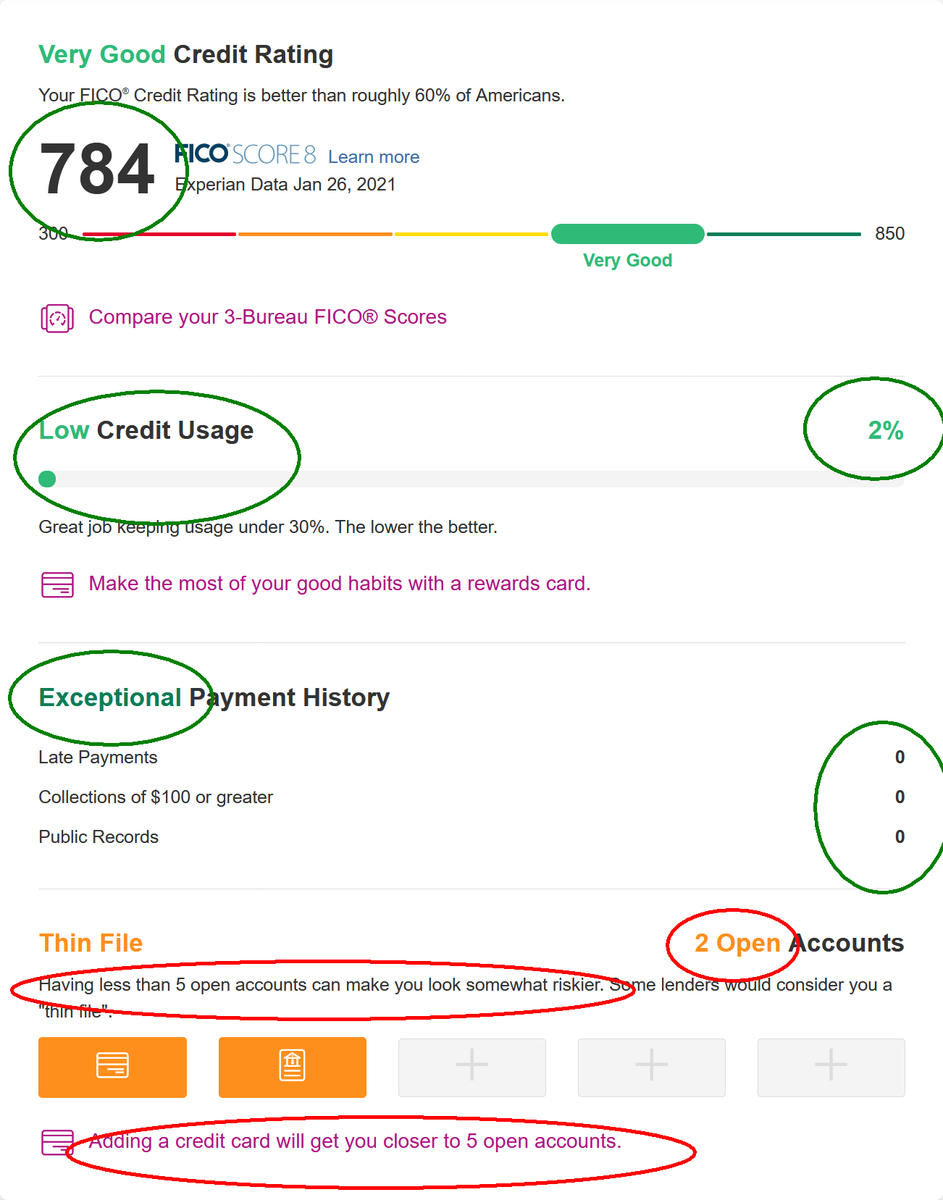

Your reminder that credit scores aren't for how good you are at managing credit. They're for telling financial institutions how much of a reliable money-making machine you are for them. Otherwise things like closing your open accounts would raise your score not lower it.

Thread:

Thread:

