1) This thread will answer questions people have asked during the past month.

I'll attempt to answer the question: Will Donald Trump put America back on the gold standard?

I'll explain what the gold standard is, why it's not used today and why some experts think it should be

I'll attempt to answer the question: Will Donald Trump put America back on the gold standard?

I'll explain what the gold standard is, why it's not used today and why some experts think it should be

2) I'll offer my thoughts on the likelihood that the President will change the way the Federal Reserve operates or whether he'll do away with it completely.

4) I'll offer my thoughts on the sustainability of US government spending levels and its mounting debt.

5) I'll offer my thoughts (and some prophetic perspective) on the likelihood of a stock market collapse.

6) First, we should look at the fundamental question: What is money?

Money is simply an object that is accepted as payment for good and services.

Money is simply an object that is accepted as payment for good and services.

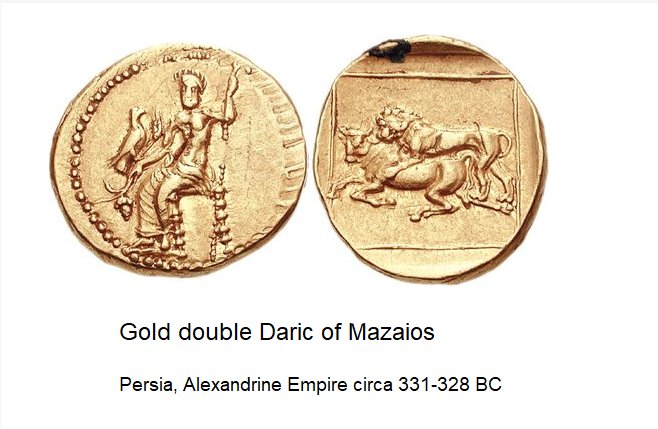

8) Even the most ancient civilizations used gold and silver as money.

That's largely due to its scarcity. The more scarce something is, the more value it tends to have to society.

That's largely due to its scarcity. The more scarce something is, the more value it tends to have to society.

9) Gold has been accepted as money during 99% of human history. It's only recently that it has not been accepted as money.

Some nations are accepting gold once again but not because the government chose to make it their official currency.

Some nations are accepting gold once again but not because the government chose to make it their official currency.

10) When a nation suffers currency devaluation the way Venezuela and Argentina have, they revert back to a system of bartering objects of value instead of using official currency. Small items of gold or silver will get you anything you need. https://schiffgold.com/key-gold-news/faced-rampant-inflation-argentines-turn-barter/

11) Most nations today use printed paper or plastic currency. These currencies have no intrinsic value. They only have value because we voluntarily accept them in exchange for goods and services.

12) If we refused to accept printed currency, because it has no intrinsic value, it is worth nothing.

(If a gold coin were rejected as currency, it could be smelted into a lump and sold at market value.)

(If a gold coin were rejected as currency, it could be smelted into a lump and sold at market value.)

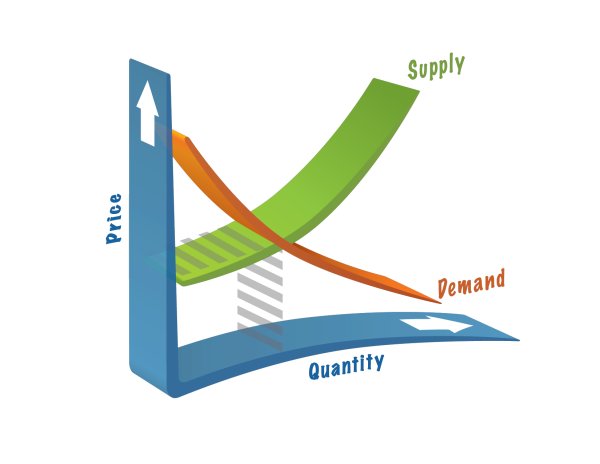

13) The value of an object used as currency is directly related to its abundance or scarcity.

The more abundant something is, the less valuable it is.

The more scarce something is, the more valuable it is.

It's the law of supply and demand.

The more abundant something is, the less valuable it is.

The more scarce something is, the more valuable it is.

It's the law of supply and demand.

14) When currency is printed in greater amounts, its relative value decreases.

As a currency's value decreases, it requires more money to buy a given item.

As currency value falls, prices rise.

Rising prices and the falling value of money is known as inflation.

As a currency's value decreases, it requires more money to buy a given item.

As currency value falls, prices rise.

Rising prices and the falling value of money is known as inflation.

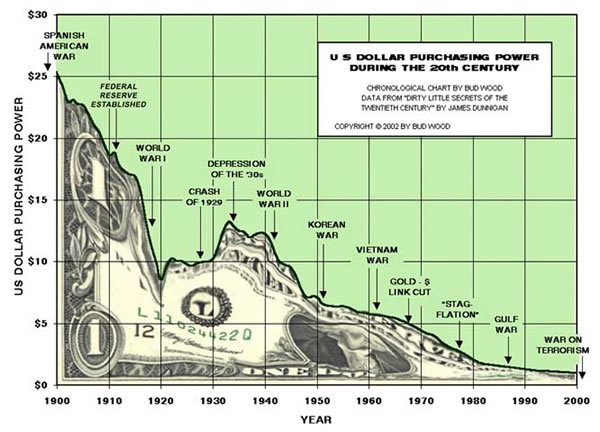

15) Over the last century, the value of the dollar (its purchasing power) has decreased dramatically.

16) There are a number of reasons why the dollar has decreased in value. It isn't only because more dollars have been printed. But it's a necessary point to make because the next discussion will require us to understand the relationship of an object's scarcity to its value.

17) The Continental paper money that was issued during the Revolutionary War (1775-1783), was not backed by a physical asset such as gold or silver. It lost all value shortly after the war because people stopped accepting it as payment for goods and services.

18) There were no less than six different types of dollar bills in circulation following the revolution. All these paper currencies were convertible to gold “on demand”, which meant that one could walk into a bank and be given gold for the value of their dollars.

19) This, by the way, was the original "gold standard" as it was used by the nation's founders and which was implemented successfully over most of the next century.

20) During the Civil War, (1862) because thousands of troops had to be paid, ships and artillery had to be built and the treasury did not have adequate gold supplies on hand, President Lincoln issued a paper dollar that was not fully exchangeable for gold.

