Reading some Q2 fund letters from the underutilized resource that is r/securityanalysis and stumbled on a possible explanation of why value has underpreformed recently and why it might continue...

https://www.reddit.com/r/SecurityAnalysis/comments/8x2hbr/q2_2018_letters_reports/

https://www.reddit.com/r/SecurityAnalysis/comments/8x2hbr/q2_2018_letters_reports/

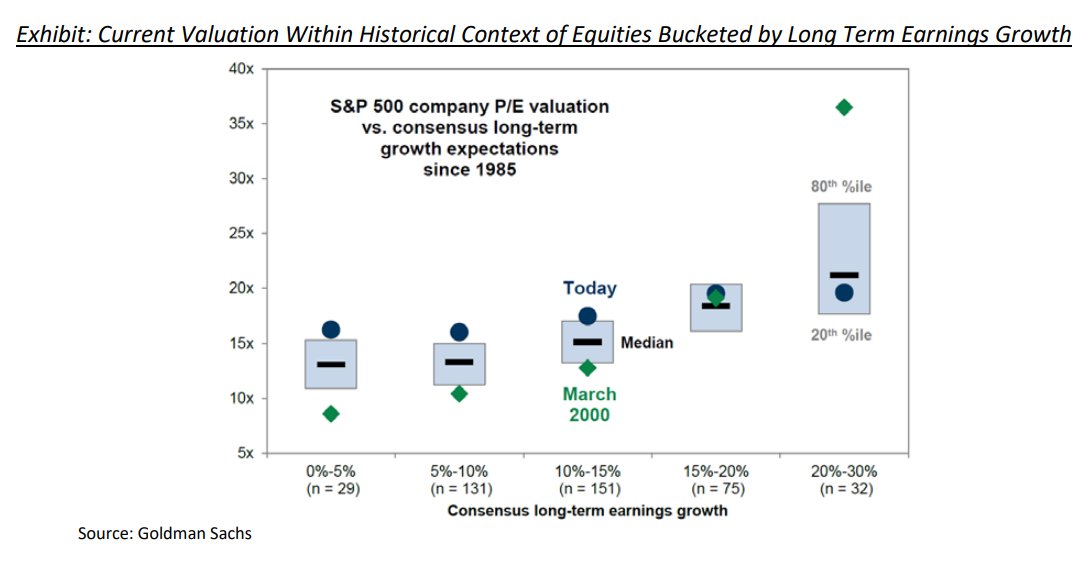

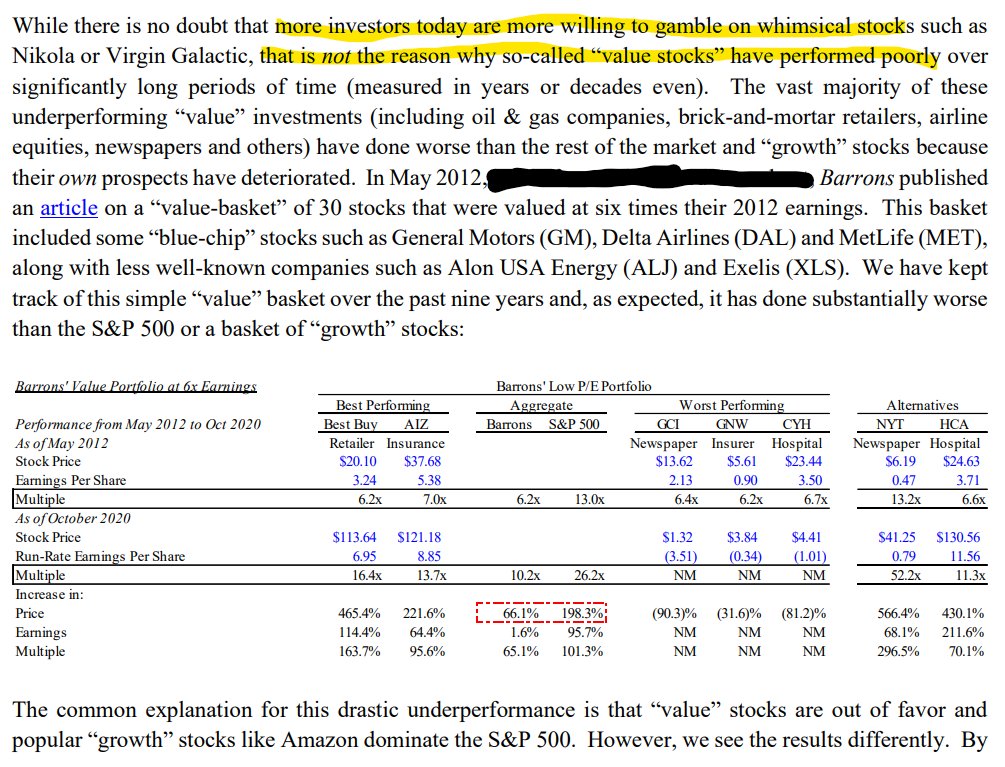

Exhibit A from Blue Hawk's Q2 letter. Compared to history, low growth (or traditional "value" names) appear to be the most overvalued stocks in the market, and "growth" names appear to be the 𝑜𝑛𝑙𝑦 undervalued stocks

