This is the Judy Shelton thread [1 of many] https://twitter.com/realDonaldTrump/status/1146185983458775042

1st thing--

this is not a done deal

Stephen Moore and Herman Cain were supposed to be nominated ... never were

Marvin Goodfriend was nominated ... never confirmed

this is not a done deal

Stephen Moore and Herman Cain were supposed to be nominated ... never were

Marvin Goodfriend was nominated ... never confirmed

2nd thing -- Fed governors serve long terms.

There are 2 open seats - one goes until 2024, the other goes until 2030.

Shelton has huge monetary ambitions, already lives in Virginia and is financially secure. She could serve until 2030.

There are 2 open seats - one goes until 2024, the other goes until 2030.

Shelton has huge monetary ambitions, already lives in Virginia and is financially secure. She could serve until 2030.

3rd thing -- last 3 Fed chairs 1st served as Fed governors. If Trump reelected, Powell will be replaced. Given her relationship w Trump world (campaign advisor, media cheerleader, friend of Kudlow, friend of Pence, etc) she would be favorite to succeed Powell as Chair in 2022.

ok let's dig in. Here's how Shelton described Trump in 2016 https://twitter.com/sam_a_bell/status/1128002279779520512

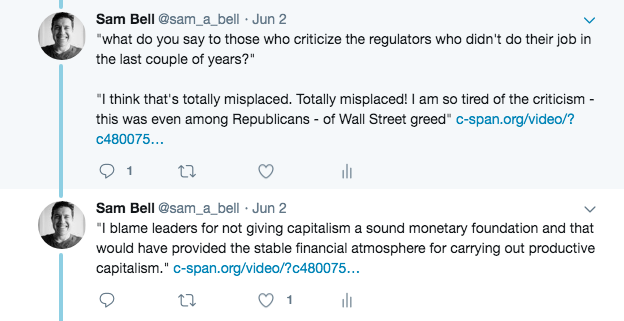

Here she is talking about the 0 rates - which she now supports - in 2012

for years she had talked about IOER (interest on excess reserves) as bad... and also about how low rates were crushing savers, creating bubbles, etc.

a spot opens up on the Fed and all of a sudden she's talking about cutting rates to 0 as a way to eliminate IOER.

a spot opens up on the Fed and all of a sudden she's talking about cutting rates to 0 as a way to eliminate IOER.

if she gets nominated, it will be because she did a very quick 180: from one of the most hard money commentators in America to wanting 0 interest rates.

one of the most hard money people in America? don't take my word for it. Trump's top economic advisor Larry Kudlow described Shelton as "a leading hard money conservative" in 2015 https://twitter.com/sam_a_bell/status/1144653211531452416

basically every alarmist talking point about monetary policy during the Obama years, she embraced. Here's the classic -- the dollar is being destroyed and the Fed is fueling the fire https://twitter.com/sam_a_bell/status/1145032419973718021

more poetically-- "If we continue to allow the Fed to underwrite deficit spending... we will witness the steady demoralization of democratic capitalism." https://twitter.com/sam_a_bell/status/1145861170034860032 (don't hear too much about that from Shelton anymore)

and of course the inflation fearmongering. Here in 2009 -- "American families deserve better than to be punished by wasteful public spending and ruinous inflation." https://twitter.com/sam_a_bell/status/1131038525745504257

interestingly she went further than many Fed critics who predicted inflation ... she actually wanted the Fed not to tolerate low inflation (its target is 2%) and instead aim for 0% inflation. Here's a mini thread on that https://twitter.com/sam_a_bell/status/1145023679077765121

(in case you don't read through that one, apparently the 2% inflation target is "an egregious violation of your property rights")

Nor does she think the Fed should be allowed to engage in so-called quantitative easing (buying long-term government bonds) https://twitter.com/sam_a_bell/status/1145040705099878407

her view on regulation and the financial crisis? https://twitter.com/sam_a_bell/status/1135193767110205445

this is all lead-up to the main event: her goal is the return of the gold standard.

here she is in the @WSJ as America shedding jobs https://twitter.com/sam_a_bell/status/1134093897204948993

(the push for Indiana to experiment with gold on its own was not a fluke. in 2013 she supported efforts in Virginia to plan for an alternative currency in case the dollar imploded) https://twitter.com/sam_a_bell/status/1146123500039675907

and she called this guy the "Rosa Parks of monetary policy" because he got arrested for creating gold tokens https://twitter.com/sam_a_bell/status/1131056280364355584

but we are getting distracted... why the gold standard? https://twitter.com/sam_a_bell/status/1145856520296587272

the final destination is a global system where all major countries pegged to gold... but America would probably move first. https://twitter.com/sam_a_bell/status/1134276978989830145

this is from short book (I think her latest) which you can buy for $.99 https://www.amazon.com/Fixing-Dollar-Now-Integrity-Restore-ebook/dp/B0067OHBSW/ref=redir_mobile_desktop?_encoding=UTF8&qid=1556881918&ref_=tmm_kin_title_0&sr=8-1 since we are talking about monetary policy, here's how she describes gold price rule https://twitter.com/sam_a_bell/status/1134276150124077056

(losing steam ... will pick up tomorrow)

. @RameshPonnuru from @AEI https://www.bloomberg.com/opinion/articles/2019-07-03/which-judy-shelton-would-show-up-at-the-fed

. @biancoresearch https://www.bloomberg.com/opinion/articles/2019-07-03/trump-s-latest-picks-may-be-what-the-fed-needs “However, these are not the positions she has advocated in recent weeks...”