21) The new Federal Dollars were printed with green ink, and became known as “greenbacks" or "funny money."

22) The value of greenbacks fluctuated wildly with military wins and losses because this form of currency wasn't tied to the price of gold. The Inflation rate for greenbacks soared as high as 75%.

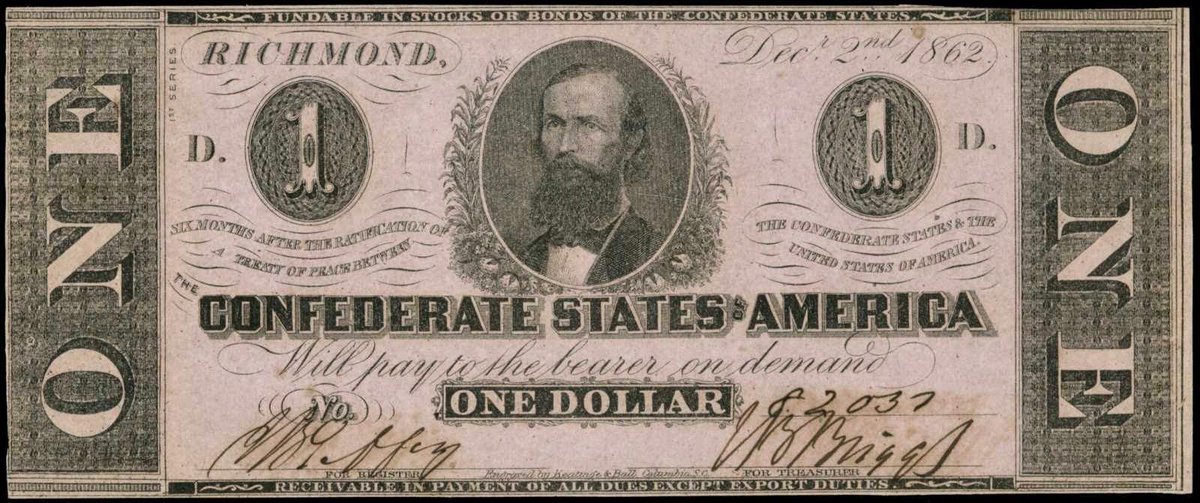

23) As a lesson in how demand affects the value of non-commodity backed currency, Confederate dollars, that were also issued during this period, followed the fate of the Confederacy and were worthless by the end of the war.

24) Officially, the US didn't begin with a gold standard, but with a "bimetallic" standard. Both gold and silver were used to define the monetary unit. The first coinage act defined the dollar as 371.25 grains of pure silver minted with alloy into a coin of 416 grains.

25) Gold coins were also authorized in denominations of $10 (eagle) and $2.50 (quarter-eagle). The ratio of silver to gold in a given denomination was 15 to 1.

This document provides a nice history of the gold standard. https://fas.org/sgp/crs/misc/R41887.pdf

This document provides a nice history of the gold standard. https://fas.org/sgp/crs/misc/R41887.pdf

26) Following the Civil War, America went back to using money exclusively backed by either gold or silver.

(But Lincoln's greenback seemed to put into the conscience of Americans the idea that paper currency not backed by gold or silver was an acceptable form of money.)

(But Lincoln's greenback seemed to put into the conscience of Americans the idea that paper currency not backed by gold or silver was an acceptable form of money.)

27) During the 1800's state banks issued bank notes, certificates and coins of various denominations.

28) During the War of 1812, the Treasury issued treasury notes that were a promise to repay an amount of gold or silver at a later date though they were not declared to be legal tender.

29) During the Civil War, the Federal Government created a National Bank system that issued notes similar to ones issued by state banks. These notes were backed by government bonds.

30) Because bonds earned interest and state issued notes did not, banks made profits from the issuance of these notes. The notes were not legal tender, but were accepted because they were redeemable in gold or in legal tender notes.

31) State bank notes were soon driven out of circulation when a tax of 10% was imposed on them. The new national bank notes were of uniform design and were perceived to be a safe form of currency.

32) Slowly, the federal government began forcing states out of the business of issuing currency. In many respects, this was the beginning of the end of gold standard although it would not come to fruition for many years.

33) The early 20th century brought many challenges to the gold standard including the creation of the Federal Reserve and the first World War.

34) At the onset of World War I, U.S. corporations owed large debts to European entities that they paid with gold. This caused large gold outflows from the US and on July 31, 1914, the New York Stock Exchange closed and the gold standard was temporarily suspended.

35) To protect the exchange value of the dollar, the Treasury Department authorized state and national banks to issue emergency non-gold backed currency under the Aldrich-Vreeland Act.

The newly created Federal Reserve would guarantee debts to foreign creditors.

The newly created Federal Reserve would guarantee debts to foreign creditors.

36) This strategy proved successful as an emergency measure, and the Aldrich-Vreeland notes were retired beginning in November 2014.

The gold standard was restored when the New York Stock Exchange re-opened in December 1914.

The gold standard was restored when the New York Stock Exchange re-opened in December 1914.

37) While the US remained neutral during World War I, it maintained a gold standard, doing so without restricting the import or export of gold from 1915 to 1917. Nations involved in the war suspended their gold standard.

38) As the United States became involved in World War I, President Wilson banned gold exports, effectively suspending the gold standard for foreign exchange.

39) After the war, the US and European countries slowly returned to their gold standards, though in a somewhat different form.

40) The stock market crash of 1929 led to the Great Depression. Some have blamed the gold standard for the Great Depression. Others have blamed the Federal Reserve.

41) During the Great Depression, every major currency abandoned the gold standard. Among the earliest was the Bank of England. In 1931, speculators demanded gold in exchange for currency, which threatened the solvency of the British monetary system.

42) In the US, the Federal Reserve was forced to raise interest rates to protect the gold standard. After bank runs became more pronounced in early 1933, people hoarded gold as distrust for banks led to distrust of paper money.

43) In 1933, Congress and the President suspended the gold standard except for foreign exchange. They revoked gold as legal tender for debts and banned private ownership of gold coins in significant amounts.

44) Although the dollar would remain officially connected to the price of gold until 1971, for practical purposes, the true gold standard as it had been practiced ended in 1933.

