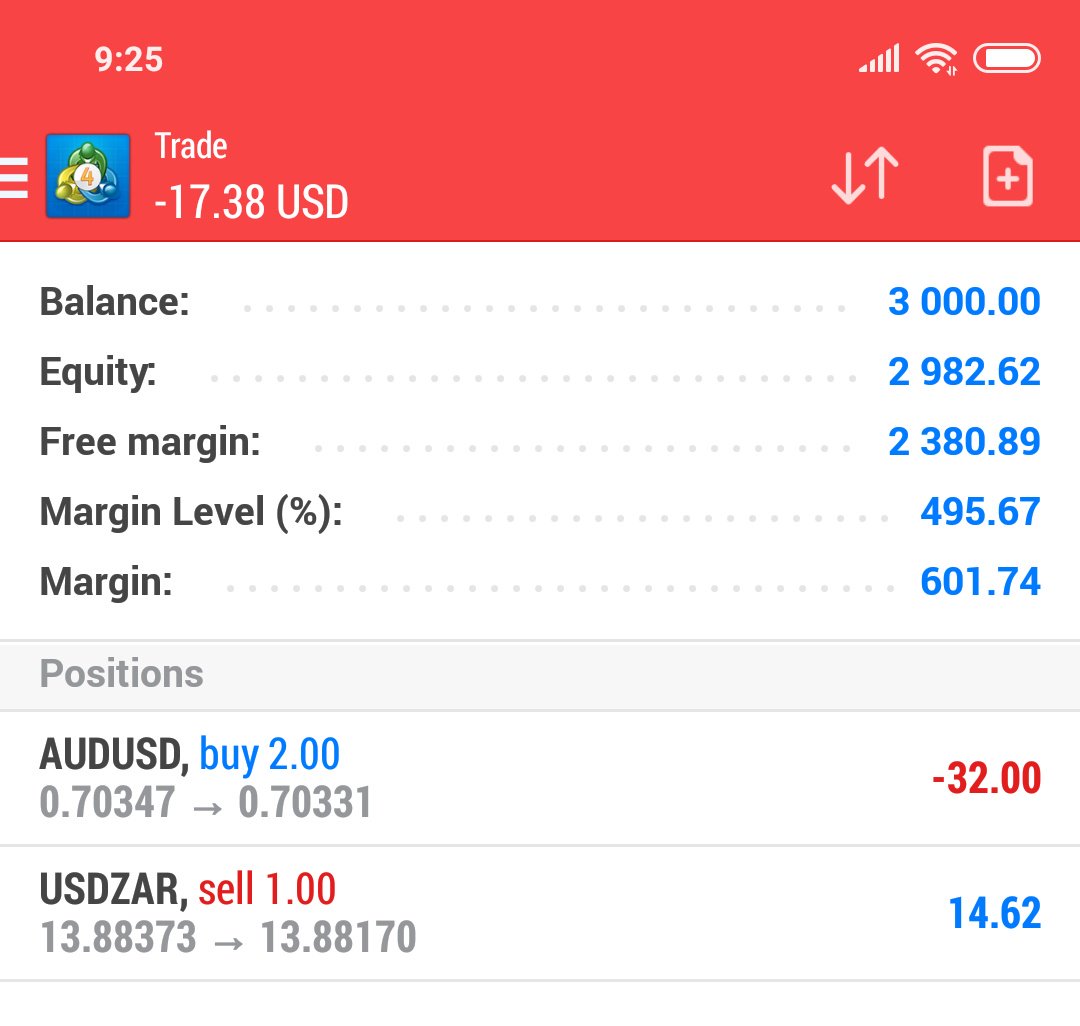

Open with an "appetite" trade to test volatility. Look at 4H, 1H technical price indicators ++ see if they speak to fundamentals. Can you ride a quick trend, what's the overarching thesis?

Softer dollar, fed rate cut in July, does it hold on all cross pairs?

Softer dollar, fed rate cut in July, does it hold on all cross pairs?

We want to make cash faaaaaaasssst, so there's literally no risk management here... which I would never recommend.

If we think there's a softer dollar, we know it would favour a higher gold price. Let's overexpose ourselves & take a long position...

If we think there's a softer dollar, we know it would favour a higher gold price. Let's overexpose ourselves & take a long position...

