Think about how absurd this is.

Our cost of living not rising faster than it already is is "one of the major challenges of our time."

Screw you, Jerome. @federalreserve https://twitter.com/economics/status/1109568998210002944

Our cost of living not rising faster than it already is is "one of the major challenges of our time."

Screw you, Jerome. @federalreserve https://twitter.com/economics/status/1109568998210002944

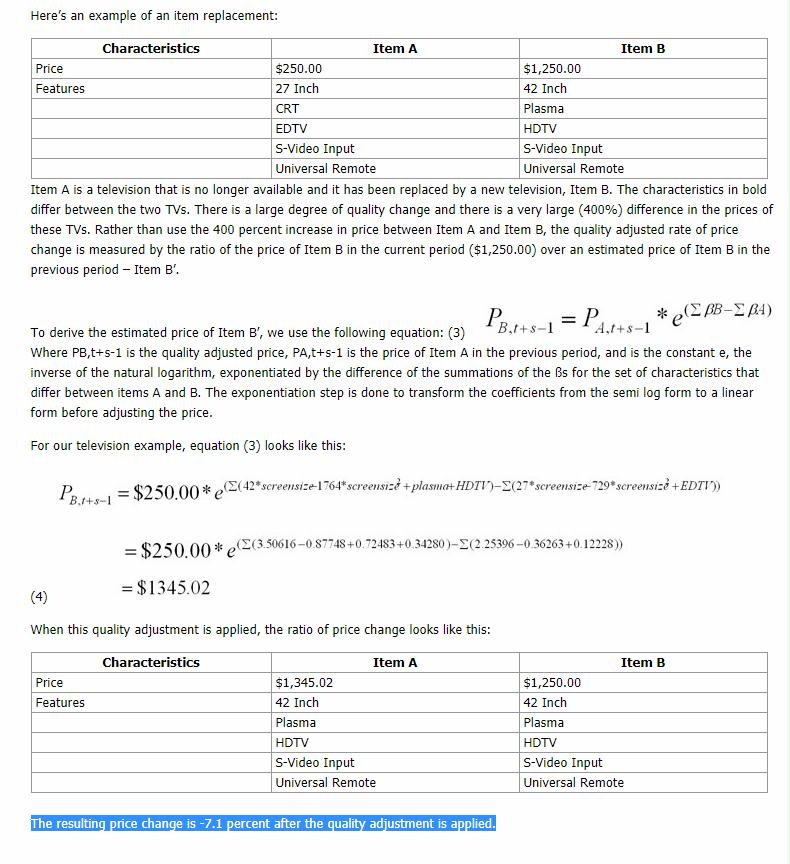

Here's a fun "hedonic quality adjustment" lesson on how $1,250 televisions are cheaper than $250 televisions. https://web.archive.org/web/20100531202521/https://www.bls.gov/cpi/cpihqaqanda.htm

If you read this example. a $1,250 Television (admittedly much nicer) is -7.1% CHEAPER than the old $250 TV, "after the quality adjustment is applied."

So they are saying that something that costs 5x what an older model cost is actually -7.1% CHEAPER, & that's in the CPI.

So they are saying that something that costs 5x what an older model cost is actually -7.1% CHEAPER, & that's in the CPI.

Of course the real reason for the Fed wanting more inflation is to reduce the real value of debt. Wages have nothing to do with it. The biggest beneficiary will be the biggest debtors. It's like how they say we need to ban cash to stop crime, when really it's for negative rates

Inflation is the most regressive tax. People tell me that Joe Six Pack's debt burden will be lessened by higher inflation.

So he saves some, in real terms, on his 20% credit card bill, but his rent goes up $200 a month. And don't even mention about tuition or healthcare.

So he saves some, in real terms, on his 20% credit card bill, but his rent goes up $200 a month. And don't even mention about tuition or healthcare.

Every single day I hear someone on TV or in the WSJ, or The FT, or whatever, say "We have no inflation," or "We need more inflation."

It's insulting normal people, who take "inflation" to mean "cost of living," because that's been spiking up for a long time. Don't bullshit us.

It's insulting normal people, who take "inflation" to mean "cost of living," because that's been spiking up for a long time. Don't bullshit us.

