1/n

The topic of today's thread is the findings of the transport sector chapter in TERI's flagship H2 report released in December last year.

This is really important because too many actors in India misunderstand the role of H2 in transport.

The topic of today's thread is the findings of the transport sector chapter in TERI's flagship H2 report released in December last year.

This is really important because too many actors in India misunderstand the role of H2 in transport.

2/n

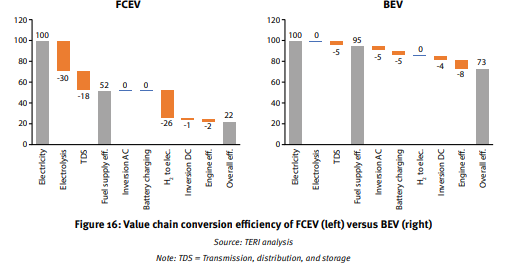

Firstly, we have to understand the low round-trip conversion efficiency of FCEV.

FCEV have a round trip conversion efficiency that is far lower than battery electric vehicles.

This means increased costs and increased emissions, if the H2 is not 100% green.

Firstly, we have to understand the low round-trip conversion efficiency of FCEV.

FCEV have a round trip conversion efficiency that is far lower than battery electric vehicles.

This means increased costs and increased emissions, if the H2 is not 100% green.

3/n

It also means increased electricity consumption, which is crucial for a country like India with rapidly growing baseline electricity consumption and constraints on how fast zero carbon supply can ramp up.

It also means increased electricity consumption, which is crucial for a country like India with rapidly growing baseline electricity consumption and constraints on how fast zero carbon supply can ramp up.

4/n

To put this in perspective: powering the entire Indian 2050 trucking fleet with electrolytic H2 would take around 2500 TWh of electricity.

This is nearly as much as combined generation of UK, Germany, Japan, and South Korea.

Green electricity's scarce: don't waste it!

To put this in perspective: powering the entire Indian 2050 trucking fleet with electrolytic H2 would take around 2500 TWh of electricity.

This is nearly as much as combined generation of UK, Germany, Japan, and South Korea.

Green electricity's scarce: don't waste it!

5/n

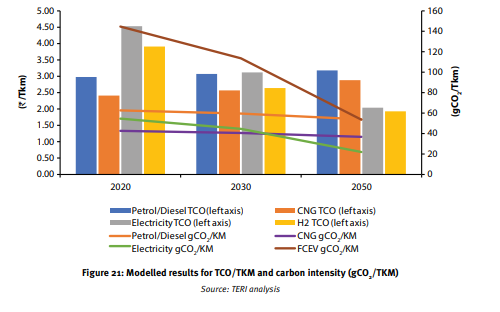

According to our total cost of ownership model, BEV will be competitive with ICE and FCEV in buses and neck and neck with FCEV in trucks, even if the weight penalty is considered.

According to our total cost of ownership model, BEV will be competitive with ICE and FCEV in buses and neck and neck with FCEV in trucks, even if the weight penalty is considered.

5/n

Importantly, because of the low conversion efficiency of FCEV, electricity would need to be less than ~200 gCO2 per kWh for FCEV trucks to be lower CO2 than diesel trucks.

At the same CO2 intensity of electricity, BEVs represent ~3 times more CO2 savings than FCEV.

Importantly, because of the low conversion efficiency of FCEV, electricity would need to be less than ~200 gCO2 per kWh for FCEV trucks to be lower CO2 than diesel trucks.

At the same CO2 intensity of electricity, BEVs represent ~3 times more CO2 savings than FCEV.

6/n

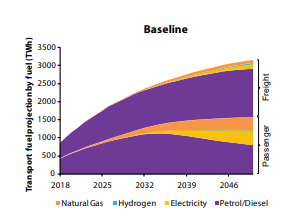

When we run our annual road transport stock model, we see liquid fuel demand peaking in the passenger segment by ~2035, driven by electrification of 2-wheelers and commercial 4-wheelers, even in a baseline scenario.

Freight liquid fuel demand continues to grow .

When we run our annual road transport stock model, we see liquid fuel demand peaking in the passenger segment by ~2035, driven by electrification of 2-wheelers and commercial 4-wheelers, even in a baseline scenario.

Freight liquid fuel demand continues to grow .

7/n

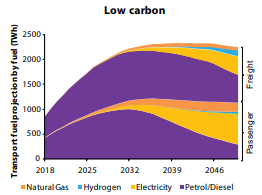

In the low-carbon scenario, total transport liquid fuel demand peaks in the 2030s and starts to decline, although there is still a residual due to the dynamics of vehicle stock turnover.

So yes: India can peak its petroleum product demand by ~2040.

In the low-carbon scenario, total transport liquid fuel demand peaks in the 2030s and starts to decline, although there is still a residual due to the dynamics of vehicle stock turnover.

So yes: India can peak its petroleum product demand by ~2040.

8/n

Consistent with the discussion above, we see efficiency, modal shift, logistics optimisation and electrification taking most of the weight of decarbonization of freight, with FCEV a last resort for truly long-distance, unpredictable operations.

Consistent with the discussion above, we see efficiency, modal shift, logistics optimisation and electrification taking most of the weight of decarbonization of freight, with FCEV a last resort for truly long-distance, unpredictable operations.

9/n

So in transport, H2 is a niche application to be used only where alternative don't exist. Its conversion efficiencies are too low for the benefit of greater energy density to outweigh the costs.

Improvements in BEV technology substantially reduce range and weight concerns.

So in transport, H2 is a niche application to be used only where alternative don't exist. Its conversion efficiencies are too low for the benefit of greater energy density to outweigh the costs.

Improvements in BEV technology substantially reduce range and weight concerns.

10/n

Finally, on a political note: I am concerned that India's view of the energy transition is being distorted by the perception that it has lost the RE and battery manufacturing race.

Hence, the push for H2, where it is perceived that the head-start of other is less.

Finally, on a political note: I am concerned that India's view of the energy transition is being distorted by the perception that it has lost the RE and battery manufacturing race.

Hence, the push for H2, where it is perceived that the head-start of other is less.

11/n

I have one response: the best foundation of a domestic manufacturing industry is stable domestic demand. The best way to get stable domestic H2 demand to seed a manufacturing industry is to target H2 to sectors where it can actually be competitive + practicable.

I have one response: the best foundation of a domestic manufacturing industry is stable domestic demand. The best way to get stable domestic H2 demand to seed a manufacturing industry is to target H2 to sectors where it can actually be competitive + practicable.

Read on Twitter

Read on Twitter