Correction: Bernard von NotHaus, who Shelton calls the “Rosa Parks of monetary policy” was not making gold tokens but rather something he called the “Liberty Dollar,” which was 99% silver and I think supposed to compete with dollars.  @lawrencehwhite1 https://twitter.com/lawrencehwhite1/status/1146815817755103232?s=21

@lawrencehwhite1 https://twitter.com/lawrencehwhite1/status/1146815817755103232?s=21

@lawrencehwhite1 https://twitter.com/lawrencehwhite1/status/1146815817755103232?s=21

@lawrencehwhite1 https://twitter.com/lawrencehwhite1/status/1146815817755103232?s=21

“Ms. Shelton missed 11 of 26 board meetings, or 42%, of the European Bank for Reconstruction and Development, or EBRD, in her first year as the U.S. representative, according to minutes of the meetings.”

Hard to win a majority if you don't show for the meetings?

"...it comes as no surprise that Ms. Shelton is often in a minority when the board votes at the European Bank of Reconstruction and Development, although the U.S. is its biggest shareholder." https://www.wsj.com/articles/trump-the-fed-and-interest-rates-11561760850

"...it comes as no surprise that Ms. Shelton is often in a minority when the board votes at the European Bank of Reconstruction and Development, although the U.S. is its biggest shareholder." https://www.wsj.com/articles/trump-the-fed-and-interest-rates-11561760850

. @chrisjcondon reports:

"But given Trump’s disdain for Powell, Shelton would, if confirmed, represent a potential chair-in-waiting. One administration official familiar with the matter told Bloomberg in July that’s an option once Powell’s term expires, or even before."

"But given Trump’s disdain for Powell, Shelton would, if confirmed, represent a potential chair-in-waiting. One administration official familiar with the matter told Bloomberg in July that’s an option once Powell’s term expires, or even before."

Read the whole piece https://www.bloomberg.com/news/articles/2019-07-17/in-donald-trump-vs-jay-powell-new-battle-lines-are-being-drawn?srnd=premium

Shelton is clearly the Chair-in-waiting. And the wait might not be that long.

Shelton is clearly the Chair-in-waiting. And the wait might not be that long.

. @AEI's Desmond Lachman: "it would be a big mistake for the Senate to confirm her [Shelton's] nomination." https://thehill.com/opinion/finance/453371-trumps-bizarre-federal-reserve-nomination

The "End the Fed" Fed nominee? https://www.wsj.com/articles/SB123811225716453243

story on Shelton from @byHeatherLong ... with appearance from @MichaelRStrain https://www.washingtonpost.com/business/economy/the-federal-reserve-is-not-your-friend-trump-quest-to-remake-the-fed-hinges-on-judy-shelton/2019/07/22/d6440a3e-a35e-11e9-b8c8-75dae2607e60_story.html

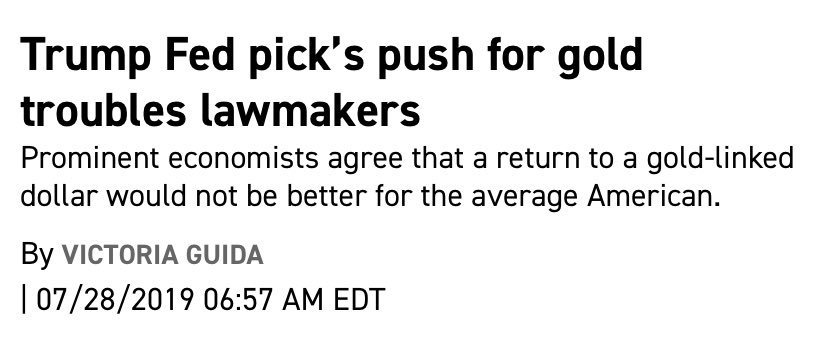

trouble already for Shelton nomination? https://www.politico.com/story/2019/07/28/judy-shelton-fed-gold-standard-dollar-1616538 by @vtg2