The Fed is "preparing to inflate away debts but are looking for "widespread societal understanding and acceptance" before doing so." #Napier https://www.zerohedge.com/news/2019-03-30/russell-napier-terrible-market-combination-has-emerged-suggests-it-indeed-all-over

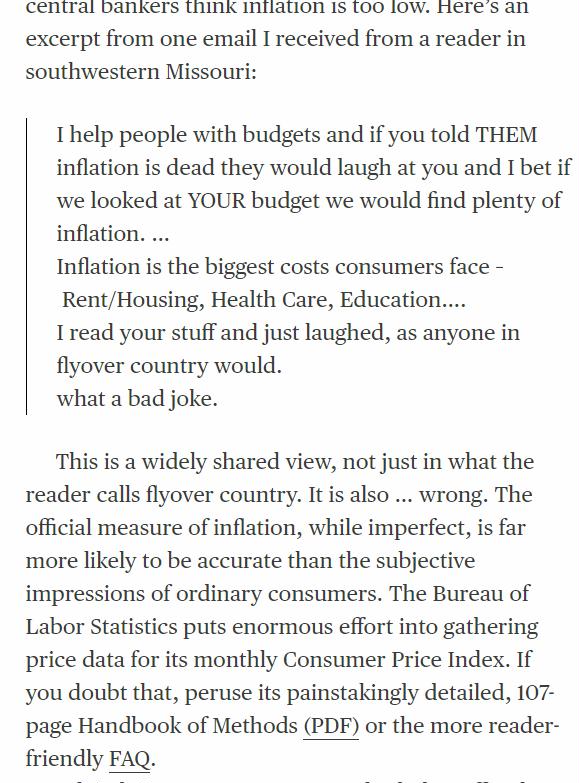

This is complete nonsense. There's plenty of "inflation," which normal people understand to mean "a rise in the cost of living." The propagandists use CPI, which is a MODEL of the cost of living, full of goofy hedonic & other adjustments & weightings. https://www.bloomberg.com/news/articles/2019-04-17/did-capitalism-kill-inflation

Peter Coy is back to ask "who you gonna believe, the BLS or your lying eyes?"

Every time some MSM goofball writes an "inflation is so low" article, readers set them straight, but pundits never understand that the BLS CPI model is not the cost of living.

https://www.bloomberg.com/news/articles/2019-04-29/inflation-is-lower-than-most-people-think

Every time some MSM goofball writes an "inflation is so low" article, readers set them straight, but pundits never understand that the BLS CPI model is not the cost of living.

https://www.bloomberg.com/news/articles/2019-04-29/inflation-is-lower-than-most-people-think

Our buddy @neelkashkari wants our cost of living to spike even higher than it already is. https://www.reuters.com/article/us-usa-fed-kashkari/fed-needs-to-let-inflation-rise-above-2-kashkari-says-idUSKCN1SM1ZK

“For our current framework to be effective and credible, we must walk the walk and actually allow inflation to climb modestly above 2 percent in order to demonstrate that we are serious about symmetry.” - Minneapolis Fed President Professor Jiggly

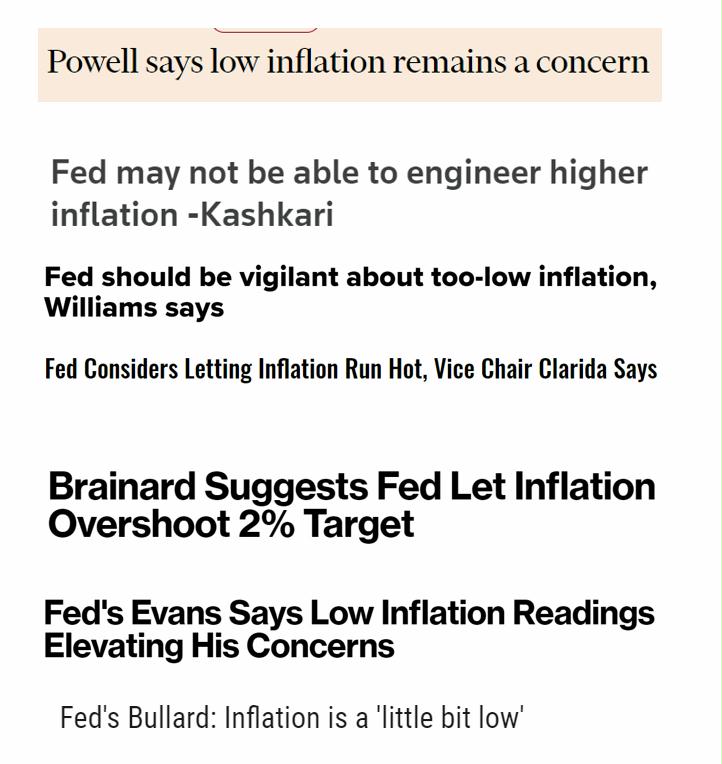

These headlines are all from the past few months. You'd think Americans were rioting for a higher cost of living or something.