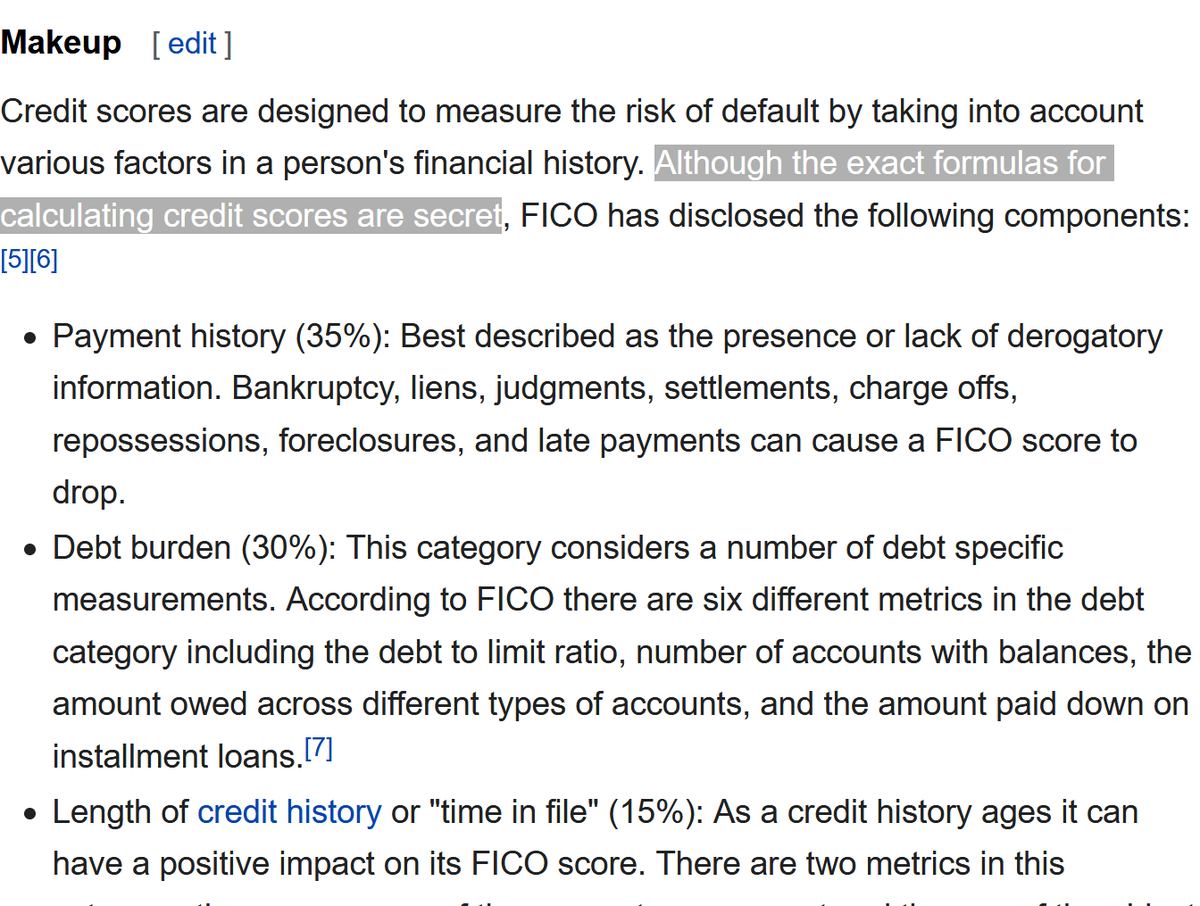

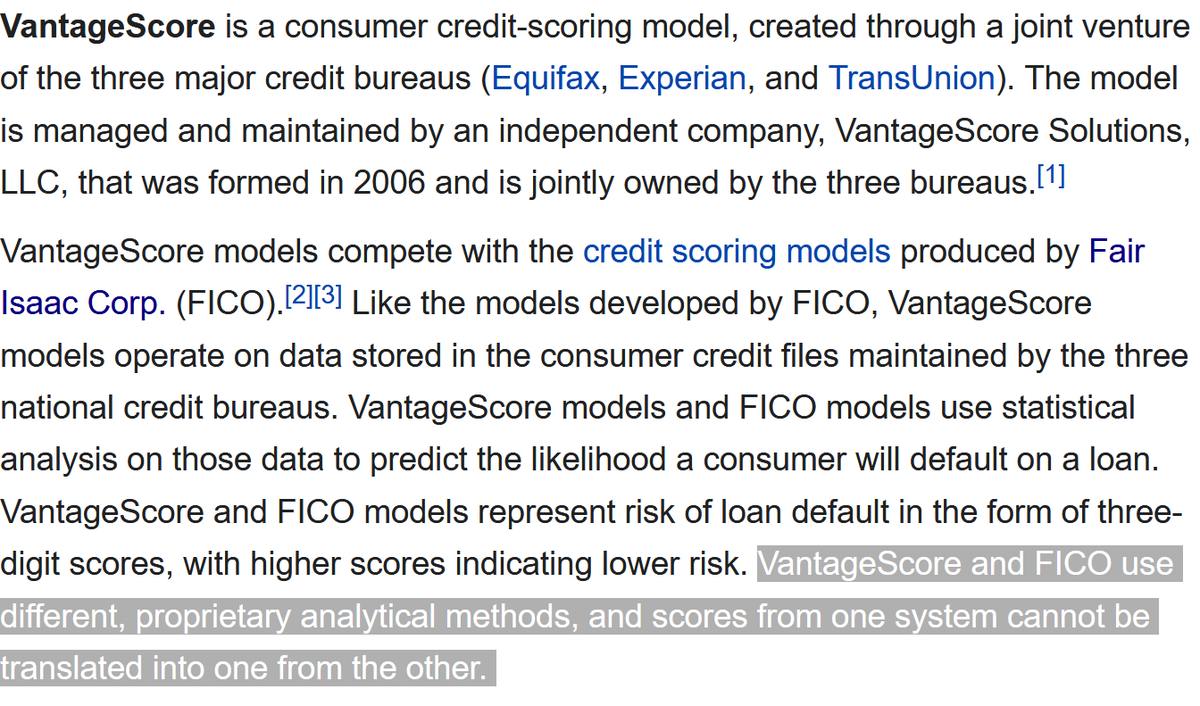

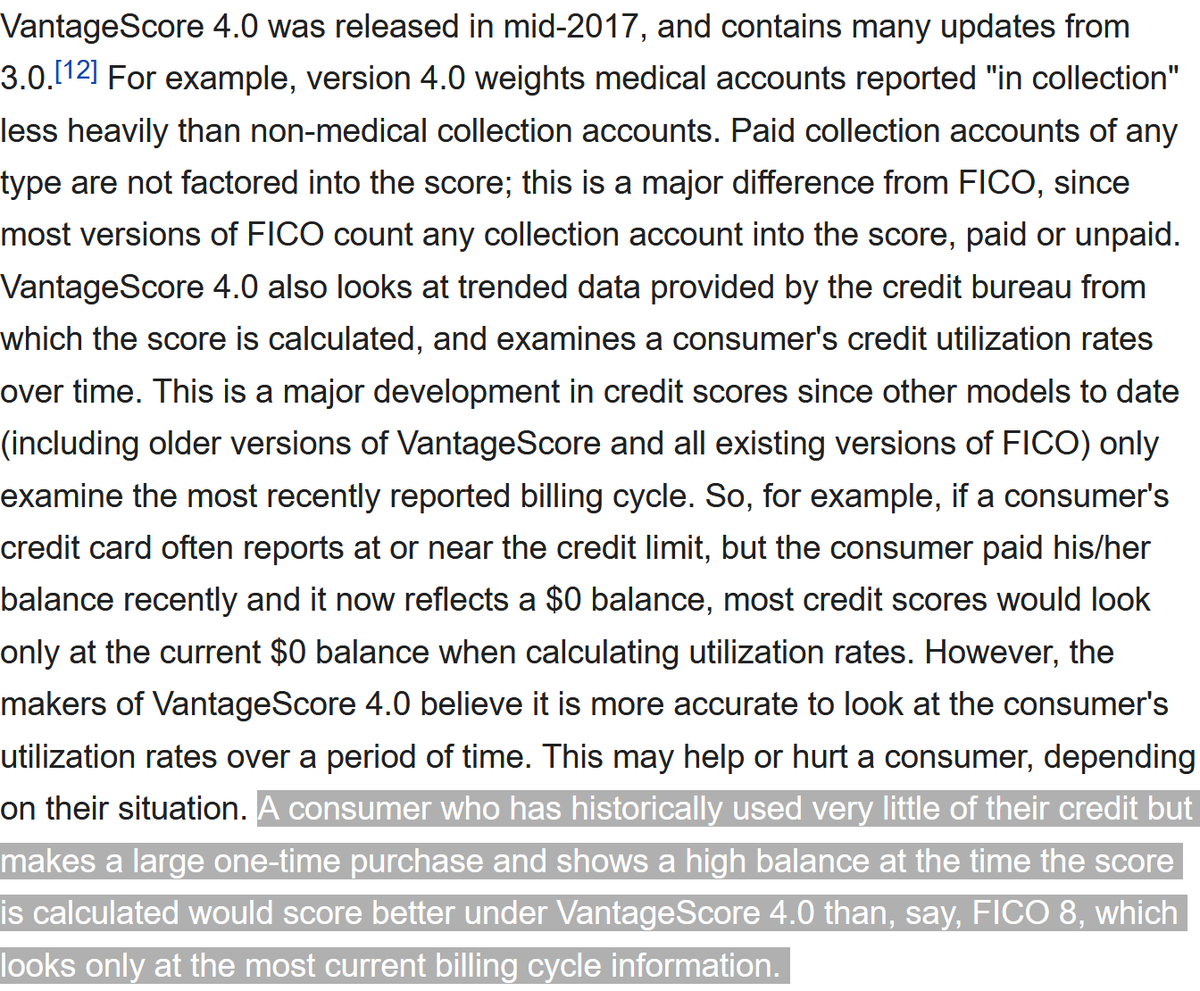

Credit Karma uses VantageScore 3.0 (4.0 is latest), other places uses FICO 8. All are algorithms for calculating a number to tell you your credit is poor/fair/good/excellent. They update them when it benefits them. The algorithms are proprietary, you can't see how they work.