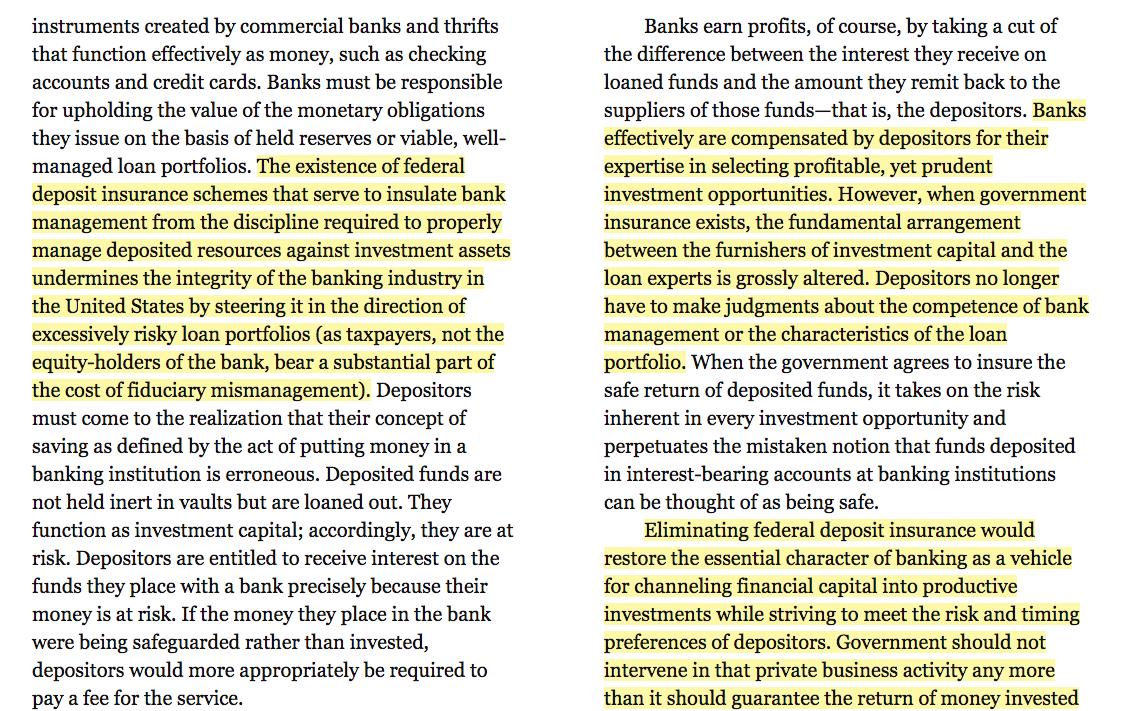

obviously still early but tough for Shelton to get this kind of skepticism from Senators before she is even nominated and before Senators even know her greatest hits... like her opposition to federal deposit insurance

since Shelton and WSJ editorial page seem to be deemphasizing Shelton’s long advocacy for global common currency anchored by gold convertibility and instead emphasizing stable exchange rates it bears mentioning that many conservatives seem to disagree https://twitter.com/sam_a_bell/status/1149731827889819649?s=21

More Senate trouble for Shelton. Via @saksappeal http://www.rollcall.com/news/gop-senators-uneasy-with-fed-pick-on-gold-deposit-insurance

. @stltoday skeptical of Shelton ... will be interesting to see if more local papers come out against https://twitter.com/dnickbiz/status/1160931787687829505?s=20

Shelton on @CNBC today seems to think inflation is too high --

"for me a dependable dollar wouldn’t lose value at all. Instead we have this regimented built-in obsolescence. I would rather…not have 2% [inflation]… I guess I prefer 0 [inflation]” https://www.cnbc.com/video/2019/11/14/santelli-exchange-negative-rates-are-not-the-way-to-stimulate-productive-growth.html

"for me a dependable dollar wouldn’t lose value at all. Instead we have this regimented built-in obsolescence. I would rather…not have 2% [inflation]… I guess I prefer 0 [inflation]” https://www.cnbc.com/video/2019/11/14/santelli-exchange-negative-rates-are-not-the-way-to-stimulate-productive-growth.html

Judy Shelton still being vetted, according to @larry_kudlow ... Trump announced he was nominating her to the Fed on July 2nd https://twitter.com/vtg2/status/1195341490559561730?s=20

"The remarks may complicate Shelton’s nomination, should Trump proceed to send it to the Senate...Some Republicans on the Senate Banking Commitee, which would consider Shelton’s nomination, have expressed concerns about her to the White House" https://www.bloomberg.com/news/articles/2019-11-21/trump-fed-pick-shelton-cast-doubt-on-central-bank-independence

story by @SalehaMohsin tracks what other DC reporters are hearing from Senate R's https://twitter.com/haggertynDC/status/1195360815047725057?s=20

Stephen Moore - almost nominated to Fed - weighs in on Judy Shelton:

"Judy Shelton thinks like Trump does,” Moore said. "He wants to put his own footprint and fingerprint on the Fed and I think he wants his own people." https://finance.yahoo.com/news/trump-calls-jerome-powell-and-fed-boneheads-former-economic-adviser-says-hes-right-215346184.html

"Judy Shelton thinks like Trump does,” Moore said. "He wants to put his own footprint and fingerprint on the Fed and I think he wants his own people." https://finance.yahoo.com/news/trump-calls-jerome-powell-and-fed-boneheads-former-economic-adviser-says-hes-right-215346184.html

. @vtg2 reports that the official Judy Shelton nomination could come "as soon as Thursday" https://www.politico.com/newsletters/morning-money

via @JeffCoxCNBCcom https://www.cnbc.com/2020/01/17/trump-fed-pick-judy-shelton-faces-obstacles-to-confirmation.html?__source=sharebar|twitter&par=sharebar

. @HooverInst 's @JohnHCochrane: "Some of President Trump’s potential nominees to the Federal Reserve Board have expressed sympathy for a return to the gold standard... The gold standard won’t work for a 21st-century monetary and financial system." https://www.wsj.com/articles/forget-the-gold-standard-and-make-the-dollar-stable-again-11563404235

. @mises asks the right question -- "COULD TRUMP'S NEXT FED CHAIR BE A "GOLDBUG?" https://mises.org/power-market/could-trumps-next-fed-chair-be-goldbug

why gold?