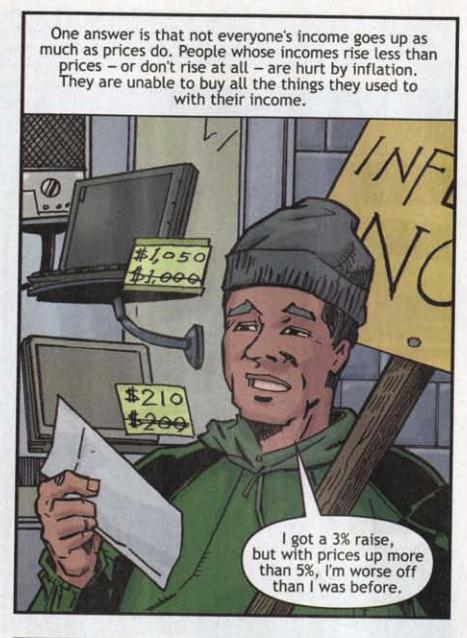

The Fed used to understand how real wages work. https://ia800307.us.archive.org/26/items/gov.frb.ny.comic.inflation/gov.frb.ny.comic.inflation.pdf

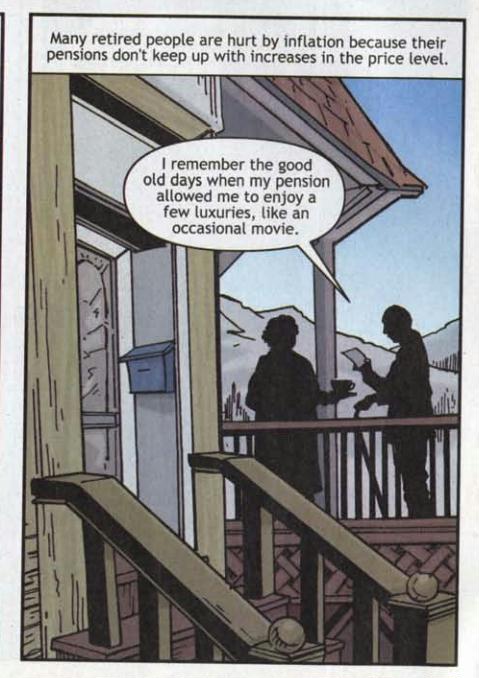

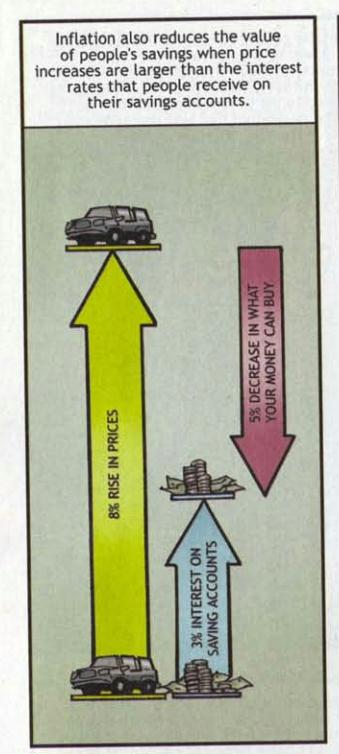

This is so cute - the Fed used to pretend they care about old people! #ZIRP

Here's the Fed pretending to care about savers!!

I think the term now is "money hoarders," guys. @NewYorkFed

I think the term now is "money hoarders," guys. @NewYorkFed

The Fed talking about malinvestment!! How quaint.

We need $91 million rabbits for the Mnuchin family, folks!

We need $91 million rabbits for the Mnuchin family, folks!

Hasn't the Fed been calling for higher inflation for years? Aren't they worried anymore about what that'd do to business plans?

This kind of bizarre thinking (from 2009) from the New York Fed is so strange to me. Inflation isn't the panacea we've been told it is?

The funny thing is, this cartoon was intended 10 years ago as a warning - now it's why they're trying to achieve!

This sounds like "shifting demand forward." Wait - hasn't the been the goal of everything the Fed has done in the past 10 years? So confused.