45) The Gold Reserve Act fixed the value of the dollar at $35 per ounce, making it very attractive for foreign buyers (and making foreign currencies more expensive). This led to more conversion of gold into dollars, allowing the U.S. to effectively corner the world gold market.

46) The post-World War II Bretton Woods agreement valued all world currencies in terms of U.S. dollars. The U.S. government was required to maintain both a $35 per troy ounce market price of gold and the conversion to foreign currencies.

47) By 1968, the system had become too complicated to manage. The effort to control the private market price of gold was abandoned and a two-tier system was put in place. All central-bank transactions in gold were insulated from the free market.

48) Central banks traded gold between themselves at $35 per ounce but did not trade with the private market. The private market traded gold at the spot market price.

49) In 1971, President Richard Nixon ordered the cancellation of the direct convertibility of the dollar to gold, ending the gold standard completely.

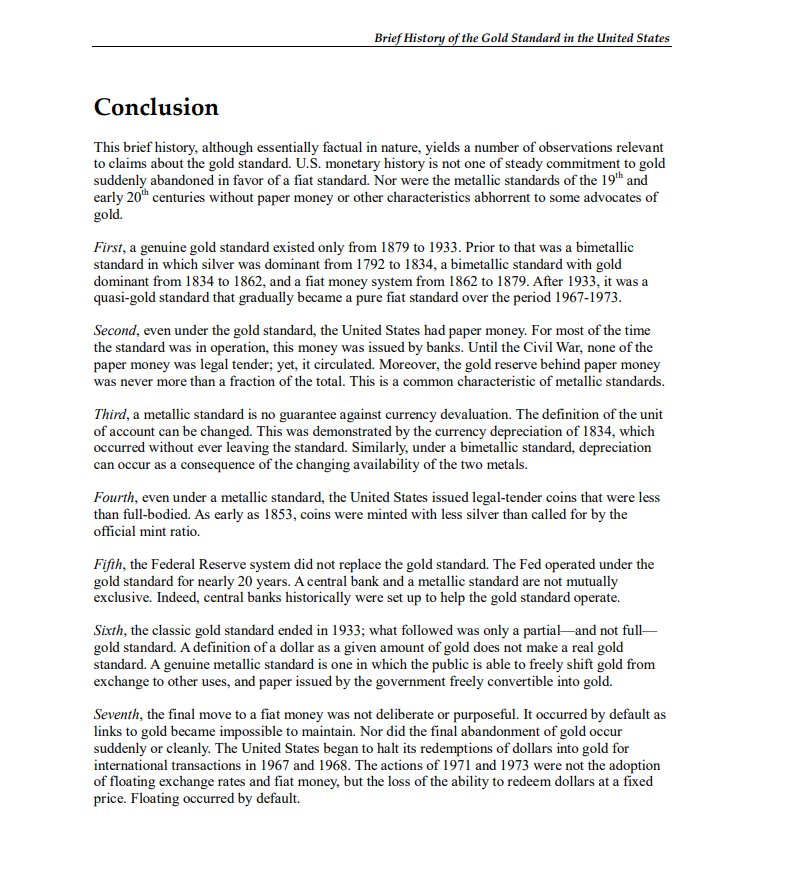

49) Conclusions from the "Brief History of the Gold Standard in the United States"

https://fas.org/sgp/crs/misc/R41887.pdf

https://fas.org/sgp/crs/misc/R41887.pdf

50) Although Nixon made the decision to end convertibility of the dollar to gold in 1971, a series of negotiations including the "Smithsonian Agreement" prolonged the gold standard until 1973. The definition of the dollar in terms of gold was changed by the legislature in 1976.

51) Our next questions is: Would it would be wise for the US to return to the gold standard?

If the US returns to the gold standard, the entire world returns, since the dollar is the world's reserve currency and other currencies will follow suit.

If the US returns to the gold standard, the entire world returns, since the dollar is the world's reserve currency and other currencies will follow suit.

52) Returning to the gold standard does not necessarily mean the end of the Federal Reserve. The Fed oversaw nearly two decades of monetary policy from 1914-1933 when the US was on a true gold standard.

53) We must evaluate the performance of the Fed, the current situation regarding our monetary supply, economic growth, inflation, debt and other factors before we can determine the best course of action.

We also need to know how the President views the Fed and the gold standard

We also need to know how the President views the Fed and the gold standard

54) Let's look next at monetary supply (the amount of money in circulation) and debt.

Some nations have attempted to get out of debt by printing more money. The newly printed money is then used to settle the debt that is owed.

Some nations have attempted to get out of debt by printing more money. The newly printed money is then used to settle the debt that is owed.

55) From 1921-1923, the Weimar Republic of Germany incurred massive debt. The government printed money day and night in an attempt to repay it. The printing of money cause one the worst cases of hyperinflation in history and led to economic collapse.