Shelton: "Gold provides a straightforward and easily observable measure that instantly resonates as a historical proxy for money. Whereas the composition of a basket of goods is subject to change, gold has a more permanent quality about it." https://www.centralbanking.com/central-banking-journal/feature/2123801/gold-trust

Shelton: "Gold provides a straightforward and easily observable measure that instantly resonates as a historical proxy for money. Whereas the composition of a basket of goods is subject to change, gold has a more permanent quality about it." https://www.centralbanking.com/central-banking-journal/feature/2123801/gold-trust

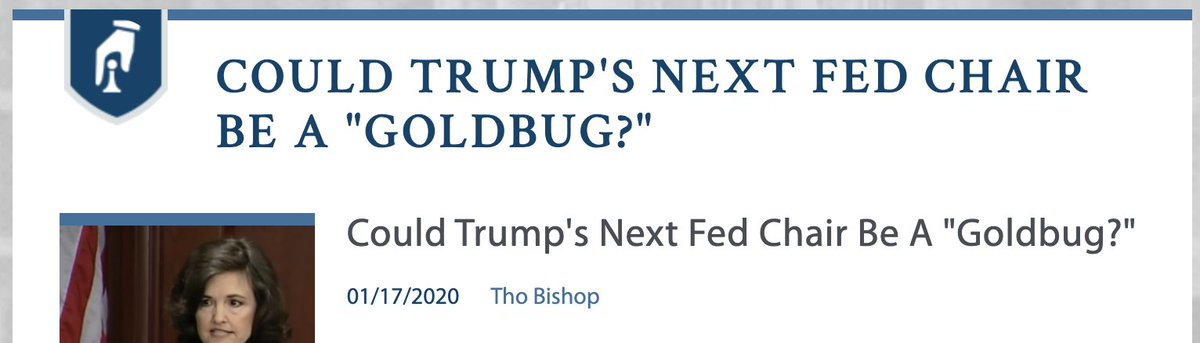

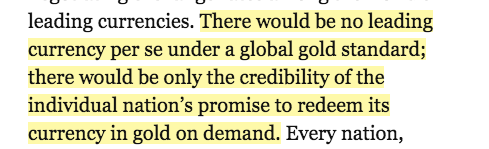

of course there would be challenges to going back to gold but Shelton explains in her latest book: "the advantages of forging an inviolable link between the value of US money and gold through fixed convertibility seem to make it well worth tackling the difficulties."

in fact, she writes that we can't afford not to go back to gold: "we cannot allow the integrity of US money to deteriorate further... [continued debasement] violates the intentions of our Founders."