Hmmm...what's the huge incentive here for the Fed, BLS and US Treasury? To understate or overstate CPI??

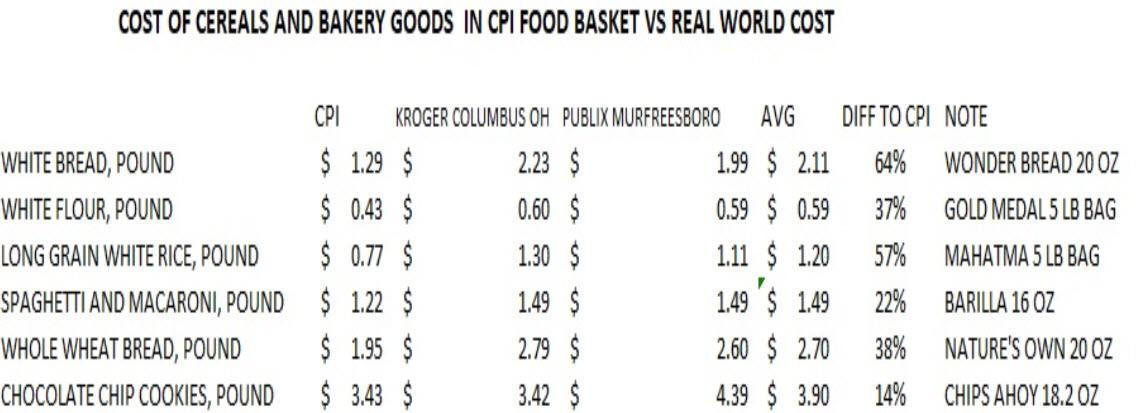

An example of the CPI Is under-representing real world inflation.

"When Bloomberg's Cameron Crise encountered the dataset that is used to compute elements of the CPI...he decided to compare how this theoretical price compares to real world prices."

https://www.zerohedge.com/news/2019-05-25/heres-proof-how-cpi-underrepresenting-food-inflation-40

"When Bloomberg's Cameron Crise encountered the dataset that is used to compute elements of the CPI...he decided to compare how this theoretical price compares to real world prices."

https://www.zerohedge.com/news/2019-05-25/heres-proof-how-cpi-underrepresenting-food-inflation-40

"The story emerging in the Fed listening sessions is that a strategy seeking higher inflation hits the most vulnerable part of the population hard..." https://www.bloomberg.com/news/articles/2019-06-06/what-the-fed-heard-when-it-listened-to-americans-about-inflation

"The sometimes positive impacts of inflation for certain of us have no good benefits for people at the lower end of the spectrum’’ cc @federalreserve

"Using bar code data to track actual household consumption and prices, ..found that the cumulative inflation rate was 8-to-9 percentage points lower for households with incomes above $100,000 versus those with incomes below $20,000 over the 2004-2012 period." #FedHistory

These comments were written by Wall Street Journal subscribers, not members of the Communist Party. https://web.archive.org/web/20150611190032/http://blogs.wsj.com/economics/2015/06/02/grand-central-a-letter-to-stingy-american-consumers/tab/comments/

Meanwhile, the sociopaths at the Fed, and their cheerleaders, want our cost of living to rise ever higher. https://money.cnn.com/2018/05/17/news/economy/us-middle-class-basics-study/index.html

"There’s been no inflation. There’s been no nothing." - @realDonaldTrump, July 16, 2019 https://www.whitehouse.gov/briefings-statements/remarks-president-trump-cabinet-meeting-14/

"maybe we could defeat lowflation..."

Hey wankers - go into a supermarket or better yet an NFL game beer-line and try that propaganda line. See what happens.

Hey wankers - go into a supermarket or better yet an NFL game beer-line and try that propaganda line. See what happens.

