1/ Data businesses are generally misunderstood. DaaS has different metrics than SaaS.

While there has been a lot written about SaaS businesses (how they operate, what metrics to watch, etc.), there has been surprisingly little written about data businesses.

While there has been a lot written about SaaS businesses (how they operate, what metrics to watch, etc.), there has been surprisingly little written about data businesses.

2/ Great data companies look like the ugly child of a SaaS company (like Salesforce) and a compute service (like AWS).

DaaS companies have their own unique lineage, lingo, operational cadence, and more. They are an odd duck in the tech pond.

DaaS companies have their own unique lineage, lingo, operational cadence, and more. They are an odd duck in the tech pond.

3/ Data is ultimately a winner-takes-most market.

As a data company starts to dominate its niche, it can lower its price and gain more market share and use those resources to invest more in the data … thereby gaining more market share (and the cycle continues).

As a data company starts to dominate its niche, it can lower its price and gain more market share and use those resources to invest more in the data … thereby gaining more market share (and the cycle continues).

4/ Data is a growing business due to:

+ growth in powerful software tools (like Snowflake, Looker, Tableau)

+ growth in # of data scientists

+ growth in the power of compute

+ massive decline in cost of compute

+ growth in powerful software tools (like Snowflake, Looker, Tableau)

+ growth in # of data scientists

+ growth in the power of compute

+ massive decline in cost of compute

5/ DaaS is just about assembling verifiable facts. It is all about Veracity and TRUTH.

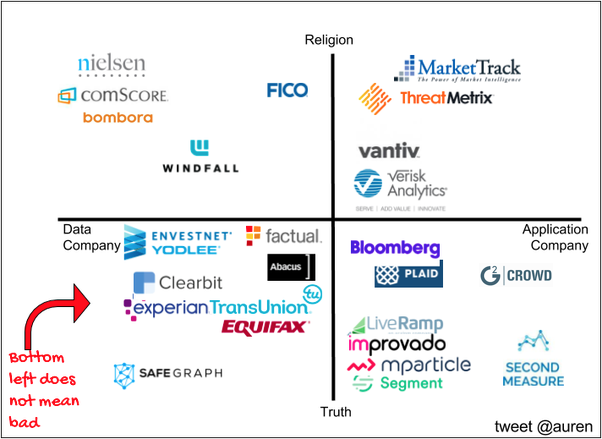

Good framework is truth vs. religion.

Good framework is truth vs. religion.

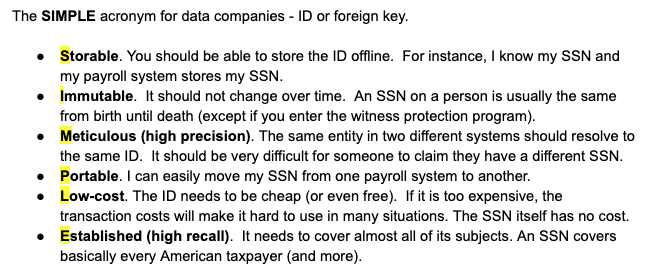

6/ Your data will be much more valuable if you enable it to be joined with other datasets (even if you make no money off the other datasets). This is the #1 thing that most people who work at data companies do not understand.

Build join keys into the data:

Build join keys into the data:

7/ DaaS margins look horrible at $10M ARR and look amazing at $100M ARR because the cost of data goes in COGS.

“incremental margins eventually become extremely attractive at successful data businesses” - Michael Meltz, EVP of @Experian

“incremental margins eventually become extremely attractive at successful data businesses” - Michael Meltz, EVP of @Experian

8/ The goal of getting to market share dominance is NOT to increase prices.

The goal is to lower your CACs so that you can LOWER prices for your customers. CACs go down because there is one dominant player. DaaS is like Amazon: “your margin is my opportunity”

The goal is to lower your CACs so that you can LOWER prices for your customers. CACs go down because there is one dominant player. DaaS is like Amazon: “your margin is my opportunity”

9/ DaaS is growing. Just 5 yrs ago, only ~20 of the 11,000 hedge funds were using alternative data. Today it is still only about 100 funds. In five years it will be over 500 funds.

And every other industry is buying data at the same rate as hedge funds.

And every other industry is buying data at the same rate as hedge funds.

10/ Good examples of data companies include:

@accuweather @bomboradata @clearbit @TheCoStarGroup @DnBUS @liveramp @reonomy @verisk @WindfallData

@accuweather @bomboradata @clearbit @TheCoStarGroup @DnBUS @liveramp @reonomy @verisk @WindfallData

11/ Read more about Everything you want to know about running DaaS companies (Data-As-A-Service Bible) at the @SafeGraph blog: https://blog.safegraph.com/data-as-a-service-bible-everything-you-wanted-to-know-about-running-daas-companies-d4cf4c15c038

Read on Twitter

Read on Twitter