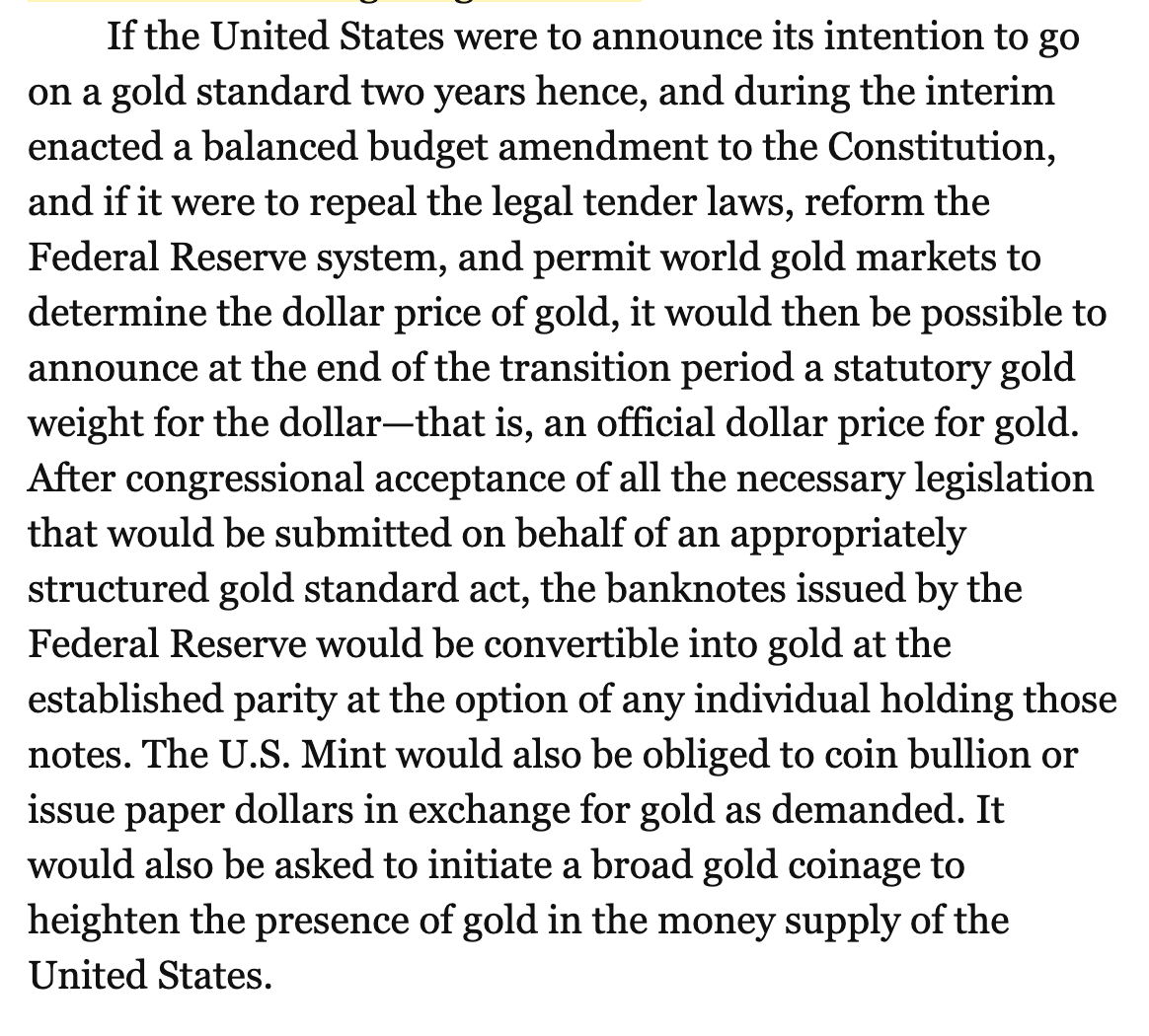

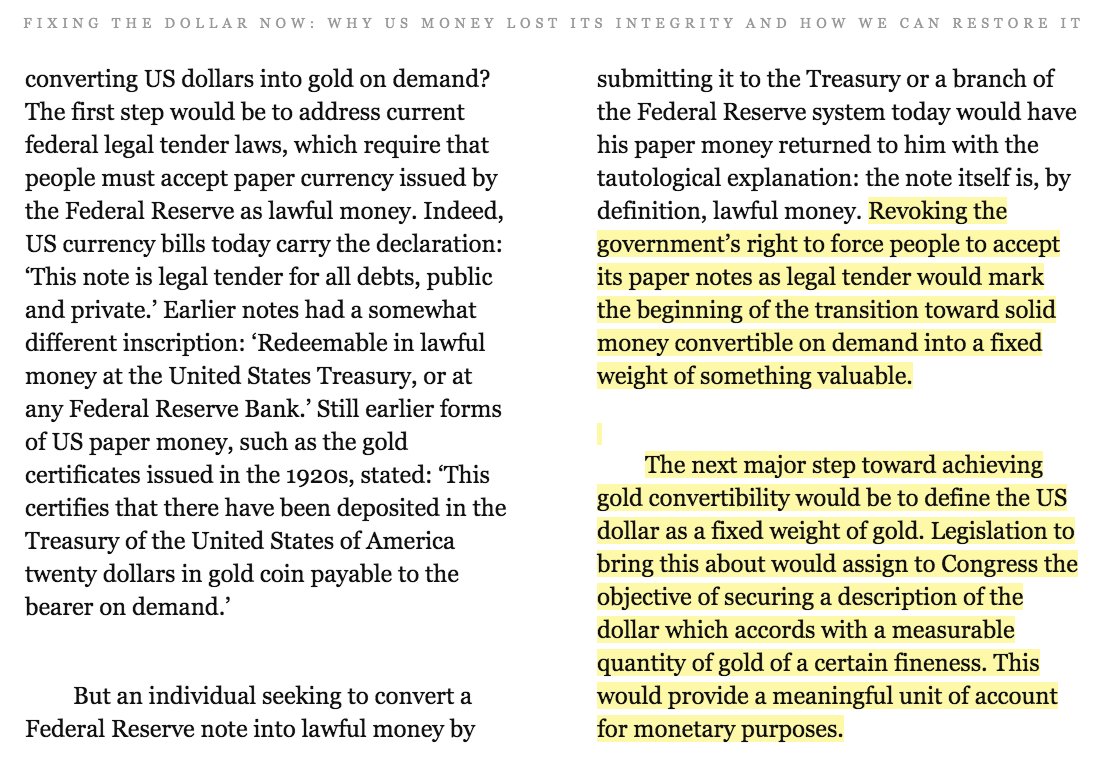

how to get there?

"Revoking the government's right to force people to accept its paper notes as legal tender would mark the beginning of the transition...The next major step toward achieving gold convertibility would be to define the US dollar as a fixed weight of gold."

"Revoking the government's right to force people to accept its paper notes as legal tender would mark the beginning of the transition...The next major step toward achieving gold convertibility would be to define the US dollar as a fixed weight of gold."

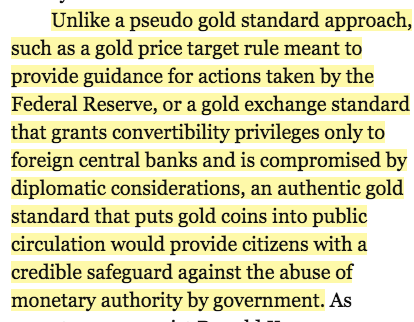

the vision is larger than a gold price rule or a gold exchange standard... as Shelton writes "an authentic gold standard that puts gold coins into public circulation would provide citizens with a credible safeguard against the abuse of monetary authority by government"

from Shelton's book Money Meltdown: "the gold coin system has this little-realized advantage: once the coins are circulating widely it is difficult, embarrassing and costly to call them back."