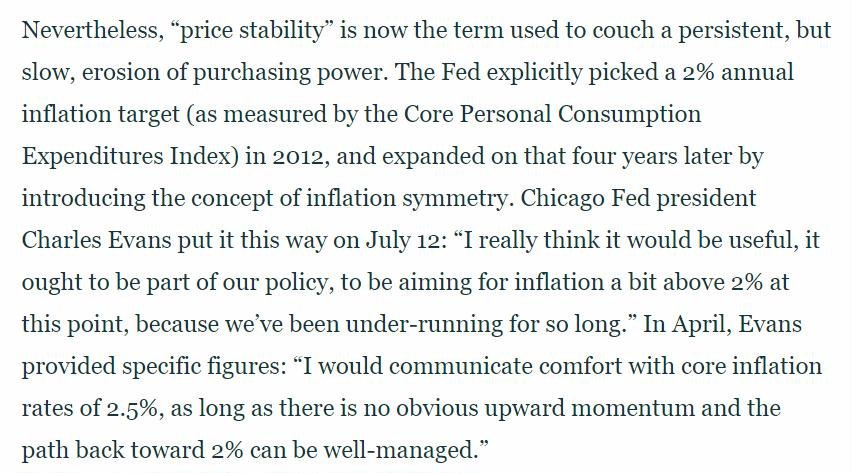

""Price stability” is now the term used to couch a persistent, but slow, erosion of purchasing power." - @GrantsPub

"NY Fed President John Williams says low inflation is ‘the problem of this era’" https://www.cnbc.com/2019/09/04/ny-feds-john-williams-says-low-inflation-is-the-problem-of-this-era.html

Hey John Williams @NewYorkFed -

Hey John Williams @NewYorkFed -

"The monetary policy endgame" by some guy at Blackrock

https://www.blackrockblog.com/2019/09/05/monetary-policy-endgame/

He's mostly full of shit (as Upton Sinclair might say) - but here's the money quote, which I agree with:

"Today money is created by printing presses, or even a few computer keystrokes."

https://www.blackrockblog.com/2019/09/05/monetary-policy-endgame/

He's mostly full of shit (as Upton Sinclair might say) - but here's the money quote, which I agree with:

"Today money is created by printing presses, or even a few computer keystrokes."

You think you've seen populism @federalreserve? You ain't seen nothin' yet.

Your currency debasement is the most regressive tax around, and you are trying to make our cost of living explode. More inflation will DESTROY what's left of the middle class.

Your currency debasement is the most regressive tax around, and you are trying to make our cost of living explode. More inflation will DESTROY what's left of the middle class.

This op-ed was written by a guy at Blackrock, which has benefited immeasurably from the central bank GINI-spiking currency explosion this century. Now he says to own equities, real estate and gold (and I agree). Too bad 85% of America has already been destroyed by CB policies.

"Powell says making up for lost inflation is ‘great idea’" https://www.ft.com/content/7224c41e-d0cf-11e9-99a4-b5ded7a7fe3f

Hey Jay Powell! @federalreserve

Hey Jay Powell! @federalreserve

"As it makes up for lost inflation, the bank would also be making up for lost growth."

This is such bullshit. "Inflation" is not a synonym for "real growth."

This is such bullshit. "Inflation" is not a synonym for "real growth."

"This idea that low inflation, and sometimes even falling goods prices, is necessarily very harmful for the economy is something that is not born by the data." - Claudio Borio, Head of the Monetary and Economic Department, BIS

cc @federalreserve https://hiddenforces.io/podcasts/claudio-borio-bis-2019/

cc @federalreserve https://hiddenforces.io/podcasts/claudio-borio-bis-2019/

In the end, though, Borio is at heart just another lifelong inbred economist - he tells @CoveringDelta that having a small group of econ clerics price-fixing rates is the best system possible. @BIS_org https://mobile.twitter.com/RudyHavenstein/status/662671472968667136

"Monetary policy has gone from the ridiculous to the absurd. The Fed...is clueless and is driven by theories with little basis in reality. Why are they so tethered to a 2% inflation rate that will reduce purchasing power by 50% over 36 years? What is the magic of this number?"

"These unsound policies have distorted the economic system by allowing zombie companies to survive, with little hope of true positive economic outcomes." https://www.advisorperspectives.com/articles/2019/09/09/bob-rodriguez-the-fed-is-clueless

"Negative yielding debt is a concept that could only be considered rational by an academic. Given 4,000 years of human history, I’ll bet this is as faulty an idea as there ever has been...Negative yields distort the entire capital asset pricing model. "