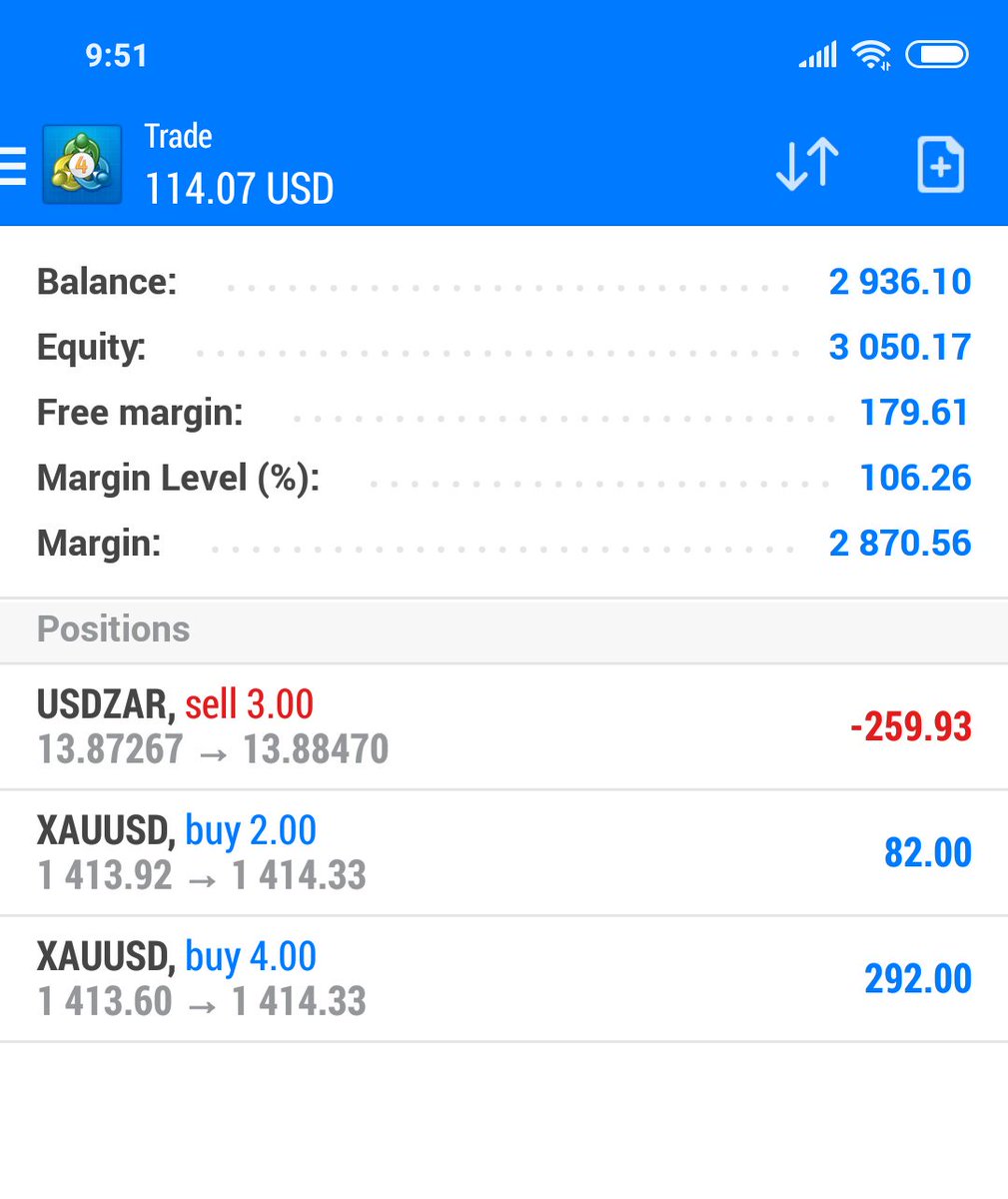

Extremely tough to trade range bound...

Volatility is where you can really ride it (again, don't do this at home).

In the absence of underlying vol, we need to amplify leverage to squeeze some juice. This means we're soaking up margin & have a higher risk of being wiped out.

Volatility is where you can really ride it (again, don't do this at home).