https://en.wikipedia.org/wiki/Hyperinflation_in_the_Weimar_Republic

https://en.wikipedia.org/wiki/Hyperinflation_in_the_Weimar_Republic

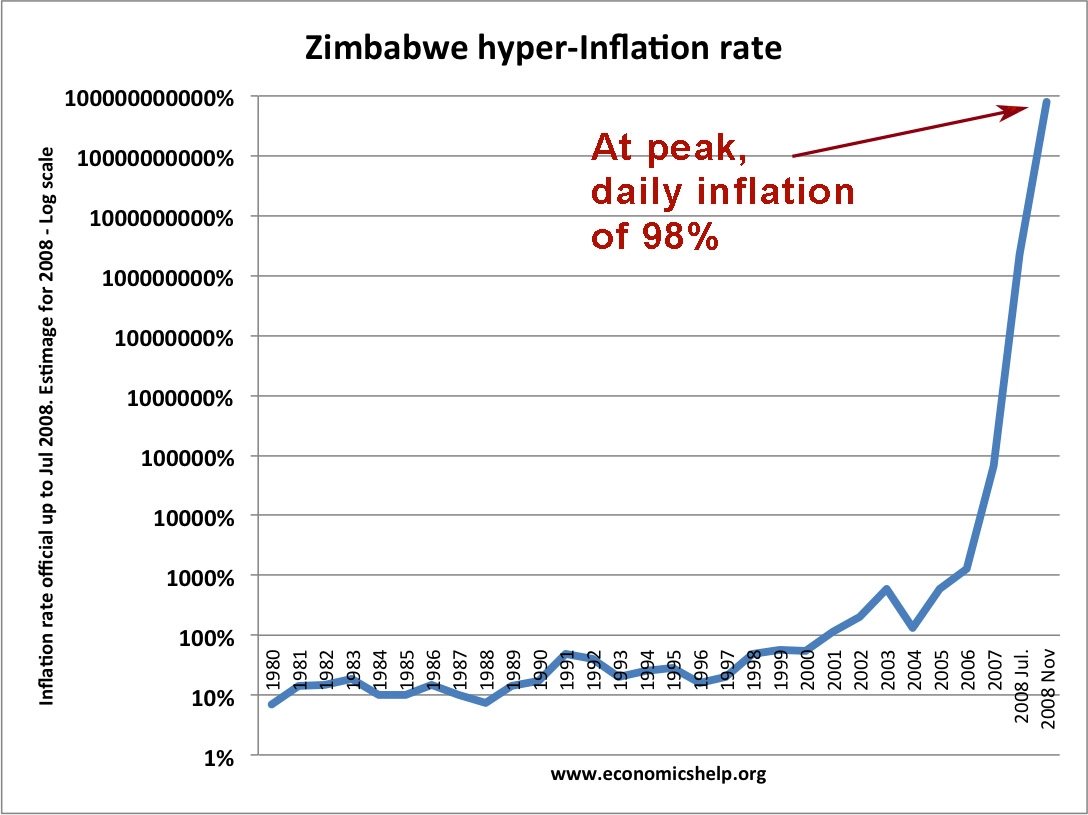

56) From 2006-2008 Zimbabwe suffered massive government debt. Their response was to print more money to repay it. The inflation rate for November of 2008 was 79,600,000,000%.

Roughly every day, prices doubled.

https://www.economicshelp.org/blog/390/inflation/hyper-inflation-in-zimbabwe/

Roughly every day, prices doubled.

https://www.economicshelp.org/blog/390/inflation/hyper-inflation-in-zimbabwe/

57) Argentina suffered a severe economic crisis from 1998-2002. Poor fiscal management, hyperinflation and loss of confidence in their currency were major contributing factors.

https://www.jec.senate.gov/public/_cache/files/5fbf2f91-6cdf-4e70-8ff2-620ba901fc4c/argentina-s-economic-crisis---06-13-03.pdf

https://www.jec.senate.gov/public/_cache/files/5fbf2f91-6cdf-4e70-8ff2-620ba901fc4c/argentina-s-economic-crisis---06-13-03.pdf

58) Those who study the subject have found that hyperinflation (a dramatic increase in prices) is the culprit in nearly all cases of economic collapse.

59) These same experts have also concluded that the best predictor of hyperinflation (and therefore economic collapse) is a high debt to GDP ratio.

60) That is what one would expect since massive government debt is what compels a nation to print money. The money is used to repay the debt but in doing so, the nation's currency is devalued which causes hyperinflation and economic collapse.

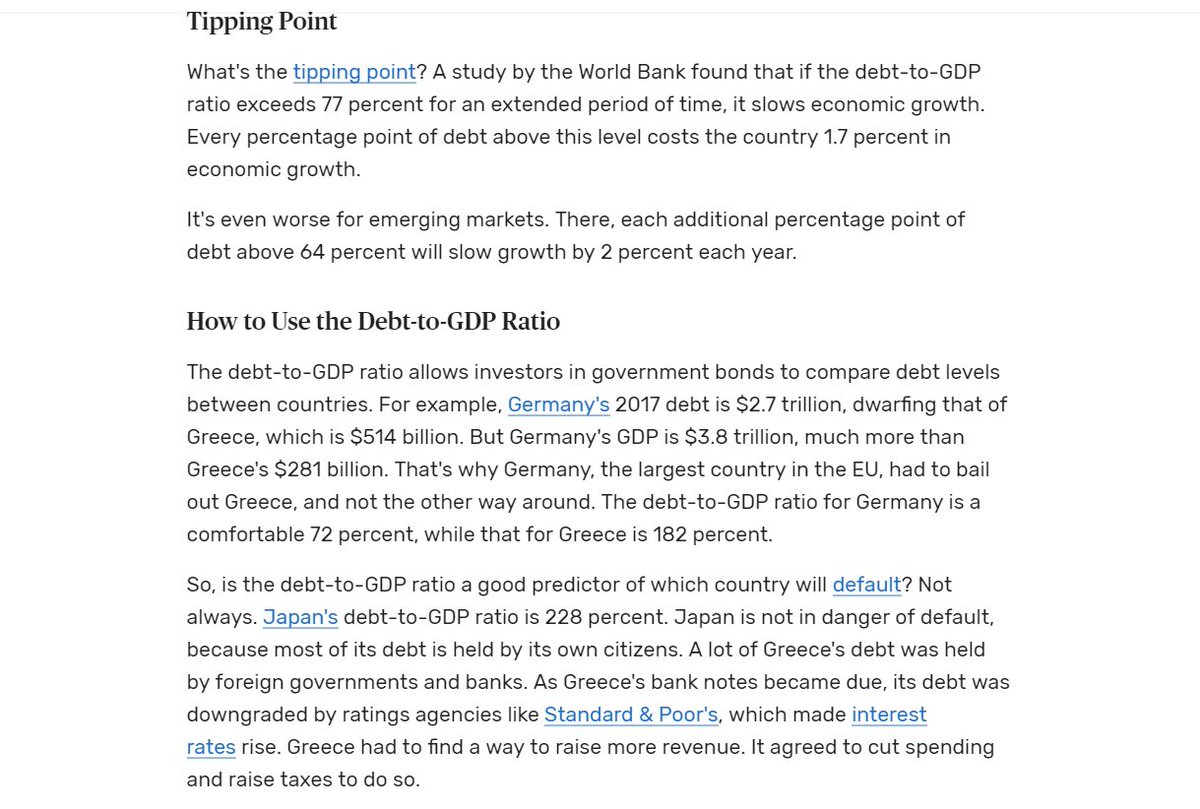

61) Researchers have found that once a nation exceeds an 80% debt to GDP ratio, they significantly increase their risk of causing hyperinflation and suffering an economic crisis.