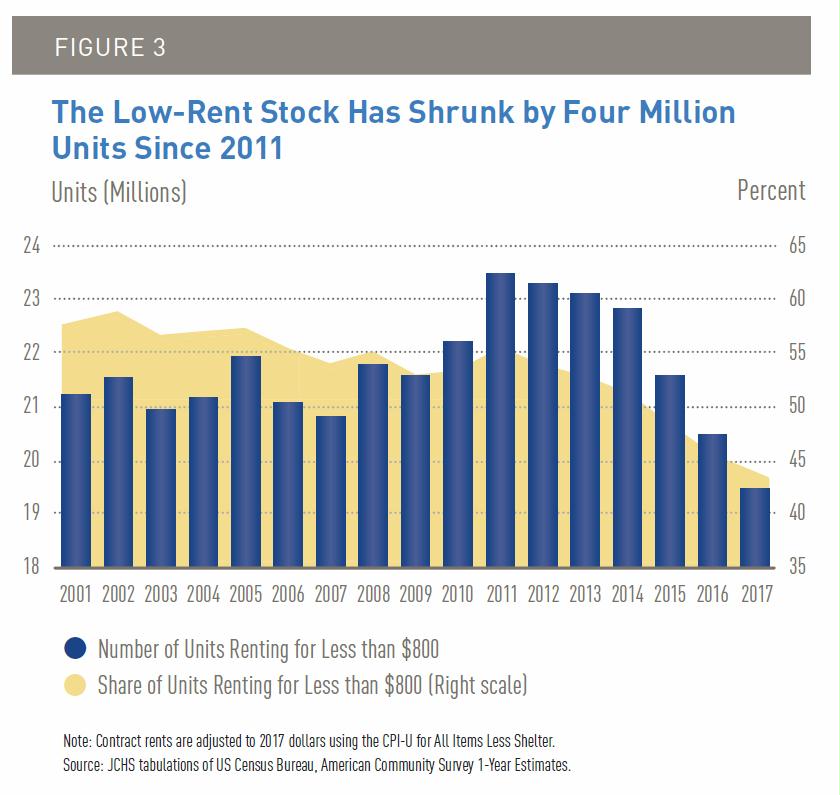

Good thing there's no inflation. #FedHistory

https://www.jchs.harvard.edu/state-nations-housing-2019

https://www.jchs.harvard.edu/state-nations-housing-2019

"Over the Next Decade, the Fastest-Growing Household Types Will Be Younger Families with Children and Older Single Persons and Empty-Nesters"

Oh, so not foreign money launderers, hedge funds, wealthy investors reaching for yield, and flippers?

Oh, so not foreign money launderers, hedge funds, wealthy investors reaching for yield, and flippers?

"Low inflation is indeed the problem of this era." - @newyorkfed President John Williams, September 4, 2019

