This friend had trouble making money in options though he was directionally right. Let us see how a basic understanding of greeks would have helped him, This thread will be about two attributes of option pricing, extrinsic value and theta https://twitter.com/VikashS28/status/1133039405676072960

An option has two parts, intrinsic and extrinsic value. Think of a pack of Lay's potato chips. When you buy and open the pack, what you find is some chips and a lot of air. Intrinsic value is the chips, extrinsic value is air

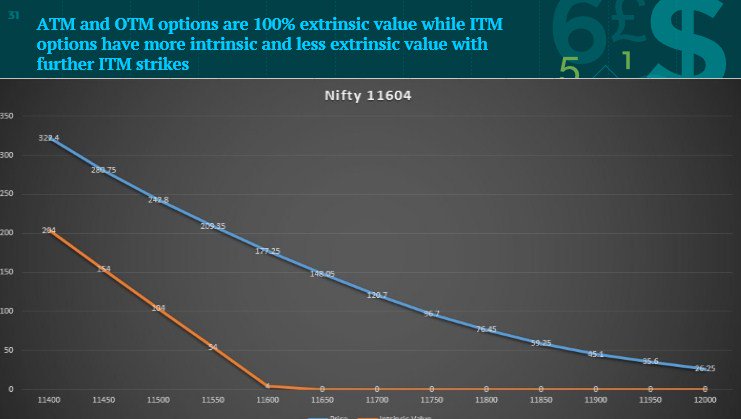

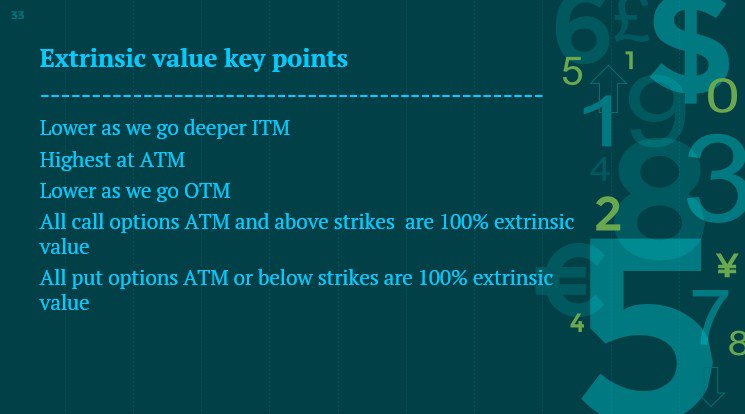

Let us stop for a second here. When our friend was buying the 31700CE, he was buying pure extrinsic value, i.e, AIR

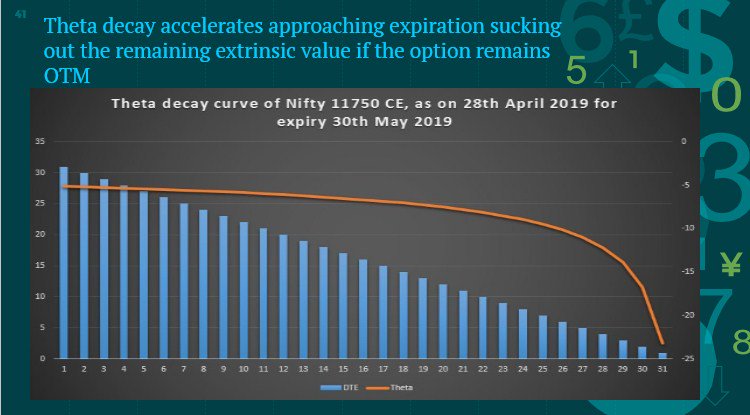

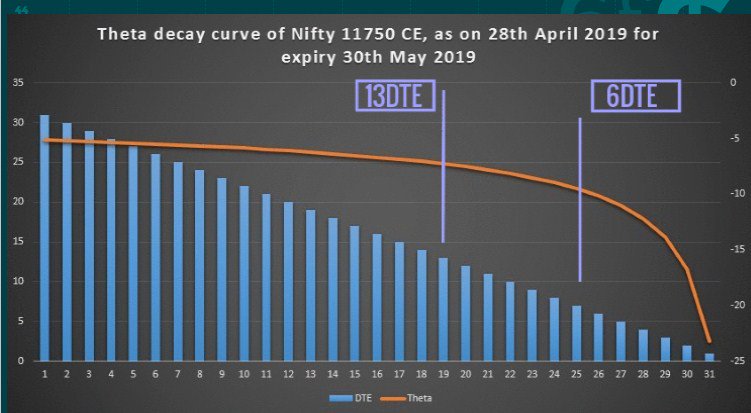

DTE = Days to expiration. Watch that the theta decay curve is not linear, it speeds up as we approach expiration

Theta decay starts to accelerate at 13 DTE. From 6DTE, it justs accelerates like crazy . This is true for all options

So our friend in this example was hit by a double whammy ( triple actually, due to vega, but vega on a later day. Explaining vega will confuse if you are a novice).

1. He was playing pure extrinsic value

2. He has a high theta burn rate so close to expiry, the highest

1. He was playing pure extrinsic value

2. He has a high theta burn rate so close to expiry, the highest

Hence, his 31700 call was not moving up fast. It was continuously losing theta. Being an OTM option with pure extrinsic value, the theta burn was very high

So what is the solution ? An options buyer has to negate theta burn to a certain degree. Best way ? Should have used a bull call spread. What you lose due to theta in your bought option can be somewhat covered by theta gain in the sold option

I can or anyone knowing greeks can make a position almost theta neutral thru spreads

THIS IS HOW GREEKS HELP YOU !

THIS IS HOW GREEKS HELP YOU !

I understand that when one opens an options book, the maths seems daunting. It's supposed to be, Black and Scholes won the Nobel prize for making that formula  To be very frank, if you ask me the total maths, I will also have trouble explaining

To be very frank, if you ask me the total maths, I will also have trouble explaining

To be very frank, if you ask me the total maths, I will also have trouble explaining

To be very frank, if you ask me the total maths, I will also have trouble explaining

So, focus on the graphs. Using graphs is the easiest way to understand options. Whatever strategy you use, plot it graphically and play around with vols, DTE and direction

1. http://opstra.definedge.com ( web based)

2. http://www.pasitechnologies.com/2015/08/happy-independence-day-to-all-indian-as.html ( software)

BOTH FREE, use them

1. http://opstra.definedge.com ( web based)

2. http://www.pasitechnologies.com/2015/08/happy-independence-day-to-all-indian-as.html ( software)

BOTH FREE, use them

Read on Twitter

Read on Twitter