"Audit the Fed" is a remarkably silly bill. https://twitter.com/RepThomasMassie/status/1080882491043573762

Their audited financial statements are available: https://www.federalreserve.gov/monetarypolicy/bst_fedfinancials.htm

Their balance sheet is available: http://www.federalreserve.gov/monetarypolicy/bst_fedsbalancesheet.htm

Full transcripts of their past meetings are available: https://www.federalreserve.gov/monetarypolicy/fomc_historical.htm

Their statement from the last meeting is available: https://www.federalreserve.gov/newsevents/pressreleases/monetary20181219a.htm

The minutes for December haven't beem released (yet!), but here are November's: https://www.federalreserve.gov/monetarypolicy/files/fomcminutes20181108.pdf

The Fed holds a press conference after every other meeting. https://www.federalreserve.gov/monetarypolicy/fomcpresconf20181219.htm

Their short-term projections of economic variables are here https://www.federalreserve.gov/monetarypolicy/files/fomcprojtabl20181219.pdf

Their statement on medium-term strategy is available: https://www.federalreserve.gov/newsevents/pressreleases/monetary20140917c.htm

Their statement on longer-term strategy is available. http://www.federalreserve.gov/monetarypolicy/files/FOMC_LongerRunGoals.pdf

They even publish their internal forecasting model! https://www.federalreserve.gov/pubs/ifdp/2005/835/revision/IFDP835r.pdf

The Fed chair meets with Congress twice a year: https://www.federalreserve.gov/newsevents/testimony/powell20180717a.htm

They answer questions from Congress (even silly ones):

Other Federal Reserve officials provide remarks from time to time: https://www.federalreserve.gov/newsevents/testimony.htm

Senior FOMC official discuss policy options in speeches: https://www.federalreserve.gov/newsevents/speeches.htm

What else do you want?

(h/t to Integralds in @rBadEconomics for compiling the initial links)

One last thing.

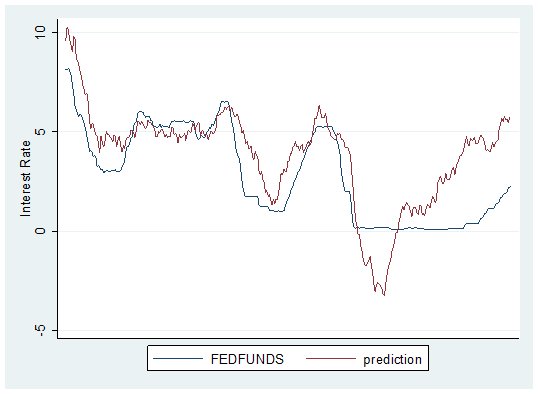

The interest rate is pretty easy to predict. Not only is the Fed very transparent, but you can effectively predict it with two variables - inflation and unemployment.

The interest rate is pretty easy to predict. Not only is the Fed very transparent, but you can effectively predict it with two variables - inflation and unemployment.

Economists call this a "Taylor rule" and there are some really good estimates. But here's a simple one: The Federal Reserve will set interest rates close to 5 + inflationx2 - unemployment.

Note that it's very accurate until 2008, at which the FOMC couldn't set rates lower because of the Zero Lower Bound. Right now, rates are a bit lower than the Taylor rule would predict because the FOMC thinks there's more slack in the labor market than unemployment alone suggests

(A belief that corresponds with today's jobs announcement)

Read on Twitter

Read on Twitter