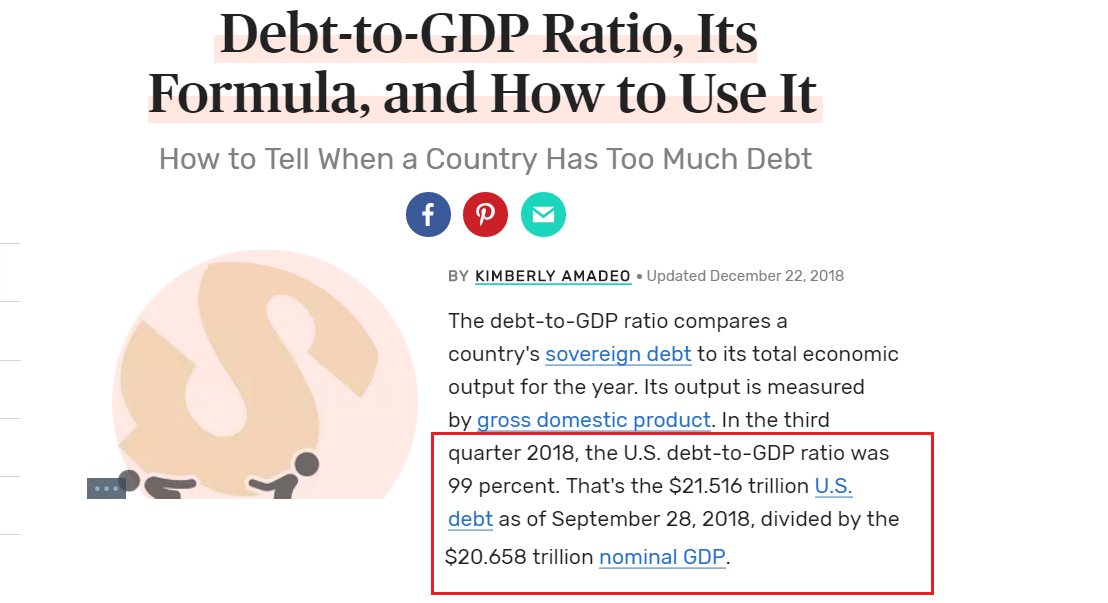

62) A study by the World Bank found that a 77% debt to GDP ratio tends to slow economic growth. For developing nations, even a 64% debt to GDP is bad news.

(A country that spends money on debt, can't spend money on things that stimulate the economy.)

https://www.thebalance.com/debt-to-gdp-ratio-how-to-calculate-and-use-it-3305832

(A country that spends money on debt, can't spend money on things that stimulate the economy.)

https://www.thebalance.com/debt-to-gdp-ratio-how-to-calculate-and-use-it-3305832

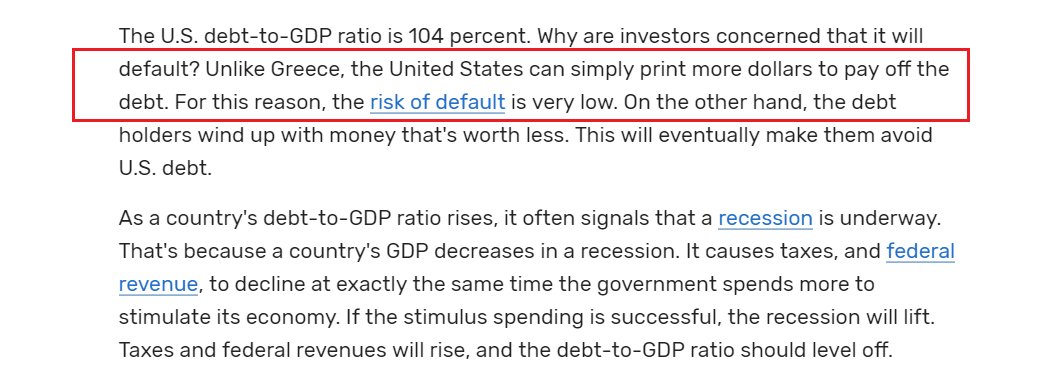

63) Currently, the US debt to GDP ratio is close to 100%.

(Our GDP is around $21 trillion and so is our debt.)

(Our GDP is around $21 trillion and so is our debt.)

64) Side note: Japan leads all nations in debt to GDP ratio at 228%.

Most nations would have suffered economic collapse long ago with those numbers but Japan owns most of its debt so it can repay it whenever it wants (or not).

Most nations would have suffered economic collapse long ago with those numbers but Japan owns most of its debt so it can repay it whenever it wants (or not).

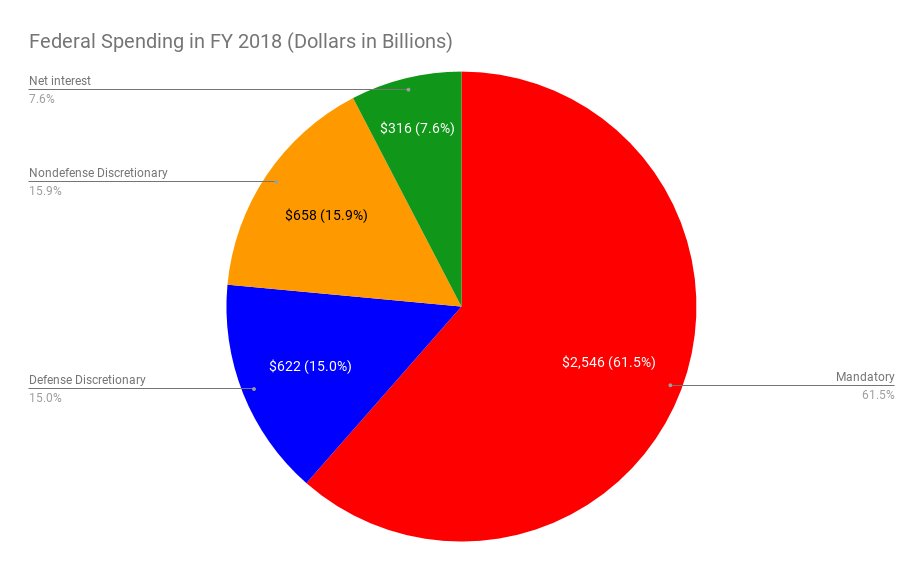

65) Currently, the total US Federal budget is a little more than 4 trillion dollars.

2.5 trillion is spent on non-discretionary items.

Around 700 billion is spent on the military.

More than 300 billion is spent on the interest payment on the federal debt.