In the absence of underlying vol, we need to amplify leverage to squeeze some juice. This means we're soaking up margin & have a higher risk of being wiped out.

We're finally squeezing a small profit, after closing out a few initial positions. Still fairly range bound, can't really control that.

Long gold position was a decent move, created the tiniest of breathing room...

If ZAR drag persists, might have to roll in fully on commodities

Long gold position was a decent move, created the tiniest of breathing room...

If ZAR drag persists, might have to roll in fully on commodities

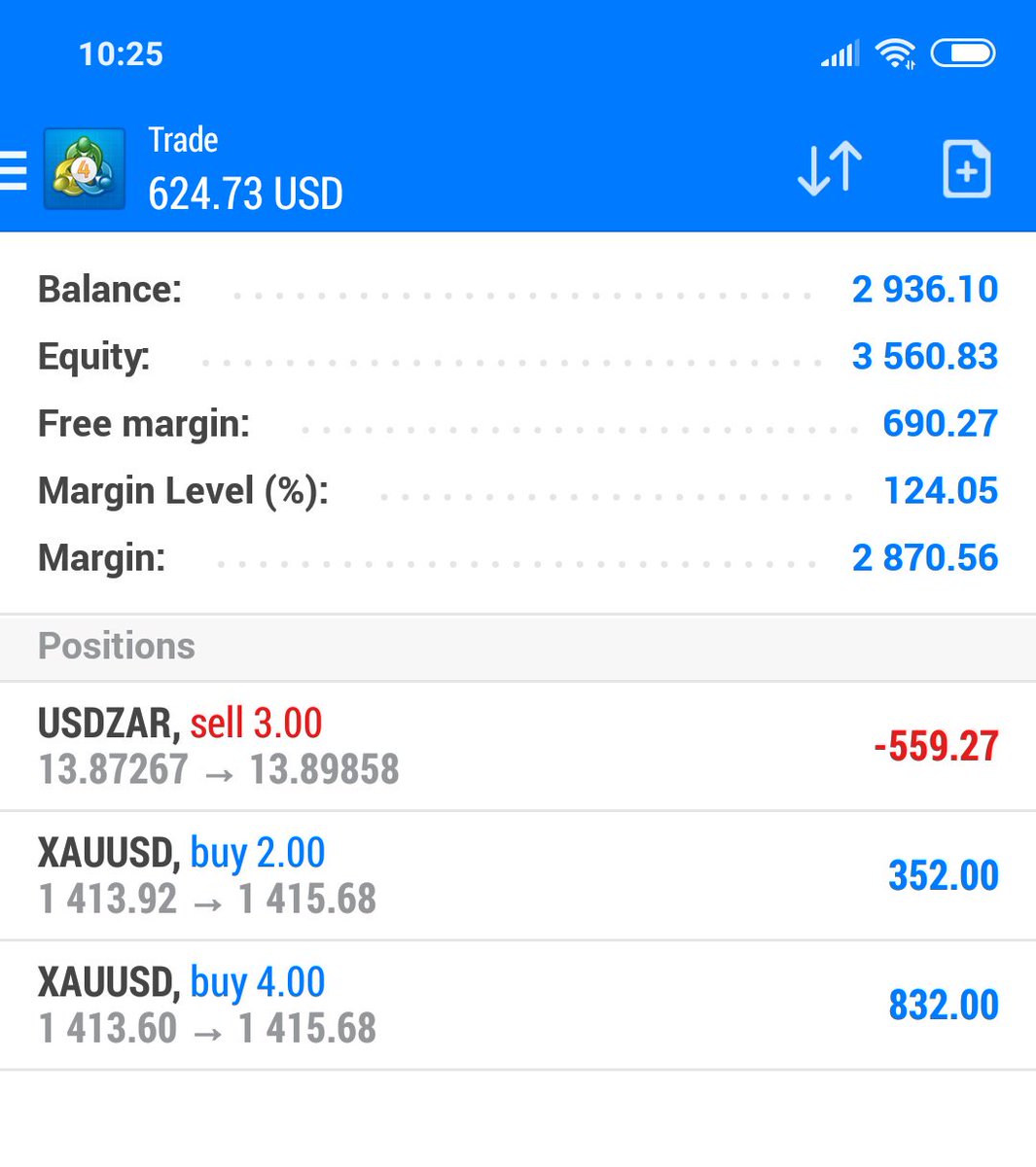

