Dark side of credit ratings agencies [Thread]:

1. How do agencies make money?

Simple - companies and government pay them in exchange for a credit rating.

If you're paying for an 'independent' report, is it really independent?

Here's how much SA paid back in 2017:

#Moodys

1. How do agencies make money?

Simple - companies and government pay them in exchange for a credit rating.

If you're paying for an 'independent' report, is it really independent?

Here's how much SA paid back in 2017:

#Moodys

2. Can they be influenced?

Short answer: Yes.

Excerpt from a research paper by Gill (2015).

Government meets with ratings agencies all the time. Ratings are almost exclusively based on financial metrics. This is like standing trail and hanging out with the judge all the time.

Short answer: Yes.

Excerpt from a research paper by Gill (2015).

Government meets with ratings agencies all the time. Ratings are almost exclusively based on financial metrics. This is like standing trail and hanging out with the judge all the time.

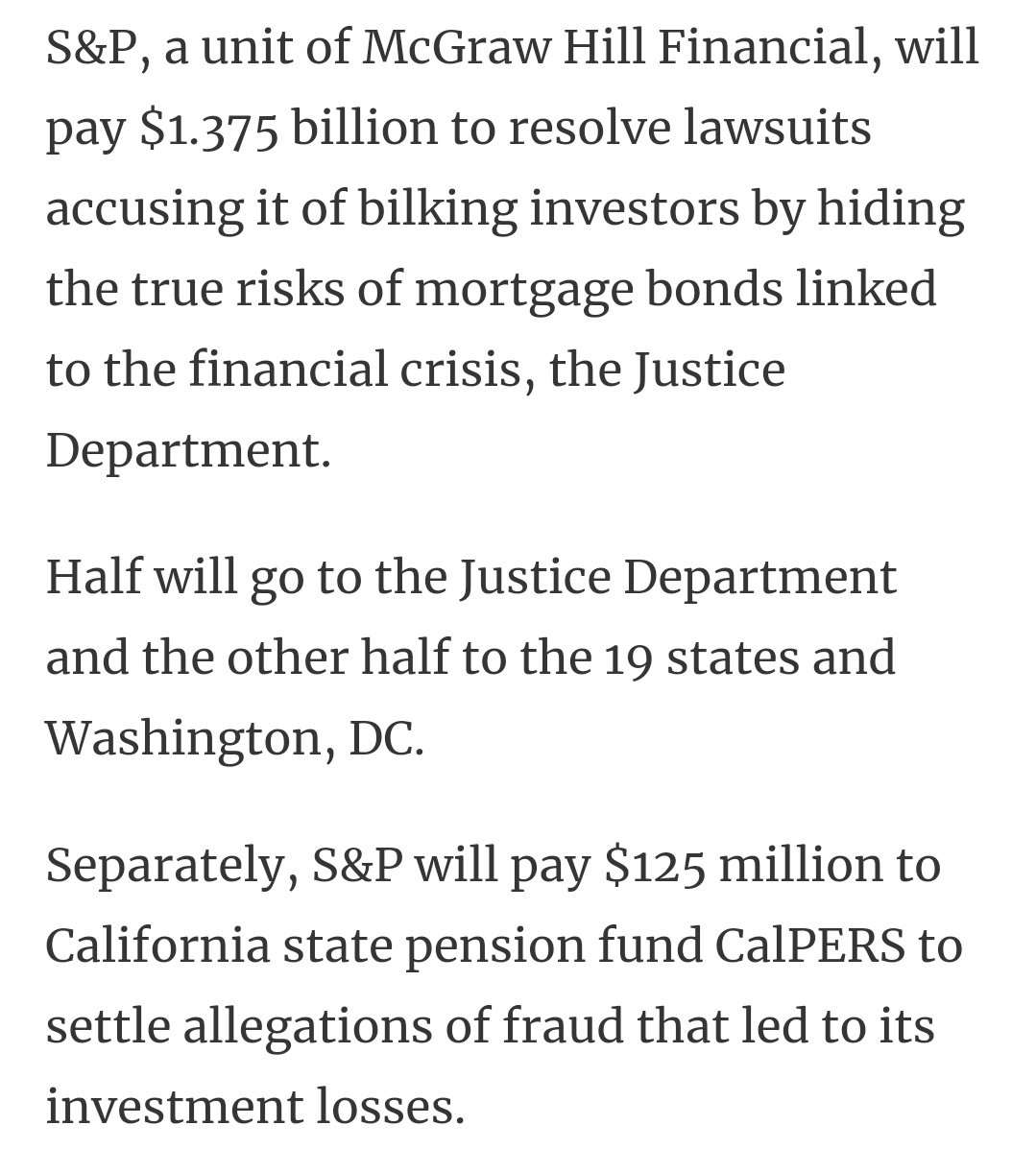

3. Do they have flawless integrity?

Short answer: No

Found guilty of publishing false ratings, overlooking serious risks, rating companies they own & insider trading.

S&P is owned by textbook publisher McGraw-Hill. McGraws have an age old link to the Bush family.

Short answer: No

Found guilty of publishing false ratings, overlooking serious risks, rating companies they own & insider trading.

S&P is owned by textbook publisher McGraw-Hill. McGraws have an age old link to the Bush family.

4. Do they have far too much power?

Short answer: yes

Top 3 credit rating agencies account for roughly 95% of global market share.

How can we reliably measure the risks of a complex, interlinked financial system using 3 firms?! Irony is ratings agencies are too big to fail.

Short answer: yes

Top 3 credit rating agencies account for roughly 95% of global market share.

How can we reliably measure the risks of a complex, interlinked financial system using 3 firms?! Irony is ratings agencies are too big to fail.

5. Analysts actually do whatever it takes to get a job on Wall Street.

Agency analysts aren't paid much relative to Wall Street credit analysts (Michael Lewis, Big Short: 2010).

The best way to get noticed is to give the bank a great rating and then move over to work for them.

Agency analysts aren't paid much relative to Wall Street credit analysts (Michael Lewis, Big Short: 2010).

The best way to get noticed is to give the bank a great rating and then move over to work for them.

Juicy facts to end the thread:

Enron was rated as investment grade just 4 days before it went bankrupt.

Ratings agencies widely employ the use of Black-Scholes option pricing methods. Fisher Black & Myron Scholes won a Nobel Prize for this.

They lost $4bn in 6 weeks (LTCM)

Enron was rated as investment grade just 4 days before it went bankrupt.

Ratings agencies widely employ the use of Black-Scholes option pricing methods. Fisher Black & Myron Scholes won a Nobel Prize for this.

They lost $4bn in 6 weeks (LTCM)

Read on Twitter

Read on Twitter![Dark side of credit ratings agencies [Thread]:1. How do agencies make money?Simple - companies and government pay them in exchange for a credit rating.If you're paying for an 'independent' report, is it really independent?Here's how much SA paid back in 2017: #Moodys Dark side of credit ratings agencies [Thread]:1. How do agencies make money?Simple - companies and government pay them in exchange for a credit rating.If you're paying for an 'independent' report, is it really independent?Here's how much SA paid back in 2017: #Moodys](https://pbs.twimg.com/media/D25YUjhWsAAQI_O.jpg)