2.5 trillion is spent on non-discretionary items.

Around 700 billion is spent on the military.

More than 300 billion is spent on the interest payment on the federal debt.

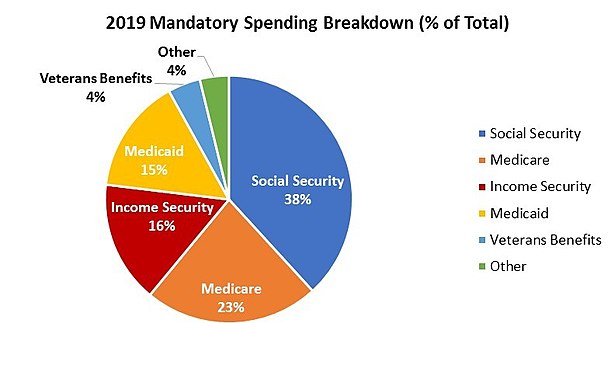

66) The 2.5 trillion in nondiscretionary items is spent on federally mandated programs like Medicare, Medicaid, Social Security and veteran's benefits.

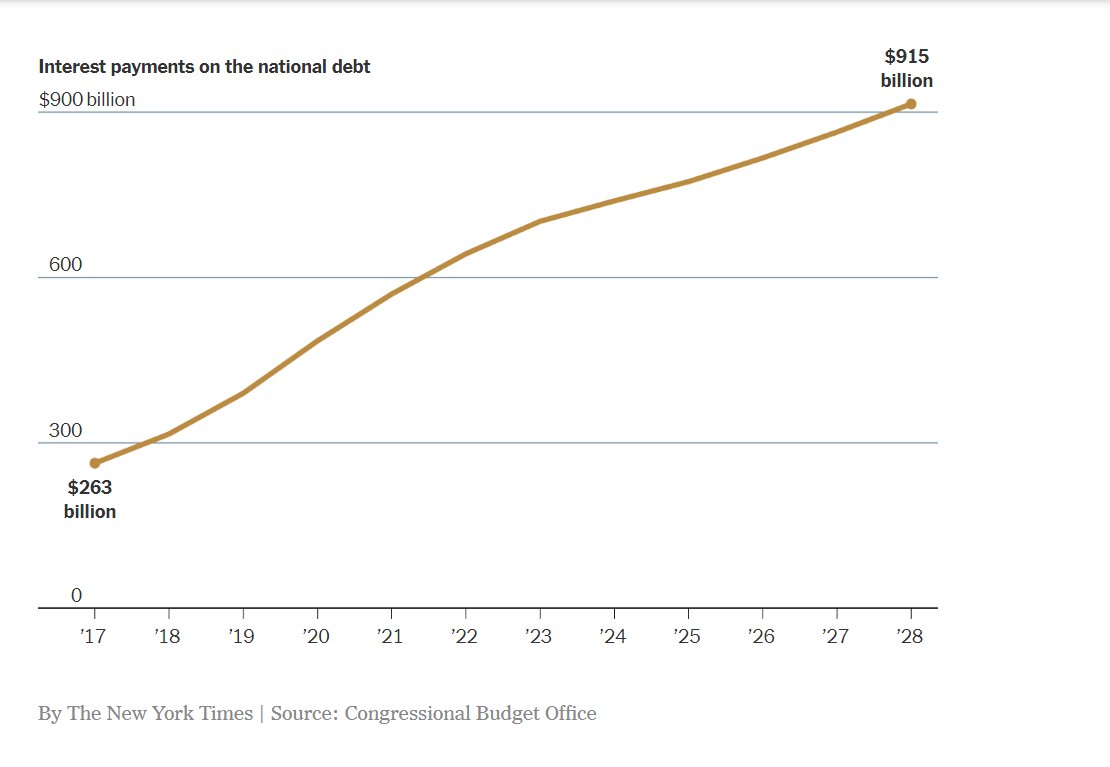

67) Because our federal debt keeps rising we will soon spend more on the interest on our debt than on our military.

(Note, we aren't paying down the principal.)

In ten years, we may be spending a trillion dollars a year on debt repayment. https://www.nytimes.com/2018/09/25/business/economy/us-government-debt-interest.html

(Note, we aren't paying down the principal.)

In ten years, we may be spending a trillion dollars a year on debt repayment. https://www.nytimes.com/2018/09/25/business/economy/us-government-debt-interest.html

68) Some people aren't concerned about rising debt. They point out that we can always print more money to repay it.

You know... the way Zimbabwe and the Weimar Republic did.

https://www.thebalance.com/debt-to-gdp-ratio-how-to-calculate-and-use-it-3305832

You know... the way Zimbabwe and the Weimar Republic did.

https://www.thebalance.com/debt-to-gdp-ratio-how-to-calculate-and-use-it-3305832

69) Our debt problem can't be solved by printing more money.

What happens to our economy and national security when we can't pay for other programs because we owe a trillion dollars in debt payments?

That is the most serious problem we currently face. https://www.thebalance.com/interest-on-the-national-debt-4119024

What happens to our economy and national security when we can't pay for other programs because we owe a trillion dollars in debt payments?

That is the most serious problem we currently face. https://www.thebalance.com/interest-on-the-national-debt-4119024

70) When a nation passes the tipping point—when it cannot realistically repay its debt to other nations, there is only one option left:

It must default on its debt.

It must default on its debt.

71) If the US were ever to default on its debt, the ramifications would be earth-shaking.

The central banks of the world are depending on us to make good on our debt—eventually (even though we're only keeping up on the interest payment right now.)

The central banks of the world are depending on us to make good on our debt—eventually (even though we're only keeping up on the interest payment right now.)

72) A US default would likely collapse the world's central banks.

The $1 trillion we owe China and Japan would never be repaid.

The world's stock markets would implode and trading would be halted.

It could precipitate another world war.

The $1 trillion we owe China and Japan would never be repaid.

The world's stock markets would implode and trading would be halted.

It could precipitate another world war.

73) As uncomfortable as that possibility may be, the more time passes and the larger our debt grows, the more likely we are to default on it.

74) Some people are hoping that Trump has a silver bullet. A secret source of money, like Leo Wanta, that will magically repay our debt. That would be nice but I don't know if it's a realistic possibility. https://www.newsmax.com/pre-2008/what-the-truth-about/2006/09/17/id/687589/

75) Let's look at the money currently in circulation.