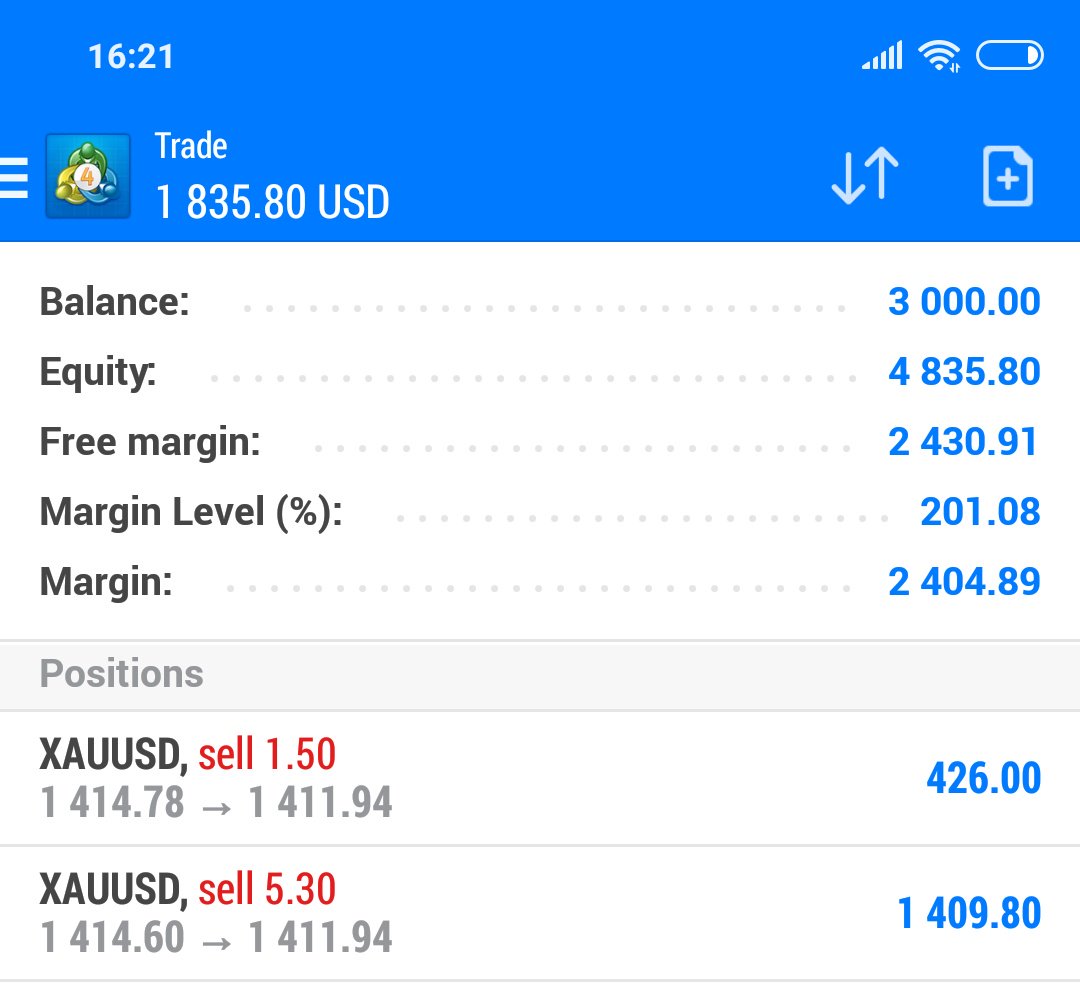

We're now making $600 with every $1 increase in the gold price...

Times up!

We didn't make 100k... sadly.

We did make 7k though in the last hour.

USD/ZAR pairing stuck on the psychological 13.90 barrier. But we had to have it in as a hedge to the gold trade. My view was the gold price would run in a softer dollar... so that was the stategy.

We didn't make 100k... sadly.

We did make 7k though in the last hour.

USD/ZAR pairing stuck on the psychological 13.90 barrier. But we had to have it in as a hedge to the gold trade. My view was the gold price would run in a softer dollar... so that was the stategy.