"'I think it would be extremely positive, but the initial effect would be so bold as to be alarming,' says Judy Shelton" https://www.usnews.com/news/articles/2011/12/01/what-happens-if-we-end-the-fed

review of Shelton's Money Meltdown by Rudi Dornbusch:

"This book offers a passionate plea for a return to gold, the real stuff: actual gold coins, not just a simple goldbased monetary system"

"This book offers a passionate plea for a return to gold, the real stuff: actual gold coins, not just a simple goldbased monetary system"

https://fortune.com/2016/08/18/trump-gold-standard-economic-advisor-woman-judy-shelton/ "In terms of gold being involved, some people may think of that as a throwback, but I see it as a sophisticated, forward-looking approach because gold is neutral and it’s universal. It’s a well-accepted monetary surrogate that transcends borders and time."

"I have known Judy for a decade now... A conversation with Judy Shelton on monetary matters always involved a return to the gold standard." https://bearingdrift.com/2016/11/16/monetary-policy-return-gold-standard-trump/

Local press starts weighing in https://www.al.com/news/2020/01/whitmire-can-shelby-save-fed-from-fools-gold.html?outputType=amp&__twitter_impression=true @aldotcom

in 2015 a delegation of "free market" folks met with Janet Yellen to complain about loose monetary policy (among other things). According to @ralphbenko, Shelton used the opportunity to push for a reformed system: "Gold comes to mind as a logical anchor" https://finance.townhall.com/columnists/ralphbenko/2015/03/10/janet-yellens-historic-meeting-with-the-right-n1968154

Senator Toomey re Shelton https://twitter.com/NickTimiraos/status/1219623002373083141?s=20

particularly troubling about Shelton's flip flopping for Trump: she had economic arguments but ultimately her critique of low interest rates was moral. Here's video of her quoting Deuteronomy at event criticizing Fed policy (pushing "sound money") in 2010 https://www.c-span.org/video/?c4847963/user-clip-judy-moral

"If Judy Shelton, who advocates for lower rates, wins confirmation to the Federal Reserve Board of Governors, President Trump may have his choice to replace Chairman Jerome Powell." https://www.bondbuyer.com/news/does-trump-plan-to-replace-powell-with-judy-shelton

2015 oped "By launching an American initiative for exchange-rate stability anchored by gold, we can truly write the rules for the global economy in keeping with free-market values." https://thehill.com/blogs/pundits-blog/finance/258815-a-new-sound-money-movement-for-the-gop#.Vj47Y5vTIAo.twitter

2014 speech "It is so nice to be with like-minded people who understand that we need fundamental monetary reform. It’s so comfortable to be among those seeking an alternative to central banking, which increasingly seems like central planning." https://www.atlasnetwork.org/news/article/shouldnt-america-be-the-one-to-link-its-currency-to-gold-by-dr.-judy-shelto

2018 "In proposing a new international monetary system linked in some way to gold, America has an opportunity to secure continued prominence in global monetary affairs... We make America great again by making America’s money great again." https://www.cato.org/cato-journal/springsummer-2018/case-new-international-monetary-system

same piece -- according to Shelton, Trump apparently was able to shake off the "usual 'goldbug' epithets" that usually slow down other gold standard advocates

"Anyone who believes that the effort to reaffirm a gold link for the dollar is politically quixotic was not paying attention when Senator Jim DeMint questioned Fed chairman Ben Bernanke at a hearing earlier this year." https://www.washingtonexaminer.com/weekly-standard/gold-standard-or-bust

report that Crapo wants to move the nominations to the floor quickly https://twitter.com/NOgnanovich/status/1222268394151587840?s=20