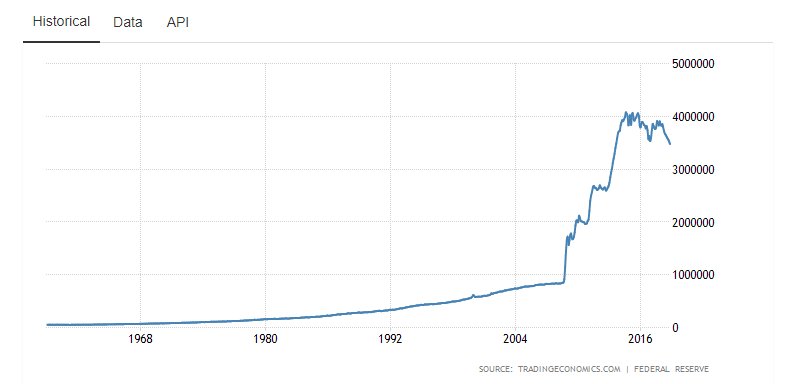

There are about 4 trillion dollars in circulation now. The monetary supply was static for years but bank failures in 2008 caused the Fed to print trillions of new dollars in an attempt to avoid a complete market collapse.

There are about 4 trillion dollars in circulation now. The monetary supply was static for years but bank failures in 2008 caused the Fed to print trillions of new dollars in an attempt to avoid a complete market collapse.

76) One would think that printing all that new money would lead to significant inflation. Keynesian economic theory tells us that the more currency there is in circulation, the less each dollar is worth and the higher prices will go— resulting in inflation.

77) But inflation didn't rise as a result of all that money being printed. In fact, the rate of inflation fell.

Why?

Why?

78) Because the money never reached consumers. It was loaned to banks who didn't loan it to average people like us due to new lending laws.

Financial institutions invested the money in the market and the new money inflated the stock market instead.

https://www.thebalance.com/what-is-money-supply-3306128

Financial institutions invested the money in the market and the new money inflated the stock market instead.

https://www.thebalance.com/what-is-money-supply-3306128

79) Ever since 2009, we've been in the midst of a market filled with price bubbles. Assets are overvalued. It's only a matter of time before prices collapse. (Maybe it's already happening.) https://nypost.com/2018/12/26/why-i-keep-warning-you-about-the-stock-market-bubble/

80) Adding insult to injury, the Federal Reserve has been raising interest rates.

That's had a negative effect on the stock market.

With no signs of inflation in sight, people are asking why. https://nypost.com/2018/12/22/blame-the-federal-reserve-for-the-tanking-stock-market/

That's had a negative effect on the stock market.

With no signs of inflation in sight, people are asking why. https://nypost.com/2018/12/22/blame-the-federal-reserve-for-the-tanking-stock-market/

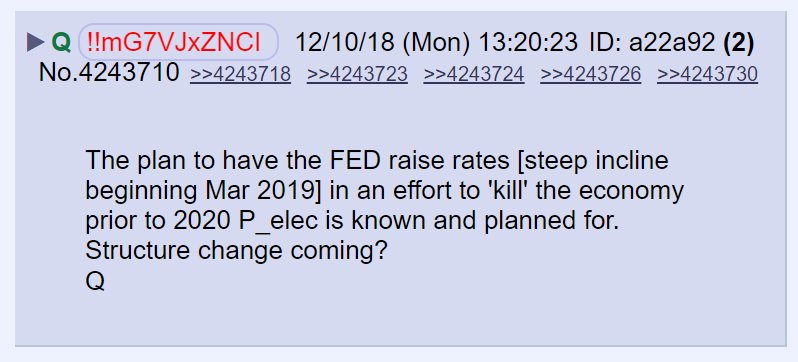

81) Q said POTUS is aware of the Fed's plans to increase interest rates throughout 2019 in an attempt to stall the economy, thereby preventing Trump from being reelected in 2020.

Q indicated Trump has plans to restructure the Fed.

Q indicated Trump has plans to restructure the Fed.

82) As a candidate for President, Donald Trump didn't express much fondness for the Federal Reserve. (Politics being what they are, I would imagine he held back some of his real feelings.)

83) In the same interview, Trump shared his thoughts on the US returning to the gold standard, noting it would be difficult because we don't have the gold.

