Best time to look for a multi-bagger is around the time when masses start to find the word 'multi-bagger' as disgusting. This masterpiece from @chriswmayer is inspired by Thomas Phelps's "100 to 1 in the Stock Market" and is an addition to that with more recent data. #100BAGGERS

“Bear market smoke gets in one’s eyes,” he said, and it blinds us to buying opportunities if we are too intent on market timing. [1]

"In Alice in Wonderland, one had to run fast in order to stand still. In the stock market, the evidence suggests, one who buys right must stand still in order to run fast.” [2]

So the lesson is one needs to stick to the original theme and if it is intact just hold on......

One needs to isolate the common threads and place one’s bets on the table after much research and conviction then hold on......

Key here is the idea that you must sit still. [3]

One needs to isolate the common threads and place one’s bets on the table after much research and conviction then hold on......

Key here is the idea that you must sit still. [3]

Once you've done your homework - it's time to sit on that asset for as long as the original thesis holds (assuming you don't need funds).

Remember - the downside in any stock is CMP, but the upside could well be unlimited. As @MrMotilalOswal says - "Buy Right, Sit Tight" [4]

Remember - the downside in any stock is CMP, but the upside could well be unlimited. As @MrMotilalOswal says - "Buy Right, Sit Tight" [4]

People don't hold stocks long enough, because, it is the daily volatility and erratic price movements that move their perception and conviction to hold!

[5]

[5]

The biggest hurdle....the ability to stomach the ups and downs and hold on.

#Apple has had a peak-to-trough loss of 80%—twice!

#Netflix lost 25% of its value in a single day—4 times! On its worst day, it fell 41% and there was a 4-month stretch where it dropped 80%

[6]

#Apple has had a peak-to-trough loss of 80%—twice!

#Netflix lost 25% of its value in a single day—4 times! On its worst day, it fell 41% and there was a 4-month stretch where it dropped 80%

[6]

Microeconomics usually helps | Macroeconomics mostly misleads

Warren Buffett himself once said, “If Fed Chairman Alan Greenspan were to whisper to me what his monetary policy was going to be over the next two years, it wouldn’t change one thing I do.”

Warren Buffett himself once said, “If Fed Chairman Alan Greenspan were to whisper to me what his monetary policy was going to be over the next two years, it wouldn’t change one thing I do.”

Digesting the quarterly or annual earnings - apply some #SecondLevelThinking

Learn to separate the ephemeral earnings setback from the real thing. The more important thing is to assess the long term free cash generation growth probability, likely timing and quantum of that cash.

Learn to separate the ephemeral earnings setback from the real thing. The more important thing is to assess the long term free cash generation growth probability, likely timing and quantum of that cash.

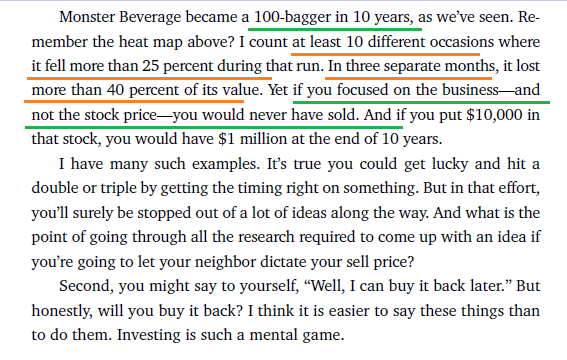

Stop losses are popular because they take a difficult decision—perhaps the most difficult in all —

and make it mechanical. You don’t have to think about it. The stock hit your stop loss and you are out.

#TGBL lost ~40% (315 to 185 in 2019); #ITC too ~40% (336 in 2017 to 200 ??)

and make it mechanical. You don’t have to think about it. The stock hit your stop loss and you are out.

#TGBL lost ~40% (315 to 185 in 2019); #ITC too ~40% (336 in 2017 to 200 ??)