These trades were all real, much to the detriment of my nerves... here's the best advice I can share:

1. FX scammers almost always have profitable trades in the P&L. It's the first red flag

2. Never trade money you can't afford to lose

3. Trade to a thesis but don't be rigid

1. FX scammers almost always have profitable trades in the P&L. It's the first red flag

2. Never trade money you can't afford to lose

3. Trade to a thesis but don't be rigid

4. Leverage will ruin your life. Never trade on margin, use stop losses.

5. Be able to read indicators, MACD, RSI, different candlestick charts (I like Heiken Ashi)

6. Never chase a losing trade or double down on a winning one

7. Small consistent wins > one big win

5. Be able to read indicators, MACD, RSI, different candlestick charts (I like Heiken Ashi)

6. Never chase a losing trade or double down on a winning one

7. Small consistent wins > one big win

8. Own the underlying. Avoid CFDs, binary options, all of that. At one point in my life my personal portfolio would swing 300k in an afternoon... don't be that person.

9. Ask questions, try demos & be patient.

10. Don't gamble, invest. Think long term, it's far more rewarding!

9. Ask questions, try demos & be patient.

10. Don't gamble, invest. Think long term, it's far more rewarding!

++ Forex scammers use demo accounts to make these wins appear huge. It's really easy... open two demo accounts & trade opposite positions with each one.

After a while, one of the accounts will be profitable. It's why they always trade in one direction. Not rocket science.

After a while, one of the accounts will be profitable. It's why they always trade in one direction. Not rocket science.

Risk management:

Never risk more than 1-2% of your account on a single trade.

Cash out winning positions early, avoid the urge to "let it run".

Use stops to cut losses.

Don't trade any instruments you don't understand.

Don't trust anyone to trade for you.

Read everything.

Never risk more than 1-2% of your account on a single trade.

Cash out winning positions early, avoid the urge to "let it run".

Use stops to cut losses.

Don't trade any instruments you don't understand.

Don't trust anyone to trade for you.

Read everything.

Final tweet...