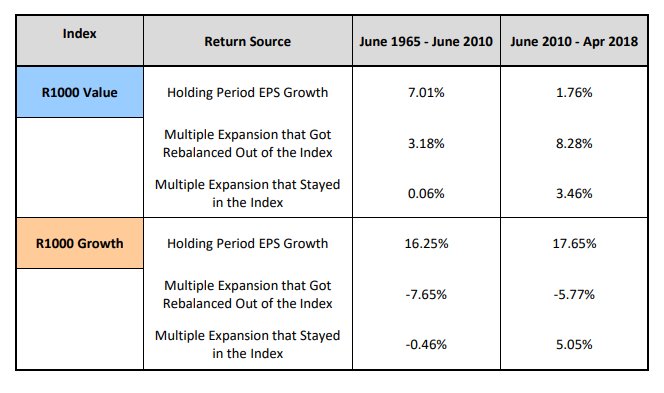

Exhibit B from the O’Shaughnessy Q2 letter. Shows longer term source of returns for value vs growth factors by EPS growth and multiple expansion longer term and for just the 2010-2018 slice.

Returns from EPS growth for value stocks has declined since 2010. The baby used to get thrown out with the bathwater (good companies would trade down to low multiples) but recently, the bots have picked these over leaving only value stocks that are cheap for a reason.