When I filed Chap 7 bankruptcy in 2010, everyone said "It's the worst thing you could do to your credit!"

Looking back, it's the best thing I could have done.

It was barely a year later when financial institutions were *begging* me again to open credit with them at huge rates.

Looking back, it's the best thing I could have done.

It was barely a year later when financial institutions were *begging* me again to open credit with them at huge rates.

My life was hit badly by the economic crash of 2008. Lost jobs, lost savings, couldn't pay. Since bankruptcy, I've paid every additional debt on time. I got good paying jobs. By my responsibility alone, my credit score *should* have been perfect. But that's not what it judges on.

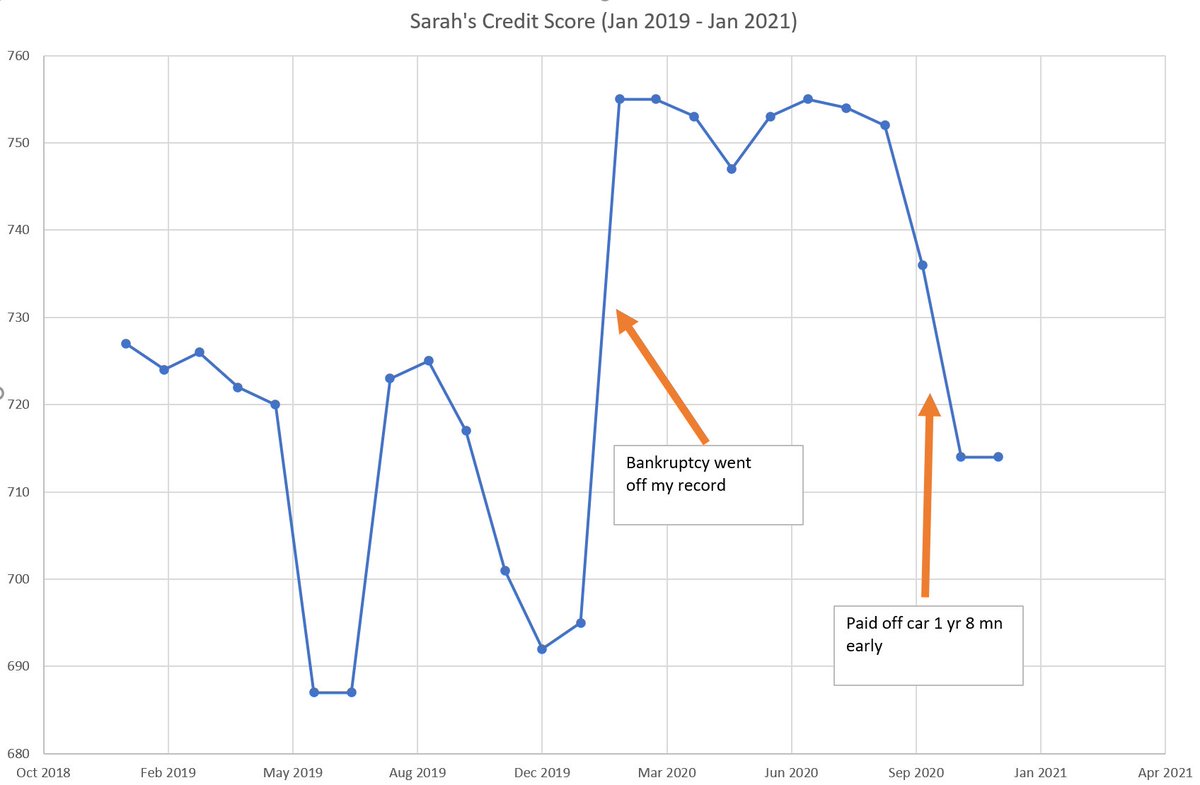

My bankruptcy went off my credit record in 2020. My score went up a bit. Then it started to fall back down again.