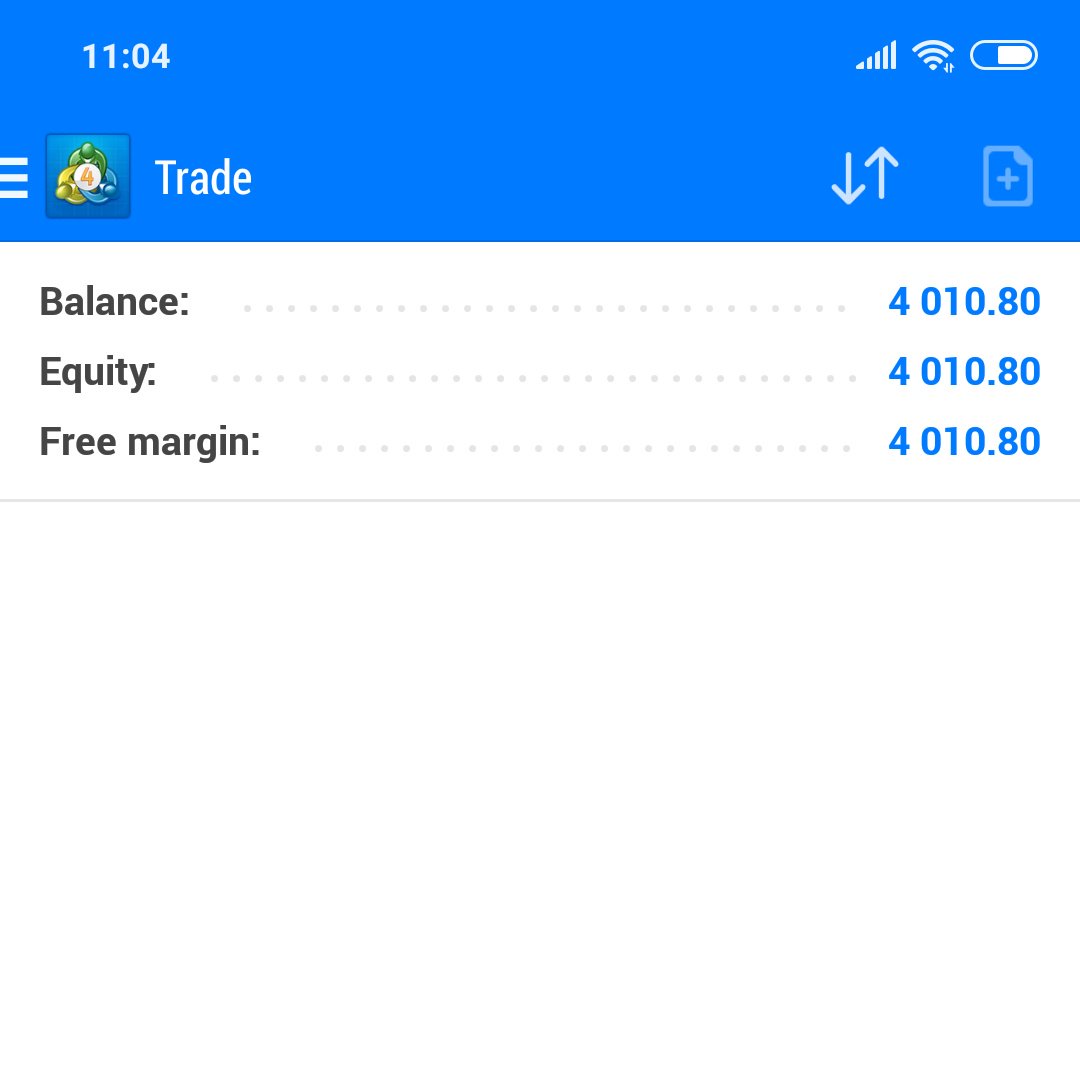

Remember that long gold position we took about an hour ago...

We end this tweet thread on $4,010 (profit of $1,010 = R14k).

14k... not bad for a Monday morning

(Still, don't try this at home!!)

Remember that long gold position we took about an hour ago...

We end this tweet thread on $4,010 (profit of $1,010 = R14k).

14k... not bad for a Monday morning

(Still, don't try this at home!!)

A couple of hours later... here's what a short gold position looks like...

Notice how a $4 move in the price is nearly R25k in profit because of the leverage. Note, it could very well go the other way.

Notice how a $4 move in the price is nearly R25k in profit because of the leverage. Note, it could very well go the other way.

The emotional side of trading:

Back at UCT I made the Traders Trophy finals 2x (national live trading contest). Everyone is a rockstar on a demo account. There's limited downside.

Once you have real cash on the line, the choices are different. You can physically taste losses.

Back at UCT I made the Traders Trophy finals 2x (national live trading contest). Everyone is a rockstar on a demo account. There's limited downside.

Once you have real cash on the line, the choices are different. You can physically taste losses.

Your framing of risk, reward & leverage all change. Trade FX without proper stops & you can lose more than you invest. Most people forget that.

You won't consistently beat the market unless you have material information (but that's illegal).

My view? Invest rather than trade.

You won't consistently beat the market unless you have material information (but that's illegal).

My view? Invest rather than trade.

Another thing to gauge about yourself if you're still keen on trading (I think everyone should try it once in their lives) is your pain threshold.

How much are you willing to lose?

& are you in control of your position?

Everybody loves gains, it's losses that are crippling.

How much are you willing to lose?

& are you in control of your position?

Everybody loves gains, it's losses that are crippling.

This is the most important tweet in this thread & the one to remember.

The market is "controlled" by a number of huge players. Most trades are algo driven (machines). The largest volumes happen in dark pools. It's opaque.

People know the future, but it's not "Teko the FX guru".

The market is "controlled" by a number of huge players. Most trades are algo driven (machines). The largest volumes happen in dark pools. It's opaque.

People know the future, but it's not "Teko the FX guru".

Key terms to check out/ Google:

Dark pools

Algo trading

HFT

Fat finger trades

Prop trading desks

Market breadth

Value at Risk

Technical Analysis

Human trading bias

Latency

Spoofing

Option Greeks

The fall of LTCM

Rocket scientists

Bulls, bears, betas, vol, vix

Margin calls

Dark pools

Algo trading

HFT

Fat finger trades

Prop trading desks

Market breadth

Value at Risk

Technical Analysis

Human trading bias

Latency

Spoofing

Option Greeks

The fall of LTCM

Rocket scientists

Bulls, bears, betas, vol, vix

Margin calls

Read on Twitter

Read on Twitter