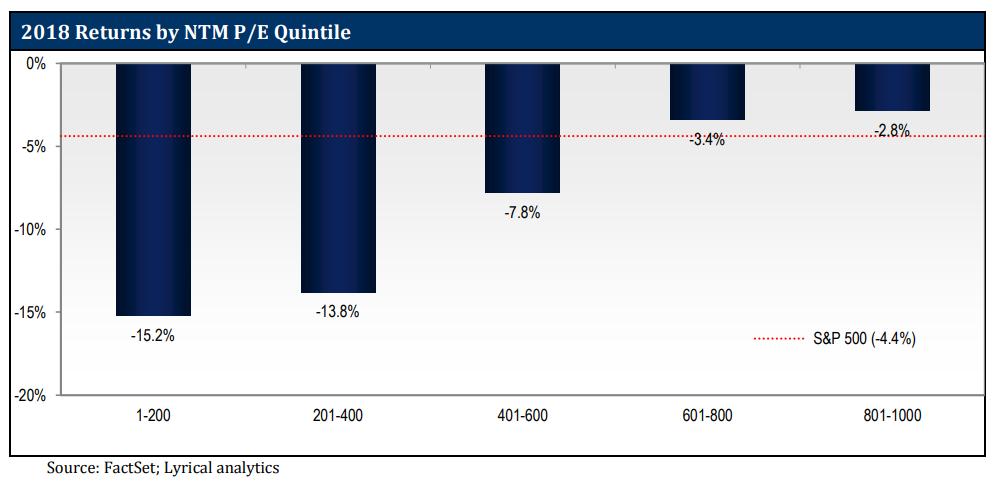

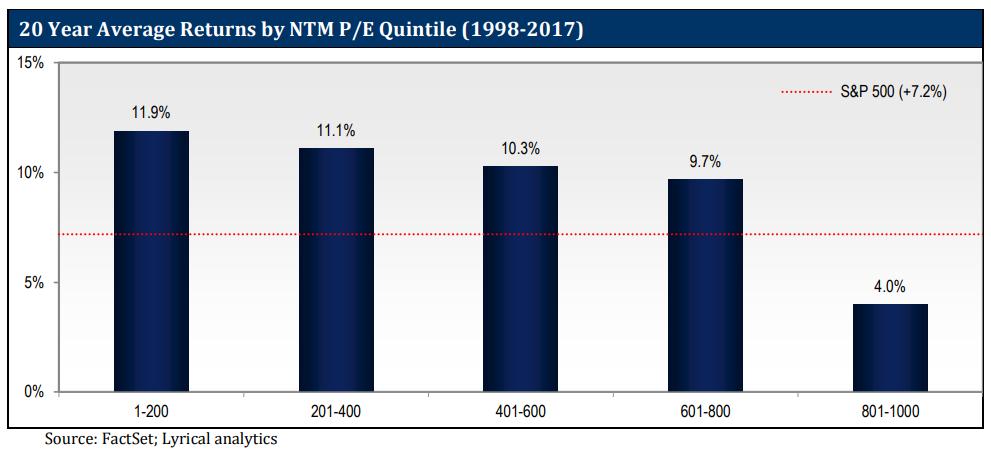

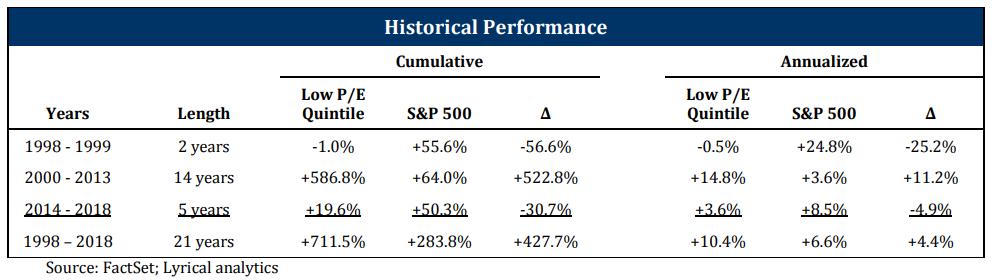

Lyrical Asset Management had some interesting commentary on performance by P/E ratio in their 2018 letter. The last few years have been rough for traditional value investing...

https://www.lyricalam.com/wp-content/uploads/2019/01/LAM-2018-Review-letter.pdf

https://www.lyricalam.com/wp-content/uploads/2019/01/LAM-2018-Review-letter.pdf

This meme had a shelf life of 48 hours but the resulting thread was probably my best attempt at defining the growth vs value vs "tech" investing debate. https://twitter.com/schaudenfraud/status/1281355280249286657

Value stocks that don't work are just analysis errors at the time of investment. https://twitter.com/Upper20sStCap/status/1214986176978919425