I paid off my car several months later. Small boost for paying extra. Then went down because I didn't have enough open accounts of different types.

I paid off my car several months later. Small boost for paying extra. Then went down because I didn't have enough open accounts of different types.

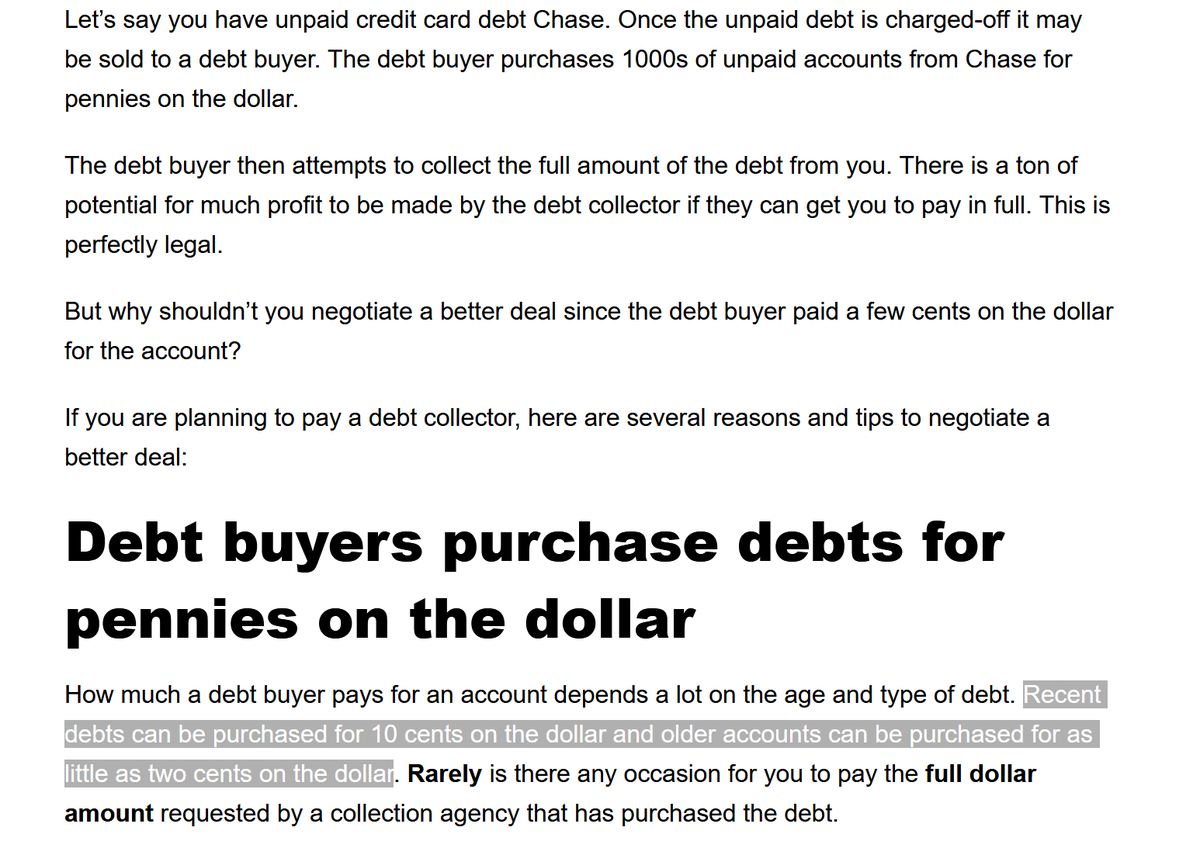

It's also telling that if a debt goes into collections, the company sells it for pennies-on-the-dollar to a collector, they get the tax write-off as lost profits, then you owe the collector the full amount and they profit.

So: you're screwed and both parties make out just fine.

So: you're screwed and both parties make out just fine.

Fun fact: FICO originally stood for Fair, Isaac and Company, the 1st company to make the score. They renamed themselves to FICO (as in the name of the company is FICO). They are a data analytics company focused on credit scoring services and make millions of dollars on this.

Credit scores aren't a way to show how reliable you are at paying your debts or anything like that. Otherwise paying off one small credit card every month would be a perfect score.

They WANT you to have many accounts open and to pay minimum payments. They make more that way.

that way.

They WANT you to have many accounts open and to pay minimum payments. They make more

that way.

that way.

Finally: even though a lot of financial things are tied to credit scores... you're more than your credit score. And this number isn't a direct reflection of your responsibility. It's an algorithm made by financial companies for financial companies. It sucks and you don't.

Read on Twitter

Read on Twitter