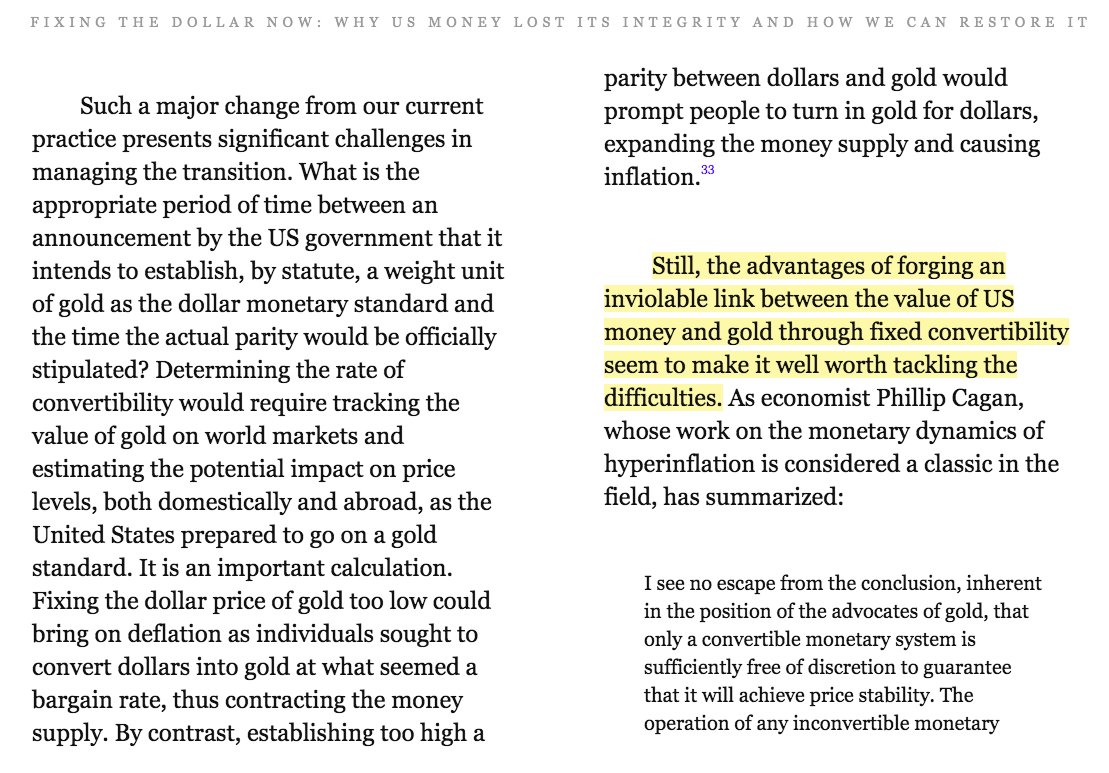

the road back to the gold standard may be a bit bumpy ... but there is no alternative [from Shelton's book Money Meltdown]

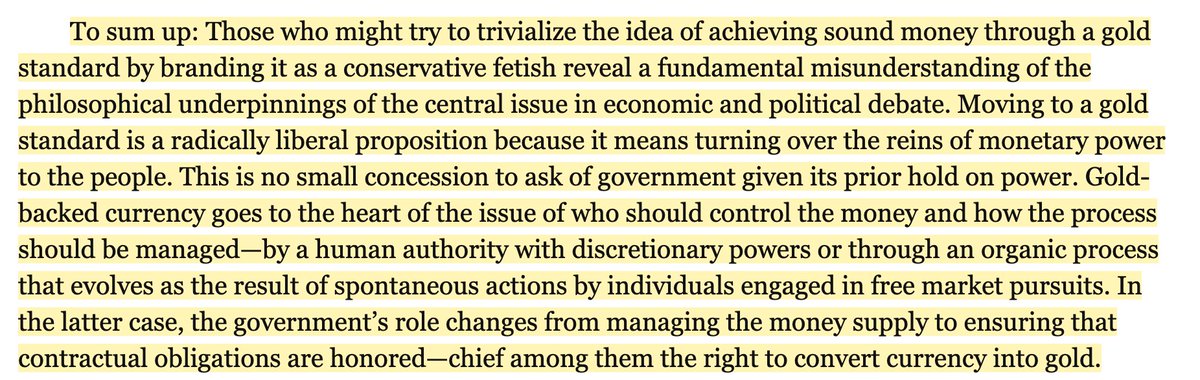

"Those who might try to trivialize the idea of achieving sound money through a gold standard by branding it as a conservative fetish reveal a fundamental misunderstanding of the philosophical underpinnings of the central issue in economic and political debate." #TrueBeliever

when Shelton is Fed Chair we are going to need to appropriate more money for the US Mint so they can be pumping out all those gold coins we will need

2012 Shelton joins http://TheGoldStandardNow.org http://www.prweb.com/releases/2012/1/prweb9090173.htm

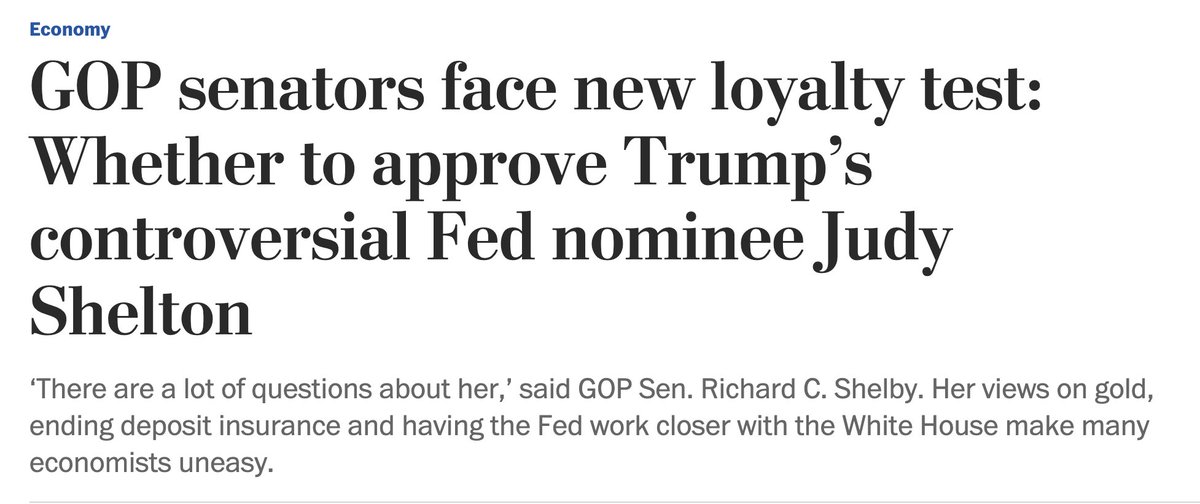

by @byHeatherLong https://www.washingtonpost.com/business/2020/02/06/gop-senators-face-new-loyalty-test-whether-approve-trumps-controversial-fed-nominee-judy-shelton/?utm_campaign=wp_business&utm_medium=social&utm_source=twitter