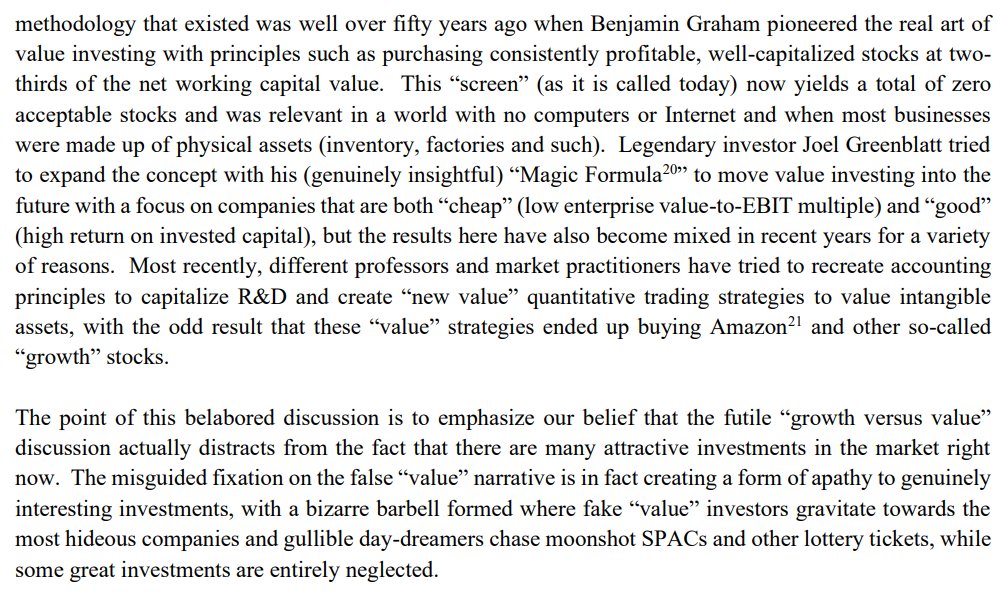

I think this is the final word on the value investing discussion and reiterates the message of this thread: you rarely get to buy good companies cheaply now that quants have learned to do it. There must be a catch that a computer can't see. https://twitter.com/Upper20sStCap/status/1329872181552181249

Accurately identifying the "catch", not an aesthetic multiple, is your edge as a so-called value investor

Right into my veins:

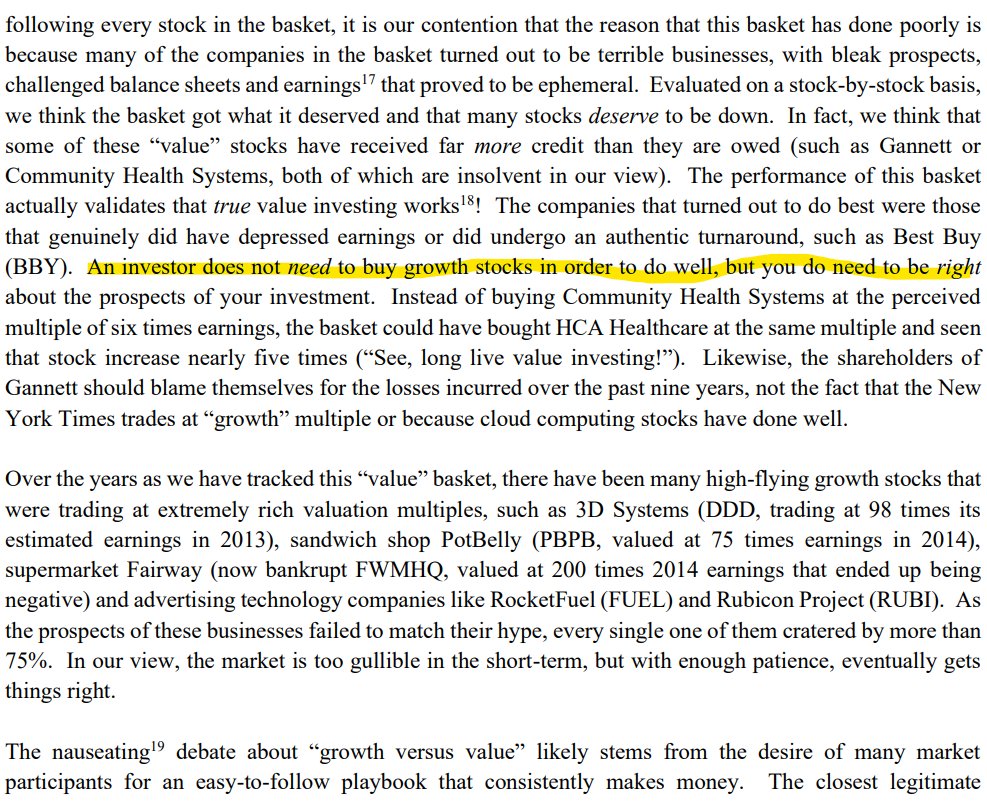

"An investor does not need to buy growth stocks in order to do well, but you do need to be right about the prospects of your investment"

"An investor does not need to buy growth stocks in order to do well, but you do need to be right about the prospects of your investment"

The reason Graham earned high returns buying stocks at aesthetically low multiples is because finding them was not easy and the equity markets were extremely inefficient. The market is much more efficient now, so you don't get those returns anymore from doing the same thing.

Read on Twitter

Read on Twitter