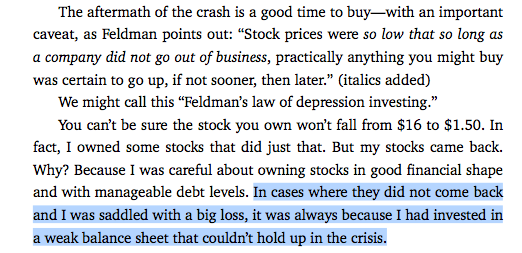

Not all stocks are likely to come back, after a deep correction

Whitman's 3 broad categories:

1. Were grossly overpriced (particularly low-quality)

2. Suffered permanent impairment (e.g. - accounting fraud)

3. Massive equity dilution (bailout attempt on high-debt businesses)

Whitman's 3 broad categories:

1. Were grossly overpriced (particularly low-quality)

2. Suffered permanent impairment (e.g. - accounting fraud)

3. Massive equity dilution (bailout attempt on high-debt businesses)

You need a business with a high return on capital with the ability to reinvest and earn that high return on capital for years and years.

Read on Twitter

Read on Twitter

![“Bear market smoke gets in one’s eyes,” he said, and it blinds us to buying opportunities if we are too intent on market timing. [1] “Bear market smoke gets in one’s eyes,” he said, and it blinds us to buying opportunities if we are too intent on market timing. [1]](https://pbs.twimg.com/media/D_RseG1UIAAvHzL.png)

!["In Alice in Wonderland, one had to run fast in order to stand still. In the stock market, the evidence suggests, one who buys right must stand still in order to run fast.” [2] "In Alice in Wonderland, one had to run fast in order to stand still. In the stock market, the evidence suggests, one who buys right must stand still in order to run fast.” [2]](https://pbs.twimg.com/media/D_RvGe9UcAE0qsS.png)

!["In Alice in Wonderland, one had to run fast in order to stand still. In the stock market, the evidence suggests, one who buys right must stand still in order to run fast.” [2] "In Alice in Wonderland, one had to run fast in order to stand still. In the stock market, the evidence suggests, one who buys right must stand still in order to run fast.” [2]](https://pbs.twimg.com/media/D_RvHGGXUAAVzjm.png)

![So the lesson is one needs to stick to the original theme and if it is intact just hold on......One needs to isolate the common threads and place one’s bets on the table after much research and conviction then hold on......Key here is the idea that you must sit still. [3] So the lesson is one needs to stick to the original theme and if it is intact just hold on......One needs to isolate the common threads and place one’s bets on the table after much research and conviction then hold on......Key here is the idea that you must sit still. [3]](https://pbs.twimg.com/media/D_Rw0FkU4AE8MRv.png)

![Once you've done your homework - it's time to sit on that asset for as long as the original thesis holds (assuming you don't need funds). Remember - the downside in any stock is CMP, but the upside could well be unlimited. As @MrMotilalOswal says - "Buy Right, Sit Tight" [4] Once you've done your homework - it's time to sit on that asset for as long as the original thesis holds (assuming you don't need funds). Remember - the downside in any stock is CMP, but the upside could well be unlimited. As @MrMotilalOswal says - "Buy Right, Sit Tight" [4]](https://pbs.twimg.com/media/D_RyXZhX4AAoSHP.png)

![People don't hold stocks long enough, because, it is the daily volatility and erratic price movements that move their perception and conviction to hold![5] People don't hold stocks long enough, because, it is the daily volatility and erratic price movements that move their perception and conviction to hold![5]](https://pbs.twimg.com/media/D_RzqjRUEAA04Jt.png)

![The biggest hurdle....the ability to stomach the ups and downs and hold on. #Apple has had a peak-to-trough loss of 80%—twice! #Netflix lost 25% of its value in a single day—4 times! On its worst day, it fell 41% and there was a 4-month stretch where it dropped 80%[6] The biggest hurdle....the ability to stomach the ups and downs and hold on. #Apple has had a peak-to-trough loss of 80%—twice! #Netflix lost 25% of its value in a single day—4 times! On its worst day, it fell 41% and there was a 4-month stretch where it dropped 80%[6]](https://pbs.twimg.com/media/D_R5-WxWkAEup3C.png)