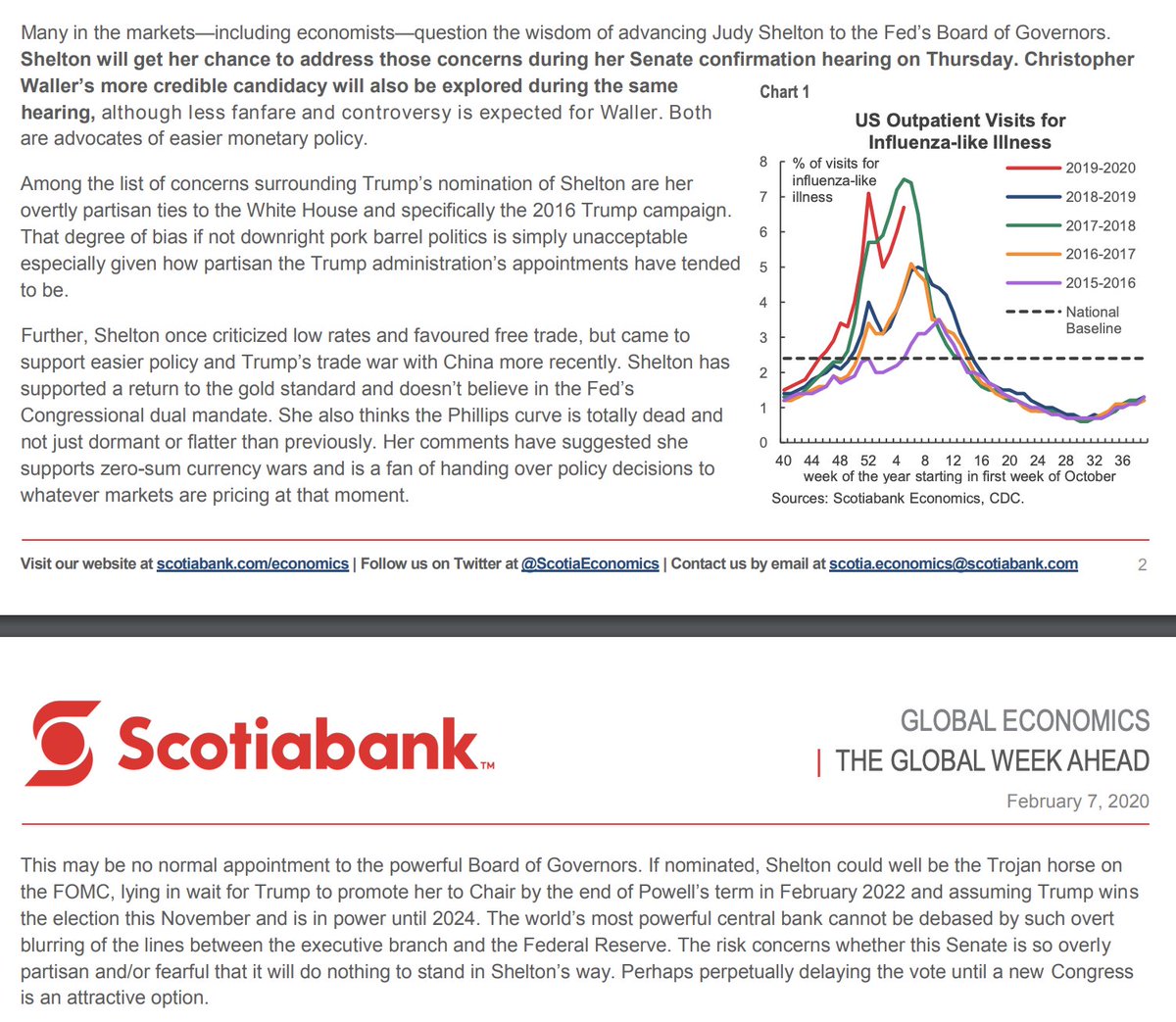

. @scotiabank on the Shelton nomination https://www.scotiabank.com/content/dam/scotiabank/sub-brands/scotiabank-economics/english/documents/the-global-week-ahead/globalweekahead20200207.pdf "Many in the markets—including economists—question the wisdom of advancing Judy Shelton.... Shelton could well be the Trojan horse on the FOMC, lying in wait for Trump to promote her to Chair." h/t @FiatElpis

Read on Twitter

Read on Twitter

![in fact, she writes that we can't afford not to go back to gold: "we cannot allow the integrity of US money to deteriorate further... [continued debasement] violates the intentions of our Founders." in fact, she writes that we can't afford not to go back to gold: "we cannot allow the integrity of US money to deteriorate further... [continued debasement] violates the intentions of our Founders."](https://pbs.twimg.com/media/EOllN1NUYAAaJl8.jpg)

![the road back to the gold standard may be a bit bumpy ... but there is no alternative [from Shelton's book Money Meltdown] the road back to the gold standard may be a bit bumpy ... but there is no alternative [from Shelton's book Money Meltdown]](https://pbs.twimg.com/media/EPoaChgW4AE0KY-.jpg)