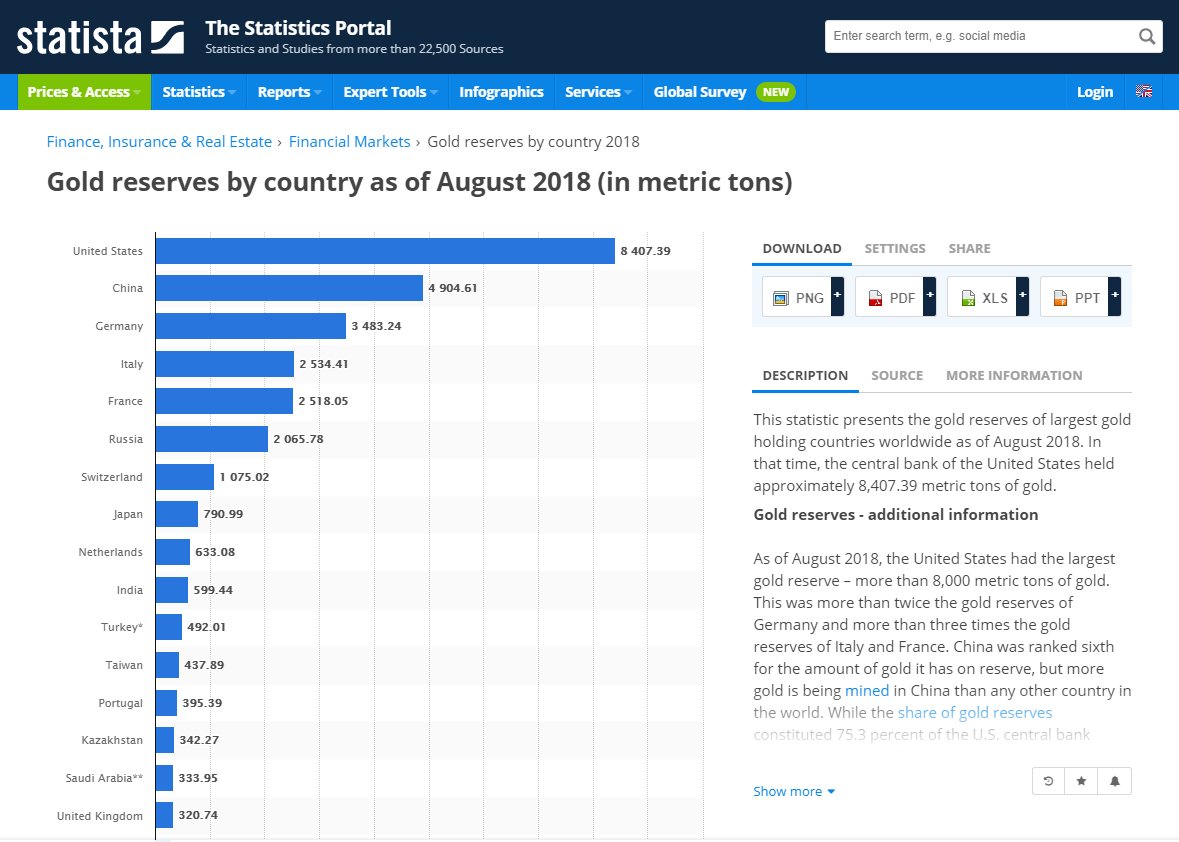

84) I don't know if Trump was ignorant or just pretending to be, but the US has the most gold in the world at 8.4 metric tons. China has 4.9 tons and Germany has 3.4 tons.

(It's impossible to know how accurately nations are when reporting gold reserves.)

https://www.statista.com/statistics/267998/countries-with-the-largest-gold-reserves/

(It's impossible to know how accurately nations are when reporting gold reserves.)

https://www.statista.com/statistics/267998/countries-with-the-largest-gold-reserves/

85) In his question and answer session a couple of weeks ago, Q didn't mince words. He said we have the gold it will destroy the Fed.

86) Some commentators believe POTUS will eventually take control of the Fed. https://www.cnbc.com/2018/07/20/trump-poised-to-take-control-of-the-federal-reserve.html

87) People who know Trump know he's always had a love (perhaps obsession is a better word) for gold. https://www.bloomberg.com/opinion/articles/2016-07-22/donald-trump-loves-gold-and-don-t-you-forget-it

88) Trump's comments on the gold standard didn't fall on deaf ears. Economists and political commentators have been writing about the idea ever since.

https://www.americanthinker.com/articles/2018/03/is_trump_serious_about_returning_to_a_gold_standard.html

https://www.americanthinker.com/articles/2018/03/is_trump_serious_about_returning_to_a_gold_standard.html

89) Some think returning to the gold standard would make America great again.

https://www.forbes.com/sites/ralphbenko/2017/02/25/president-trump-replace-the-dollar-with-gold-as-the-global-currency-to-make-america-great-again/#449786234d54

https://www.forbes.com/sites/ralphbenko/2017/02/25/president-trump-replace-the-dollar-with-gold-as-the-global-currency-to-make-america-great-again/#449786234d54

90) A couple of weeks before the 2016 election, this writer wanted both candidates to know the gold standard deserved serious consideration.

http://thepulse2016.com/ralph-benko/2016/10/19/memo-to-president-trump-or-president-clinton-the-gold-standard-made-america-both-good-and-great/

http://thepulse2016.com/ralph-benko/2016/10/19/memo-to-president-trump-or-president-clinton-the-gold-standard-made-america-both-good-and-great/

91) I can't say with any certainty whether the President will return America to the gold standard. I also can say with certainty what his plans are for the Federal Reserve.

The two are not mutually exclusive.

We could have both.

Or neither.

The two are not mutually exclusive.

We could have both.

Or neither.

92) If we were to return to the gold standard, the effect it would have on us and our investments would depend on the way the gold standard was implemented.

There are many possibilities. Each would have a very different outcome.

There are many possibilities. Each would have a very different outcome.

93) In 1982, the Cato Institute evaluated several proposals on how we might return to the gold standard.

(I found this article to be the most helpful of all the information I've read on this subject.)

https://object.cato.org/sites/cato.org/files/pubs/pdf/pa016.pdf

(I found this article to be the most helpful of all the information I've read on this subject.)

https://object.cato.org/sites/cato.org/files/pubs/pdf/pa016.pdf

94) Fiat currency is money that is not backed by a commodity.

Monetary theorist Robert Barro noted that a major problem with fiat currency is its tendency to be politicized.

Monetary theorist Robert Barro noted that a major problem with fiat currency is its tendency to be politicized.

95) Economist William Fellner admitted that fiat currency has throughout history been misused by those in power.

96) A second problem with fiat currency is the federal government's role as the sole issuer of money. Hyak noted there is no legitimate reason for a government to take such a position.

97) Milton Friedman pointed out that a true commodity based currency would have no need of government meddling or regulation.

98) Most proposals to return to the gold standard evaluated by the Cato Institute seemed inadequate and would likely to lead to the use of fiat currency controlled by a central bank. One proposal held promise but only if modified. (A summary is provided at the bottom of page 3)

99) Yeager argued that anything less than a 100% free market system devoid of government regulation would lead to the problems seen in past and present monetary systems.

100) Former Fed chair Alan Greenspan has had many positive things to say about gold and the gold standard.

https://www.americanbullion.com/8-eloquent-quotes-on-gold-by-alan-greenspan/

https://www.americanbullion.com/8-eloquent-quotes-on-gold-by-alan-greenspan/

101) Between 2011 and 2014, I received a number of dreams from God about a coming stock market collapse. I also received revelation about what life might be like in the aftermath.

(I've had very little revelation from God since then on that subject.)

(I've had very little revelation from God since then on that subject.)

102) I've been under the impression that warnings about a possible stock market collapse were behind us since Donald Trump had been elected and the stock market had been doing well.

Recently, I've been reconsidering my views on that.

Recently, I've been reconsidering my views on that.

103) If you're interested, I wrote an ebook (it's 99 cents) explaining much of what I've shared here about economics. I discuss my dreams about economic collapse and provide a hopeful look at what life might be like afterward. https://amzn.to/2RqmtZS

104) That brings us to the end of this thread.

(Thanks for coming along on the journey.)

(Thanks for coming along on the journey.)

Read on Twitter

Read on Twitter