https://www.newyorkfed.org/newsevents/speeches/2019/wil190904?mod=article_inline

https://www.newyorkfed.org/newsevents/speeches/2019/wil190904?mod=article_inline

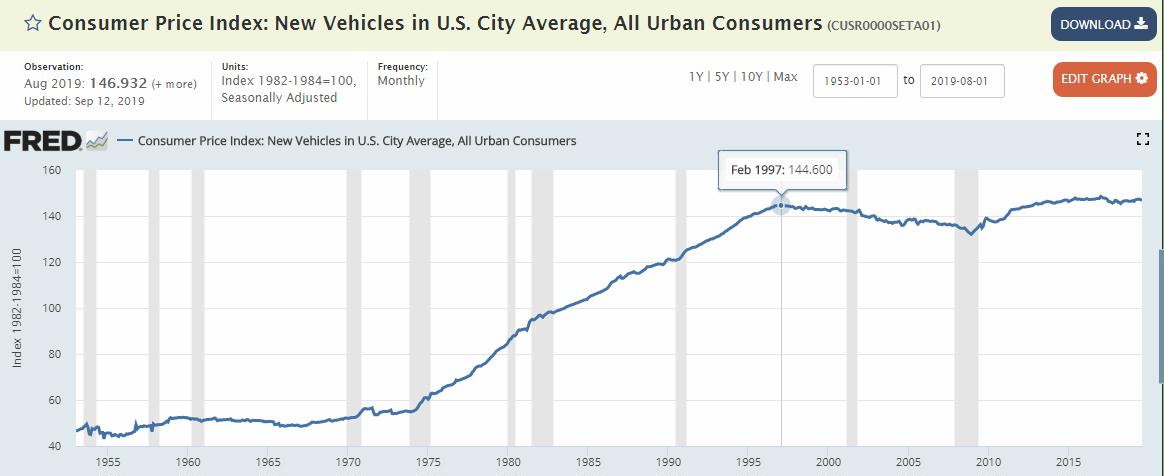

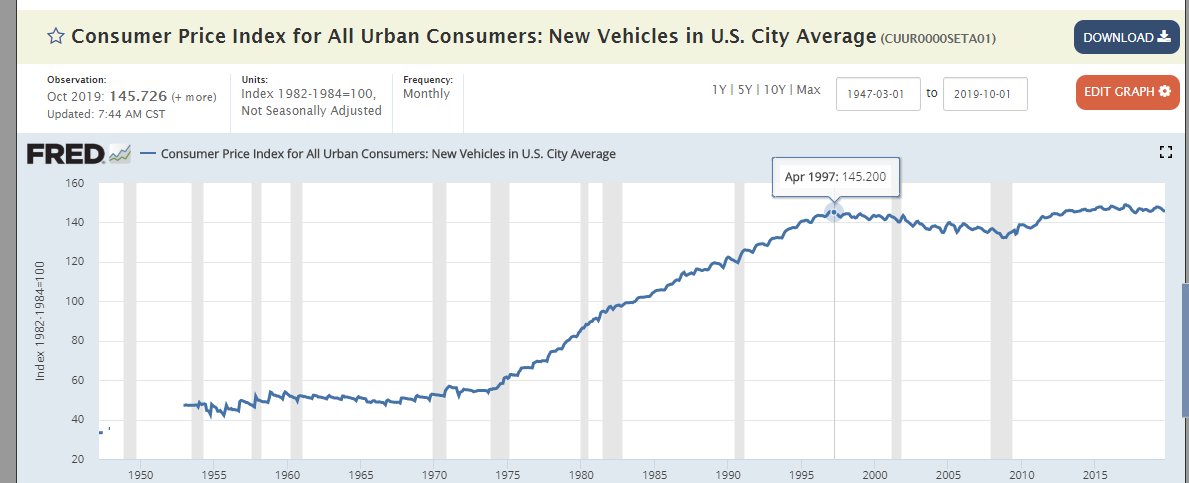

PhD: New car prices are about the same 1997.

You: What? Are you insane??

PhD: I'll have you know I have a Ph.D. in Economics from MIT, so yes, but that's besides the point. There has been no inflation.

You:

PhD: You can't argue with me, can you?

https://fred.stlouisfed.org/series/CUSR0000SETA01

You: What? Are you insane??

PhD: I'll have you know I have a Ph.D. in Economics from MIT, so yes, but that's besides the point. There has been no inflation.

You:

PhD: You can't argue with me, can you?

https://fred.stlouisfed.org/series/CUSR0000SETA01

"...the size of the average auto loan has grown by about a third over the past decade to $32,119 for a new car, according to Experian"

Good thing there's no inflation, right @federalreserve?

Good thing there's no inflation, right @federalreserve?

"average loan stretches for roughly 69 months, a record. Some last much longer. In the first half of the year, 1.5% of auto loans for new vehicles had terms of 85 months or longer, according to Experian. Five years ago, these eight- and 9-year loans were practically nonexistent"

If the BLS CPI-model, with its goofy hedonic adjustments & arbitrary weightings, greatly understates the real-world "cost of living", then official real-wage growth (and real-GDP growth) is too high, and may in fact be negative.

"The average cost of a new vehicle rose to $34,000 for the first time in October per J.D. Power & LMC Automotive, up from $32,700 a year ago." - @Grantspub

Fake news. According to the Fed (BLS), new auto prices haven't risen since 1997. https://fred.stlouisfed.org/series/CUUR0000SETA01

Fake news. According to the Fed (BLS), new auto prices haven't risen since 1997. https://fred.stlouisfed.org/series/CUUR0000SETA01

Wait a minute...maybe it's the @federalreserve and @BLS_gov with the fake news...

Oh, this is how they do it...

"Debt helps explain that pricing power: According to data from the NY Fed, auto loans outstanding stood at $1.3 trillion as of the end of the second quarter, up 4.8% from a year ago and up 76% over the past decade."

"Debt helps explain that pricing power: According to data from the NY Fed, auto loans outstanding stood at $1.3 trillion as of the end of the second quarter, up 4.8% from a year ago and up 76% over the past decade."

The BLS' CPI weighting for "Health Insurance" is less than their weighting for "Water and sewer and trash collection services."

https://www.bls.gov/cpi/tables/relative-importance/2018.pdf

https://www.bls.gov/cpi/tables/relative-importance/2018.pdf

Last month, my monthly health insurance premium was 30-times what my water and sewer bill was. @neelkashkari

Read on Twitter

Read on Twitter